APAC Hair Styling Products Market Size 2025-2029

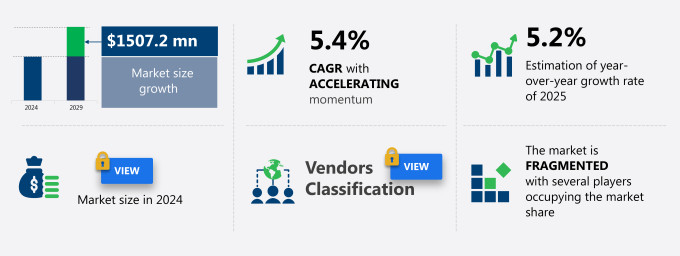

The APAC hair styling products market size is forecast to increase by USD 1.51 billion at a CAGR of 5.4% between 2024 and 2029.

- The market is witnessing significant growth due to evolving fashion trends and increasing consumer preference for natural and organic offerings. This trend is driven by the growing awareness of health and wellness, leading consumers to seek out products free from harsh chemicals. However, the market faces challenges such as the availability of counterfeit hair care products, which can negatively impact brand reputation and consumer trust. To stay competitive, companies must focus on product innovation, quality assurance, and effective digital marketing strategies to differentiate themselves in the market. Additionally, partnerships with influencers and salons can help expand reach and build brand loyalty. Overall, the market is expected to continue its growth trajectory, driven by these trends and challenges.

What will be the Size of the Market During the Forecast Period?

- The hair styling products market in the APAC region is rapidly growing, driven by increasing demand for diverse hair care routines and hair styling products. Consumers are gravitating towards natural hair products, plant-based beauty, and organic hair care solutions, fueling the rise of hair growth products, hair styling mousse, hair styling wax, and hair styling clay. Hair volumizing products, hair texture products, and hair smoothing products are popular for creating diverse hair styles, while hair curling products, hair straightening products, and hair styling gel provide versatile styling options. With the growing preference for eco-conscious hair care and biodegradable packaging, cruelty-free cosmetics and sustainable beauty are becoming priorities. Additionally, hair loss solutions, scalp care products, and damaged hair repair items cater to both hair care for men and hair care for women, with premium hair care brands and ethical beauty brands offering quality products for all hair needs.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- HCGP

- Hair styling spray

- Dry shampoo

- Geography

- APAC

- China

- India

- Japan

- APAC

By Product Insights

- The HCGP segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, driven by the presence of prominent players such as L'Oreal SA, Unilever PLC, Procter & Gamble, Henkel, and Beiersdorf AG. These companies hold substantial market shares and contribute to the expansion of the market. The Hair Care Products segment, specifically, is projected to expand during the forecast period. This growth can be attributed to the rising popularity of heat protectant products and the increasing demand for hair styling and grooming solutions among men. Consumers are increasingly recognizing the advantages of hair styling products.

For instance, hair creams offer various benefits, including styling the hair, promoting hair health, combating environmental pollutants, shielding from UV rays and dirt, revitalizing dull hair, fortifying hair, maintaining its integrity, and minimizing hair fall. Sustainability is a growing concern in the hair care industry, leading to an increasing demand for plant-based products. Additionally, scalp treatments and conditioners, including shampoos, masks, and leave-in conditioners, are gaining popularity due to their ability to improve hair health and appearance. Cosmetics brands are responding to this trend by introducing eco-friendly and natural hair styling solutions.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our APAC Hair Styling Products Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of APAC Hair Styling Products Market?

Evolving fashion trends in hair styling is the key driver of the market.

- The hair styling products market in the US is driven by various factors, including fashion trends and consumer preferences. Fashion trends significantly impact the demand for hair styling products, with consumers seeking items to achieve popular hairstyles for daily and special occasions. These trends extend to various hair types, such as thin and thick, curly, and straight, providing manufacturers with opportunities to develop specialized formulations. Millennials represent a significant customer base for personal care and beauty products, fueling sales growth in the hair styling products market. Their focus on personal grooming and fashion consciousness creates a positive impact on sales.

- Hair colorants and hair colorant products are also essential hair-related products, with consumers seeking long-lasting, vibrant colors. The beauty industry's premiumization trend is reflected in the hair styling products market, with high-end products and luxury offerings gaining traction. Digital sales channels, including digital shopping platforms, have become increasingly important for reaching consumers and expanding market reach. Sustainability, such as post-consumer recycled materials and eco-friendly practices, is also a key consideration for many consumers and brands in the hair care and personal grooming space.

What are the market trends shaping the APAC Hair Styling Products Market?

Growing demand for natural and organic hair styling products is the upcoming trend in the market.

- The hair styling products market in the US is witnessing a shift towards natural and organic offerings due to growing concerns over the potential health risks associated with synthetic hair styling products. These risks include skin irritation, allergies, nerve damage, chemical burns, and blisters on the scalp, hair breakage, and even some forms of cancer. In response, consumers are turning to organic hair styling products, which are made from natural and organic ingredients such as plant extracts, natural oils, and other herbal substances. Popular natural ingredients in organic hair styling products include aloe vera, sea salt, charcoal, coconut oil, argan oil, and moringa oil.

- Hair oil, deep conditioners, hairdressing, hairstyles, and hair styling creams are all popular categories within this market. In summary, the US hair styling products market is experiencing a shift towards natural and organic offerings as consumers prioritize their health and wellness. Popular natural ingredients include aloe vera, sea salt, charcoal, coconut oil, argan oil, and moringa oil. The market includes a range of products such as mousse, serum, hair sprays, pomade, oil, hair styling creams, wax, glue, clay, powder, shampoo, conditioner, leave-in conditioner, and hair masks. The beauty industry as a whole is experiencing a digital sales channel revolution, with eco-friendly packaging and vegan certification becoming increasingly important to consumers.

What challenges does APAC Hair Styling Products Market face during the growth?

Availability of counterfeit products is a key challenge affecting the market growth.

- The hair styling products market in the US is experiencing significant growth due to increasing consumer demand for various hair care and styling solutions. However, the market faces challenges from counterfeit products, which often contain harmful chemicals such as ammonia, toluene-2,5-diamine, resorcinol, and p-phenylenediamine. These chemicals can lead to various hair and skin-related issues, including dryness, irritation, allergies, hair fall, and even cancer. To address these concerns, there is a growing trend towards natural and plant-based hair styling products. Many cosmetics brands are introducing organic formulations, herbal substances, and smoothening serums made from argan oil, mousse, serum, hair sprays, pomade, and oil.

- Moreover, there is a premiumization trend in the beauty industry, with consumers willing to spend more on high-end hair styling products. This includes advanced formulations for curly hair, thickening hair lotions, and hair colorant products. Salon brands and personal care companies are also investing in formula enhancements, such as sulfate-free shampoo and conditioner, leave-in conditioner, and hair masks. Digital sales channels, including digital shopping platforms and cosmetics brands' websites, are becoming increasingly popular for purchasing hair styling products. Consumers are also seeking out natural and vegan certification, as well as post-consumer recycled packaging, to align with their personal values and social trends. Overall, the hair styling products market is expected to continue growing, with a focus on natural ingredients, sustainability, and personalized hair care solutions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Oriflame Cosmetics S.A.: The company offers hair styling products such as Advanced Care Style Smart Styling Hair Spray, Power Hold and Sleek Invisible Hair Gel, and Advanced Care Style Smart Shine Spray

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amorepacific Corp.

- Amway Corp.

- Arimino Co. Ltd.

- Beiersdorf AG

- Henkel AG and Co. KGaA

- Kao Corp.

- Kose Corp.

- LOreal SA

- Mandom Corp.

- MOROCCANOIL

- Natura and Co Holding SA

- Nature Republic

- Olaplex Holdings Inc.

- Revlon Inc.

- Shiseido Co. Ltd.

- The Estee Lauder Co. Inc.

- The Procter and Gamble Co.

- Unilever PLC

- Wella International Operations Switzerland Sarl

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The hair styling and hair care market is a significant segment within the personal grooming and beauty industry. This market encompasses a wide range of products, including but not limited to, argan oil, mousse, serums, hair sprays, pomade, clay, powders, shampoo, conditioner, leave-in conditioner, hair styling creams, and various hair-related cosmetics. The demand for hair styling and hair care products is driven by several factors. The increasing focus on hair aesthetics and the premiumization trend in the beauty industry have led to a wave in the popularity of high-end products. Consumers are increasingly seeking advanced formulations and natural ingredients, such as argan oil, in their hair care regimens. The use of chemicals, wax, and glue in hair styling products has been a topic of concern for many consumers. However, the market is witnessing a shift towards plant-based products, which are more sustainable and eco-friendly. Many cosmetics brands are now offering organic formulations and vegan certification to cater to this growing demand. Social trends, such as the rise of natural curls and sustainable living, have also influenced the hair styling and hair care market. Consumers are increasingly looking for hair care items that address specific hair concerns, such as dryness, frizzy hair, and scalp treatments.

Further digital shopping platforms have transformed the way consumers purchase hair styling and hair care products. The convenience and accessibility offered by these channels have led to a significant increase in digital sales. Moreover, the use of post-consumer recycled packaging and plant-based plastic packaging is becoming increasingly common to reduce the environmental impact of these products. The beauty industry is constantly evolving, with new hair styling and hair care products being launched regularly. The market is expected to continue growing, driven by the increasing demand for personal care and grooming products, as well as the ongoing trend towards sustainability and natural ingredients. In conclusion, the hair styling and hair care market is a dynamic and evolving industry, driven by various factors, including consumer preferences, social trends, and technological advancements. The market offers a wide range of products, from argan oil to hair gels, catering to the diverse needs and preferences of consumers. The use of natural ingredients, sustainability, and eco-friendly practices are becoming increasingly important in this market, as consumers seek out products that align with their values and concerns.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 1.51 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.2 |

|

Key countries |

China, Japan, India, Australia, and Rest of APAC |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch