Heat and Energy Recovery Ventilation System Market Size 2024-2028

The heat and energy recovery ventilation system market size is forecast to increase by USD 1.77 billion at a CAGR of 8.17% between 2023 and 2028.

-

The market is driven by several key factors. Primarily, the rising awareness of indoor air quality has led to an increasing demand for HERV systems. These systems effectively recover heat and energy from exhaust air, making them an essential component of modern buildings. Additionally, the integration of HERV systems with smart building technologies and the Internet of Things (IoT) is trending, enabling remote monitoring and control of ventilation systems for enhanced energy efficiency and comfort. However, the high initial upfront cost of HERV systems remains a significant challenge, which may hinder market growth. Despite this, the long-term energy savings and improved indoor air quality offered by HERV systems make them a worthwhile investment for building owners and managers.

What will be the Size of the Market During the Forecast Period?

- The market encompasses the production, sales, and installation of HERV systems used for maintaining pleasant air quality in buildings. These systems, which include ERV air exchangers and air handling units, facilitate the exchange of indoor and outdoor air while conserving energy. HERV systems play a crucial role in mitigating the impact of pollutants, pollen, and hazardous contaminants in buildings, contributing significantly to Environmental Protection and the enhancement of cognitive function. The market for these systems is experiencing growth trends in the context of Green Buildings, as asset value and air quality become increasingly important considerations.

- Furthermore, the market research methodology for HERV systems involves the use of secondary sources, such as industry reports and publications, to gather data on energy conservation, air filtration mechanisms, and ventilation ducts. The market is driven by the demand for improved indoor air quality, as well as the need for sustainable and energy-efficient building solutions. Air handling units and ductwork are integral components of HERV systems, ensuring efficient heat and energy transfer between the indoor and outdoor air streams. The HERV market is expected to continue its growth trajectory, driven by the increasing awareness of the importance of maintaining healthy indoor environments.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Ceiling-mounted

- Wall-mounted

- Cabinet-mounted

- End-user

- Commercial

- Residential

- Industrial

- Geography

- North America

- Canada

- US

- Europe

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Type Insights

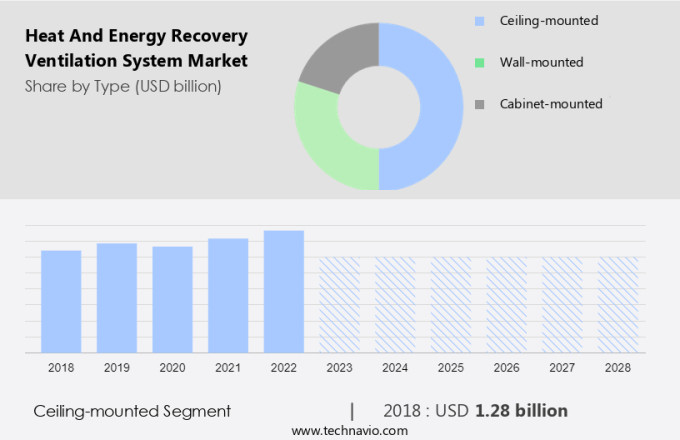

- The ceiling-mounted segment is estimated to witness significant growth during the forecast period.

Ceiling-mounted heat and energy recovery ventilation systems have gained significant popularity in the global market due to their adaptability, efficiency, and compact design. These systems are favored for both residential and commercial applications due to their ability to be discreetly installed in ceiling spaces, enhancing interior design and minimizing installation footprint. In commercial buildings, they are often chosen to optimize usable floor areas. The efficient dispersion of conditioned air, made possible by their centralized positioning, is another advantage. Ceiling-mounted systems also minimize visual effects in living spaces and ensure improved air quality in residential situations. Government regulations promoting energy efficiency and sustainable building solutions have driven the market's YOY growth.

Furthermore, the fragmented market is witnessing increasing competition among key players, leading to innovations and advancements in air filtration technologies. Smart building integration and the increasing focus on energy expenses are also key trends in the market. Ceiling-mounted heat and energy recovery ventilation systems offer an excellent return on investment by reducing energy expenses in the long run. The market is expected to continue growing as more buildings adopt sustainable building solutions to reduce their carbon footprint.

Get a glance at the market report of share of various segments Request Free Sample

The Ceiling-mounted segment was valued at USD 1.28 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

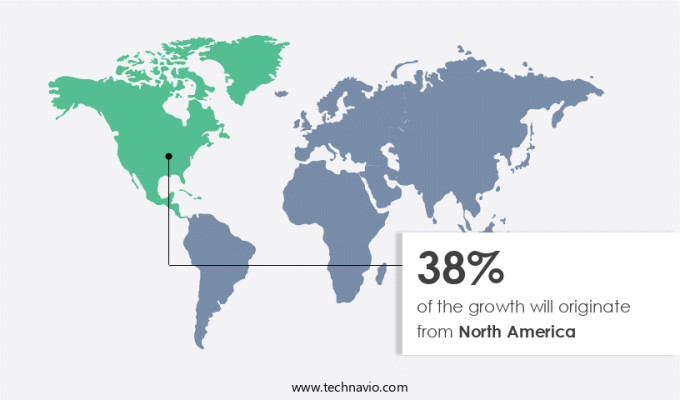

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market represents a fragmented landscape, experiencing year-on-year growth. This expansion is driven by the increasing demand for smart and sustainable building solutions, as well as stricter environmental regulations. Heat and energy recovery ventilation systems are gaining popularity due to their ability to conserve energy while maintaining optimal interior climate. These systems incorporate advanced technologies, such as heat pumps and air handling units, to facilitate efficient heat exchange between incoming and outgoing air streams. The ceiling-mounted segment of energy recovery ventilation systems is particularly adaptable, offering compact designs that cater to various architectural requirements. Upfront expenses for these systems may be higher than traditional ventilation methods, but the long-term energy savings and air filtration mechanisms make them a worthwhile investment.

Furthermore, ventilation ducts and ductwork are essential components of these systems, ensuring proper air circulation and climate settings. Contaminants are effectively removed through air filtration mechanisms, contributing to improved indoor air quality. Modern heat and energy recovery systems are equipped with automation and control features, allowing for precise climate settings and energy conservation. As leading North American manufacturers, such as Lennox, Carrier, and Trane, continue to innovate and introduce new technologies, the market for energy recovery ventilation systems is poised for continued growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Heat and Energy Recovery Ventilation System Market?

Rising demand for heat and energy recovery ventilation systems due to awareness of indoor air quality is the key driver of the market.

- The significance of indoor air quality in green buildings is gaining increasing recognition, leading to the growth of the heat and energy recovery ventilation systems market. With people becoming more conscious of the health hazards posed by indoor air pollution, there is a rising demand for systems that offer superior air filtration and efficient ventilation. Heat and energy recovery ventilation systems address this need by recovering heat or energy from the exhausted interior air and introducing fresh outdoor air. This approach not only enhances indoor air quality but also reduces energy costs, making it an attractive solution for commercial and residential buildings.

- In densely populated cities like Los Angeles, Delhi, and Beijing, where air pollution is a major concern, these systems have gained popularity due to their ability to maintain good indoor air quality by filtering out contaminants. By investing in these systems, building owners not only contribute to the well-being and productivity of their occupants but also reduce their carbon footprint and improve energy efficiency.

What are the market trends shaping the Heat and Energy Recovery Ventilation System Market?

Integration of heat and energy recovery ventilation systems with smart building technologies and the Internet of Things is the upcoming trend in the market.

- In the market, raw material suppliers are collaborating with leading companies to integrate the Internet of Things (IoT) and smart building technologies. This integration aims to enhance the functionality and efficiency of ventilation systems. The demand for energy-efficient and sustainable building solutions is fueling this trend.

- IoT sensors and automation enable ventilation systems to respond to real-time changes in temperature, air quality, and occupancy levels, optimizing air quality and reducing energy consumption. For instance, Panasonic's smart ventilation solutions employ IoT technology to analyze indoor air quality data and make precise, automated adjustments. This not only ensures optimal air quality but also contributes to energy savings.

What challenges does Heat and Energy Recovery Ventilation System Market face during the growth?

The high initial upfront cost is a key challenge affecting the market growth.

- The market experiences growth driven by the energy efficiency and indoor air quality benefits these systems provide. However, the high upfront costs of purchasing and installing these systems can be a significant barrier for some customers, particularly in residential applications where less expensive ventilation alternatives may be preferred.

- The cost of a household unit can range from USD 1,500 to USD 5,000, while industrial or commercial installations can cost tens of thousands of dollars. To gain a comprehensive understanding of the market, this analysis utilizes a combination of primary and secondary sources. Primary sources include interviews with industry experts, such as chief executive officers, and the market engineering process.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airxchange Inc.

- Carrier Global Corp.

- Daikin Industries Ltd.

- Dais Corp.

- Fujitsu General Ltd.

- Greenheck Fan Corp.

- Johnson Controls International Plc

- Lennox International Inc.

- LG Electronics Inc.

- Loren Cook Co.

- Mitsubishi Electric Corp.

- Munters Group AB

- Nortek Air Solutions LLC

- Ostberg Group AB

- Panasonic Holdings Corp.

- Paschal Air Plumbing and Electric.

- S and P SISTEMAS DE VENTILACION S.L.U.

- Trane Technologies plc

- Zehnder Group AG

- KARYER Heat Transfer San. and Tic. Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing focus on environmental protection and the need for pleasant air in buildings. ERV ventilation systems help in reducing energy consumption by recovering heat or cool from the exhaust air and using it to precondition the incoming fresh air. These systems play a crucial role in maintaining air quality by removing pollutants, pollen, and hazardous contaminants, contributing to better cognitive function, productivity, and well-being. ERV air exchangers are gaining popularity in both residential and commercial applications, with the latter segment accounting for a larger market share.

Furthermore, energy efficiency and carbon footprint reduction are key drivers for the adoption of ERV systems in green buildings and smart buildings. The market is fragmented with several players, including Daikin, Mitsubishi Electric, Munters, Nortek Air Solutions, and Greenheck Fan Corporation, among others. The market is witnessing growth trends in the form of increasing government regulations on air quality and energy efficiency, the adoption of automation and control in HVAC systems, and the integration of ERV systems with heat pumps and air handling units. The market engineering process involves secondary sources, including industry reports, whitepapers, and publications, as well as primary research through interviews with chief executive officers and other key personnel in the value chain.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.17% |

|

Market Growth 2024-2028 |

USD 1.77 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.66 |

|

Key countries |

US, Canada, China, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch