Graphite Electrode Market Size 2024-2028

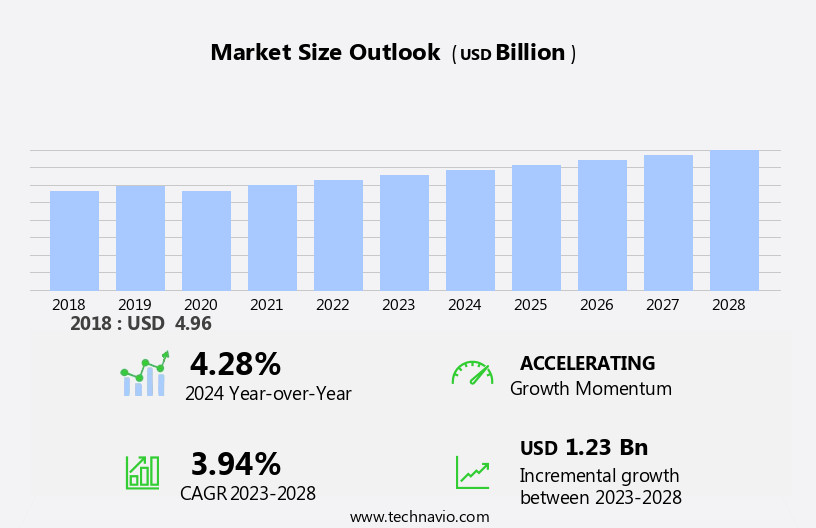

The graphite electrode market size is forecast to increase by USD 1.23 billion, at a CAGR of 3.94% between 2023 and 2028.

- The market is driven by the surging demand for high-quality steel, particularly in the electric arc furnace (EAF) process. This trend is attributed to the increasing production of automobiles and construction materials, which necessitate the use of superior steel. However, the market is characterized by its capital-intensive nature, which poses a significant challenge for new entrants. The high initial investment required for setting up graphite electrode manufacturing facilities can deter potential competitors, creating a relatively stable market landscape. Despite this challenge, opportunities exist for companies to innovate and optimize production processes to reduce costs and improve efficiency.

- Additionally, the ongoing research and development efforts in the field of advanced materials, such as high-performance graphite electrodes, present growth opportunities for market participants. Companies seeking to capitalize on these opportunities must navigate the capital-intensive nature of the market and stay abreast of technological advancements to maintain a competitive edge.

What will be the Size of the Graphite Electrode Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic interplay of various sectors and technological advancements. In the realm of energy storage, graphite electrodes play a pivotal role in the production of lithium-ion and lithium metal batteries. These batteries, in turn, power electric vehicles (EVs) and renewable energy systems, such as wind and solar power. The market's ongoing evolution is characterized by a focus on improving temperature performance, ensuring quality control, and adhering to safety standards. The quest for higher energy density and longer cycle life propels innovation in anode materials, power electronics, and electrode coating technologies. Data science and artificial intelligence (AI) are increasingly integrated into the manufacturing process, optimizing production capacity and reducing costs through process optimization and predictive maintenance.

Solid-state batteries and silicon anodes are emerging as potential game-changers, offering enhanced power output and faster charging capabilities. The market's continuous unfolding is further shaped by regulatory compliance, raw materials availability, and the circular economy's growing importance. Carbon fiber, internal resistance, charging infrastructure, and battery recycling are among the various aspects under scrutiny as the industry strives for sustainability and cost reduction. The interconnected nature of the market's components â from material science and cathode material to battery safety, cell manufacturing, and thermal management â necessitates a holistic approach to understanding its intricacies. The supply chain, big data analytics, and machine learning (ML) are crucial elements in this complex ecosystem, ensuring the efficient and effective delivery of high-performance graphite electrodes to meet the evolving demands of diverse industries.

How is this Graphite Electrode Industry segmented?

The graphite electrode industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- UHP graphite electrode

- HP graphite electrode

- RP graphite electrode

- Application

- Ferrous metals

- Non-ferrous metals

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

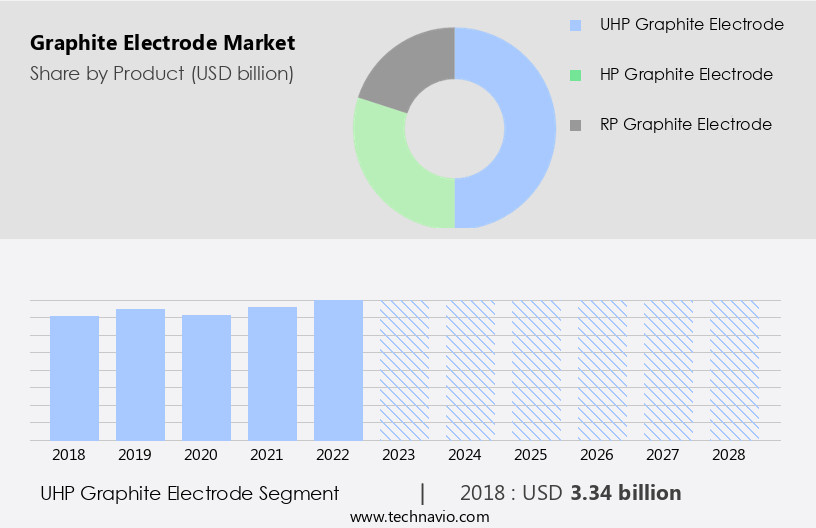

The uhp graphite electrode segment is estimated to witness significant growth during the forecast period.

The market is driven by the increasing demand for ultra-high-power graphite electrodes in the electric arc furnace (EAF) industry for steel recycling. These electrodes, which are primarily composed of high-value needle coke derived from petroleum or coal tar, are machined into cylindrical shapes with threaded areas at each end for assembly into electrode columns using electrode nozzles. To enhance work efficiency and reduce total costs, large-capacity and ultra-high-voltage EAFs are gaining popularity. Consequently, graphite electrodes with diameters exceeding 500 mm are expected to dominate the market during the forecast period. In the realm of renewable energy, graphite electrodes play a crucial role in power electronics, lithium-ion and lithium metal batteries, and solid-state batteries.

The manufacturing process involves stringent quality control measures to ensure optimal energy density, cycle life, safety standards, and power output. Raw materials, such as anode and cathode materials, carbon fiber, and silicon anode, are subjected to rigorous testing and optimization for cost reduction and improved performance. Digital technologies, including data science, machine learning, and artificial intelligence, are employed to enhance manufacturing processes, optimize production capacity, and improve battery safety. Regulatory compliance, thermal management, and supply chain efficiency are also critical factors influencing market trends. Additionally, the circular economy and battery recycling are gaining importance as sustainability becomes a key consideration in the energy sector.

The UHP graphite electrode segment was valued at USD 3.34 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

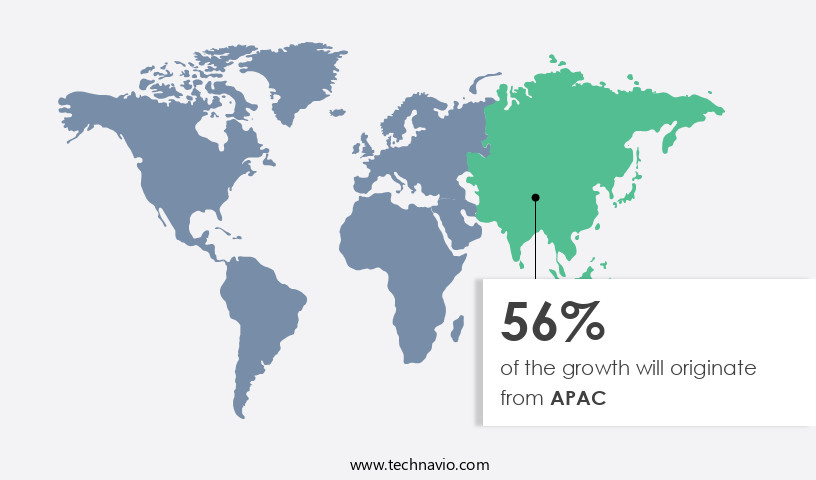

APAC is estimated to contribute 56% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to several factors. The increasing urban population and resulting construction boom are primary drivers, as the demand for graphite electrodes is high in the building and infrastructure sectors. Additionally, government initiatives for infrastructure development and the entry of automobile manufacturers are boosting market growth. Renewable energy sources, such as wind and solar power, are also fueling the market's expansion, as graphite electrodes are essential in the production of lithium-ion batteries used in renewable energy storage. Quality control and safety standards are crucial considerations in the manufacturing process, with companies focusing on process optimization and raw material sourcing to ensure high-quality electrodes.

Lithium-ion batteries, including lithium metal batteries, are a significant application area for graphite electrodes, and advancements in material science and battery technology are driving innovation. The market is also witnessing trends such as cost reduction through process optimization and the adoption of digital technologies like data science, machine learning, and artificial intelligence to improve production efficiency and battery performance. Additionally, the circular economy and battery recycling are gaining importance, with companies focusing on reducing carbon footprints and improving battery safety through cell manufacturing, thermal management, and supply chain optimization. Fast charging, power electronics, and self-discharge rate are critical performance factors for graphite electrodes, and companies are investing in research and development to address these challenges.

The market is also witnessing the emergence of solid-state batteries and the use of silicon anodes, which offer higher energy density and longer cycle life. In conclusion, the market in APAC is experiencing robust growth, driven by urbanization, industrialization, and government initiatives. The market is witnessing trends such as innovation in battery technology, digitalization, and sustainability, making it an exciting space for companies and investors alike.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Graphite Electrode Industry?

- The market is primarily fueled by the heightened demand for superior quality steel, which is a crucial factor driving its growth.

- The market is experiencing significant growth due to the increasing demand for steel in various industries, including building and construction, automotive, aviation, and oil and gas. Graphite electrodes, a crucial component in the smelting process for high-quality steel production, are valued for their high electrical conductivity, heat dissipation capacity, and excellent mechanical strength. The shift towards renewable energy sources, such as wind power and solar power, is also driving market growth. Graphite electrodes play a vital role in the manufacturing process of renewable energy technologies, particularly in the production of silicon and solar-grade silicon.

- Their high energy density, long cycle life, and safety standards compliance make them an ideal choice for these applications. Moreover, the increasing focus on regulatory compliance and process optimization in industries is expected to further boost market growth. Electric vehicles (EVs) are another emerging application area for graphite electrodes, as they require high-performance batteries with long cycle life and excellent temperature performance. The market is expected to continue its growth trajectory during the forecast period, driven by these factors and the increasing demand for steel in various industries.

What are the market trends shaping the Graphite Electrode Industry?

- The growing preference for Electric Arc Furnaces (EAF) represents a significant market trend in the metallurgical industry. This shift towards EAF technology is driven by its numerous advantages, including energy efficiency, cost savings, and reduced environmental impact.

- The market is experiencing significant growth due to the increasing adoption of electric arc furnaces (EAF) in steel manufacturing. EAFs offer advantages such as lower establishment costs, higher production flexibility, and reduced carbon dioxide emissions, making them a preferred choice over traditional blast and ladle furnaces. As the demand for steel continues to rise, the need for efficient graphite electrodes to support EAF processes will increase, driving market growth. Beyond steel manufacturing, graphite electrodes are also used in various other applications, including power electronics and the production of non-ferrous materials. In the realm of energy storage, graphite electrodes are essential components in lithium-ion batteries and emerging lithium metal batteries.

- These batteries are gaining popularity due to their high power output and potential for cost reduction. Advancements in technology, such as the development of solid-state batteries and silicon anodes, are further enhancing the market potential for graphite electrodes. Additionally, electrode coatings and artificial intelligence (AI) are being employed to improve efficiency and reduce self-discharge rates. These advancements underscore the market's dynamic nature and the ongoing efforts to optimize graphite electrode performance.

What challenges does the Graphite Electrode Industry face during its growth?

- The capital-intensive character of the market poses a significant challenge to the industry's growth trajectory.

- The market is characterized by its technology-intensive and capital-heavy nature, resulting in an oligopolistic industry structure with minimal new entrant threats. Manufacturers are progressively moving from blast and ladle furnaces to Electric Arc Furnaces (EAF) due to advanced technology adoption. Establishing production facilities demands significant capital investment, which can be a challenge for small and medium-sized steel producers with limited financial resources. This constraint hampers their transition from conventional steelmaking methods. Material science plays a crucial role in the production of high-quality cathode materials for graphite electrodes, which are essential for battery manufacturing. The growing emphasis on battery recycling and fast charging infrastructure necessitates the development of graphite electrodes with lower internal resistance and improved charging efficiency.

- Carbon fiber, a key component in graphite electrodes, is gaining popularity due to its superior properties, such as high strength and low weight. Module testing and pack assembly are critical processes in the production of lithium-ion batteries, and graphite electrodes serve as current collectors. As the demand for batteries with smaller carbon footprints grows, manufacturers are focusing on reducing the environmental impact of graphite electrode production. This involves adopting sustainable production methods and investing in research and development to improve the efficiency and reduce the environmental impact of the manufacturing process.

Exclusive Customer Landscape

The graphite electrode market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the graphite electrode market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, graphite electrode market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agilent Technologies Inc. - Graphite electrodes, including those used in Graphite Furnace Atomic Absorption Spectroscopy (GFAAS), deliver optimal performance by ensuring excellent electrical contact. This crucial aspect prolongs tube life, enhancing overall efficiency and effectiveness in various industrial applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- AMERI SOURCE SPECIALITY PRODUCTS

- Brothers International Industry

- China BaoWu Steel Group Corp. Ltd.

- CIMM Group

- Dan Carbon

- EDM TEC oHG

- El 6

- Fangda Carbon New Materials Technology Co. Ltd.

- GrafTech International Ltd.

- Graphite India Ltd.

- HEG Ltd.

- Kaifeng Pingmei New Carbon Material Technology Co. Ltd.

- Nippon Carbon Co. Ltd.

- Oriental Carbon and Chemicals Ltd.

- Resonac Holdings Corp.

- Sangraf International

- SEC CARBON LTD.

- Tokai Carbon Co. Ltd.

- Weaver Industries Inc.

- ZHENGZHOU RONGSHENG REFRACTORY CO. LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Graphite Electrode Market

- In January 2024, leading graphite electrode manufacturer, GrafTech International Ltd., announced the launch of its new high-performance graphite electrodes for electric arc furnace applications, featuring enhanced durability and longer lifespan. This innovation aimed to address the increasing demand for energy efficiency and cost reduction in the steel industry (GrafTech International Press Release).

- In March 2024, SGL Carbon, a global leader in the production of carbon-based solutions, and Sumitomo Electric Industries, Ltd., a major Japanese technology enterprise, entered into a strategic partnership to jointly develop and commercialize advanced graphite electrodes for the steel industry. This collaboration aimed to leverage each company's expertise and expand their market reach (SGL Carbon Press Release).

- In July 2024, Imerys Graphite & Carbon, a global leader in mineral-based specialty solutions, completed the acquisition of Carbon Solutions, a US-based graphite electrode manufacturer. This acquisition strengthened Imerys' position in the market and expanded its production capacity (Imerys Press Release).

- In May 2025, the European Union (EU) approved the use of synthetic graphite electrodes in electric arc furnaces, marking a significant regulatory milestone. This approval is expected to accelerate the adoption of synthetic graphite electrodes in the EU steel industry, offering improved performance and reduced environmental impact (European Commission Press Release).

Research Analyst Overview

- The market encompasses various applications, including electric trucks, portable power, and industrial automation. Material characterization and cell chemistry play crucial roles in enhancing energy efficiency and battery performance. Recycling technologies and responsible sourcing are key trends, reducing the cost of ownership and environmental impact. Galvanostatic charge-discharge, battery modeling, and optimization algorithms are essential for improving battery life and performance. Battery aging, failure analysis, and battery degradation are ongoing challenges, necessitating advanced testing and process control. Sustainable sourcing, supply chain transparency, and waste management are vital in mitigating environmental concerns. Smart manufacturing, military applications, aerospace, and medical industries are adopting graphite electrodes for their unique properties.

- Electric buses and green energy sectors are growing markets, driving demand for high-performance graphite electrodes. Battery testing and fault detection are crucial for ensuring safety and reliability, especially in the context of thermal runaway risks. Carbon emissions reduction and industrial automation are significant applications, contributing to the market's growth. Blockchain technology and battery pack design are emerging areas of interest, offering potential for increased transparency and optimization. Cyclic voltammetry (CV) and other advanced techniques contribute to understanding battery behavior and improving overall performance. Overall, the market is dynamic, with ongoing research and innovation addressing various challenges and opportunities.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Graphite Electrode Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.94% |

|

Market growth 2024-2028 |

USD 1.23 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.28 |

|

Key countries |

US, China, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Graphite Electrode Market Research and Growth Report?

- CAGR of the Graphite Electrode industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the graphite electrode market growth of industry companies

We can help! Our analysts can customize this graphite electrode market research report to meet your requirements.