Glass Blocks Market Size 2025-2029

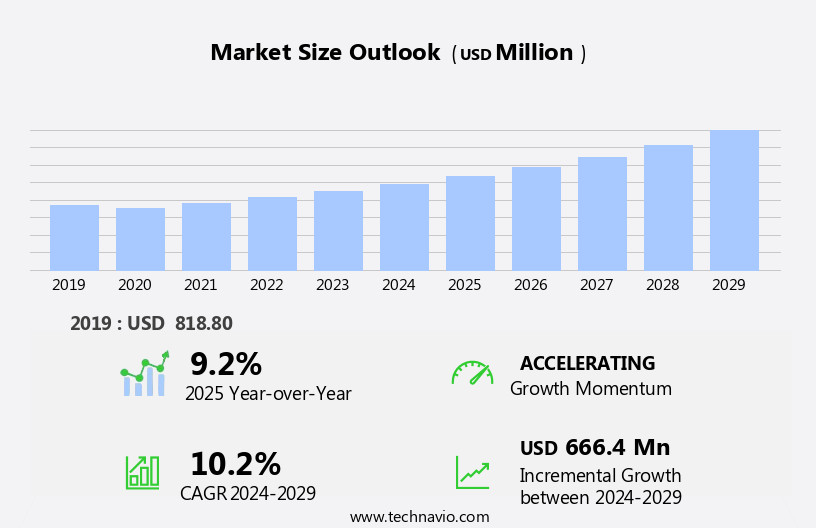

The glass blocks market size is forecast to increase by USD 666.4 million at a CAGR of 10.2% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing demand for privacy and security in buildings. Advanced manufacturing technologies have led to the production of high-quality glass blocks, offering superior insulation and durability. However, the high cost of manufacturing and installation remains a challenge for market growth. These trends are shaping the future of the market, providing opportunities for stakeholders to capitalize on the growing demand for secure and energy-efficient building solutions. The need for sustainable and eco-friendly construction practices is also driving the market, with these offering excellent thermal insulation properties. Overall, the market is expected to experience steady growth In the coming years, with innovations in manufacturing processes and design expected to further boost demand.

What will be the Size of the Market During the Forecast Period?

- The market encompasses the production and supply of transparent, translucent, colored, patterned, and frosted glass blocks, also known as glass bricks, used as architectural materials in various sectors. These blocks are primarily manufactured using silica, sodium, and lime, with the opacity level varying from clear to opaque. The market is driven by the growing demand for sustainable construction methods and their versatility in various architectural styles. These are utilized in both residential and commercial applications, with a focus on natural light transmission, thermal insulation, and soundproofing properties. Large-sized glass blocks are increasingly popular due to their ability to create unique design features and allow for natural light to penetrate deeper into buildings.

- The market is witnessing significant growth due to the increasing adoption of it in modern architectural designs, offering improved energy efficiency and enhanced aesthetic appeal. These are fused together in a cavity system, providing excellent thermal insulation and soundproofing properties. The market's future direction is towards the development of more sustainable and cost-effective manufacturing processes, as well as the integration of advanced technologies to enhance the functionality and design possibilities of glass blocks.

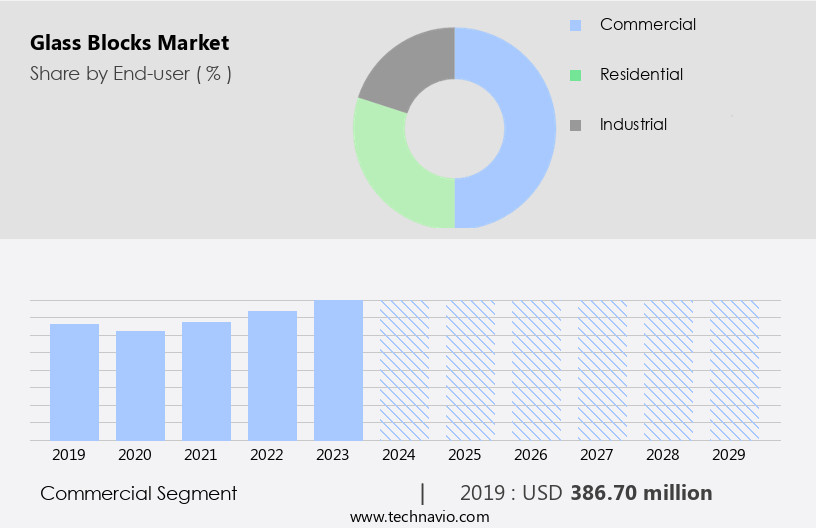

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Commercial

- Residential

- Industrial

- Type

- Tempered glass block

- Annealed glass block

- Wired glass block

- Patterned glass block

- Product

- Solid

- Hollow

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- Middle East and Africa

- South America

- APAC

By End-user Insights

- The commercial segment is estimated to witness significant growth during the forecast period.

The commercial sector's adoption of glass blocks has experienced notable growth, with these architectural materials increasingly utilized In the construction of offices, shopping malls, hotels, and restaurants. These offer a blend of aesthetics and functionality, enhancing commercial spaces with their sleek and modern appearance while providing insulation from noise, privacy, and environmental elements. In office buildings, glass block walls and partitions contribute to open and spacious work environments, allowing natural light to permeate the space, fostering a bright and uplifting atmosphere. These translucent architectural materials are also available in various colors, patterns, and sizes, enabling customized solutions tailored to specific design requirements.

Get a glance at the market report of share of various segments Request Free Sample

The commercial segment was valued at USD 386.70 million in 2019 and showed a gradual increase during the forecast period.

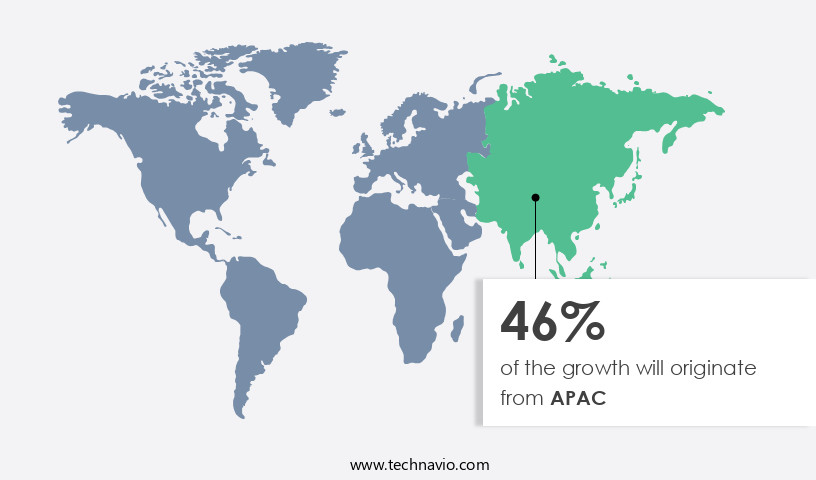

Regional Analysis

- APAC is estimated to contribute 46% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing growth due to their increasing usage in sustainable and energy-efficient construction projects. With a focus on reducing carbon emissions and promoting green building materials, glass blocks' insulating qualities and natural light transmission make them an attractive option for both residential and commercial applications. Architects and designers are incorporating these architectural materials into various building facades, dividers, partitions, windows, and shower walls for their aesthetic appeal and structural integrity. These are available in various sizes, colors, and patterns, allowing for personalized solutions and creative design applications. Advanced manufacturing techniques, such as precision engineering and automated production, ensure consistency and efficiency.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Glass Blocks Industry?

Rising need for privacy and security in buildings is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for sustainable construction methods, energy efficiency, and privacy in buildings. These offer a unique solution with their transparent and translucent properties, allowing natural light to penetrate while maintaining privacy and security. These blocks come in various colors, patterns, and textures, providing creative design solutions for architectural styles in both residential and commercial applications. Frosted, patterned, and colored glass blocks offer a range of opacity levels, making them suitable for various interior and exterior spaces, including partitions, windows, shower walls, and building facades. These also provide excellent thermal insulation and soundproofing properties, making them eco-friendly solutions for energy-efficient building materials.

- Precision engineering and automated manufacturing processes ensure the structural integrity of glass blocks, while smart technology, such as solar control coatings and embedded sensors, enhance their functionality. Tempered and annealed glass blocks offer durability and expansive views, making them popular architectural materials. Skilled professionals, including architects and designers, value the customization possibilities of large-sized glass blocks for personalized solutions. Glass block manufacturers continue to innovate, offering smart building technologies and sustainable production methods to meet the evolving needs of the building sector.

What are the market trends shaping the Glass Blocks Industry?

Advancements in glass block manufacturing technology is the upcoming market trend.

- The market has experienced notable progress in manufacturing technology, leading to the production of stronger and more durable glass blocks. Traditional glass blocks, made from standard composition glass, can be brittle and susceptible to breakage. However, advancements such as fiberglass thread reinforcement and polymer coating have significantly improved glass blocks' strength and durability. These enhancements extend beyond strength, as glass blocks now offer superior thermal and acoustic insulation. These are transparent and translucent, allowing natural light transmission while maintaining privacy and energy efficiency. They are also available in colored and patterned designs, providing creative solutions for architectural features in both residential and commercial applications.

- In the building sector, these are increasingly being recognized as sustainable construction materials due to their insulating qualities and precision engineering. Smart technology integrations, such as solar control coatings, embedded sensors, and tempered or annealed glass blocks, further augment their appeal. Architects and designers utilize it for various applications, including partitions, windows, shower walls, and building facades. Their durability, expansive views, and eco-friendly production methods make them an attractive choice for sustainable and energy-efficient building designs. Skilled professionals continue to innovate, offering personalized solutions through large-sized glass blocks and customization options. Glass blocks' thermal insulation properties and soundproofing capabilities make them valuable in both interior and exterior spaces, as walls, dividers, and architectural features.

What challenges does the Glass Blocks Industry face during its growth?

High cost of manufacturing and installation is a key challenge affecting the industry growth.

- The market is characterized by the use of transparent, translucent, colored, patterned, frosted, and sustainably produced blocks in various architectural styles across the building sector. These glass blocks offer energy efficiency through natural light transmission and thermal insulation properties, making them eco-friendly solutions for both residential and commercial applications. Their insulating qualities, precision engineering, automated manufacturing, and smart technology integration contribute to their popularity. Solar control coatings, embedded sensors, and tempered or annealed glass blocks are among the innovative offerings in this market. Architects and designers utilize these for creative design solutions in partitions, windows, shower walls, interior and exterior spaces, walls, dividers, architectural features, and building facades.

- Despite their durability and expansive views, the high cost of production and installation remains a challenge for market growth. The industry requires skilled professionals to ensure structural integrity and proper installation, which can impact profitability and competitiveness.

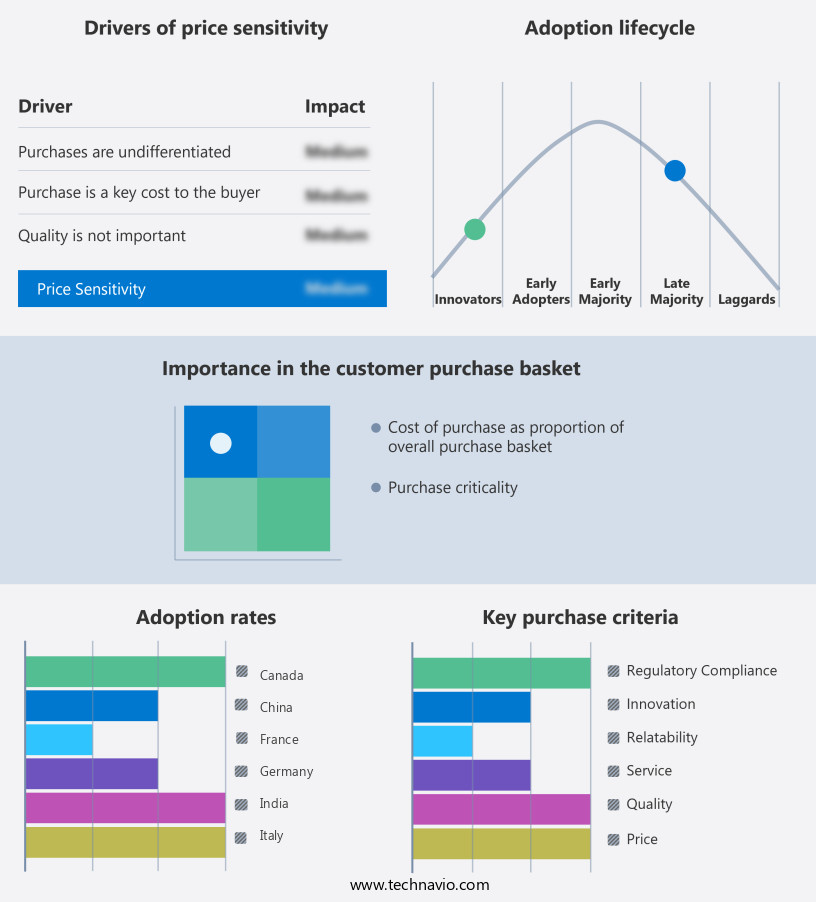

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Allegion Public Ltd. Co. - The company offers glass blocks under brands such as Cisa, Falcon, Brio, and Briton.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bormioli Rocco SA

- Carl Zeiss Stiftung

- Ciech SA

- Corning Inc.

- CRH Plc

- DAKOTA GROUP SAS

- Dezhou Jinghua Group co. ltd.

- Essar Sons

- Float Glass Centre

- La Rochere SAS

- Nippon Electric Glass Co. Ltd.

- PT Mulia Industrindo Tbk

- Saint-Gobain Glass

- SEVES Group S.a r.l.

- Starglass SA

- Stark Glass Block

- WENG HOLDING CO. LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The glass block market encompasses a diverse range of architectural materials, characterized by their transparent and translucent nature. These blocks come in various forms, including colored, patterned, frosted, and textured options. The use of glass blocks extends beyond functional applications, as they also serve decorative purposes in both residential and commercial settings. Sustainable construction methods have gained significant traction In the building sector, and glass blocks have emerged as a preferred choice due to their energy efficiency and thermal insulation properties. These eco-friendly solutions contribute to green construction materials and energy-efficient building materials, making them an essential component of modern architectural design.

In addition, natural light transmission is a crucial factor In the appeal of glass blocks. They allow for expansive views and an abundance of natural light, which can significantly enhance interior spaces and create a more inviting atmosphere. In addition, glass blocks offer soundproofing properties, making them suitable for various applications, including walls, partitions, and windows. Precision engineering and automated manufacturing processes have revolutionized the production of glass blocks, ensuring consistent quality and durability. Advanced technologies such as smart technology, solar control coatings, and embedded sensors have further enhanced their functionality, providing customized solutions for various applications. Tempered and annealed glass blocks are popular choices for their insulating qualities and structural integrity.

Moreover, glass bricks, another variant, offer a unique aesthetic appeal and can be used for both interior and exterior applications. The versatility of glass blocks makes them suitable for various architectural styles and building facades. The building sector relies on skilled professionals, including architects and designers, to incorporate these architectural materials into their projects. Glass blocks offer creative design solutions for various applications, including glass block windows, shower walls, and interior and exterior spaces. Their durability and expansive views make them a preferred choice for both residential and commercial applications. In summary, the glass block market caters to the demand for sustainable, energy-efficient, and aesthetically pleasing architectural materials.

Furthermore, these materials offer functional benefits, including thermal insulation, soundproofing, and natural light transmission, while also contributing to the overall design and aesthetic of a building. The ongoing advancements in manufacturing technologies and smart building solutions continue to expand the potential applications and possibilities for glass blocks in modern construction projects.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.2% |

|

Market growth 2025-2029 |

USD 666.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.2 |

|

Key countries |

China, US, India, UK, Germany, France, Japan, Italy, UAE, and Canada |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Glass Blocks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.