Glass Curtain Wall Market Size 2025-2029

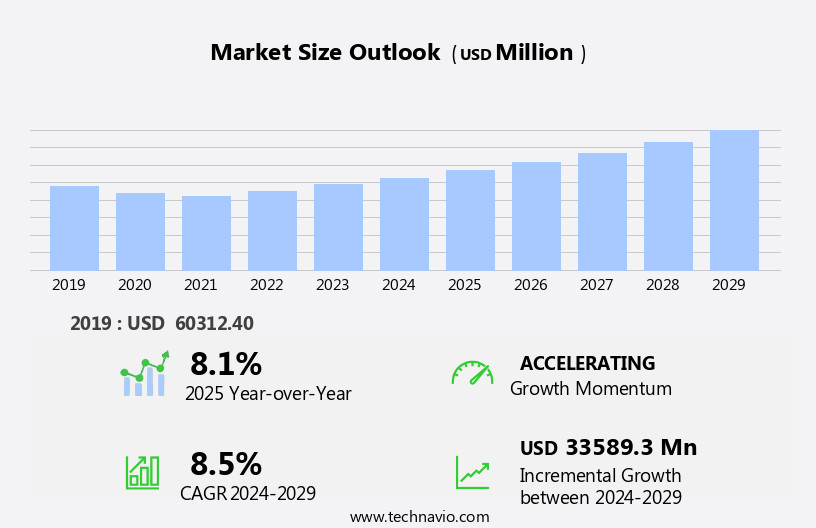

The glass curtain wall market size is forecast to increase by USD 33.59 billion at a CAGR of 8.5% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing number of high-rise buildings and the rising demand for modern, energy-efficient facades in the real estate sector. Key trends in the market include the integration of LED lighting, protective coatings, solar panels, and smart glass technologies to enhance the aesthetic appeal and functionality of curtain walls. Additionally, the use of fire-resistant glass and insulation materials is gaining popularity for improved safety and energy efficiency. The adoption of aluminum frames and unitized systems for construction logistics is also on the rise. Coworking spaces and wellness facilities, such as spas, are increasingly incorporating curtain walls to create open, inviting work and relaxation environments. Despite these growth factors, the high cost of curtain walls remains a challenge for market expansion.

What will be the Size of the Glass Curtain Wall Market During the Forecast Period?

- The market encompasses the production and installation of large, transparent building facades, primarily utilized in commercial construction projects. This market is driven by the growing demand for architecturally innovative building solutions that prioritize energy efficiency, building safety, and sustainable design. Building regulations and codes play a significant role in market dynamics, as these structures must adhere to stringent safety standards and building insurance requirements. Building professionals and experts in the industry continue to explore new ways to enhance building management systems, incorporating building automation and consulting services to optimize energy usage and improve overall building performance. Green building trends and the increasing importance of building sustainability further fuel market growth.

- Building development and renovation projects, particularly in the commercial sector, continue to invest in curtain walls for their aesthetic appeal and ability to maximize natural light. Market segments include building materials suppliers, architectural firms, construction companies, and building technology providers. The use of green building materials and advanced glass technologies further expands market opportunities. Building inspection and certification processes ensure the quality and safety of these structures, while building financing and portfolio management remain crucial considerations for investors and developers. Overall, the market is poised for continued growth as it addresses the evolving needs of the building industry.

How is this Glass Curtain Wall Industry segmented and which is the largest segment?

The glass curtain wall industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Unitized

- Stick

- End-user

- Commercial

- Public

- Residential

- Product Type

- Double glazed

- Three glazed

- Single glazed

- Product

- Exterior glazed

- Interior glazed

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

By Type Insights

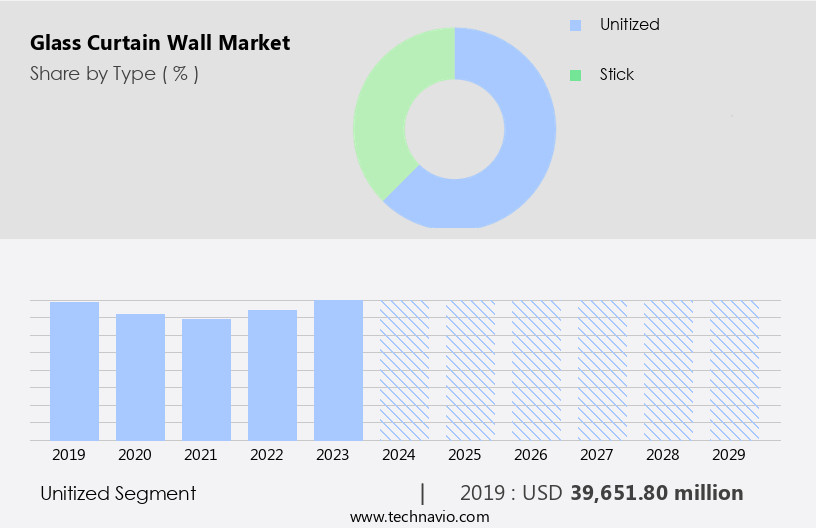

- The unitized segment is estimated to witness significant growth during the forecast period.

Unitized curtain wall systems, consisting of glass panels supported by aluminum frames, represent an efficient construction method. Manufactured in factories as prefabricated and preassembled units, these systems simplify installation through positioning and anchoring into building structures. Comprising vertical mullions and horizontal transoms, these elements encircle opaque and glazing panels to form complete unitized curtain wall assemblies. Superior quality materials, thermal efficiency, and modern aesthetic appeal are integral to these systems. Maintenance is facilitated through accessible joints, while cooling systems ensure energy efficiency. Cost-effective, these systems offer modern amenities for commercial projects, including premium architectural enhancements. Infrastructure development in emerging economies and urbanization fuel market growth.

Insulation properties, performance, and energy efficiency are key considerations, alongside regulatory requirements and environmental concerns. Advanced glazing technologies, such as low-emissivity and double-glazed, ensure unobstructed views and indoor air quality. Sustainable, high-strength glass materials are increasingly utilized, enhancing functionality and durability. Technological advancements continue to influence the market, with innovations in insulated glass units, photovoltaic building facades, and advanced glazing technologies.

Get a glance at the market report of the share of various segments Request Free Sample

The Unitized segment was valued at USD 39.65 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

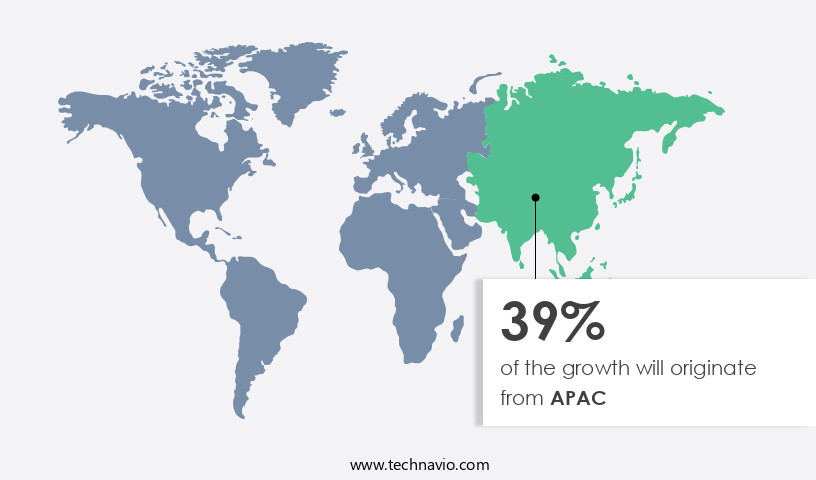

- APAC is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In APAC, the construction market's expansion is primarily driven by the increasing number of projects, particularly in infrastructure development. Countries such as India, China, Japan, Thailand, Indonesia, and the Philippines are at the forefront of this growth, fueled by rising income levels and urbanization. The resulting demand for residential and commercial buildings is propelling the market forward. Superior quality materials, energy efficiency, and modern amenities are key considerations in these projects. Glass curtain walls offer sleek, unobstructed views, while also providing insulation properties, thermal performance, and durability. Advanced glazing technologies, including low-emissivity (Low-E) glass and insulated glass units, contribute to energy efficiency and indoor air quality.

Regulatory requirements and environmental concerns are also driving the adoption of cost-efficient, sustainable, and cost-effective curtain wall systems in commercial projects, such as office complexes and high-rise buildings.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Glass Curtain Wall Industry?

Increasing number of skyscrapers is the key driver of the market.

- The global market is experiencing significant growth due to the increasing number of commercial and residential buildings with modern designs. Urbanization and population growth are key drivers, as people move to cities in pursuit of better opportunities and improved lifestyles. This trend is leading to an increased demand for curtain walls, which offer superior quality materials, thermal efficiency, and a modern aesthetic appeal. Curtain wall systems are essential for building structures, providing functionality, energy efficiency, and structural strength. They offer unobstructed views, modern amenities, and premium architectural enhancements for both commercial projects and residential spaces.

- These systems are also cost-effective, as they require minimal maintenance and offer cooling benefits through the use of advanced glazing technologies and insulation properties. Design consultants and builders are increasingly incorporating curtain walls into their projects to meet regulatory requirements and address environmental concerns. Advanced glazing technologies, such as double-glazed, low-emissivity (Low-E) glass, and insulated glass units, offer improved thermal performance and indoor air quality. Additionally, the integration of photovoltaic systems into building facades is becoming more common, further enhancing the energy efficiency of curtain walls. The market for curtain walls is expected to continue growing, as the demand for sustainable, energy-efficient, and high-performance building designs increases.

- The use of cost-efficient and durable high-strength glass materials, such as low-e glass, is a testament to the technological advancements in this field. As the world continues to urbanize, curtain walls will remain a crucial component of modern architecture, providing both functionality and aesthetic appeal to commercial and residential buildings alike.

What are the market trends shaping the Glass Curtain Wall Industry?

Growing demand for unitized glass curtain walls is the upcoming market trend.

- Glass curtain walls are a popular choice for both residential and commercial buildings due to their modern aesthetic appeal and energy efficiency. These building structures consist of glass panels held in place by metal framing, creating unobstructed views and allowing natural light to enter. Two primary categories of glass curtain walls are stick systems and unitized systems. In stick systems, the majority of the assembly occurs onsite, necessitating the use of mullions, transoms, metal panels, spandrel panels, and brise-soleils, which must be connected piece by piece. This method requires more time and labor at the construction site compared to unitized systems, where approximately 70% of the assembly is completed in the factory.

- Superior quality materials, such as double-glazed insulated glass units and high-strength glass, contribute to the thermal efficiency and structural strength of curtain walls. Advanced glazing technologies, including low-emissivity (Low-E) glass, photovoltaic glass, and insulation properties, enhance the performance and energy efficiency of these systems. Maintenance is essential to ensure the longevity and functionality of curtain walls. Regular checks for leakage, cooling, air and water, and indoor air quality are crucial. Cost-efficient solutions, such as maintenance plans and energy-efficient designs, can help minimize ongoing expenses. Modern building designs and green building certifications, like LEED and BREEAM, increasingly prioritize curtain walls for their sleek appearance, sustainability, and productivity benefits in commercial projects.

- As urbanization continues to grow and population increases, curtain walls play a significant role in infrastructure development and premium architectural enhancements for both residential spaces and office complexes. Market dynamics, including technological advancements and regulatory requirements, influence the demand for curtain walls. Environmental concerns and the need for cost-effective, energy-efficient solutions further contribute to their popularity. Glass processing techniques and regulations ensure the highest standards of safety, durability, and performance.

What challenges does the Glass Curtain Wall Industry face during its growth?

High cost of glass curtain walls is a key challenge affecting the industry growth.

- Glass curtain walls, a premium architectural enhancement for both residential and commercial buildings, offer superior quality materials, thermal efficiency, and a modern glass effect. These building structures, consisting of large expanses of glass, require intricate engineering for repairs and maintenance, including cooling systems for air and water. Despite the high costs associated with their production, curtain walls are increasingly sought after for their energy efficiency, sleek design, and modern amenities. Manufacturing curtain walls involves the use of high-energy and high-temperature processes, primarily relying on natural gas for heating engineering furnaces. The incorporation of advanced glazing technologies, such as low-emissivity (Low-E) glass, insulation properties, and photovoltaic systems, adds to the production costs.

- However, the benefits of curtain walls, including thermal performance, aesthetic appeal, and indoor air quality, make them a cost-effective investment in the long run for commercial projects and office complexes. Building designs incorporating curtain walls must adhere to regulatory requirements and environmental concerns. Glass processing techniques, such as insulated glass units and double-glazed systems, ensure unobstructed views while maintaining energy efficiency. The durability and structural strength of curtain walls make them a popular choice for high-rise buildings and urban landscapes, contributing to infrastructure development in emerging economies. Incorporating curtain walls into building designs offers numerous benefits, including productivity, sustainability, and unobstructed views.

- Architects and developers recognize the marketability and appeal of these systems, making them a valuable investment for corporate settings and residential spaces. With technological advancements in glass processing and glazing technologies, curtain walls continue to evolve, offering improved performance and energy efficiency.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the curtain wall market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, glass curtain wall market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AGC Inc. - The company offers glass curtain wall products such as artlite digital, artlite silkscreen, and colorbel.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGC Inc.

- Apogee Enterprises Inc

- Arconic Corp.

- Asahi India Glass Ltd.

- Beijing Northglass Technologies Co. Ltd.

- Central Glass Co. Ltd.

- China Glass Holdings Ltd.

- Compagnie de Saint-Gobain SA

- Guangzhou TopBright Building Materials Co. Ltd.

- Hainan Development Holdings Nanhai Co., Ltd.

- Koch Industries Inc.

- Nippon Sheet Glass Co. Ltd.

- Oldcastle BuildingEnvelope

- Permasteelisa Spa

- SCHOTT AG

- Shanghai Meite Curtain Wall Co., Ltd.

- Vetrina Windows

- Vitro SAB De CV

- Xinyi Glass Holdings Ltd.

- Yuanda China Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the production and installation of large, transparent facades for both residential and commercial buildings. These systems, which consist of glass panels and supporting framework, offer superior quality materials that provide numerous benefits for building structures. Curtain wall systems are increasingly popular due to their modern aesthetic appeal and energy efficiency. The use of advanced glazing technologies, such as low-emissivity (Low-E) glass and insulated glass units, contributes significantly to the thermal performance of buildings. This results in cost-efficient heating and cooling systems, making these structures more environmentally friendly and sustainable. The demand for glass curtain walls is driven by infrastructure development and urbanization in emerging economies.

The need for modern amenities and premium architectural enhancements in commercial projects has led to the adoption of these systems. Incorporating glass curtain walls in building designs not only adds to the aesthetic appeal but also enhances functionality and productivity in corporate settings. Building designers and consultants are increasingly turning to glass curtain wall systems due to their sleek and unobstructed appearance. These systems offer unparalleled views, allowing natural light to flow freely into buildings. The use of advanced insulation properties in glass materials ensures that energy efficiency is maintained, contributing to improved indoor air quality and overall building performance. The Glass Curtain Wall Market is a dynamic and innovative sector of the architectural building industry, focusing on the design, construction, and renovation of building facades using glass. This market segment is characterized by its commitment to pushing the boundaries of building design and construction, offering aesthetic building facades that not only enhance the visual appeal of architectural structures but also provide functional benefits.

Building permits and code compliance are crucial aspects of glass curtain wall construction, requiring building expertise and investment in building services and consulting to ensure optimal building envelope performance. Innovations in glass technology, such as lightweight glass materials and energy-saving technologies, have revolutionized the industry, making glass facades a popular choice for building design trends. Moreover, glass curtain walls offer enhanced building accessibility, security, and building code compliance, making them a preferred choice for both new building projects and building renovations. Building investment in glass curtain walls is also driven by the potential for energy savings through the use of renewable energy sources and building automation systems. The glass curtain wall market caters to various market segments, including commercial, residential, and institutional buildings. With a focus on building performance optimization and the integration of HVAC costs into the design, glass curtain walls offer a sustainable and cost-effective solution for architectural building projects. The future of glass curtain walls lies in continued innovation, with a focus on glass facade design, architectural glass, and glass innovation, all working together to create functional, beautiful, and energy-efficient buildings.

Maintenance of glass curtain walls is crucial to ensure their longevity and structural strength. Regular inspections and repairs address potential issues such as leakage, ensuring that the systems continue to function optimally. The integration of photovoltaic technology into building facades is a significant technological advancement in the market. This innovation enables buildings to generate their electricity, further reducing their carbon footprint and contributing to energy efficiency. Regulations and regulatory requirements play a vital role in the market. Ensuring compliance with green building certifications and environmental concerns is essential for builders and developers to remain competitive in the industry.

The market is experiencing significant growth due to its numerous benefits, including energy efficiency, thermal performance, and modern design. The integration of advanced glazing technologies and regulatory compliance are key factors driving the market forward. As urbanization continues and population growth accelerates, the demand for glass curtain walls is expected to remain strong.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

232 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.5% |

|

Market growth 2025-2029 |

USD 33.58 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.1 |

|

Key countries |

US, China, Germany, Canada, UK, Japan, South Korea, India, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Glass Curtain Wall Market Research and Growth Report?

- CAGR of the Glass Curtain Wall industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the glass curtain wall market growth of industry companies

We can help! Our analysts can customize this glass curtain wall market research report to meet your requirements.