Mexico Food Sweetener Market Size and Trends

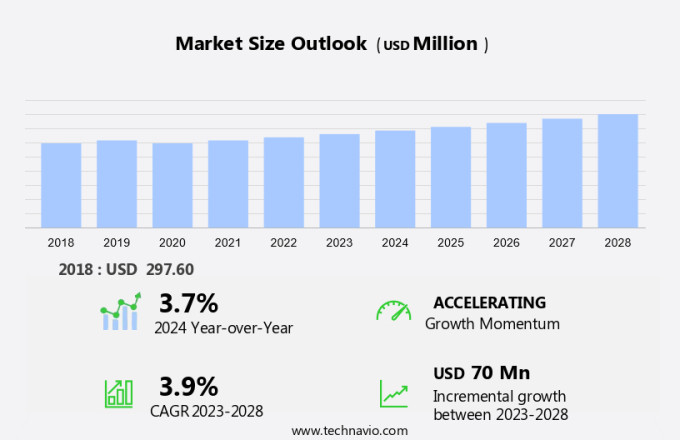

The Mexico food sweetener market size is forecast to increase by USD 70 million, at a CAGR of 3.9% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for sugar reduction in processed foods, particularly in ready-to-eat (RTE) products. Sucrose, sugar alcohols, aspartame, and sucralose are popular sweetener options used in various industries, including bakery and confectionery, dairy and desserts, meat products, soups and sauces, online stores, health food stores, and organic shops. The market is driven by the growing preference for natural and organic sweeteners, as consumers seek clean-label ingredients. However, taste issues with artificial sweeteners remain a challenge, limiting their widespread adoption. Sucrose reduction is a key trend, with companies developing innovative sweetener formulations to cater to this demand. The market is expected to continue its growth trajectory, driven by these factors. In the market, the demand for sugar reduction is particularly high, with consumers increasingly conscious of their health and seeking to reduce their sugar intake. The market is expected to grow significantly, with companies focusing on developing natural and organic sweetener options to cater to this demand. The market for sugar alcohols, such as erythritol and xylitol, is expected to grow rapidly, as they offer a low glycemic index and are suitable for use in a wide range of applications.

The market has witnessed a significant shift towards healthier alternatives, with a growing emphasis on low-calorie and sugar-free options. This trend is particularly noticeable in the sweeteners market, where demand for natural and plant-based sweeteners is on the rise. Low-calorie sweeteners have gained popularity among consumers who are health-conscious and looking to reduce their sugar intake. These sweeteners offer a solution for individuals with diabetes, obesity, and those following specific dietary requirements. The market for these sweeteners spans various industries, including beverages, food and beverage, personal care, pharmaceutical, oral care, chewing gums, cosmetics, and paediatric medications. Natural sweeteners, such as stevia and monk fruit, have emerged as popular alternatives to traditional sugar. These sweeteners are derived from plants and offer a clean label, which is increasingly important to consumers. Multifunctional sweeteners, which can provide both sweetness and additional functional benefits, are also gaining traction in the market. Xylitol, a sugar alcohol, is another low-calorie sweetener that is widely used in various applications. It is particularly popular in the oral care industry due to its dental health benefits.

Xylitol is also used in food and beverage, bakery food products, and chewing gums. The food and beverage industry is a significant contributor to the low-calorie sweeteners market. Fast-food chains and bakeries have started offering sugar-free and low-calorie options to cater to the changing consumer preferences. In the bakery sector, low-calorie sweeteners are used to produce cakes, pastries, and other baked goods that are palatable and have a reduced calorie count. The personal care industry also utilizes low-calorie sweeteners in various applications, including oral care products and cosmetics. In the pharmaceutical industry, these sweeteners are used in medications to improve palatability and make them more appealing to patients. The low-calorie sweeteners market is expected to continue growing due to the increasing health consciousness among consumers and the availability of a wide range of sugar alternatives. The market for liquid forms and chewable forms of sweeteners is also expected to grow, as these forms offer convenience and flexibility for consumers.

Market Segmentation

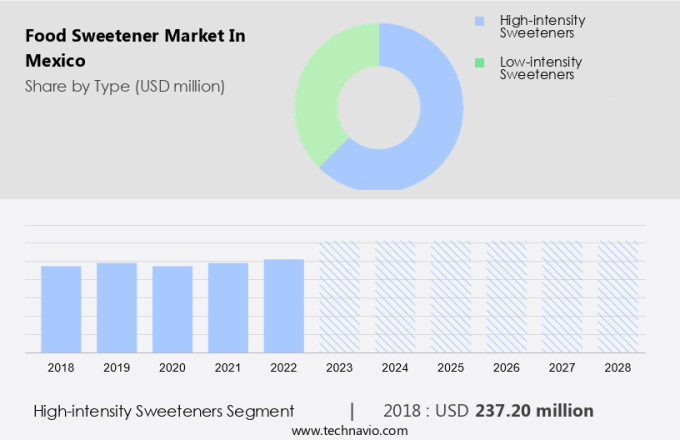

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Type

- High-intensity sweeteners

- Low-intensity sweeteners

- Application

- Food

- Beverage

- Others

- Geography

- Mexico

By Type Insights

The high-intensity sweeteners segment is estimated to witness significant growth during the forecast period. The Food and Drug Administration (FDA) has authorized the utilization of various high-intensity sweeteners, including aspartame, sucralose, acesulfame potassium (Ace-K), cyclamate, neotame, saccharin, and natural alternatives like stevia. The preference for zero-calorie natural sweeteners, specifically stevia, is experiencing significant growth in the market due to its health advantages and safety for consumption. Unlike artificial sweeteners, natural zero-calorie sweeteners, predominantly sourced from stevia, resonate with consumers due to their perceived fewer health risks.

Get a glance at the market share of various segments Download the PDF Sample

The high-intensity sweeteners segment was valued at USD 237.20 million in 2018. The consumer base for natural sweeteners is expanding rapidly, particularly among health-conscious younger demographics who are well-informed about the benefits of natural alternatives. At present, the application of natural sweeteners is primarily confined to flavored water, juices, and tabletop products. The market for natural sweeteners is expected to expand further into various sectors, such as bakery and confectionery, dairy and desserts, meat products, soups and sauces, and ready-to-eat (RTE) products. Consumers can easily access these natural sweetener options through various retail channels, including online stores, health food stores, and organic shops.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Mexico Food Sweetener Market Driver

Growing demand for organic food sweeteners is notably driving market growth. Consumers are increasingly making conscious dietary choices, influencing the food industry to offer healthier alternatives. This trend is particularly noticeable in the market, where organic and natural sweeteners are gaining popularity. Sweeteners derived from plants, such as Mannitol and Erythritol, are being used as sugar substitutes in various food products, including baked goods and soft drinks. Honey, a rare sugar, is also being embraced as a healthier alternative to refined sugar. The preference for alternative sweeteners is driven by concerns over the health implications of high sugar consumption. As a result, the market for polyol sweeteners, which include Sorbitol, Xylitol, and Erythritol, is expected to grow significantly.

Additionally, rare sugars like Stevia, derived from the Stevia rebaudiana plant, are gaining commercial applications due to their natural sweetness and low calorie count. The convenience food industry, which includes fast-food and bakery food products, is also adapting to this trend. For instance, Stevia, a low-calorie sweetener, is being used to sweeten various baked goods and beverages. With the increasing demand for healthier options, the market for organic and natural sweeteners is expected to continue growing. Thus, such factors are driving the growth of the market during the forecast period.

Mexico Food Sweetener Market Trends

The rising popularity of clean-label ingredients is the key trend in the market. In today's health-conscious society, there is a growing preference for low-calorie and natural sweeteners as alternatives to sugar. This trend is particularly noticeable in the food and beverage industry, where consumers are seeking out clean-label products that meet their dietary needs and align with their values. Natural sweeteners, such as stevia and monk fruit, have gained popularity due to their plant-based origins and zero-calorie count. These sweeteners offer a multifunctional role in food and beverage production, enabling the creation of sugar-free and diabetic-friendly products. Western dietary habits, characterized by high sugar and calorie intake, have contributed to the rise in obesity and diabetes.

As a result, the demand for sugar alternatives is increasing, with artificial sweeteners also playing a role in the market. The clean-label movement, which focuses on natural and organic ingredients, is driving innovation in the food and beverage industry. Organic food sales have been on the rise due to increasing disposable income, improved living standards, and a focus on healthcare. Consumers are willing to pay a premium for products that align with their health goals and values. Thus, such trends will shape the growth of the market during the forecast period.

Mexico Food Sweetener Market Challenge

Taste issues with artificial sweeteners are the major challenge that affects the growth of the market. Artificial sweeteners, including Tagatose and non-nutritive sweeteners, are increasingly used in dairy products and other food processing applications to reduce caloric intake. However, their adoption comes with challenges such as perceived differences in sweetness, lingering sweetness, bitter or licorice aftertaste, and metallic undertones, which are more pronounced in Stevia. These taste alterations can take time for consumers to acclimate to, necessitating careful reformulation of food products. This process involves rigorous testing to ensure the new product's taste profile matches the original or a pre-established standard.

Sweetening agents like high-fructose corn syrup, maple syrup, and polyols also face similar challenges in maintaining consistent taste and texture. Incorporating these low-calorie alternatives into food and beverage lines requires a thorough understanding of their unique properties and careful product development. Food manufacturers and processors must address these taste and texture issues to create palatable, high-quality products for consumers with dietary restrictions or those seeking to reduce their caloric intake. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Archer Daniels Midland Co. - The company offers food sweeteners such as SweetRight

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amalgamated Sugar

- AB Sugar Ltd.

- Cargill Inc.

- Celanese Corp.

- DuPont de Nemours Inc.

- Evolva Holding AG

- Ingredion Inc.

- Kerry Group Plc

- Koninklijke DSM NV

- Morita Kagaku Kogyo Co. Ltd.

- Nestle SA

- Roquette Freres SA

- Sudzucker AG

- Tate and Lyle PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

The market is witnessing significant growth due to the increasing health consciousness among consumers. With the rise in obesity and diabetes, there is a growing demand for low-calorie sweeteners as sugar alternatives. Natural sweeteners, such as stevia and monk fruit, are gaining popularity due to their plant-based origins and clean label appeal. Sugar reduction is a key trend in the food and beverage industry, leading to the increased use of multifunctional sweeteners in various applications. Beverages, bakery and confectionery, dairy and desserts, meat products, soups and sauces, and ready-to-eat (RTE) products are some of the major categories that use sweeteners. Artificial sweeteners, such as aspartame and sucralose, continue to be widely used due to their high-intensity sweetness and caloric reduction properties. However, concerns over health risks associated with their use are driving the demand for natural and clean-label sweeteners. The market for sugar-free products is expanding, with online stores, health food stores, and organic shops offering a wide range of sweetener formulations. Xylitol, a sugar alcohol, is gaining popularity due to its dental health benefits and low glycemic index. Sweeteners are used in various industries, including personal care, pharmaceutical, oral care products, chewing gums, cosmetics, and medications. Liquid and chewable forms of sweeteners are preferred in these applications for their ease of use and versatility. Sweeteners are used to enhance the palatability of foods and beverages, especially in the context of Western dietary habits and the prevalence of fast food and convenience food. However, the use of caloric sweeteners, such as sucrose and high-fructose corn syrup, is being replaced by non-nutritive sweeteners and polyol sweeteners, such as tagatose and rare sugars, to reduce caloric content and promote healthier lifestyles.

The market is diverse, with applications ranging from bakery food products and sugar substitutes to nutritional products and sweetening agents in food processing. The demand for diabetic-friendly sweeteners, such as those that do not affect blood sugar levels, is also on the rise due to the increasing prevalence of type 2 diabetes and related health issues, such as liver fat, visceral fat, and fatty liver disease. Product labeling and food safety are key considerations in the sweetener market, with consumers increasingly demanding transparency and additive-free, non-GMO, organic, and natural products. The use of sweeteners in various industries, such as pharmaceuticals and oral care, is also driving innovation in sweetener formulations and applications. In conclusion, the food sweetener market in Mexico is expected to grow significantly due to the increasing demand for low-calorie, natural, and clean-label sweeteners, as well as the trend towards sugar reduction and healthier lifestyles. The market is diverse and dynamic, with applications ranging from food and beverage to personal care and pharmaceuticals, and innovations in sweetener formulations and delivery forms driving growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

138 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.9% |

|

Market Growth 2024-2028 |

USD 70 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.7 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Amalgamated Sugar, Archer Daniels Midland Co., AB Sugar Ltd., Cargill Inc., Celanese Corp., DuPont de Nemours Inc., Evolva Holding AG, Ingredion Inc., Kerry Group Plc, Koninklijke DSM NV, Morita Kagaku Kogyo Co. Ltd., Nestle SA, Roquette Freres SA, Sudzucker AG, and Tate and Lyle PLC |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Mexico

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.