High Temperature Superconducting Wires Market Size 2024-2028

The high temperature superconducting wires market size is forecast to increase by USD 307.8 million at a CAGR of 10.09% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. One of the primary factors driving market expansion is the increased adoption of these wires in medical applications, particularly in magnetic resonance imaging (MRI) systems and radiofrequency ablation devices. Additionally, the transition towards renewable energy sources is boosting the demand for high temperature superconducting wires in power generation and power transmission applications. However, the high cost of these wires remains a major challenge for market growth. Despite the cost barrier, the potential benefits of using high temperature superconducting wires, such as increased energy efficiency and reduced energy losses, make them an attractive option for various industries. Overall, the market is expected to witness steady growth in the coming years due to these trends and the ongoing research and development efforts to reduce the cost of high temperature superconducting wires.

What will be the Size of the High Temperature Superconducting Wires Market During the Forecast Period?

- The high-temperature superconducting wires market is experiencing significant growth due to the increasing demand for energy-efficient power transmission and distribution solutions. High-temperature superconducting cables, which operate at temperatures above liquid nitrogen, offer advantages over conventional wires, including higher current capacity and lower energy losses. Two main types of high-temperature superconducting cables exist: warm dielectric and cryogenic dielectric. In the power sector, high-temperature superconducting technologies are gaining traction for power transmission infrastructures, particularly in offshore wind farms.

- Additionally, high-temperature superconducting motors are used in various industries, including motors, maglev trains, nuclear fusion reactors, and particle accelerators. The market is driven by the need for power efficiency and the potential for significant energy savings. Metal alloys, such as niobium-titanium, are commonly used in the production of high-temperature superconducting wires. The market is also expanding into new sectors, including medicine, research, defense, and automotive, as superconducting technology continues to advance. Overall, the high-temperature superconducting wires market is poised for continued growth as the energy sector and other industries seek to improve power efficiency and reduce energy losses.

How is this High Temperature Superconducting Wires Industry segmented and which is the largest segment?

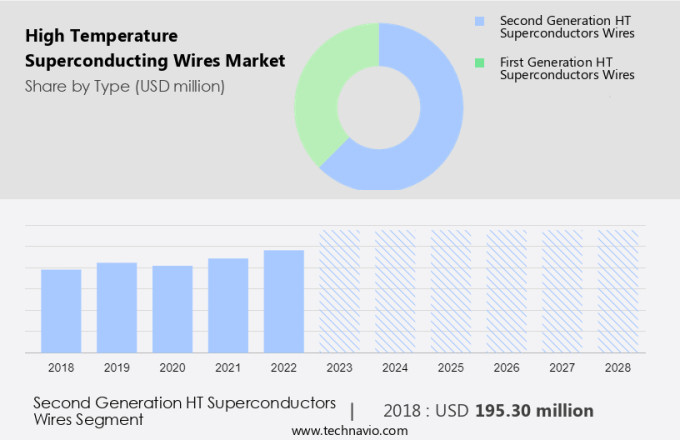

The high temperature superconducting wires industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Second generation HT superconductors wires

- First generation HT superconductors wires

- Application

- Healthcare

- Electronics

- R and D

- Others

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Type Insights

- The second generation HT superconductors wires segment is estimated to witness significant growth during the forecast period.

Second-generation high temperature superconducting wires, with dimensions of approximately 10 mm in width and 100 mm in thickness, are coated with superconductor materials. These wires allow for an intermediate phase where magnetic fields can penetrate as vortexes, enabling operation in higher fields. The energy-efficient and high-power-density electricity delivery facilitated by these wires supports the expansion of clean energy generation, transmission, storage, and conversion. Advancements in manufacturing technology have increased the appeal of second-generation high temperature superconducting wires within the power transmission industry, contributing to the growth of the market in the renewable energy sector, particularly in wind energy farms.

The capacity addition in onshore wind energy relies on the enhanced conductivity and load capacities offered by these wires for transmission lines. Cryogens are utilized to cool the wires to the required low temperatures for superconductivity.

Get a glance at the High Temperature Superconducting Wires Industry report of share of various segments Request Free Sample

The Second generation HT superconductors wires segment was valued at USD 195.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

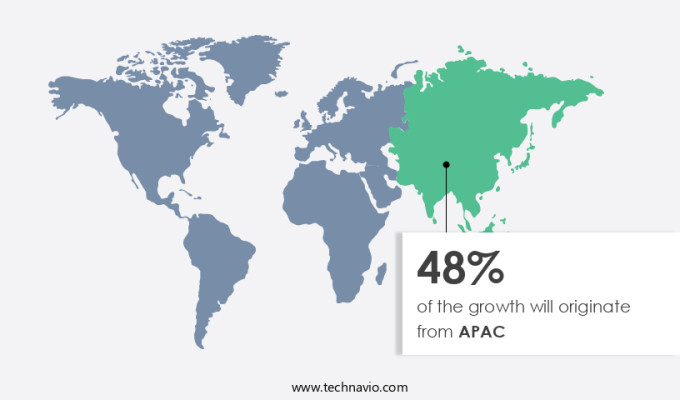

- APAC is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is experiencing significant growth due to increasing investments in renewable energy infrastructure. Governments in the region are prioritizing the development of high-voltage power grids, with notable projects. The energy sector's shift towards cleaner and more efficient energy sources is driving the demand for high temperature superconducting wires, which offer increased power efficiency compared to traditional cooling methods such as cryogenic systems using helium or nitrogen cooling. The market's growth is further boosted by applications in the medicine, research, and defense sectors, where low-temperature superconducting technology provides advantages in terms of energy savings and improved performance.

Market Dynamics

Our high temperature superconducting wires market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of High Temperature Superconducting Wires Industry?

Increased adoption of high temperature superconducting wires in medical applications is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for high-performance magnetic devices, particularly in the medical sector. Superconducting magnets are essential components of medical equipment such as MRI scanners, CT scans, magnetic resonance spectrometers, and particle beam therapy systems, which require high magnetic fields for precise imaging and diagnosis. To meet the demands of these industries, manufacturers are investing in the development of advanced superconducting wires using high-temperature superconductors like Niobium-Titanium. These wires offer improved conductivity, higher load capacities, and lower energy consumption compared to conventional wires. The power transmission and distribution sectors are also exploring the use of high-temperature superconducting cables for power efficiency and energy savings.

- Superconducting cables can transmit power with minimal energy loss, making them an attractive alternative to conventional cables for power transmission infrastructures. The utility segment, renewable industry, and wind energy farms are potential markets for high-temperature superconducting cables, with onshore wind capacity expected to reach new heights. Superconducting technologies are also gaining traction in other industries such as transportation, where they are used in MagLev trains, and nuclear fusion reactors, particle accelerators, and other advanced applications. The cost-efficiency and economies of scale of high-temperature superconducting wires are driving their adoption in various sectors. However, the lack of expertise in manufacturing and handling these wires presents a challenge for widespread adoption.

What are the market trends shaping the High Temperature Superconducting Wires Industry?

The growing adoption of renewable energy is the upcoming trend in the market.

- The High-temperature superconducting wires market is witnessing significant growth due to the increasing adoption of high-temperature superconducting cables for power transmission and distribution. High-temperature superconducting cables offer enhanced conductivity, which results in increased load capacities and improved power efficiency. These cables can operate at temperatures above the boiling point of liquid nitrogen, making them suitable for various applications such as motors, generators, and transmission lines. The utility segment and the renewable industry, particularly wind energy farms, are major contributors to the market's growth. Capacity addition in onshore and offshore wind farms is driving the demand for high-temperature superconducting cables to transmit power efficiently.

- The consortiums involved in the development of transmission lines for these projects are investing in superconducting technologies to reduce energy losses and improve cost efficiency. Superconducting technologies are also being explored for applications in nuclear fusion reactors, MagLev trains, particle accelerators, and other industries such as transportation, electric vehicles, and magnetic levitation. The use of superconducting wires in MRI scanners, CT scans, magnetic resonance spectrometers, and particle beam therapy in the medical sector is also increasing. The market's growth is influenced by the energy sector's shift towards renewable energy sources, urbanization, and the development of smart cities. The manufacturing cost of high-temperature superconducting wires is expected to decrease due to economies of scale and advancements in metal alloys like Niobium-Titanium.

What challenges does High Temperature Superconducting Wires Industry face during its growth?

The high cost of high temperature superconducting wires is a key challenge affecting the industry growth.

- High temperature superconducting wires have gained significant attention in various industries due to their ability to transmit large currents with minimal energy loss. These wires are primarily used in high-performance applications such as power transmission, motors, and generators in the utility segment and the renewable industry, particularly in wind energy farms. The use of high temperature superconducting cables in onshore and offshore wind capacity addition can increase conductivity, load capacities, and power efficiency. The development of warm and cryogenic dielectric cables has further expanded the applications of high temperature superconducting wires. These cables can operate at temperatures above the boiling point of liquid nitrogen, eliminating the need for extensive cryogenic systems.

- However, the high cost of high temperature superconducting wires, which is primarily due to the use of expensive metal alloys such as Niobium-Titanium, has been a significant barrier to their widespread adoption. Despite the high cost, the potential cost-efficiency and economies of scale of high temperature superconducting wires make them an attractive option for power transmission infrastructures. Superconducting technologies are also being explored in various sectors, including nuclear fusion reactors, particle accelerators, and MagLev trains. In addition, high temperature superconducting wires have potential applications in medical diagnostics, transportation, electric vehicles, and magnetic levitation systems. The development of high temperature superconducting wires is a complex process that requires a high level of expertise.

Exclusive Customer Landscape

The high temperature superconducting wires market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry. The high temperature superconducting wires industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Superconductor Corp.

- Bruker Corp.

- Fujikura Ltd.

- Furukawa Electric Co. Ltd.

- High Temperature Superconductors Inc.

- Hitachi Ltd.

- Innova Superconductor Technology Co. Ltd.

- Japan Superconductor Technology Inc.

- MetOx Technologies Inc.

- Southwire Co. LLC

- Sumitomo Electric Industries Ltd.

- SuNam Co. Ltd.

- Supercon Inc.

- THEVA Dunnschichttechnik GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

High-temperature superconducting wires have emerged as a significant advancement in the realm of electrical conductivity, offering enhanced power transmission capabilities compared to conventional wires. These innovative cables, which can conduct electricity with minimal resistance even at relatively high temperatures, have a wide range of applications in various sectors. Power transmission is one of the primary areas where high-temperature superconducting cables have gained considerable attention. The High Temperature Superconducting Wires Market is experiencing significant growth due to advancements in the medicine sector, research sector, and defense sector, with applications spanning from automotive sector and distribution cables to cryogenic and warm dielectric cable. The utility segment and renewable energy industries, in particular, stand to benefit from these advanced cables. In power transmission, high-temperature superconducting cables can increase the capacity of existing power lines, reduce energy losses, and improve overall power efficiency.

Furthermore, high-temperature superconducting cables can be categorized into different types based on the dielectric medium used, such as warm dielectric cables and cryogenic dielectric cables. Warm dielectric cables operate at temperatures slightly above room temperature, while cryogenic dielectric cables require cooling, typically with liquid nitrogen. Both types offer distinct advantages, including increased current carrying capacity and improved power efficiency. Motors and generators are other essential applications for high-temperature superconducting wires. These components can benefit from the increased efficiency and reduced energy losses associated with superconducting technologies. In the context of motors, high-temperature superconducting wires can lead to more powerful and energy-efficient electric motors, which can be employed in various industries, including transportation and manufacturing.

|

High Temperature Superconducting Wires Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.09% |

|

Market Growth 2024-2028 |

USD 307.8 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

8.92 |

|

Key countries |

US, China, Japan, Germany, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the High Temperature Superconducting Wires industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch