Flour Market Size 2024-2028

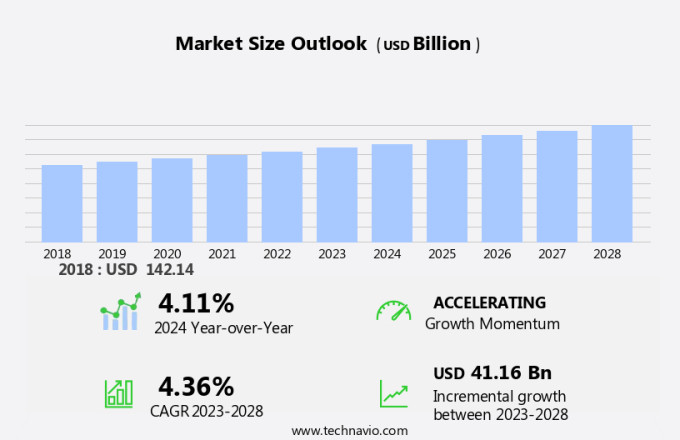

The flour market size is forecast to increase by USD 41.16 billion at a CAGR of 4.36% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for bakery items, particularly in the US and North America. This trend is driven by the rising preference for convenient and ready-to-eat food options. Soya flour is used as a protein source in various industries, while flavored flours add taste and variety to food products. Additionally, flour is used In the production of bioplastics and glue, further expanding its applications. However, the market faces challenges due to the high manufacturing and production costs associated with the fermentation process of wheat flour. These costs can be attributed to the use of expensive raw materials and the energy-intensive production process. Despite these challenges, the market is expected to continue its growth trajectory, driven by the increasing consumer preference for bakery products and the growing trend towards healthier food options. The market analysis report provides a comprehensive study of these trends and growth factors, offering valuable insights to stakeholders and industry participants.

What will be the Size of the Flour Market During the Forecast Period?

- The market encompasses a diverse range of grains, including wheat, corn, and others, that are processed into various forms such as wheat flour, corn flour, and clean-label flours. Key applications include bakery items like bread and pastries, as well as fried food, fast food, and the production of noodles, pasta, and other wheat-based products. Demand for flour is driven by the growing popularity of baked goods and clean-label foods, particularly whole grain varieties.

How is this Flour Industry segmented and which is the largest segment?

The flour industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2017-2022 for the following segments.

- Type

- Wheat

- Maize/corn

- Rice

- Application

- Bakery products

- Noodles and pasta

- Biscuits/waffles/wafers

- Others

- Geography

- APAC

- China

- India

- Europe

- Germany

- France

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

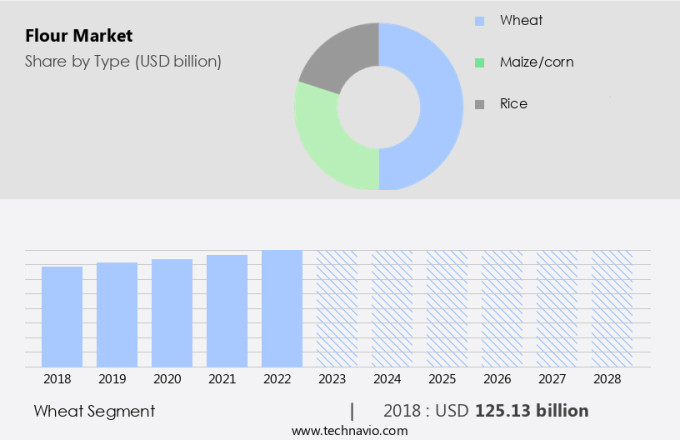

- The wheat segment is estimated to witness significant growth during the forecast period.

Wheat flour, derived from wheat, is a fundamental ingredient in baking, contributing to the structure, texture, and taste of various baked goods. The global bakery industry's growth, driven by the rising consumption of bread, cakes, pastries, and other baked items, fuels the demand for wheat flour. Consumers' modern and urban lifestyles, with an increasing preference for convenience foods like fast food and fried items, also contribute to the market's expansion. Health concerns, such as gluten intolerance and celiac disease, have led to the development of alternative flours, including rice, maize, oat, rye, and soya, further broadening the market scope. The baking industry's growth, driven by the millennial generation's spending on food and the emergence of new clean-label and fiber-rich food products, also presents significant opportunities.

The market encompasses various applications, including baked goods, pet food, bio-plastics, glue, roux, baby food, and various food processing technologies, such as dry and wet. The market's growth is influenced by factors like the urban population's increasing working population, the cereal-based foods' popularity, and the growing demand for clean-label and whole-grain foods.

Get a glance at the Flour Industry report of share of various segments Request Free Sample

The Wheat segment was valued at USD 125.13 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

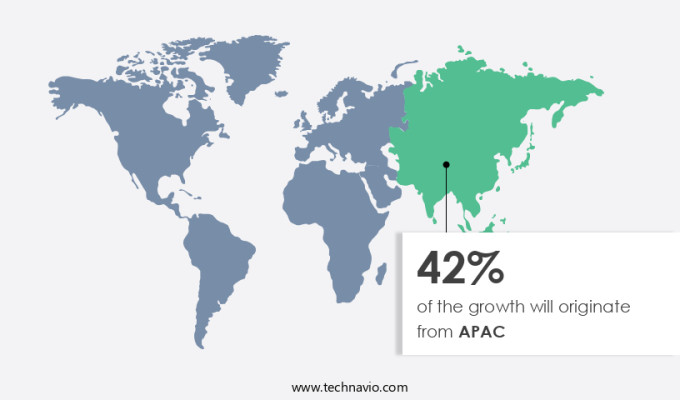

- APAC is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia Pacific is experiencing significant growth due to several key factors. Increasing health concerns and urbanization are major drivers, leading to a rise in demand for fiber-rich, low-sugar, and low-calorie food products. Consumers in this region have diverse tastes and preferences, necessitating the production of a wide range of flour types, including wheat, rice, maize, oat, rye, and durum. Key countries contributing to market growth are China, India, the Philippines, Thailand, and Vietnam. The bakery and pet food industries are significant consumers of flour, while it also finds applications In the production of wafers, crackers, and biscuits, and non-food items like biomaterials, glue, roux, and baby food.

Urbanization and the working population's increasing spending on food are further fueling market growth. The millennial generation's preference for clean-label and whole-grain foods is also driving the demand for value-added flour. Key trends include the adoption of dry and wet technology in flour processing and the expansion of e-commerce platforms for sales.

Market Dynamics

Our flour market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Flour Industry?

Growing demand for bakery items is the key driver of the market.

- The market is experiencing notable growth due to several key factors. These include the expanding urban population and the increasing demand for convenient food options, such as fast food and fried food, which are major consumers of flour. Modern lifestyle and urbanization have led to a rise In the popularity of bakery items, including bread, cakes, pastries, biscuits, and cookies, all of which require flour as a primary ingredient. Additionally, there is a growing trend towards cereal-based foods, noodles, and pasta, which also contribute significantly to the market. Dietary concerns, such as gluten intolerance and celiac disease, have led to the production of value-added flours, including rice flour, maize flour, soya flour, and flavored flour.

- These flours cater to the specific needs of consumers and have gained popularity in recent years. Furthermore, the market is not limited to human consumption; it also serves the pet food industry and is used In the production of non-food items, such as biomaterials, glue, roux, and baby food. The market is driven by several factors, including the increasing purchasing power of the population in emerging economies, such as China and India, and the adoption of Western culture and nutrition patterns. The market is segmented into various types of flours, including wheat flour, durum flour, rice, maize, oat flour, rye flour, and animal feed.

What are the market trends shaping the Flour Industry?

Increasing demand for organic and gluten-free bakery products is the upcoming market trend.

- The market In the US is experiencing significant growth due to the increasing demand for wheat flours used in various bakery items and processed foods. Consumers' preferences for taste and dietary concerns, such as gluten-free and organic options, are driving this trend. As a result, there is a rising demand for alternative flours like corn flour, rice flour, maize flour, soya flour, and flavored flours. Moreover, the urban and modern lifestyle of the population is leading to an increase in demand for fast food and fried food, which also relies on flour as a raw material. Commercial farmlands produce food grains in large quantities to meet the demand for these flours.

- Durum flour, rye flour, and oat flour are also gaining popularity In the market. The market caters to various industries, including the bakery industry, pet food industry, bio-plastic production, glue production, and baby food. The market is segmented based on technology, including dry technology and wet technology. The market dynamics are influenced by factors such as health concerns, contamination, and consumer spending on food. The millennial generation's preference for clean-label, whole grain foods and fiber-rich foods is driving the demand for clean-label flour.

What challenges does the Flour Industry face during its growth?

High manufacturing and production costs associated with the fermentation process of wheat flour is a key challenge affecting the industry growth.

- The market encompasses a wide range of wheat-based and alternative flours used in various industries, including bakeries, fast food, and processed food. Wheat flour, a key component of bread and bakery items, is in high demand due to its versatility and taste preference. However, the production of wheat flour, particularly fermented wheat flour, comes with significant costs. The lengthy fermentation process, which can take hours to days, requires careful monitoring and specific conditions to ensure proper fermentation. This adds to the overall production expenses. Beyond wheat flour, the market includes corn flour for fried food and fast food, rice, maize, oat, rye, and durum flours for cereal-based foods and animal feed.

- Additionally, flours like soya, rice, and maize are used In the production of wafers, crackers, and biscuits. Flours also find applications in non-food sectors such as biomaterials, glue, roux, and baby food. Modern and urban lifestyles have led to increased spending on food, particularly convenience foods and clean-label products. Consumers are increasingly concerned with health issues, including gluten intolerance and dietary requirements. As a result, value-added flours like clean-label and whole grain are gaining popularity. The bakery and pet food industries are significant consumers of various flours. The market is driven by factors such as changing consumer preferences, the demand for fiber-rich foods, and the rise of celiac disease. Segmentation of the market includes refined wheat flour, noodles and pasta, and specialized flours like flavored and functional flours.

Exclusive Customer Landscape

The flour market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the flour market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, flour market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- Ardent Mills LLC

- Associated British Foods Plc

- Bay State Milling Co.

- Bunge Ltd.

- Burapa Prosper Co. Ltd.

- Cargill Inc.

- General Mills Inc.

- GrainCorp Ltd.

- Hodgson Mill

- ITC Ltd.

- King Arthur Baking Co. Inc.

- Lieng Tong Rice Vermicilli Co. Ltd.

- Manildra Flour Mills Pty. Ltd.

- Parrish and Heimbecker Ltd.

- PT Sriboga Raturaya

- Savage Services Corp.

- Thai Flour Industry Co. Ltd.

- Thai Wah Public Co. Ltd.

- Wilmar International Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of raw materials, including wheat, corn, rice, maize, oat, durum, and others. These grains are transformed into various types of flours through processes such as dry technology and wet technology. The resulting flours serve numerous industries and applications, from bakery items and processed foods to animal feed, pet food, and biomaterials. Flour is an essential ingredient in numerous consumer products, particularly In the food sector. The bakery industry utilizes a significant portion of the flour supply, with items such as cakes, pastries, biscuits, cookies, and bread being popular choices. The demand for these products is driven by various factors, including changing consumer preferences and dietary trends.

Moreover, the modern lifestyle and urban population have led to an increase in demand for convenience foods and ready-to-eat items. This trend has resulted In the production of a wide range of new food products, many of which incorporate value-added flours. These flours offer enhanced nutritional properties, improved taste, and extended shelf life. The millennial generation's spending on food has also influenced the market. This demographic is known for their health consciousness and preference for fiber-rich foods. As a result, there is a growing demand for whole grain foods and clean-label flours. These flours are free from additives and preservatives, making them an attractive option for health-conscious consumers.

Furthermore, the bakery industry is not the only sector driving the demand for flour. The pet food industry also relies heavily on flour as a raw material. The market is segmented based on the type of flour, with each segment catering to specific industries and applications. For instance, refined wheat flour is commonly used In the production of baked goods, while rice flour and maize flour are popular in Asian cuisine.

|

Flour Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2017-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 41.16 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

China, India, US, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Flour Market Research and Growth Report?

- CAGR of the Flour industry during the forecast period

- Detailed information on factors that will drive the Flour market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the flour market growth of industry companies

We can help! Our analysts can customize this flour market research report to meet your requirements.