Healthcare Third-Party Logistics Market Size 2025-2029

The healthcare third-party logistics market size is forecast to increase by USD 98.5 billion at a CAGR of 9.5% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for efficient and integrated medical logistics solutions. Healthcare institutions are expanding their distribution centers to improve logistics enhancements, with a focus on real-time tracking and automation. The integration of Internet of Things (IoT) technology is enabling cold chain logistics to ensure the safe and timely delivery of temperature-sensitive medical supplies.

- Moreover, the healthcare third-party logistic market is also witnessing an uptick in mergers and acquisitions, as well as the opening of new facilities, to meet the growing demand for specialized logistics services. The implementation of complex and evolving regulations further underscores the importance of outsourcing logistics functions to third-party providers. In summary, the market is witnessing robust growth, driven by the need for advanced biopharmaceutical third-party logistics solutions, regulatory compliance, and the integration of technology to enhance efficiency and accuracy.

What will be the Healthcare Third-Party Logistics Market size during the forecast period?

- The healthcare industry is one of the most critical sectors in any economy, requiring the timely and efficient delivery of a diverse range of products, including pharmaceuticals, medical devices, and healthcare supplies. Third-party logistics (3PL) providers play a pivotal role in ensuring the seamless flow of these goods from manufacturers to healthcare institutions and end-users. 3PLs offer various services, including warehousing, transportation, temperature-controlled logistics, and technology integration, to address the unique challenges of the healthcare sector. Warehousing solutions cater to the specific needs of healthcare supplies, such as temperature-controlled storage for biopharmaceuticals and cold chains for sensitive medical devices.

- Moreover, transportation services ensure the timely and secure delivery of healthcare products, often requiring specialized handling and temperature control. Temperature-controlled logistics is particularly crucial for biopharmaceuticals, as many require specific storage conditions to maintain their efficacy and safety. Technology integration is another essential aspect of 3PL services in healthcare. Advanced retrieval systems and automated storage solutions help manage vast amounts of data and inventory, reducing information asymmetry and improving overall supply chain efficiency. The healthcare sector's growing focus on personalized medicine and medical devices necessitates the need for sophisticated logistics solutions. Biopharmaceuticals, for instance, require specialized handling due to their unique characteristics, such as temperature sensitivity and short shelf life.

- Furthermore, freight services are another critical component of 3PL offerings in healthcare. Contracted logistics services enable healthcare institutions to optimize their supply chain operations by leveraging the expertise and resources of 3PL providers. Database management and online shopping are also gaining traction in the healthcare sector, with 3PLs offering solutions to help healthcare providers and patients manage their inventory and access essential supplies more efficiently. In conclusion, third-party logistics providers offer a range of services, from warehousing and transportation to technology integration and database management, to address the unique challenges of the healthcare sector. By partnering with 3PLs, healthcare institutions and manufacturers can improve their supply chain efficiency, reduce costs, and ultimately, enhance patient care.

How is this market segmented and which is the largest segment?

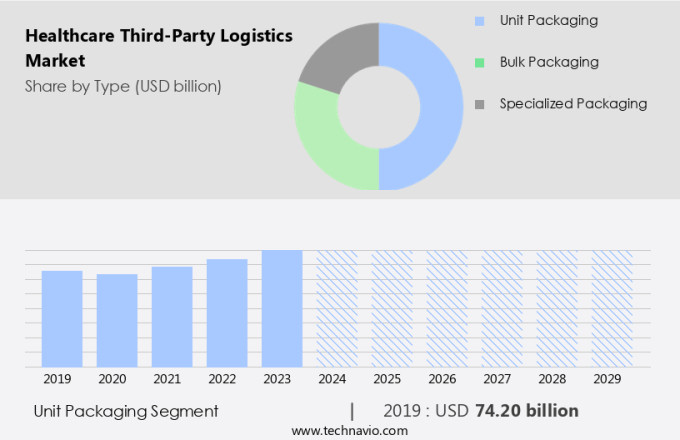

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Unit packaging

- Bulk packaging

- Specialized packaging

- Service Type

- Warehousing and distribution

- Transportation management

- Packaging and labelling

- Inventory management

- Value-added services

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Spain

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- North America

By Type Insights

- The unit packaging segment is estimated to witness significant growth during the forecast period.

In the realm of healthcare third-party logistics, unit packaging plays a pivotal role in ensuring the safety, compliance, and efficiency of distributing individual healthcare products. This process involves preparing products into single, ready-to-use quantities, such as individual doses of medication, medical devices, or diagnostic kits. By doing so, hospitals, pharmacies, and patients can easily identify and handle products, leading to streamlined inventory management. This approach facilitates enhanced traceability, allowing for quick and accurate location of products within the supply chain. The importance of unit packaging is further amplified in managing recalls and ensuring that only safe, compliant products reach end-users.

In the healthcare industry, sectors like temperature-controlled logistics for biopharmaceuticals, personalized medicine, and remote patient monitoring devices heavily rely on this packaging solution. The ability to track individual units is crucial for maintaining the integrity and efficacy of these sensitive products throughout the supply chain. Overall, unit packaging is an indispensable component of the healthcare third-party logistic market, addressing information asymmetry and ensuring the secure and efficient delivery of healthcare products.

Get a glance at the market report of share of various segments Request Free Sample

The unit packaging segment was valued at USD 74.20 billion in 2019 and showed a gradual increase during the forecast period.

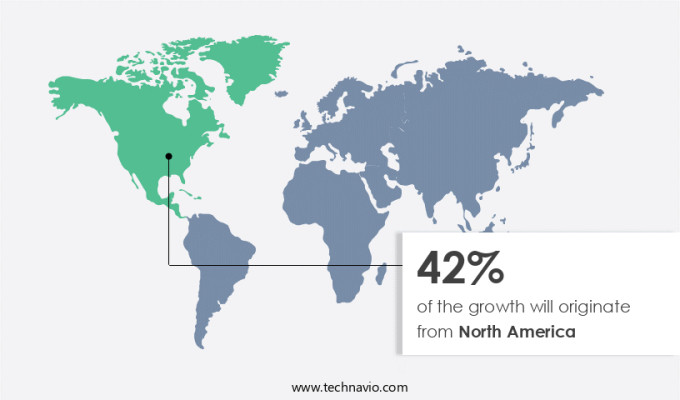

Regional Analysis

- North America is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is witnessing notable expansion, fueled by strategic mergers and acquisitions and the growing intricacy of healthcare supply chains. One significant transaction occurred in January 2024, with SCI Group Inc. Being acquired by Metro Supply Chain Inc. This deal brought together a Canadian supply chain solutions provider and a 3PL company previously owned by Canada Post Corporation and Purolator Holdings Ltd., signaling ongoing consolidation and growth within the industry. North America, comprising the United States and Canada, is a significant player in healthcare logistics due to its advanced logistics infrastructure, substantial medical product demand, and stringent regulatory framework.

The integration of advanced technologies, such as database management systems, online shopping platforms, and big data analytics, is transforming the sector. Moreover, the adoption of artificial intelligence (AI) and blockchain technology is revolutionizing the handling and distribution of biopharmaceutical therapies. The North American market's growth is further driven by the increasing need for efficient and secure supply chain management in the healthcare sector.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Healthcare Third-Party Logistics Market?

Opening of new facilities is the key driver of the market.

- The market in the United States is experiencing notable growth due to the expansion of specialized facilities to accommodate the unique storage needs of pharmaceuticals and medical devices. Leading 3PL providers, including DHL, UPS Healthcare, and FedEx, are investing in advanced infrastructure, such as temperature-controlled environments, clean rooms, and Good Distribution Practice (GDP)-compliant warehousing spaces. These facilities are outfitted with sophisticated cold chain management systems, cutting-edge inventory tracking technologies, and stringent security measures to safeguard the integrity of healthcare products.

- For instance, Kuehne+Nagel, a prominent 3PL provider, opened its tenth healthcare logistics facility in the US in October 2024, signaling ongoing expansion efforts to enhance service capabilities and geographical coverage. Cold chain solutions play a crucial role in maintaining the efficacy of temperature-sensitive products, such as clinical trial materials, vaccines, and immunization initiatives. Effective inventory management and technology integration are essential components of supply chain management in the healthcare sector, ensuring timely and accurate delivery of critical medical supplies.

What are the market trends shaping the Healthcare Third-Party Logistics Market?

Merger and acquisitions are the upcoming trend in the market.

- The market in the United States is experiencing a notable trend of consolidation, fueled by the objective of augmenting service capabilities, broadening geographic presence, and securing economies of scale. This trend is exemplified by significant transactions such as bpost group's acquisition of Staci for USD1.36 billion in April 2023 and UPS's acquisition of Bomi Group in August 2022. Bpost group, a leading Belgian mail and logistics company, announced its intention to acquire Staci, renowned for its proficiency in value-added logistics solutions, to expedite its transformation into a major player in the high-value, adaptable logistics sector in Europe. This acquisition will empower bpost to bolster its service offerings and fortify its stance in the European market.

- In the realm of logistics, the Internet of Things (IoT) is revolutionizing the last-mile delivery process. Green logistics is another trend gaining traction, as companies strive to minimize their carbon footprint and adopt sustainable practices. As per the latest market research, the US the market is projected to expand at a steady pace, driven by these technological advancements and the growing demand for efficient and eco-friendly supply chain solutions. As a professional and knowledgeable virtual assistant, I am committed to maintaining a formal and proficient tone in all my responses. I will ensure that all outputs adhere to the given word count and are grammatically correct.

What challenges does Healthcare Third-Party Logistics Market face during the growth?

Complex and evolving regulations are key challenges affecting the market growth.

- The market in the US is characterized by intricate regulatory landscapes that vary from country to country. Compliance with these regulations is essential for 3PL providers serving healthcare institutions. In the US, adherence to Food and Drug Administration (FDA) regulations is mandatory. Elsewhere, Good Distribution Practice (GDP) guidelines apply in Europe, while diverse national frameworks govern Asia-Pacific countries. Navigating these regulatory complexities necessitates substantial investments in compliance management systems, continuous staff training, and the development of specialized facilities. These facilities must meet the specific standards of each region. For instance, cold chain logistics is crucial for pharmaceuticals, requiring temperature-controlled distribution centers and real-time tracking.

- However, integrated medical logistics solutions are increasingly popular, with automation and Internet of Things (IoT) technologies playing a significant role. These enhancements improve efficiency, reduce errors, and ensure the timely delivery of critical medical supplies. As the healthcare sector continues to evolve, 3PL providers must remain agile and adapt to the latest regulatory requirements and technological advancements. The US the market is marked by intricate regulatory frameworks that necessitate substantial investments in compliance management systems, continuous staff training, and specialized facilities.

- FDA regulations apply in the US, while GDP guidelines are essential in Europe, and diverse national frameworks govern Asia-Pacific countries. Cold chain logistics, with temperature-controlled distribution centers and real-time tracking, is crucial for pharmaceuticals. Integrated medical logistics solutions, utilizing automation and IoT technologies, improve efficiency and reduce errors. Adapting to the latest regulatory requirements and technological advancements is essential for 3PL providers in this evolving sector.

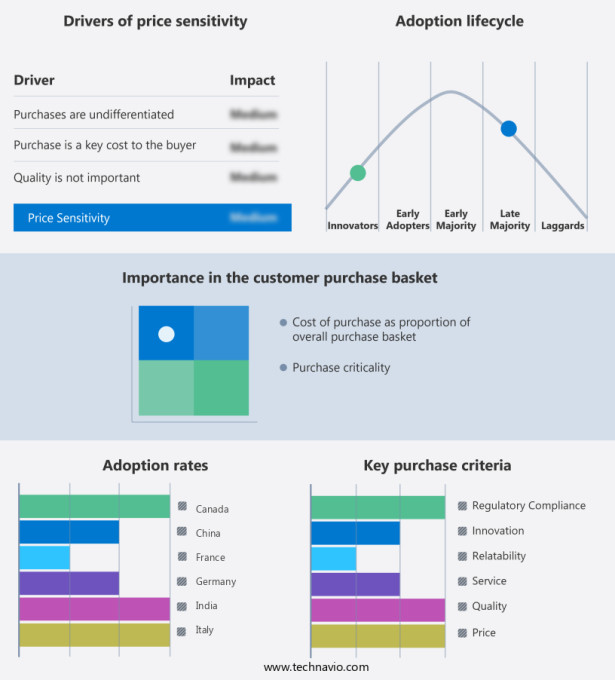

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AmerisourceBergen Corp.

- AWL India Pvt. Ltd.

- Cardinal Health Inc.

- Cencora Inc.

- CEVA Logistics

- Cold Chain 3PL

- DB Schenker

- Delta Global Solutions

- DHL Express Ltd.

- DSV AS

- FedEx Corp.

- GEODIS

- Hub Group Inc.

- Kerry Logistics Network Ltd.

- Kinesis Medical B.V.

- Kuehne Nagel Management AG

- Lynden Inc.

- Omni Logistics LLC

- SEKO Logistics

- UniGroup CA

- United Parcel Service Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global third-party logistics (3PL) market in healthcare is witnessing significant growth due to the increasing outsourcing of logistics activities in the pharmaceutical and biopharmaceutical industries. The healthcare sector requires specialized logistics solutions, including retrieval systems and automated storage solutions, to manage healthcare supplies and ensure the proper handling of temperature-sensitive pharmaceuticals and medical devices. The market is driven by the need for temperature-controlled logistics solutions for biologics, precision medicine, and personalized medicine. The use of cold chains for storing and transporting vaccines, biopharmaceutical therapies, and clinical trial materials is a major trend in the healthcare third-party logistic market.

In summary, the integration of technology such as artificial intelligence (AI), big data analytics, IoT, and blockchain is enhancing the efficiency and effectiveness of healthcare logistics networks. Value-added services, such as procurement services, inventory management, and contracted logistics services, are also gaining popularity in the market. The use of real-time tracking and logistics enhancements is enabling healthcare institutions to improve their supply chain management and ensure the timely delivery of critical medical supplies. The market is also witnessing the growth of last-mile delivery services and green logistics initiatives to reduce carbon footprint and improve sustainability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.5% |

|

Market growth 2025-2029 |

USD 98.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.1 |

|

Key countries |

US, Germany, China, Canada, UK, India, France, Japan, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch