Geofoams Market Size 2024-2028

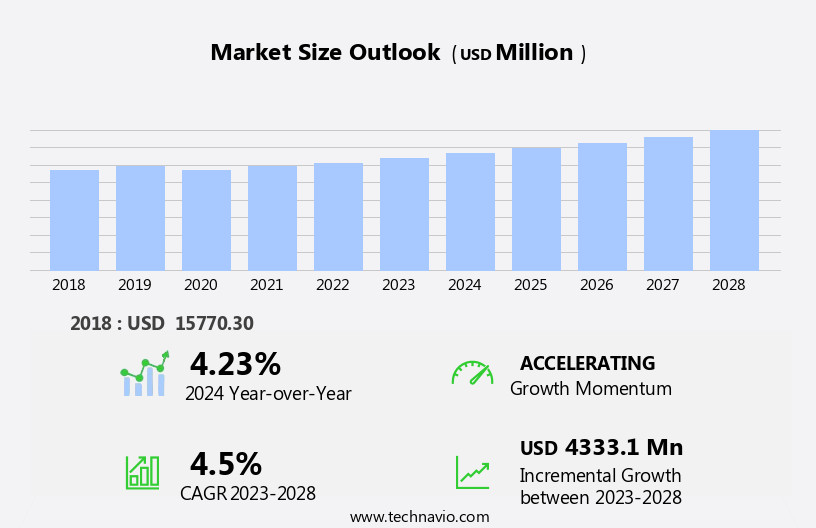

The geofoams market size is forecast to increase by USD 4.33 billion, at a CAGR of 4.5% between 2023 and 2028.

- The market is characterized by its growth potential, driven by the low cost of geofoams compared to traditional land stabilization materials. This cost advantage makes geofoams an attractive alternative for infrastructure and construction projects, particularly in regions with large development initiatives. A key trend in the market is the increasing global construction and infrastructure development activities, which is expanding the demand for geofoams. However, challenges persist, including the limited technical knowledge and awareness about geofoams in emerging markets, which may hinder market penetration and adoption. Companies seeking to capitalize on market opportunities should focus on educating potential customers about the benefits of geofoams and invest in research and development to address the technical challenges in these markets.

- Effective market strategies will involve collaboration with local partners, customized solutions, and targeted marketing efforts to build awareness and trust. Navigating these challenges will require a deep understanding of the market dynamics and a commitment to innovation and customer service.

What will be the Size of the Geofoams Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the diverse applications across various sectors. These include thermal insulation in pipeline support, retaining walls, and tunnel construction, as well as structural fill in highway construction, mine backfill, and bridge construction. The demand for geofoams with superior thermal conductivity, such as expanded polystyrene and cellular glass, is increasing due to their ability to enhance energy efficiency and reduce carbon footprint in infrastructure projects. Manufacturing processes, from extruded polystyrene to phenolic foams, are continually refined to improve product quality and meet stringent testing standards, such as ISO and ASTM. Tensile strength, shear strength, compressive strength, and moisture control are essential properties that ensure the durability and effectiveness of geofoams in various applications.

Geofoams also find use in acoustic impedance for noise reduction, fire protection, and erosion control. In addition, they are utilized in lightweight concrete, railroad ballast, seismic mitigation, and foundation support. The market's continuous dynamism is further highlighted by the ongoing research and development efforts to address environmental impact and life cycle assessment concerns. The market's evolution is marked by the integration of advanced technologies and materials, such as polyurethane foams and cellular concrete, to meet the evolving needs of infrastructure development. As the demand for sustainable and efficient construction solutions grows, geofoams are poised to play a significant role in shaping the future of the industry.

How is this Geofoams Industry segmented?

The geofoams industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- EPS

- XPS

- Geography

- North America

- US

- Europe

- Russia

- UK

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Material Insights

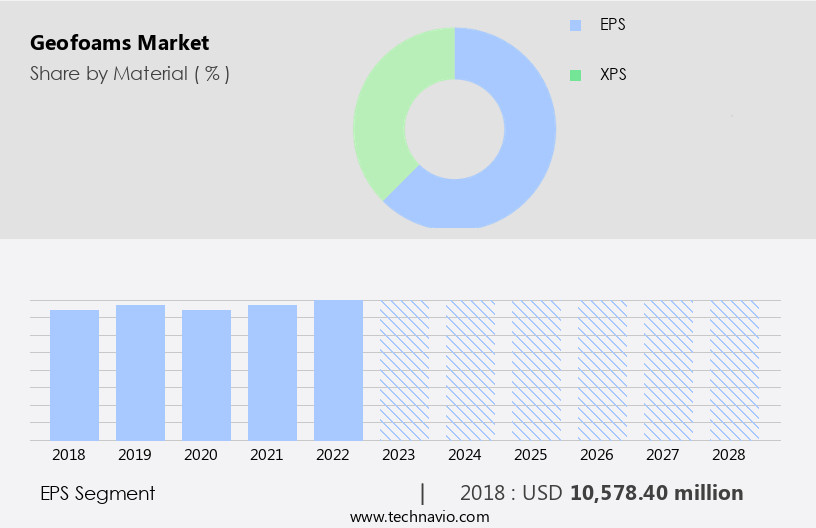

The eps segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, with expanded polystyrene (EPS) being the leading segment in 2021. EPS, known for its low density and high insulation properties, is extensively used in various applications such as structural filling, highway construction, mine backfill, and tunnel construction. Its thermal insulation properties help mitigate frost-related issues, making it an ideal choice for harsh environments. EPS geofoam's versatility extends to elevated slab applications, road building, and pipeline support. The manufacturing process ensures consistent quality through rigorous testing standards, adhering to ISO and ASTM standards. Other geofoam types, including cellular glass, phenolic foams, and polyurethane foams, offer distinct advantages, such as higher compressive strength, shear strength, and acoustic impedance.

These materials are increasingly being used for waste management, environmental impact mitigation, bridge construction, land reclamation, railroad ballast, seismic mitigation, and slope stabilization. Despite their varying properties, all geofoams share the common goal of providing lightweight, effective solutions for foundation support, void fill, and moisture control. The industry's focus on life cycle assessment and carbon footprint reduction is driving innovation in geofoam manufacturing and application methods.

The EPS segment was valued at USD 10.58 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

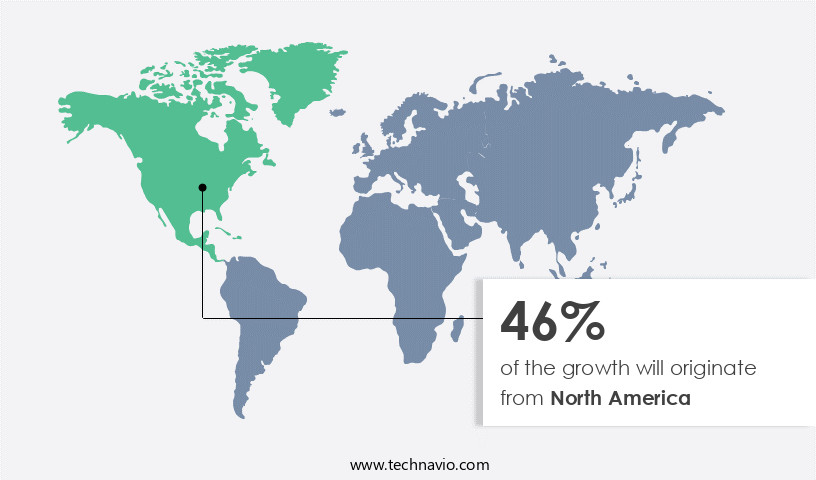

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in North America, which holds the largest market share in 2023. Civil engineers in this region are increasingly recognizing the benefits of geofoams in infrastructure and construction projects. One notable application is the maintenance and rehabilitation of roads, highways, and flyovers. Infrastructure funding, such as the Fixing America Surface Transportation (FAST) Act and the Highway Trust Fund, which approved over USD 300 billion between 2016 and 2020, has emphasized infrastructure safety and structural highway programs, further boosting demand for geofoams. Additionally, the rising construction activity in the region is expected to continue driving market growth.

Geofoams are utilized in various applications, including structural fill, mine backfill, thermal insulation, erosion control, and pipeline support. Manufacturing processes for geofoams involve the production of materials like expanded polystyrene, extruded polystyrene, phenolic foams, and cellular glass. Quality control measures and testing standards ensure the integrity of these products. In tunnel construction, geofoams provide benefits such as acoustic impedance and shear strength. Lightweight fill and void fill applications offer advantages in foundation support, slope stabilization, and seismic mitigation. Environmental impact and carbon footprint considerations are essential, with life cycle assessments and moisture control playing crucial roles in the market.

ASTM standards and other regulatory bodies ensure compliance, while polyurethane foams and cellular concrete are additional product offerings.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Geofoams Industry?

- The significant cost advantage sets engineered soil mixtures apart from conventional land stabilization materials, driving market growth.

- Geofoams have gained popularity in the construction industry due to their cost-effective solutions and versatility. These lightweight, closed-cell foams offer excellent compressive strength and flexibility, making them suitable for various applications such as acoustic insulation, slope stabilization, and soil stabilization. Geofoams can be easily installed using basic hand tools, resulting in reduced labor, investment, and operating costs. For instance, Airfoam's Foamshield, a rigid EPS insulation, was recently launched as a home insulation solution, offering significant cost savings for homeowners. Geofoams adhere to ASTM standards, ensuring their quality and reliability.

- They are also environmentally friendly, with lower carbon footprints compared to traditional construction materials. In complex projects where large machinery cannot be used, geofoams can be easily installed, and materials like soil or cellular concrete can be placed against them. Geofoams' strength, flexibility, and ease of installation make them a preferred choice for the construction industry.

What are the market trends shaping the Geofoams Industry?

- Global construction and infrastructure development activities are experiencing a significant upward trend, representing a notable market tendency. This trend is driven by numerous factors, including increasing population growth, urbanization, and economic development in various regions around the world.

- The global geofoam market is experiencing significant growth due to the increasing demand for thermal insulation and structural fill applications in various industries, including highway construction and tunnel construction. Geofoams, primarily made of expanded polystyrene, offer advantages such as low thermal conductivity, high tensile strength, and excellent quality control. These properties make geofoams an ideal choice for insulating and stabilizing structures, resulting in energy savings and improved structural integrity. Moreover, the mining industry utilizes geofoams as mine backfill to enhance mine safety and stability. The manufacturing process of geofoams involves rigorous testing to meet international standards, such as ISO standards, ensuring the production of high-quality products.

- The global infrastructure sector's expansion, particularly in developed and emerging economies, is driving the demand for geofoams in various applications. The US construction market's recovery, fueled by a robust housing market and historically low mortgage rates, is expected to further boost the demand for geofoams in the region.

What challenges does the Geofoams Industry face during its growth?

- The lack of comprehensive technical knowledge and awareness regarding geofoams poses a significant challenge to the expansion of the industry in emerging markets.

- Geofoams, a type of lightweight, cellular material, are increasingly used in infrastructure development for various applications, including pipeline support, retaining walls, thermal insulation, erosion control, fire protection, and shear strength enhancement. In developed countries, civil engineers have a better understanding of geofoams' benefits and their use in construction projects. However, in emerging markets, the awareness level is relatively low due to the availability and affordability of traditional construction materials. The design criteria for civil construction projects should incorporate the use of geofoams to enhance infrastructure development. For instance, geofoams can be used as pipeline supports to prevent soil settlement and reduce the risk of pipeline damage.

- In retaining wall applications, they provide excellent load-bearing capacity and reduce the need for extensive excavation. Additionally, geofoams offer superior thermal insulation properties, making them ideal for energy-efficient buildings. Geofoams come in various forms, such as cellular glass, extruded polystyrene, phenolic foams, and others. Each type has unique properties that make them suitable for specific applications. For example, cellular glass has high compressive strength and excellent fire resistance, making it an ideal choice for fire protection applications. Phenolic foams, on the other hand, have high shear strength and are commonly used for erosion control. In waste management, geofoams can be used as landfill covers to reduce the volume of waste and prevent the escape of landfill gases.

- Furthermore, they can be used as thermal insulation in waste-to-energy plants to improve energy efficiency and reduce greenhouse gas emissions. In summary, geofoams offer numerous benefits for infrastructure development and should be considered as a viable alternative to traditional construction materials. With increasing awareness and understanding of their properties and applications, their usage is expected to grow in both developed and emerging markets.

Exclusive Customer Landscape

The geofoams market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the geofoams market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, geofoams market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airfoam Industries Ltd. - The company specializes in providing geofoam solutions, including Atlas Geofoam Lightweight Fill.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airfoam Industries Ltd.

- Amvic Inc

- Atlas Roofing Corp.

- Beaver Plastics Ltd.

- Carlisle Companies Inc.

- Drew Foam Co. Inc.

- EXPOL Ltd.

- Foam Products Corp.

- Foamex

- Galaxy Polystyrene LLC

- Groupe Legerlite Inc.

- Harbor Foam

- Insulation Company of America LLC

- Jablite Ltd.

- Pacific Allied Products Ltd.

- Plasti Fab Ltd.

- Poly Molding LLC

- Technopol SA Pty Ltd.

- ThermaFoam Operating LLC

- Universal Foam Products

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Geofoams Market

- In January 2024, leading geofoam manufacturer, EPS Industries, announced the launch of a new, high-density geofoam product, XtraDense, designed for use in large-scale infrastructure projects. This innovation aimed to address the growing demand for lightweight, yet robust geofoam solutions in the construction industry (EPS Industries Press Release).

- In March 2024, geofoam market leader, IsoCell, entered into a strategic partnership with leading civil engineering firm, Bechtel, to collaborate on the development and implementation of advanced geofoam technologies for infrastructure projects. This collaboration aimed to enhance IsoCell's market presence and expand its reach within the civil engineering sector (Bechtel Press Release).

- In May 2024, geofoam manufacturer, Geofoam Technologies, secured a significant investment of USD25 million in a Series B funding round led by venture capital firm, Green Energy Ventures. This investment would support the company's expansion plans, including the construction of a new manufacturing facility and the development of innovative geofoam products (Geofoam Technologies Press Release).

- In April 2025, the European Commission approved the use of geofoams in large-scale infrastructure projects, paving the way for increased adoption of this technology within the European Union. This approval marked a significant regulatory milestone for the geofoam industry and opened up new opportunities for market growth (European Commission Press Release).

Research Analyst Overview

- The market encompasses a range of lightweight, high-performance building materials, including closed-cell and open-cell foams made from expanded polypropylene (EPS) and XPS. These materials offer superior fire resistance, load-bearing capacity, and chemical resistance, making them ideal for civil engineering applications such as ground improvement, soil improvement, and foundation engineering. In the realm of structural design, geofoams are valued for their long-term stability and acoustic performance. Geofoams are also gaining traction in sustainable construction due to their potential for waste reduction through recycling methods. The use of recycled geofoam in construction materials is a growing trend, contributing to environmental engineering efforts and cost savings.

- Geotechnical engineering firms employ computational fluid dynamics and finite element analysis to optimize design specifications, ensuring the thermal performance and water resistance of geofoams meet project requirements. As the demand for green building materials continues to rise, the market for geofoams is poised for growth, with applications extending beyond construction to include acoustic performance and settlement analysis in various industries.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Geofoams Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 4333.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Russia, China, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Geofoams Market Research and Growth Report?

- CAGR of the Geofoams industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the geofoams market growth of industry companies

We can help! Our analysts can customize this geofoams market research report to meet your requirements.