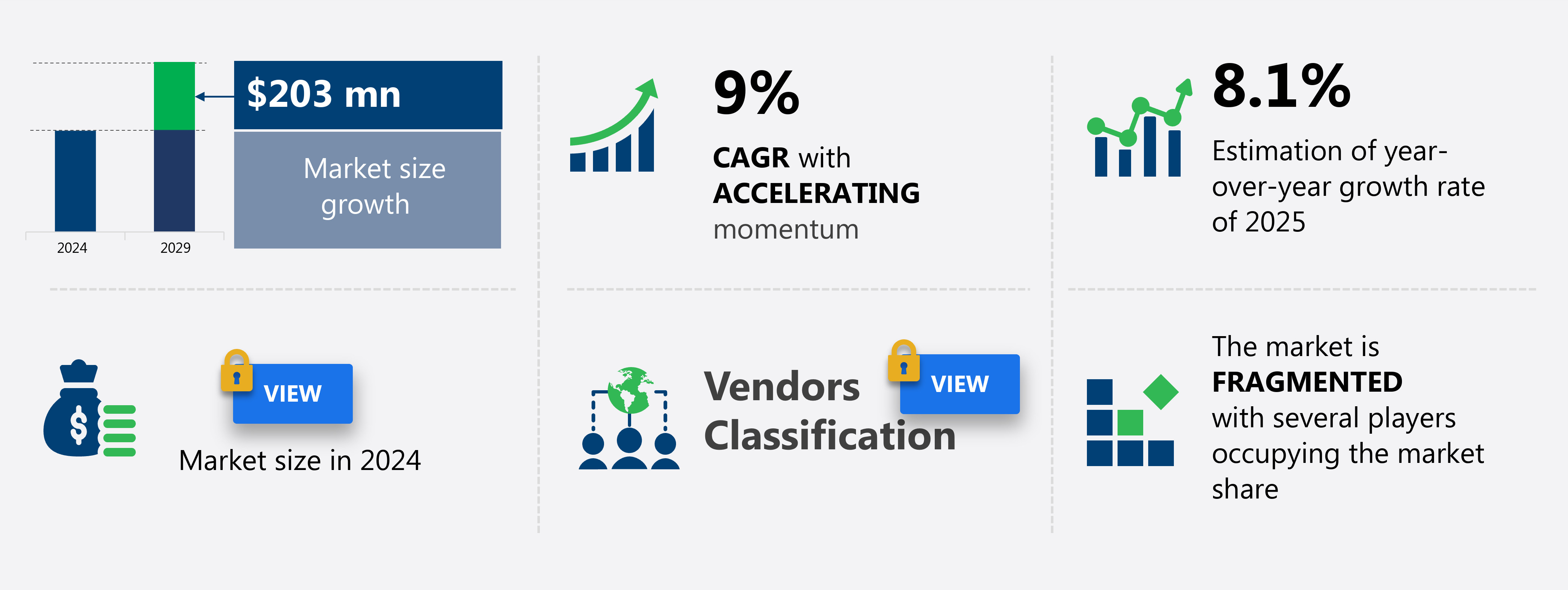

India Fruit Pulp Market Size 2025-2029

The fruit pulp market in India size is forecast to increase by USD 203 billion at a CAGR of 9% between 2024 and 2029.

- The fruit pulp market is experiencing significant growth due to several key trends. Firstly, the increasing urbanization and changing consumer lifestyle preferences towards healthier food options are driving market demand. Fruit pulp is used in a variety of applications, from beverages and cocktails to desserts and baked goods. With the increasing trend towards organic farming, many companies are using organic mangoes, which are grown without the use of fertilizers and pesticides, to manufacture mango pulp. Additionally, the expanding organized retail landscape is providing greater accessibility to consumers, further fueling market growth. Moreover, stringent regulations and guidelines are being implemented to ensure product safety and quality, which is a crucial factor in the market's growth. These trends are expected to continue shaping the fruit pulp market in the coming years.

What will be the Size of the Market During the Forecast Period?

- The fruit pulp market in the United States is experiencing significant growth due to the increasing consumer preference for processed fruits and healthy food options. This trend is driven by the desire for convenient, nutrient-dense foods and beverages, such as organic fruit juices, fruit smoothies, cocktails, and desserts. The distribution network for fruit pulp has become more organized, with an expanding presence in the retail landscape, enabling easier access for consumers. Profitability in the fruit pulp market is influenced by pricing strategies, promotions, and the competitive landscape. Key product categories include juice, pulp, and jams or marmalades.

- Consumers are increasingly seeking out fruit pulp products for their health benefits, including calcium, zinc, and stress release, as well as immune system support, osteoporosis prevention, and hypertension reduction. As a result, fruit pulp is becoming an essential ingredient in many food and beverage offerings. Overall, the fruit pulp market is poised for continued growth, driven by consumer lifestyle trends and the health benefits associated with processed fruits.

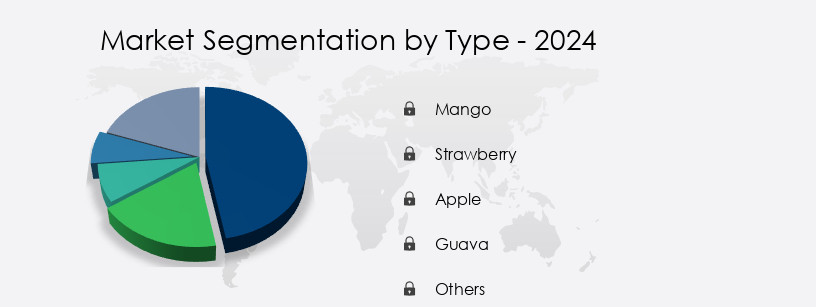

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Mango

- Strawberry

- Apple

- Guava

- Others

- Application

- Food

- Beverage

- Distribution Channel

- Online

- Offline

- Form

- Liquid

- Powder

- Geography

- India

By Type Insights

- The mango segment is estimated to witness significant growth during the forecast period.

Mango pulp is derived from fresh mangoes and is used to create delicious syrups, juices, cake fillings, marmalades, and other products. The pulp is prepared under hygienic conditions and is packaged with high quality to ensure freshness. Three main grades of mango pulp are available: alphonso mango pulp, kesar mango pulp, and Tota puri mango pulp. This not only benefits the consumers by providing healthier options but also caters to the demand for organic products.

Furthermore, the shelf life of mango pulp is a significant consideration for companies, and transportation and storage costs are essential factors in the production and distribution process.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our India Fruit Pulp Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of India Fruit Pulp Market?

Rising urbanization and changing consumer lifestyles is the key driver of the market.

- The fruit pulp market has witnessed significant growth due to the changing consumer lifestyle and increasing health consciousness. With urbanization and higher disposable incomes, there has been a shift towards the consumption of processed fruits, including fruit pulp, juices, smoothies, cocktails, desserts, jams, and jellies. These fruit-based products offer various health benefits such as calcium, zinc, stress release, immune system boost, and prevention of diseases like osteoporosis, hypertension, asthma, diabetes, and heart diseases. The organized retail landscape and distribution network have played a crucial role in the growth of the fruit pulp market. The infrastructure development, including storage facilities and quality control, has ensured the availability of fresh fruits and their derived products throughout the year.

- Food safety regulations have also been instrumental in maintaining the quality and safety of these products. The profitability of the fruit pulp market depends on various factors such as pricing, promotions, and price sensitivity. Consumers are increasingly looking for affordable and healthy options, leading to the need for effective pricing strategies and promotional offers. The market also offers opportunities for innovation through the development of new fruit types, juice concentrates, and value-added products like cake fillings, marmalades, and yogurts. The fruit pulp market faces challenges in terms of transportation and storage costs. Online distribution channels have emerged as a viable solution to reduce transportation costs and increase reach.

What are the market trends shaping the India Fruit Pulp Market?

Expanding organized retail landscape is the upcoming trend in the market.

- The market is witnessing growth due to the expanding organized retail landscape and the increasing availability of various fruit pulp products. Consumers' preference for healthy foods and beverages, including organic fruit juices, jellies, jams, and fruit-based desserts, is driving the demand for fruit pulp. The market's infrastructure, including storage facilities and quality control measures, is essential to maintain the freshness and quality of raw materials, adhere to food safety regulations, and ensure the taste and color enhancement of the final products. The profitability of the fruit pulp market depends on pricing strategies, promotions, and consumer health consciousness. Price sensitivity is a significant factor, and players in the market must balance affordability with quality.

- The market's supply chain management is crucial to minimize transportation and storage costs, extend shelf life, and maintain the freshness of the products. Fruit pulp finds applications in various food and beverage products, including juices, pulps, fruit smoothies, cocktails, yogurts, and baby food. The market's players compete for limited shelf space in organized retail stores, making it essential to offer innovative and value-added products. Additionally, the market's growth is influenced by consumer health concerns, such as calcium, zinc, stress release, immune system support, osteoporosis prevention, hypertension reduction, asthma prevention, diabetes prevention, and heart disease prevention. The market's distribution network includes both online and offline channels.

What challenges does India Fruit Pulp Market face during the growth?

Adherence to stringent regulations and guidelines is a key challenge affecting the market growth.

- The fruit pulp market in the US is driven by the increasing consumer preference for healthy foods and beverages, including organic fruit juices, fruit smoothies, cocktails, jellies, jams, and fruit-based desserts. The distribution network for these products is shaped by the organized retail landscape, with online and offline channels playing significant roles. Price sensitivity is a key factor influencing consumer decisions, and profitability depends on effective pricing strategies, promotions, and supply chain management. The infrastructure required for fruit pulp production includes storage facilities, quality control measures, and adherence to food safety regulations. Raw materials, such as fresh fruits, are essential for producing high-quality pulp, while transportation and storage costs impact the overall profitability of the market.

- The fruit pulp is rich in essential nutrients like calcium, zinc, and various vitamins, making it an attractive option for consumers seeking stress release, immune system support, and prevention of health issues such as osteoporosis, hypertension, asthma, diabetes, and heart diseases. However, the use of artificial flavoring and additives can impact the market negatively, as consumers increasingly demand natural and organic options. The fruit pulp market's profitability is influenced by factors such as fruit type, production techniques, and market trends. Effective supply chain management and adherence to quality control and food safety regulations are crucial for maintaining consumer trust and ensuring the longevity of the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ABC Fruits - The company focuses on manufacturing, supplying, and exporting fruit pulps and concentrates. The key offerings of the company include fruit pulp such as banana pulp and red papaya pulp.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABC Fruits

- Aditi Foods India Pvt. Ltd.

- Dreamland Agrofresh Products

- Ghousia Food Products Pvt. Ltd.

- Madhur Food Park

- MANCO FOODS

- Manuj Enterprises

- Mysore Fruit Products Pvt. Ltd.

- Paradise Juice Pvt Ltd

- Patidar Agro and Food Products

- Peony Food Products

- Royal Foodstuffs Pvt. Ltd.

- S N R Foods India Pvt. Ltd.

- Shimla Hills

- Srini Food Park Pvt Ltd.

- Suyog Food Products

- TMN International

- Varun Agro Processing Foods Pvt. Ltd.

- Vision Agro Foods

- Zain Natural Agro India Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The fruit pulp market is a significant segment of the global food and beverage industry, driven by the increasing demand for healthy and convenient food options. Processed fruits, including pulp, jellies, jams, and fruit-based beverages, have gained immense popularity among consumers due to their versatility and health benefits. The distribution network for fruit pulp and related products is a critical component of the organized retail landscape. Supermarkets, hypermarkets, and specialty stores are the primary channels for the sale of fruit pulp and related products. The infrastructure required for the storage, transportation, and quality control of these products is essential to maintain their freshness and shelf life.

Furthermore, health consciousness is a significant trend driving the growth of the fruit pulp market. Consumers are increasingly seeking out healthy food and beverage options, leading to an increase in demand for organic fruit juices, calcium-rich pulps, and other fruit-based products. These products offer various health benefits, such as stress release, immune system support, osteoporosis prevention, hypertension reduction, asthma prevention, and diabetes prevention. The profitability of the fruit pulp market is influenced by several factors, including pricing, promotions, and price sensitivity. Fruit pulp prices can fluctuate based on supply and demand, raw material costs, and transportation and storage costs.

Moreover, effective pricing strategies and promotional activities can help companies maintain their market share and attract new customers. Fruit pulp and related products are used in various applications, including beverages, juices, fruit smoothies, cocktails, desserts, and baby food. The market for these products is diverse and includes applications in the food service industry, bakery products, and industrial uses. The fruit pulp market faces several challenges, including food safety regulations, the need for infrastructure development, and the increasing use of artificial flavoring and color enhancement. Compliance with food safety regulations is crucial to ensure the safety and quality of fruit pulp and related products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market Growth 2025-2029 |

USD 203 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.1 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across India

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch