North America Functional Foods And Beverages Market Size 2025-2029

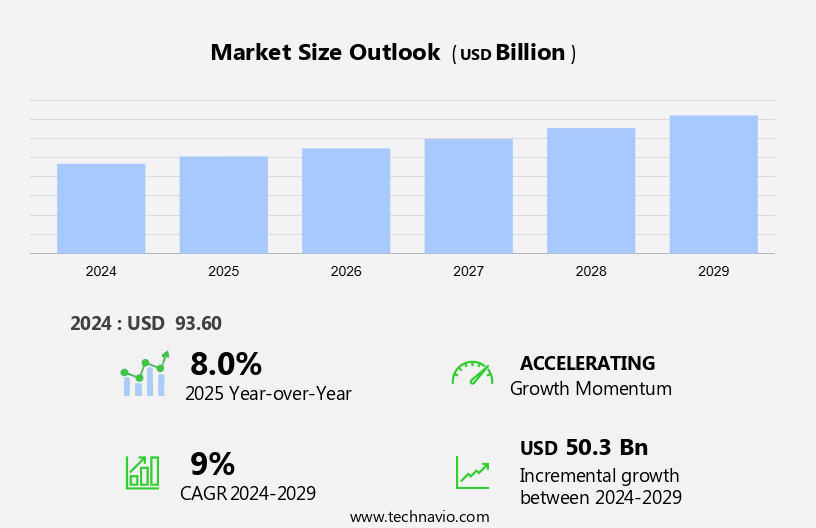

The North America functional foods and beverages market size is forecast to increase by USD 50.3 billion at a CAGR of 9% between 2024 and 2029.

- Functional foods and beverages in North America are witnessing significant growth due to the increasing consumer preference for healthier options. Product innovations in flavors and functional ingredients are driving market expansion, as companies seek to cater to evolving consumer tastes and preferences. However, regulatory hurdles impact adoption, as stringent labeling requirements necessitate extensive testing and certification processes. Supply chain inconsistencies also temper growth potential, as sourcing sustainable and high-quality ingredients remains a challenge for many manufacturers. Despite these obstacles, the market's future looks promising, with rising awareness of the health benefits of functional foods and beverages fueling demand. The rising awareness of the health benefits associated with functional foods and beverages, such as those rich in omega-3, protein, and antioxidants, is leading to increased demand.

- Companies that can navigate these challenges effectively, by investing in research and development and implementing robust supply chain strategies, stand to gain a competitive edge in this dynamic market.

What will be the size of the North America Functional Foods And Beverages Market during the forecast period?

- In the dynamic North American market, consumer desires for functional foods and beverages continue to grow, particularly in the vitamin-based functional dairy products segment. This trend is driven by the increasing prevalence of lifestyle diseases, such as obesity, and the aging population's need for better cognitive function. As a business tool, functional foods cater to busy schedules by offering convenient options like pre-packaged salads and functional beverages. Stringent regulations ensure the safety and efficacy of these products, with traceability systems and approval processes in place. The dairy products segment, including milk drinks, dominates the market due to their ability to deliver essential nutrients like calcium and protein.

- Premium products, such as those fortified with omega-3 fatty acids from meat and eggs, are gaining popularity among health-conscious consumers. Urban populations, particularly age groups with higher obesity rates, are increasingly seeking fiber-rich, immune-boosting functional foods. Fats and oils, when used responsibly, can contribute to a balanced diet and improved cognitive health. Consumer awareness of these benefits is on the rise, making functional foods and beverages an essential part of a modern business strategy.

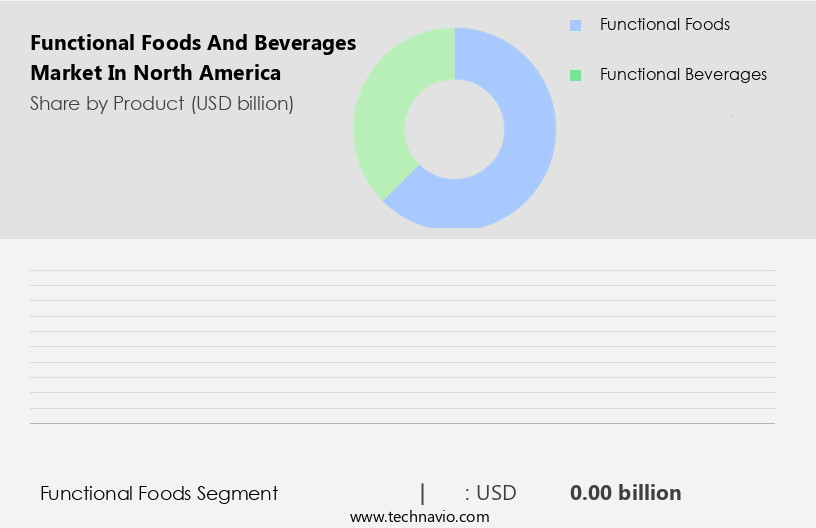

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Functional foods

- Functional beverages

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Mexico

- North America

By Product Insights

The functional foods segment is estimated to witness significant growth during the forecast period.

Functional foods and beverages in North America are experiencing significant growth due to the rising demand for products that address lifestyle diseases, particularly those related to digestive health and weight management. Innovations in targeted delivery systems, fortified food products, and premium offerings are driving market expansion. Consumer desires for improved digestion, enhanced immunity, and better cognitive function are key trends. The dairy products segment, with its focus on cardiac health, bone health, and Omega-3 fatty acids, is a significant contributor. However, high production costs, sourcing complexities, and stringent regulations pose challenges. The aging population's nutritional needs, health consciousness, and busy schedules are fueling demand for nutrient-rich, convenient foods and beverages.

Plant-based sources, fiber consumption, and functional ingredients are popular choices for meeting these needs. Regulatory compliance and consumer awareness are essential factors influencing market dynamics. Functional beverages, such as milk drinks and pre-packaged salads, cater to various age groups and urban populations. The market is also seeing innovation in meal replacement bars, sports performance products, and bakery and confectionery items. Despite these opportunities, the market faces hurdles like approval processes, traceability systems, and economic motives. Overall, the market is a dynamic and evolving landscape, shaped by consumer desires, regulatory requirements, and ongoing innovation.

The Functional foods segment was valued at USD billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the North America Functional Foods And Beverages Market drivers leading to the rise in adoption of the Industry?

- Product innovations, specifically in the realm of flavors and functional ingredients, serve as the primary catalyst for market growth.

- Functional foods and beverages in North America are witnessing significant growth due to increasing consumer focus on lifestyle diseases prevention and health consciousness. Manufacturers are responding to this trend by introducing innovative flavors and functional ingredients to meet evolving consumer preferences. For instance, Suntory's Tropical Fusion, launched in 2015, is a sugar-free and low-calorie drink that offers a blend of pineapple and kiwifruit flavors to cater to the growing demand for tropical tastes. Moreover, targeted delivery systems, such as controlled release and microbe-based sources, are gaining popularity in the market.

- Fortified food products, including dairy, are increasingly being fortified with active ingredients for digestive health, weight management, cardiac health, and bone health. Premium products with superior product quality are also in high demand as consumers prioritize healthier eating habits. The market is a valuable business tool for companies looking to cater to the health-conscious consumer base.

What are the North America Functional Foods And Beverages Market trends shaping the Industry?

- The growing recognition of functional foods and beverages for their health advantages is a significant market trend. This trend signifies a shift towards consuming products that not only satisfy taste preferences but also offer additional health benefits.

- Functional foods and beverages in North America are witnessing significant growth due to increasing consumer awareness regarding their health benefits. These products, which include cereals, flours, functional dairy products, meal replacement bars, bakery and confectionery, and beverages, are marketed as nutrient-rich foods with added functional properties. The functional properties of these foods range from enhancing immune function and fiber consumption to supporting general wellness, sports performance, and cognitive decline. For instance, oats contain beta-glucan, which is known to reduce serum LDL or bad cholesterol. Other functional foods include tea, which contains catechins, and yogurt, which provides calcium and probiotics.

- Superfruits such as cranberries, grapes, pomegranate, tomatoes, and chocolate are also rich in various antioxidants, carotenoids, flavonoids, and other beneficial nutrients. Despite the numerous health benefits, the production costs of functional foods and beverages are high due to the complexities involved in sourcing and processing the raw materials. Nevertheless, the market continues to grow as consumers seek out convenient and nutritious options for maintaining optimal health.

How does North America Functional Foods And Beverages Market faces challenges face during its growth?

- Functional foods and beverages, characterized by their health benefits beyond basic nutrition, face a significant challenge in the form of ingredient labeling regulations. Compliance with these regulations is crucial for industry growth, ensuring transparency and consumer trust.

- Functional foods and beverages in North America have gained significant attention due to the aging population and evolving consumer desires for nutritious, convenient options that support improved digestion, immune system, and holistic wellness. These products, which often contain functional ingredients such as Omega-3 fatty acids, Vitamin-based functional, amino acids, and dietary fibers, are sourced from both plant-based and animal-based sources. Consumer interest in preventive healthcare and gut health has fueled the market's growth, with economic motives also playing a role. However, skepticism regarding the efficiency and safety of these products can hinder market expansion. Extensive research is being conducted to validate the health claims made by manufacturers and ensure regulatory compliance.

- For instance, studies have shown that excessive consumption of energy drinks can impair oral glucose tolerance in adolescents and contain potentially harmful chemicals. As a result, manufacturers must ensure the safety and efficacy of their products while catering to the diverse needs and preferences of consumers.

Exclusive North America Functional Foods And Beverages Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- Arla Foods amba

- Campbell Soup Co.

- Danone SA

- Fonterra Cooperative Group Ltd.

- General Mills Inc.

- Glanbia plc

- Hearthside Food Solutions LLC

- Kellogg Co.

- Keurig Dr Pepper Inc.

- Monster Beverage Corp.

- Nestle SA

- PepsiCo Inc.

- Red Bull GmbH

- Suntory Holdings Ltd.

- The Coca Cola Co.

- The Kraft Heinz Co.

- Tyson Foods Inc.

- Unilever PLC

- Yakult Honsha Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Functional Foods And Beverages Market In North America

- In February 2024, Danone North America, a leading player in the functional food and beverages market, announced the launch of its new plant-based yogurt alternative, Silk Dairy-Free Yogurt Alternative. This product expansion underscores Danone's commitment to catering to the growing consumer demand for plant-based alternatives (Danone North America Press Release, 2024).

- In June 2025, PepsiCo and Starbucks entered into a strategic partnership to develop and market ready-to-drink coffee and tea products under the Starbucks brand. This collaboration represents a significant move by PepsiCo to strengthen its presence in the functional beverages segment (PepsiCo Inc. Press Release, 2025).

- In September 2024, The Quaker Oats Company, a subsidiary of PepsiCo, completed the acquisition of Granola King, a leading Canadian manufacturer of granolas and nutritional bars. This acquisition will enable Quaker to expand its product offerings and strengthen its position in the functional foods market (Quaker Oats Company Press Release, 2024).

- In November 2025, the U.S. Food and Drug Administration (FDA) approved the use of a new health claim for probiotics in functional foods and beverages. This approval will allow manufacturers to make specific health claims related to probiotics on their product labels, boosting consumer confidence and driving market growth (FDA Press Release, 2025).

Research Analyst Overview

Functional foods and beverages have emerged as a significant market in North America, driven by the rising awareness of lifestyle diseases and the increasing focus on health and wellness. This dynamic industry continues to evolve, with digestive health and weight management remaining key areas of focus. Targeted delivery systems, such as controlled release and microbe-based sources, have gained popularity in fortified food products, enabling better absorption of active ingredients. Premium products, with their superior product quality, have become a business tool for companies seeking to cater to the health-conscious consumer. The dairy products segment, in particular, has seen growth due to the functional properties of dairy, such as bone health and cardiac health benefits.

Consumers are increasingly seeking nutrient-rich food sources, leading to a surge in demand for omega-3 fatty acids, fiber consumption, and vitamin-based functional ingredients. The aging population and consumer desires for improved digestion, immune function, and cognitive health have fueled the demand for functional ingredients in various food categories, including bakery and confectionery, meal replacement bars, and pre-packaged salads. The convenience factor of nutritive convenience foods has also played a role in the market's growth, with busy schedules driving the demand for functional beverages and snacks. However, sourcing complexities and regulatory compliance pose challenges to the industry. The need for approval processes and traceability systems is becoming increasingly important, particularly in the wake of stringent regulations.

The economic motives of companies to meet consumer demands for functional foods and beverages have led to the exploration of plant-based sources, animal-based sources, and dietary fibers. The market's dynamics are further influenced by the evolving consumption patterns of urban populations. Consumers are increasingly aware of the health benefits of functional foods and beverages, leading to a shift towards healthier eating habits. The market for functional dairy products, functional beverages, and fiber-rich cereals and flours is expected to continue growing, driven by consumer preferences for better cognitive function, immune support, and preventive healthcare. The market is a complex and evolving landscape, shaped by consumer desires, economic motives, and regulatory requirements.

The industry's continuous dynamism is reflected in the ongoing research and development of new functional ingredients, delivery systems, and product categories. The market's focus on general wellness, cardiac health, bone health, and cognitive health is expected to drive growth in the coming years, with a particular emphasis on meeting the unique needs of different age groups and consumer segments.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Functional Foods and Beverages Market in North America insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 50.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch