Floating Boat Dock Market Size 2025-2029

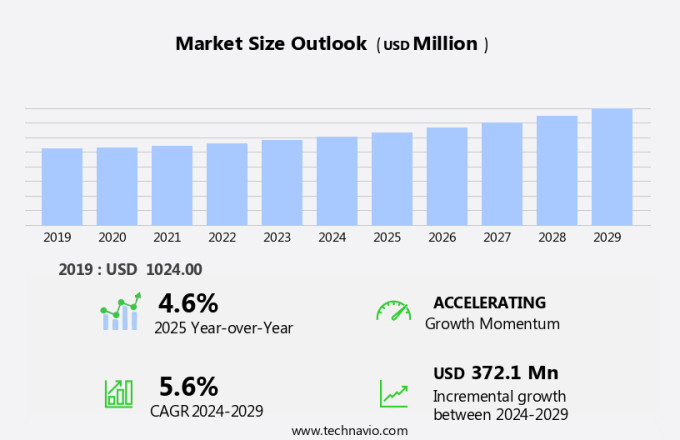

The floating boat dock market size is forecast to increase by USD 372.1 million at a CAGR of 5.6% between 2024 and 2029.

- The market is experiencing significant growth due to several key factors. First, the increasing demand for waterfront properties and outdoor activities is driving the need for advanced docking solutions, such as pontoon docks and finger docks. Additionally, the development of large cruise terminals and the rise in maritime trade require reliable and efficient docking systems. However, the market faces challenges, including labor shortages and the need for skilled laborers during construction.

- To address these challenges, there is a trend towards remote work and the use of hydraulic lift docks for easier installation and maintenance. Furthermore, smart docks with IoT Integration and real-time data are becoming increasingly popular to enhance safety and efficiency. Overall, the market is expected to continue growing due to these market trends and challenges.

What will be Floating Boat Dock Market Size During the Forecast Period?

- The floating dock market is a significant sector within the marine industry, catering to various applications such as marinas, water sports facilities, and commercial ports. Floating docks provide essential infrastructure for water-based leisure activities, maritime trade, transportation, and waterfront properties. Innovative designs and technologies have been introduced to enhance the functionality and durability of floating docks. These advancements include the use of IoT sensors for remote monitoring and adjusting to fluctuating water levels. However, weather conditions remain a critical challenge for the floating dock market, necessitating strong construction and installation techniques. Floating docks are essential in various water environments, including rivers, lakes, and coastal areas. They come in various types, such as platform docks, pontoon docks, finger docks, hydraulic lift docks, and modular docks. Each type caters to specific requirements, ensuring optimal functionality and safety. The floating dock market faces several challenges, including labor shortages during construction and installation. Skilled laborers are required for the installation process, which can be time-consuming and costly.

- Remote work and collaboration technologies have been adopted to mitigate labor shortages and streamline the installation process. The floating dock market is not limited to recreational applications. It also plays a crucial role in maritime trade and transportation, particularly in ports and harbors. Floating docks enable efficient loading and unloading of cargo, ensuring the smooth flow of maritime commerce. Shipyards also utilize floating docks for boat construction and repair. These docks provide a stable platform for boat building and maintenance, allowing for precise workmanship and timely completion of projects. The floating dock market is a dynamic and essential sector within the marine industry. It caters to various applications and faces unique challenges, necessitating continuous innovation and adaptation. The market's growth is driven by the increasing demand for water-based leisure activities, maritime trade, and transportation infrastructure. By addressing the challenges and embracing technological advancements, the floating dock market is poised for continued growth and success.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Modular floating docks

- Fixed floating docks

- Cantilever floating docks

- End-user

- Residential boat owners

- Marinas and boating facilities

- Tourism and leisure operators

- Government and military installations

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- Spain

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Middle East and Africa

- North America

By Type Insights

- The modular floating docks segment is estimated to witness significant growth during the forecast period.

The market encompasses various types of structures designed for water-based activities, including freight docks and fishing piers. Materials science plays a crucial role in the production of eco-friendly materials used in the construction of these docks. Modular floating docks, a popular choice, are made up of interlocking sections crafted from materials like metal, plastic, concrete, and wood. Their ease of installation and flexibility make them an attractive option for marina operators and those engaged in recreational boating. A prime example of this trend is the Nigerian Maritime Administration and Safety Agency (NIMASA) implementing a modular floating dock at the Apapa Continental Shipyard. This initiative aims to bolster Nigeria's maritime infrastructure and enhance operational efficiency at its ports. Solar panels can be integrated into these modular systems, further increasing their sustainability and reducing their carbon footprint. The global market is poised for growth, driven by the increasing demand for water-based infrastructure and the need for eco-friendly solutions. Hence, such factors are fuelling the growth of this segment during the forecast period.

Get a glance at the market report of share of various segments Request Free Sample

The modular floating docks segment was valued at USD 499.20 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is experiencing notable growth due to substantial investment and infrastructure development. One significant program fueling this expansion is the Boating Infrastructure Grant (BIG) Program. This initiative offers financial assistance for constructing tie-up facilities and support structures for boats over 26 feet in length. These amenities cater to stays of up to 15 days, broadening access to the United States' recreational, cultural, historical, scenic, and natural attractions. With approximately 675,000 large cruising boats in the US, the economic impact on waterfront communities is substantial. The BIG program's objective is to enhance docking and comfort facilities, thereby bolstering local economies.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Floating Boat Dock Market ?

Rising maritime trade is the key driver of the market.

- The market in the United States is experiencing growth due to the expanding maritime trade sector. In 2023, maritime trade in the US witnessed a notable increase of 2.4%, reaching a total of 3.3 billion tons. This growth signifies a rebound from the contraction seen in the previous year, demonstrating the sector's resilience and recovery. Looking forward, the US maritime trade sector is projected to continue its upward trend, with a growth rate of approximately 2% in 2024. Moreover, the sector is anticipated to maintain an average annual growth rate of 2.4% through 2029. This sustained growth in maritime trade is driving the demand for floating boat docks, as the need for modern and expanded docking facilities arises from increased trade volumes.

- Floating boat docks, such as those made of lightweight plastic composites, are an affordable solution for residential boat owners and private dock installations. Modular dock systems, including hybrid wood-plastic composites, offer flexibility and ease of installation for water sports access and harbor construction. These dock systems are also ideal for marina expansion and maritime tourism plans, as well as fisheries industries. Overall, the market is poised for continued growth as the maritime trade sector continues to thrive. Hence, such factors are driving the market growth during the forecast period.

What are the market trends shaping the Floating Boat Dock Market?

The development of large cruise terminals is the upcoming trend in the market.

- The market in the US is experiencing notable expansion, primarily due to the expansion of major cruise ports. This trend is particularly prominent in areas such as the southEastern coast, where the need to accommodate larger cruise ships is increasing. For instance, in September 2024, the US Maritime Administration initiated a thorough feasibility study for three significant cruise terminal projects, scheduled from 2020 to 2023. This undertaking, with a budget of approximately USD156.15 million, includes the construction of a major terminal in Florida, valued at around USD354.3 million, substantial improvements to the Port of Miami, and enhancements at the Long Beach Cruise Terminal in California.

- Skilled labor shortages have been a challenge in the construction industry, leading to the adoption of remote work solutions and advanced technologies such as smart docks with IoT integration. Real-time data collection and analysis enable efficient management of dock operations, ensuring optimal use of resources and improved customer experience. Pontoon docks and finger docks continue to be popular choices for boat owners due to their versatility and ease of installation. Hydraulic lift docks provide additional convenience, allowing boats to be lifted out of the water for maintenance and storage.

What challenges does Floating Boat Dock Market face during the growth?

Stringent regulations is a key challenge affecting the market growth.

- The market in the United States is experiencing regulatory challenges due to environmental concerns. Beginning in January 2024, new Washington State laws mandate that floating docks and walkways must use durable materials, such as concrete, aluminum, steel, or plastic, to fully encase expanded polystyrene foam, previously used for buoyancy. This regulation aims to prevent environmental contamination from broken foam pieces, which can harm aquatic life and shorelines. Existing structures not in compliance with these standards are not immediately required for replacement, but any repairs or replacements must adhere to the new regulations. Material procurement and transportation costs for premium-grade materials, such as composite materials like carbon fiber and lightweight aluminum alloys, can increase the initial investment for floating boat docks.

- Floating boat docks provide versatility and accessibility, making them a popular choice for various applications. To ensure compliance with regulations and maintain the longevity of floating boat docks, it is essential to invest in high-quality materials and professional installation services. This investment can yield long-term benefits, such as reduced maintenance costs and improved safety features. Additionally, the use of floating boat docks can contribute to the overall enhancement of waterfront properties and recreational areas. In summary, the market in the United States faces regulatory challenges due to environmental concerns.

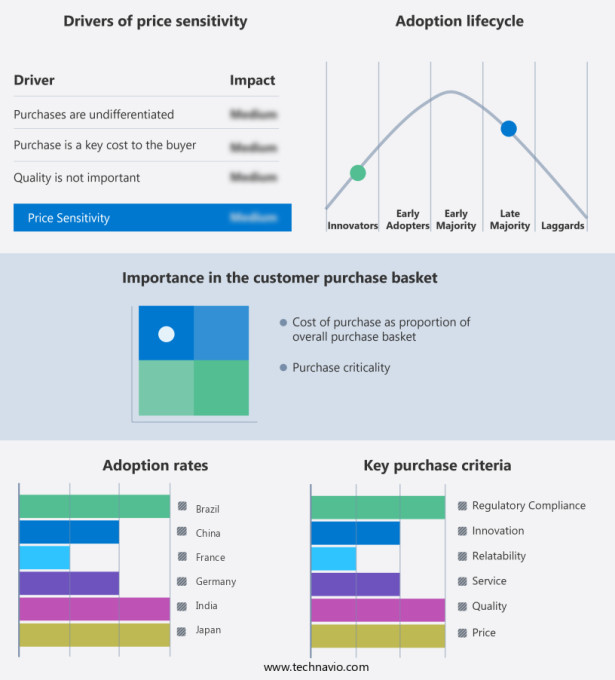

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AccuDock

- Bellingham Marine Industries

- Candock inc

- Carolina Docks

- Cellofoam North America Inc.

- Connect A Dock

- EZ Dock

- Houston Marine Systems

- HydroHoist LLC

- INGEMAR Srl

- Jetdock Systems Inc.

- Maricorp

- Meeco Sullivan

- NauticExpo

- PMS Dock Marine

- Snap Dock LLC

- Tommy Docks LLC

- TRANSPAC MARINAS INC.

- VERSADOCK

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Floating docks have gained significant popularity in various waterfront settings, including marinas, ports, harbors, and even residential properties. These innovative structures cater to diverse applications, such as maritime trade, transportation, water sports, and recreational boating. Weather conditions play a crucial role in the design and construction of floating docks, with materials like lightweight plastic composites, carbon fiber, and lightweight aluminum alloys being preferred for their ability to withstand fluctuating water levels and rough weather conditions. Modern floating docks come in various designs, including modular dock systems, hybrid wood-plastic composites, and hydraulic lift docks. These systems offer advantages like affordability, ease of installation, and accessibility to water sports and recreational activities.

Marina operators and private dock owners invest heavily in premium-grade materials, such as composite structures and plastic structures, to ensure durability and resistance to corrosion. Floating docks are not just limited to commercial applications; they are also used extensively in residential settings for boat mooring and waterfront living. The construction of floating docks requires skilled laborers and the procurement of materials, which can result in high initial investments. However, the benefits of these structures, including increased access to water-based leisure activities and real estate value, often outweigh the costs. Innovative designs in floating docks include smart docks with IoT integration, offering real-time data and monitoring capabilities.

Eco-friendly materials, such as recycled plastic and solar panels, are also being used to make floating docks more sustainable. Floating boat dock systems have become an essential component of water-related industries, including maritime tourism, fishing, and freight docks.

| Floating Boat Dock Market Scope | |

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2025-2029 |

USD 372.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

US, China, Germany, UK, France, Spain, Japan, India, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch