Hemostasis Diagnostics Market Size 2024-2028

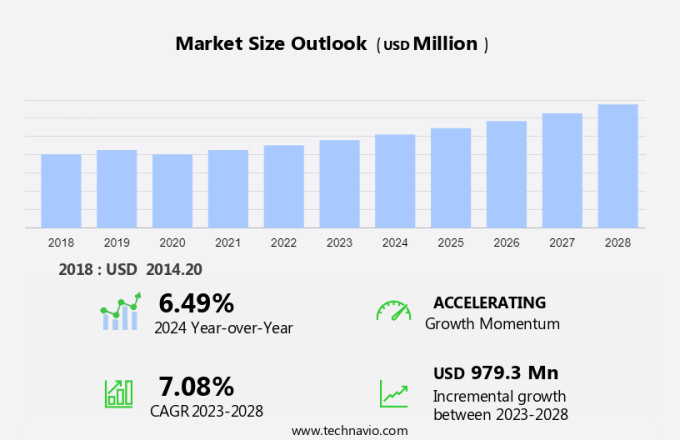

The hemostasis diagnostics market size is forecast to increase by USD 979.3 billion at a CAGR of 7.08% between 2023 and 2028. The market is driven by the rising prevalence of acquired and hereditary bleeding disorders, which necessitate accurate and timely diagnosis through coagulation testing. Hemostatic defects, such as coagulation disorders, can lead to life-threatening conditions if not identified and treated promptly. This market is also witnessing an increase in the penetration of point-of-care testing (POCT) devices in developed countries, enabling quicker diagnosis and treatment outside of traditional healthcare settings. However, the high cost of advanced hemostasis equipment, such as fully automated analyzers, may hinder market growth. Key diagnostic tests in this market include D-dimer, fibrinogen, and prothrombin time tests, as well as activated clotting time assays. These tests play a crucial role in identifying coagulation disorders and guiding appropriate treatment interventions in healthcare settings.

Market Analysis

The market represents a significant segment within the healthcare industry, focusing on the detection and monitoring of various coagulation disorders and bleeding risks. These conditions, including but not limited to blood clotting disorders such as deep vein thrombosis, hemophilia A and B, and platelet dysfunction, pose a considerable challenge to patient health and require precise diagnostic tools and therapies. Hospitals and healthcare facilities play a crucial role in the market, as they serve as the primary point of care for patients with cardiovascular diseases, coagulation disorders, and other hemostatic defects. Coagulation monitoring is a vital aspect of patient care, ensuring optimal treatment and reducing the risk of complications from anticoagulant drugs. To address the growing demand for efficient and accurate diagnostic tools, the market is witnessing a shift towards automation in hemostasis testing. Product laboratory analyzers, such as those used for d-dimer, fibrinogen, prothrombin time, activated clotting time, and platelet aggregation tests, have become essential in providing quick and reliable results.

Coagulation proteins, including fibrinogen, prothrombin, and platelets, play a crucial role in the hemostasis process. Imbalances in these proteins can lead to various conditions, necessitating the need for diagnostic tests and hemostatic therapies. The market is driven by the increasing prevalence of cardiovascular diseases and coagulation disorders, as well as the growing awareness of the importance of early and accurate diagnosis. Effective management of these conditions can significantly improve patient outcomes and reduce healthcare costs. In conclusion, the market holds immense potential for growth, with a strong focus on innovation and the development of advanced diagnostic tools and therapies. The market is expected to witness steady growth as healthcare providers continue to prioritize early and accurate diagnosis, enabling optimal patient care and improved health outcomes.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals and clinics

- Independent diagnostic centers

- Research and academic institutions

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

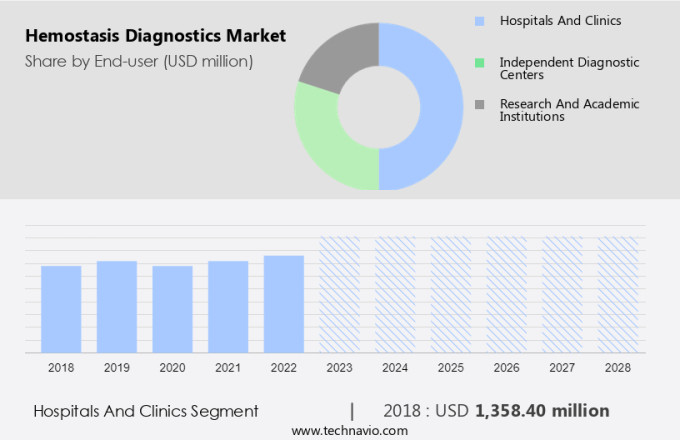

By End-user Insights

The hospitals and clinics segment is estimated to witness significant growth during the forecast period. In the healthcare industry, hospitals and clinics are the primary consumers of hemostasis diagnostics due to the increasing number of patients requiring coagulation monitoring during surgeries and intensive care. These institutions have larger budgets compared to other medical devices and facilities, enabling them to invest in expensive point-of-care (POC) devices for hemostasis diagnostics. The high demand for these tests in both outpatient and inpatient settings further justifies the significant investments made by hospitals.

Further, the use of POC devices allows minimally skilled professionals to perform hemostasis tests quickly and accurately, reducing turnaround time and improving patient care. The global market for hemostasis diagnostics is experiencing growth due to the increasing use of anticoagulant drugs, which pose a bleeding risk, and the need for hemostatic therapies to manage bleeding effectively. This trend is expected to continue as the development of new POC devices and initiatives in hemostasis diagnostics continues to advance.

Get a glance at the market share of various segments Request Free Sample

The hospitals and clinics segment accounted for USD 1.36 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the increasing prevalence of chronic diseases has led to a rise in surgical procedures, thereby fueling the demand for hemostasis diagnostics. The growing geriatric population and subsequent healthcare expenditure are also significant factors driving market growth. Advanced technological products for hemostasis diagnostics are increasingly available, attracting skilled professionals in healthcare facilities. Electronic Health Records (EHR) are increasingly adopted for effective testing outcomes, further boosting market expansion.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increasing prevalence of coagulation disorders is the key driver of the market. Coagulation disorders, including hemophilia A and B, Von Willebrand disease, deep vein thrombosis, and hypercoagulable states, impact a substantial number of individuals worldwide. In the US alone, approximately 400 newborns are diagnosed with hemophilia A each year, and nearly 900,000 people experience venous thromboembolism (DVT/PE) annually, according to the Centers for Disease Control and Prevention (CDC). The rising incidence of these conditions necessitates continuous monitoring and medical intervention. In the healthcare sector, advancements in technology have led to the automation of hemostasis diagnostics, enabling faster and more accurate identification of coagulation disorders and platelet dysfunction. This not only improves patient outcomes but also reduces healthcare costs. The increasing burden of cardiovascular diseases and the growing awareness of the importance of early diagnosis and treatment make the market a significant area of focus for researchers and investors.

Market Trends

Increased penetration of POCT devices in developed countries is the upcoming trend in the market. The European reimbursement system has fueled the demand for Point-of-Care Testing (POCT) hemostasis diagnostics. In countries like Spain, the healthcare sector is focused on integrating advanced technology and equipment to enhance patient care. Spain's universal public healthcare system, ranked seventh globally by the World Health Organization (WHO), offers free diagnostic and therapeutic services to all citizens. Similarly, the UK's National Health Service (NHS) follows the universal healthcare model, providing free healthcare services at the point of care. Consequently, ambulatory, inpatient, and outpatient care are all accessible without charge in the UK. Hemostasis diagnostics, including D-dimer tests, fibrinogen tests, prothrombin time tests, and activated clotting time tests, play a crucial role in diagnosing and managing acquired and hereditary bleeding disorders and hemostatic defects.

Market Challenge

The high cost of fully-automated hemostasis equipment is a key challenge affecting market growth. The cost-effectiveness of hemostasis diagnostics, including tests for conditions such as Von Willebrand disease and Vitamin K deficiency, is a significant consideration for healthcare providers and laboratories. The development and commercialization of new hemostasis diagnostic products is a costly process, with companies investing heavily in research and development (R&D) to gain a competitive edge. This investment in R&D can result in the introduction of innovative technologies, such as platelet function analyzers and chromogenic assays, which can improve diagnostic accuracy and efficiency.

However, the rapid pace of technological advancements in the field can lead to frequent obsolescence of existing products. As a result, companies must continually innovate to remain competitive and meet the evolving needs of the market. This dynamic market environment can present challenges for both manufacturers and healthcare providers, requiring a deep understanding of the latest trends and technologies in hemostasis diagnostics.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Abbott Laboratories - The company offers hemostasis diagnostics products under the brand name of Alinity.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Beckman Coulter Inc.

- Danaher Corp.

- F. Hoffmann La Roche Ltd.

- Grifols SA

- Helena Laboratories Corp.

- Hitachi Ltd.

- HORIBA Ltd.

- Medtronic Plc

- Nihon Kohden Corp.

- Siemens AG

- Sysmex Corp.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing prevalence of blood clotting disorders and cardiovascular diseases. Hemostasis refers to the process of blood clotting, which is essential for preventing excessive blood loss during injuries. Disorders such as hemophilia A and B, deep vein thrombosis, coagulation disorders, platelet dysfunction, von Willebrand disease, vitamin K deficiency, and acquired and hereditary bleeding disorders can disrupt this process. Hospitals and diagnostic centers play a crucial role in the diagnosis of hemostatic defects, utilizing various diagnostic devices and techniques such as platelet function analyzers, chromogenic assays, flow cytometry, and product laboratory analyzers.

These tests help assess coagulation proteins, platelet function, and detect markers of clot formation like D-dimer. Surgical procedures, dialysis, and anticoagulant medications increase the risk of bleeding and require regular monitoring. Automation in hemostasis with AI diagnostics, including POC processes and devices, allows minimally skilled professionals to perform tests quickly and accurately. The development of automated analyzers and lab automation techniques is driving market growth, enabling preventive care management and coagulation monitoring for anticoagulant drugs and hemostatic therapies. The patient pool for hemostasis diagnostics is expanding due to the increasing prevalence of venous thromboembolism and other hemostatic disorders. Medical equipment manufacturers are focusing on POC devices and initiatives to cater to this growing demand.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 979.3 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

6.49 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 45% |

|

Key countries |

US, Germany, UK, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Abbott Laboratories, Beckman Coulter Inc., Danaher Corp., F. Hoffmann La Roche Ltd., Grifols SA, Helena Laboratories Corp., Hitachi Ltd., HORIBA Ltd., Medtronic Plc, Nihon Kohden Corp., Siemens AG, Sysmex Corp., and Thermo Fisher Scientific Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch