Head And Neck Cancer Treatment Market Size 2024-2028

The head and neck cancer treatment market size is forecast to increase by USD 7.12 billion at a CAGR of 13.64% between 2023 and 2028. The market is experiencing significant growth due to the rising number of cancer cases and advancements in systemic drug therapies. In the realm of diagnostics, innovations such as positron emission tomography-computed tomography (PET-CT) and magnetic resonance imaging (MRI) have emerged as crucial tools. PET-CT scans, for instance, can detect metabolic changes in head and neck tissues, enabling early detection and precise tumor localization. Technological advancements in diagnosis and treatment, such as the use of Capecitabine, Cetuximab, Paclitaxel, Bleomycin, Hydroxyurea, and Docetaxel, are driving market growth. Additionally, the convenience of retail pharmacies and the increasing use of the Internet for sales channels are expanding access to these treatments. However, the high cost of treatment remains a challenge for many patients, limiting access and increasing the need for affordable options.

Head and neck cancer refers to a group of malignant tumors that develop in the throat, nose, mouth, salivary glands, and larynx. The primary treatment modalities for head and neck cancer include surgical treatment, chemotherapy, and systemic drug therapies. Surgical treatment is a common approach for removing the tumor and surrounding tissue. Outpatient visits for follow-up care and rehabilitation are essential post-surgery. However, surgical procedures can result in significant morbidity, including speech and swallowing impairments, which necessitate the development of nonsurgical therapeutics.

Moreover, alcohol consumption is a significant risk factor for head and neck cancer. Nonsmokers who consume alcohol heavily are at an increased risk of developing these cancers. Consequently, there is a growing interest in developing nonsurgical therapies for head and neck cancer treatment. Chemotherapy and systemic drug therapies are essential components of head and neck cancer treatment. Farnesyltransferase inhibitors, such as tipifarnib, are a class of systemic drug therapies that inhibit the growth of cancer cells. Tipifarnib has shown promise in the treatment of head and neck squamous cell carcinoma. Immunosuppressive therapies are also used in head and neck cancer treatment.

Furthermore, tiragolumab is an immune system checkpoint inhibitor that blocks the interaction between the immune system and the tumor, enhancing the immune response against the cancer. Merck/Debiopharm's xevinapant is another immunosuppressive therapy that inhibits the enzyme thrombospondin-1, which is overexpressed in head and neck squamous cell carcinoma and contributes to tumor growth and metastasis. The product pipeline for head and neck cancer treatment is strong, with several promising therapies under development. For instance, tiragolumab, an anti-TIGIT monoclonal antibody, is being evaluated in combination with tecemotide, an immune system stimulator, for the treatment of recurrent or metastatic head and neck squamous cell carcinoma.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

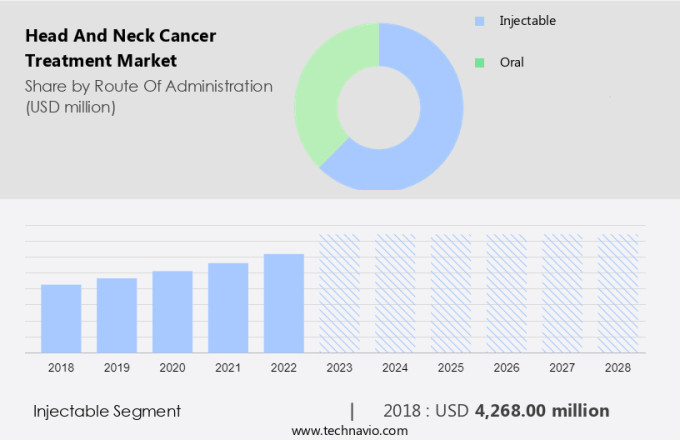

- Route Of Administration

- Injectable

- Oral

- Therapy

- Immunotherapy

- Targeted therapy

- Chemotherapy

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Route Of Administration Insights

The injectable segment is estimated to witness significant growth during the forecast period. Injectable drugs are administered directly into the bloodstream, making them a suitable and convincing treatment option for patients. The injectable drugs segment includes different types of drugs, such as chemotherapy agents, targeted therapies, immunotherapy, and supportive care medications. Cisplatin is one of the injectable drugs used in head and neck cancer treatment a chemotherapy agent that is commonly used in combination with other drugs to treat various types of cancers, including head and neck cancer. Further, the convenience and efficiency of injectable drugs permit the precise and controlled delivery of the medication, assuring maximum efficacy. In addition, the development of novel injectable formulations with improved pharmacokinetics and fewer side effects has expanded the demand for injectable drugs further in head and neck cancer treatment. Therefore, such factors are anticipated to expand the demand for injectable drugs and therapies for treating head and neck cancer treatment, which will drive the growth of the injectable segment of the market during the forecast period.

Get a glance at the market share of various segments Request Free Sample

The Injectable segment was valued at USD 4.26 billion in 2018 and showed a gradual increase during the forecast period.

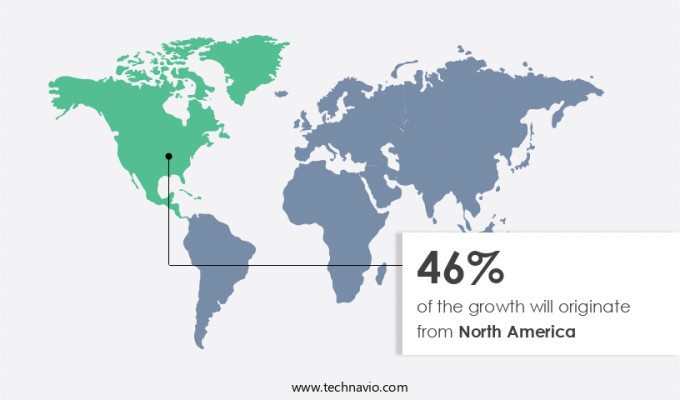

Regional Insights

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market holds a substantial share of the global industry. Factors contributing to this growth include advancements in medical technology, expanding healthcare infrastructure, and a high incidence of head and neck cancer cases in the region. This significant burden of the disease is expected to drive market growth. Merck and Debiopharm's Xevinapant, Tipifarnib (a Farnesyltransferase Inhibitor), Tiragolumab (an anti-TIGIT), Tecentriq (atezolizumab), Rozlytrek (entrectinib), and other innovative treatments are transforming head and neck cancer care.

Furthermore, hair loss and speech difficulties are common side effects of these therapies, but advancements continue to address these concerns. The Cancer Research Institute, along with pharmaceutical companies like Merck KGaA, AstraZeneca, and Regeneron, is developing immunotherapies, such as Pembrolizumab (Keytruda), Nivolumab (Opdivo), and Dostarlimab (Jemperli), to improve treatment outcomes. As disease consciousness increases, the demand for effective head and neck cancer treatments will continue to rise.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing incidence of head and neck cancers is the key driver of the market. Head and neck cancers encompass various malignant tumors that affect the oral cavity, pharynx (nasopharynx, oropharynx, and hypopharynx), larynx, paranasal sinuses and nasal cavity, and salivary glands. These cancers are primarily associated with squamous cell carcinoma (SCC), which is most commonly diagnosed in the later stages and carries a poor prognosis, particularly among men with a history of alcohol consumption and tobacco use. SCC develops along the mucosal linings of the upper respiratory and digestive tracts. According to the American Cancer Society, approximately 50,000 new cases of head and neck cancers are diagnosed in the United States each year, accounting for around 4% of all cancers in the country.

Furthermore, Squamous cell carcinoma of the head and neck (SCCHN) is the sixth most common cancer worldwide, with about 500,000 new cases diagnosed annually. Chemotherapy and targeted therapies, such as Atezolizumab and Afatinib, are among the current treatment options for SCCHN. Alcohol consumption and tobacco use significantly increase the risk of developing these cancers. The pipeline for new drugs in the market continues to expand, offering potential advancements for patients.

Market Trends

Technological advancements in diagnosis and treatment is the upcoming trend in the market. The market in the United States has experienced notable progress in diagnostic and therapeutic approaches. Technological advancements have led to improved patient outcomes and the availability of more targeted treatments. MRI, on the other hand, offers detailed images of the affected area, aiding in the identification of malignant tumors and treatment planning. Systemic drug therapies, including Capecitabine, Cetuximab, Paclitaxel, Bleomycin, Hydroxyurea, and Docetaxel, have become essential components of head and neck cancer treatment.

Furthermore, these medications are administered orally or intravenously and can target cancer cells throughout the body. Retail pharmacies and the Internet have emerged as significant sales channels, making these treatments more accessible to patients. Smoking is a leading risk factor for head and neck cancer, accounting for approximately 75% of cases. However, other factors, such as alcohol consumption, HPV infection, and poor oral hygiene, can also contribute to the development of this disease. Despite the availability of effective treatments, outpatient visits, and ongoing care are essential for managing head and neck cancer and improving patient outcomes.

Market Challenge

The high cost of treatment is a key challenge affecting the market growth. The rising incidence of head and neck cancers poses a significant financial burden on patients due to the high cost of treatment. Diagnostic procedures, such as PET scans, biopsies, CT scans, and MRI scans, are essential for accurate cancer detection but come with substantial expenses. For instance, a PET scan can cost several thousand dollars. Immunotherapies, like Ipilimumab, and targeted therapies are increasingly becoming part of the treatment regimen, adding to the overall healthcare expenditure. Non-surgical procedures, such as radiation therapy, are also common treatment types for head and neck cancers, further increasing costs. Combination therapies, which involve the use of multiple treatment modalities, are also becoming more prevalent, further increasing expenses.

Furthermore, the biopharmaceutical industry continues to invest in research and development of new treatments, which may lead to increased costs for patients. Online pharmacies offer an alternative avenue for patients to access these treatments, but they must navigate the complexities of insurance coverage and affordability. The US healthcare system continues to grapple with these challenges, requiring ongoing awareness and advocacy efforts to ensure access to effective and affordable head and neck cancer treatments.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amgen Inc. - The company offers head and neck cancer treatment solutions such as Vectibix as a first-line treatment in patients with recurrent and metastatic squamous cell head and neck cancer.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AstraZeneca Plc

- Ayala Pharmaceuticals Inc.

- Bristol Myers Squibb Co.

- Debiopharm International SA

- Eli Lilly and Co.

- Incyte Corp.

- Merck and Co. Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Malignant tumors in the head and neck region, affecting areas such as the throat, nose, mouth, and salivary glands, pose a significant health concern. The treatment for these tumors includes various modalities like chemotherapy, therapies, and surgical interventions. Tobacco and alcohol consumption are known risk factors, and the biopharmaceutical industry is continually developing pipeline drugs like afatinib, ipilimumab, and PD-L1 inhibitors to combat these diseases. Immunotherapy and targeted therapy are emerging treatment types, with immunotherapy segment showing promising results using drugs like atezolizumab, nivolumab, and pembrolizumab. The targeted therapy segment includes drugs like erlotinib, gefitinib, and lapatinib. Non-surgical procedures are gaining popularity, with the injectable segment offering drugs like Inlyta and Axitinib.

Furthermore, diagnostic tools play a crucial role in early detection and treatment. Cancer awareness and healthcare expenditure are driving factors in the market growth. The sales channel includes retail pharmacies, online pharmacies, and specialty pharmacies like Humana Specialty Pharmacy, Accredo, CVS Specialty, and Walgreens stores. Surgical treatment is still a common approach for head and neck cancer, with surgeries targeting the oral cavity, pharynx, paranasal sinuses, and nasal cavity. Immunosuppressive drugs are used during and after surgeries to prevent rejection. The immune system plays a vital role in nonsurgical therapeutics, with immunosuppression being a critical factor. Merck/Debiopharm's Xevinapant, Tipifarnib (farnesyltransferase inhibitor), and Tiragolumab (anti-TIGIT) are some of the promising pipeline drugs in the market. However, side effects like hair loss, speech difficulties, and diminished natural voice are concerns associated with these therapies. Disease consciousness and cancer research institutes are working towards improving treatment outcomes and quality of life for patients.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.64% |

|

Market Growth 2024-2028 |

USD 7.12 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

11.73 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 46% |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Amgen Inc., AstraZeneca Plc, Ayala Pharmaceuticals Inc., Bristol Myers Squibb Co., Debiopharm International SA, Eli Lilly and Co., Incyte Corp., Merck and Co. Inc., Novartis AG, Pfizer Inc., and Sanofi SA |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch