Helicopter Engines Market Size and Trends

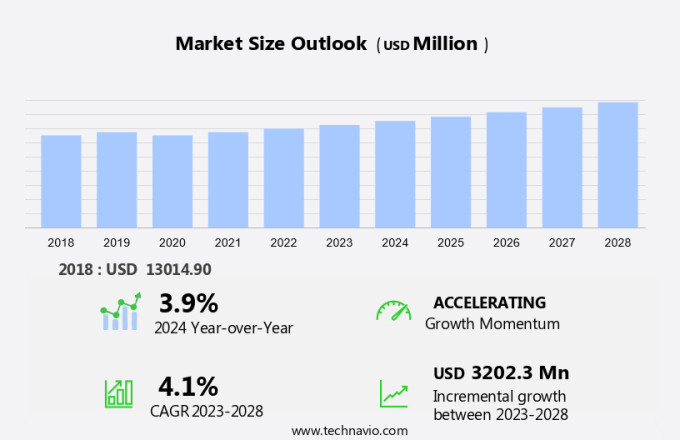

The helicopter engines market size is forecast to increase by USD 3.20 billion at a CAGR of 4.1% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for helicopters in various sectors, including emergency medical services, law enforcement, and military applications. Fuel efficiency is a key trend in the market, with OEMs focusing on developing engines that consume less fuel. Delivery backlogs for military helicopters are a challenge, as the demand for these aircraft outpaces supply. Complex product certification and stringent regulatory norms also pose barriers to market growth. New technologies, such as electric vertical takeoff and landing (eVTOL) engines, are gaining traction, but their adoption is hindered by the high cost of development and certification. Medium military helicopters, particularly those with twin engines, continue to dominate the market. Rising fuel prices and the need for greater environmental sustainability are also influencing market dynamics. Overall, the market is poised for steady growth, with OEMs and component suppliers playing crucial roles in driving innovation and meeting customer demands.

The market is experiencing significant advancements driven by the need for high-performance engines in military and civilian applications. These engines play a crucial role in powering various types of helicopters, including advanced military helicopters, vertical takeoff and landing (VTOL) aircraft, and lightweight single engine helicopters. Military helicopters continue to be a major segment in the helicopter engine market. Defense modernization programs worldwide are investing in new helicopter fleets and upgrading existing ones with more capable engines. The demand for engines that offer minimal noise pollution and high fuel efficiency is a key trend in this market. In the military helicopter market, combat helicopters and unmanned attack helicopters are the primary users of advanced engines. These engines are designed to provide superior power-to-weight ratios, enabling better maneuverability and increased mission capabilities. The integration of hybrid-electric propulsion systems and advanced avionics is also a growing trend in military helicopter engines. Civilian applications of helicopter engines include emergency assistance services, air tourism, and commercial activities. In urban air mobility (UAM), the focus is on developing lightweight and quiet engines to minimize noise pollution and enable helicopters to operate in densely populated areas.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- End-user

- Military

- Commercial

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- South America

- Middle East and Africa

- North America

By End-user Insights

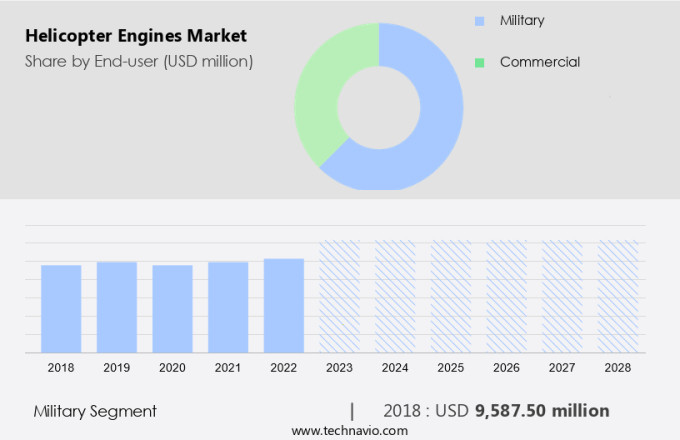

The military segment is estimated to witness significant growth during the forecast period. Helicopter engines have become essential components in various sectors, including medical evacuation, policing, and commercial operations. Fuel solutions have played a significant role in enhancing the performance and efficiency of these engines. In the medical field, helicopters equipped with specialized engine designs enable quick response in ambulance services for medical evacuation.

Get a glance at the market share of various segments Download the PDF Sample

The military segment was the largest segment and was valued at USD 9.59 billion in 2018. These advanced engine technologies offer benefits such as reduced fuel consumption, lower emissions, and increased reliability. In the commercial helicopter operations sector, helicopters are used for various applications, including offshore oil and gas exploration, construction, and passenger transportation. In the policing sector, helicopters are used for surveillance, search and rescue, and traffic management. Moreover, the adoption of hybrid engines and electric power devices in helicopter engines has gained traction, particularly in Unmanned Aerial Vehicles (UAVs) and Unmanned Aerial Systems (UAS). Hence, such factors are fuelling the growth of this segment during the forecast period.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

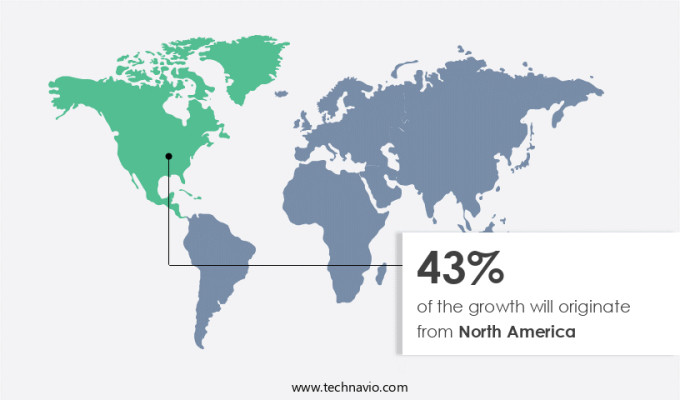

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. In North America, the market experiences significant growth due to the increasing demand for both military and commercial helicopters. The United States, with a substantial defense budget, is a major contributor to this market. Advanced helicopters are in high demand for various applications, such as reconnaissance, transportation, medical evacuation, and combat, which necessitates the development of sophisticated engines. These engines must meet stringent performance, durability, and fuel efficiency standards for military missions.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Helicopter Engines Market Driver

The rising adoption of helicopters in multiple applications is notably driving market growth. Helicopter engines play a crucial role in the aviation industry, powering these versatile aircraft that can access locations unreachable by other modes of transport. With military defense modernization programs prioritizing advanced helicopters, the demand for compatible high-performance engines continues to grow.

Military helicopters, including vertical takeoff and landing (VTOL) aircraft, require engines that offer minimal noise pollution for stealth operations. Moreover, these engines must meet stringent performance standards to ensure mission success. In the civil sector, helicopters have diverse applications, such as aerial cranes and aerial photography. For instance, helicopters' ability to hover over heavy loads makes them indispensable in construction projects and emergency assistance situations. Thus, such factors are driving the growth of the market during the forecast period.

Helicopter Engines Market Trends

New technologies gaining ground is the key trend in the market. The helicopter engine market is experiencing significant advancements due to the integration of technology and data in manufacturing processes. This transformation is leading to the emergence of innovative tools and techniques, enhancing aftermarket operations. Two noteworthy technologies gaining traction in this sector are augmented reality and virtual reality (AR/VR) and advanced predictive maintenance.

AR/VR technology extends human visualization capabilities using Optical Network Hardware such as glasses or smartphones. Its applications extend beyond operations and maintenance to training, offering a more enriching experience. Advanced predictive maintenance, on the other hand, employs real-time engine monitoring to detect potential failures and prevent high maintenance costs. Fuel efficiency remains a critical factor in the helicopter engine market, with rising fuel prices and stringent regulatory norms driving the need for more efficient engines. Thus, such trends will shape the growth of the market during the forecast period.

Helicopter Engines Market Challenge

Barriers to adoption of new technology and equipment is the major challenge that affects the growth of the market. Helicopter engines, such as T408 models, play a crucial role in the operation of the global helicopter fleet. The defense budget significantly influences the helicopter market, particularly in the military segment, which includes combat and unmanned attack helicopters. companies providing engine solutions must comply with the regulatory requirements set by government agencies and aviation authorities.

Military forces face challenges when adopting new technologies due to their rapid obsolescence. Technological advancements in areas like missile technology, smart munitions, and electronic warfare are essential for military helicopters. However, integrating these technologies comes with costs, certification requirements, and expertise challenges. Moreover, the helicopter market is witnessing the emergence of innovative technologies like hybrid-electric propulsion systems and advanced avionics. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

General Electric Co: The company offers a wide range of helicopter engines such as CT7-2E1 and T700.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- Hindustan Aeronautics Ltd.

- Honeywell International Inc.

- ITP Aero

- JSC Klimov

- Kawasaki Heavy Industries Ltd.

- Mitsubishi Heavy Industries Ltd

- MTU Aero Engines AG

- Rolls Royce Holdings Plc

- Rostec

- RTX Corp.

- Safran SA

- Textron Aviation Inc.

- Turkish Aerospace Industries Inc.

- ULPower Aero Engines

- Voronezh Mechanical Plant

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Analyst Overview

The market caters to the demand for high-performance engines used in various helicopter applications. Military and defense remain significant end-users, with modernization programs for advanced helicopters driving market growth. Compatible engines are essential for military helicopters, including vertical takeoff and landing (VTOL) and unmanned attack helicopters. Noise pollution and minimal carbon emissions are critical considerations in the development of helicopter engines. High-performance engines are increasingly being adopted for emergency assistance helicopters, with fuel efficiency and power output being key factors. OEMs are focusing on engine design and emission solutions to meet stringent regulatory norms and complex product certification requirements. The market is witnessing the emergence of hybrid-electric propulsion systems, advanced avionics, and specialized engine designs for urban air mobility (UAM) and electric power devices for unmanned aerial vehicles (UAVs). The market is influenced by factors such as rising fuel prices, military budgets, and commercial activities like air tourism. Lightweight helicopters and single engine helicopters are gaining popularity due to their fuel efficiency and lower operational costs. The market also caters to various helicopter applications, including combat helicopters, medical transport, and law enforcement.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.1% |

|

Market growth 2024-2028 |

USD 3.20 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.9 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 43% |

|

Key countries |

US, Germany, UK, Canada, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Airbus SE, General Electric Co., Hindustan Aeronautics Ltd., Honeywell International Inc., ITP Aero, JSC Klimov, Kawasaki Heavy Industries Ltd., Mitsubishi Heavy Industries Ltd, MTU Aero Engines AG, Rolls Royce Holdings Plc, Rostec, RTX Corp., Safran SA, Textron Aviation Inc., Turkish Aerospace Industries Inc., ULPower Aero Engines, and Voronezh Mechanical Plant |

|

Market dynamics |

Parent market analysis, market report , market forecast , Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch