Flame Detectors Market Size 2024-2028

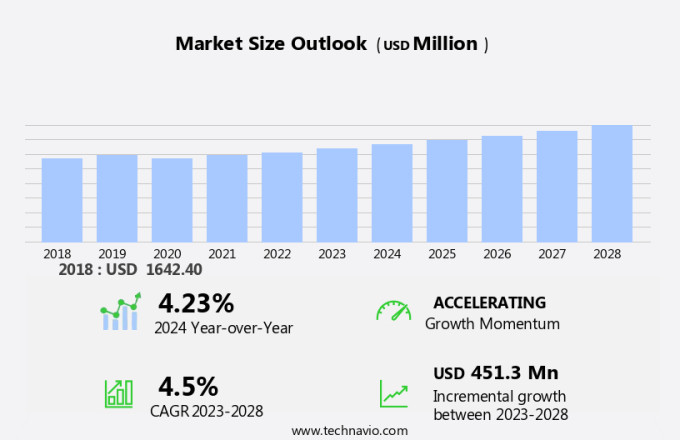

The flame detectors market size is forecast to increase by USD 451.3 billion at a CAGR of 4.5% between 2023 and 2028. The market is witnessing significant growth due to various driving factors. One key trend is the increasing emphasis on safety performance standards in industries, leading to increased investment in advanced flame detection systems. Another trend is the integration of control and safety systems to enhance emergency management capabilities. However, the weak global economic outlook poses a challenge to market growth. In terms of sales channels, both offline retail and online retail, including e-commerce logistics and warehouse properties, are contributing to the market's expansion. Product development and technology innovations are also playing a crucial role in catering to the evolving needs of customers.

What will be the Size of the Market During the Forecast Period?

The market plays a crucial role in safeguarding both public and private infrastructure, as well as commercial and industrial properties, from the destructive effects of fire. Fire is a significant risk that can lead to substantial property damage, loss of life, and business disruption. Consequently, the demand for advanced flame detection systems is on the rise, driven by stringent fire safety regulations and protection policies. Fire safety is a critical concern for federal custodians, tenants, and private building owners. Infrastructure and real estate sectors, including public infrastructure, private infrastructure, and commercial real estate, are investing in fire safety systems to ensure the well-being of their assets and occupants.

Moreover, the National Fire Protection Association (NFPA) sets the standards for fire safety and regularly updates regulations to reflect advancements in technology. Flame detectors are an essential component of fire safety systems, as they can quickly identify the presence of a fire and initiate the appropriate response. These devices use various technologies, such as infrared, ultraviolet, and photoelectric sensors, to detect temperature changes indicative of a fire. Product development in this field focuses on improving the sensitivity, accuracy, and reliability of flame detectors, ensuring they can respond effectively to various fire scenarios. The market for flame detectors is diverse, with applications ranging from offline retail and online retail to e-commerce logistics, warehouse properties, logistics-focused properties, industrial spaces, and warehouse spaces.

Furthermore, the need for fire safety systems is universal, as all these sectors require effective fire protection to mitigate risks and ensure business continuity. Flame detectors are available through various sales channels, including offline retail and online retail platforms. E-commerce logistics and warehouse spaces, in particular, are significant consumers of flame detectors due to their large inventory storage requirements and the inherent fire risks associated with these operations. In conclusion, the market is an essential component of the fire safety ecosystem, providing critical protection against the destructive effects of fire. The market's growth is driven by the increasing demand for fire safety systems in various infrastructure and real estate sectors, as well as the stringent regulations set by the National Fire Protection Association.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Single UV

- Single IR

- Dual UV/IR

- Triple IR

- Multi IR

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Product Insights

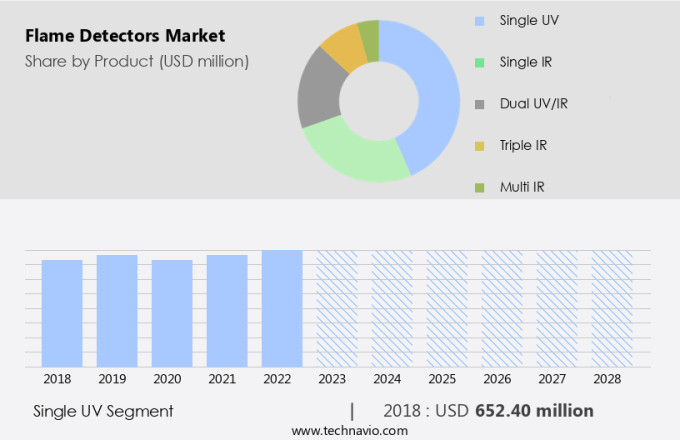

The single UV segment is estimated to witness significant growth during the forecast period. Flame detectors play a crucial role in ensuring safety in the distribution of fossil fuels, particularly natural gas, in the carbon-based gas network. Among various types of flame detectors, both Infrared (IR) and Ultraviolet (UV) sensors are widely used. IR flame detectors identify flames by sensing infrared radiation emitted by the combustion process. On the other hand, UV flame detectors, consisting of UV sensors, detect the UV radiation emitted by a flame with a wavelength less than 300 nm, including hydrocarbons, sulfur, hydrazine, and ammonia. UV sensors are the preferred choice due to their fast response time, which is less than a millisecond, and high sensitivity around Pico watt/cm cube.

Furthermore, these sensors detect UV radiations, which are mostly emitted by flames. When a flame is detected, the sensor generates a series of pulses, which are converted by detector electronics into an alarm output. Natural gas and oil industries heavily rely on flame detectors to minimize carbon dioxide emissions and ensure safety in their operations. Hydrogen addition in natural gas networks can also be monitored using UV flame detectors. In conclusion, UV flame detectors play a significant role in ensuring safety and reducing emissions in the distribution of fossil fuels.

Get a glance at the market share of various segments Request Free Sample

The single UV segment accounted for USD 652.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

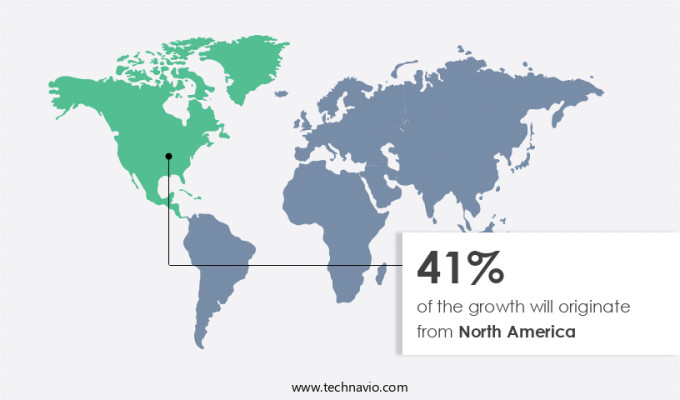

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the market, North America holds a significant position, with the United States and Canada being the primary contributors to the region's revenue. The regional market growth is influenced by the stringent fire safety regulations set by organizations such as the National Fire Protection Association (NFPA) and the Occupational Safety and Health Administration (OSHA). Enterprises in North America prioritize the protection of their infrastructure and the preservation of human life. Consequently, the installation of suitable flame detectors is essential to ensure the safety of building occupants. The expansion of small, medium, and large industries in North America is another factor fueling the growth of the market in the region.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

An increase in the number of industry safety performance standards is the key driver of the market. Flame detection systems are essential components of fire safety measures in various industries and infrastructures, both public and private. These systems play a pivotal role in risk avoidance by promptly identifying and extinguishing fires. The need for flame detection is particularly high in industries dealing with flammable materials, such as processing, manufacturing, storage, and transportation. The International Electrotechnical Commission (IEC) 61511-1 standard, equivalent to ANSI/ISA S84.01 in the US, outlines mandatory project activities for ensuring the functional safety of industrial equipment.

These activities span across various categories, including procedures, documentation, testing and validation, planning, hardware and software development, and risk assessment. Federal custodians, private building owners, tenants, and other stakeholders prioritize fire safety and protection policies. Regulations and standards, such as the IEC 61511-1, guide these entities in implementing effective fire safety measures. Adherence to these regulations not only ensures compliance but also fosters a safe environment for personnel and infrastructure.

Market Trends

Integration of control and safety systems is the upcoming trend in the market. In response to the expanding population and industrial growth in various regions, the global market for energy sources is experiencing significant demand. Countries such as the United States, China, and Mexico are witnessing an increase in exploration activities within the oil and gas, chemical, and petrochemical industries. To ensure product quality and plant safety, companies are integrating safety systems with process control.

This integration enhances the coordination between control and safety systems, enabling users to update various subsystems, including flame detectors, for the detection of gas, flames, and smoke. As e-commerce logistics and warehouse properties continue to expand, the demand for advanced flame detection technology is increasing. Networks of emergency management systems are being established to mitigate potential risks and prevent catastrophic incidents. Product development and investment in technology are key priorities for companies in this sector to meet the evolving needs of their customers, both in offline retail and online platforms.

Market Challenge

A weak global economic outlook is a key challenge affecting market growth. The market in the United States is significantly influenced by the national economy and the manufacturing and industrial sectors. A strong economy increases the demand for various goods and services, leading to an uptick in production and the need for effective fire safety systems.

However, the economic downturn caused by the COVID-19 pandemic has resulted in substantial losses in terms of production, income, and employment. As a result, the demand for flame detectors and other fire protection systems may be impacted. Agencies such as the National Fire Protection Association (NFPA) continue to highlight the importance of maintaining flame safety systems to prevent potential fires and minimize losses.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Emerson Electric Co: The company offers flame detectors such as Rosemount 975UR ultraviolet infrared flame detector, 975UF ultra-fast ultraviolet infrared flame detector and 975MR multi spectrum infrared flame detector.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- API Group Corp.

- Ciquirix

- Electro Optical Components Inc.

- Emerson Electric Co.

- Fike Corp.

- Fire and Gas Detection Technologies Inc.

- Halma Plc

- HOCHIKI Corp.

- Honeywell International Inc.

- Johnson Controls International Plc.

- Micropack Engineering Ltd.

- Minimax Viking GmbH

- MSA Safety Inc.

- Optris GmbH

- RTX Corp.

- Rezontech Co. Ltd.

- Robert Bosch GmbH

- SENSE WARE Fire and Gas Detection BV

- Siemens AG

- Teledyne Technologies Inc.

- Trace Automation Private Limited

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The flame detector market is witnessing significant growth due to the increasing prioritization of fire safety and protection policies in both public and private infrastructure. Fire risks pose a major threat to federal custodians, tenants, and private building owners, leading to substantial losses and damage to assets and personnel. Fire safety systems, including flame detectors, play a crucial role in mitigating these risks and ensuring compliance with regulations set by the National Fire Protection Association and other agencies. Flame detectors employ various technologies such as temperature, radiation, and optical methods, including infrared (IR) and ultraviolet (UV) detection, to identify and respond to potential fires.

Further, these systems are essential for various industries, including energy, power, and industrial spaces, where the risk of fires is particularly high due to the use of alternative fuels, fossil fuels, natural gas, and carbon-based gas networks. The market for flame detectors is driven by investment in fire protection systems, product development, and technology adoption. Customers can purchase flame detectors through offline retail, online retail, and e-commerce logistics channels. The market also caters to the needs of warehouses, logistics-focused properties, commercial real estate, and industrial spaces, where the importance of asset safety and personnel safety is paramount. Flame safety systems are also integral to emergency management plans, ensuring the timely detection and response to fires, thereby minimizing potential damages and losses.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 451.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 41% |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

API Group Corp., Ciquirix, Electro Optical Components Inc., Emerson Electric Co., Fike Corp., Fire and Gas Detection Technologies Inc., Halma Plc, HOCHIKI Corp., Honeywell International Inc., Johnson Controls International Plc., Micropack Engineering Ltd., Minimax Viking GmbH, MSA Safety Inc., Optris GmbH, RTX Corp., Rezontech Co. Ltd., Robert Bosch GmbH, SENSE WARE Fire and Gas Detection BV, Siemens AG, Teledyne Technologies Inc., and Trace Automation Private Limited |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch