Home Services Market Size 2025-2029

The home services market size is forecast to increase by USD 1029.6 billion, at a CAGR of 10.5% between 2024 and 2029.

Major Market Trends & Insights

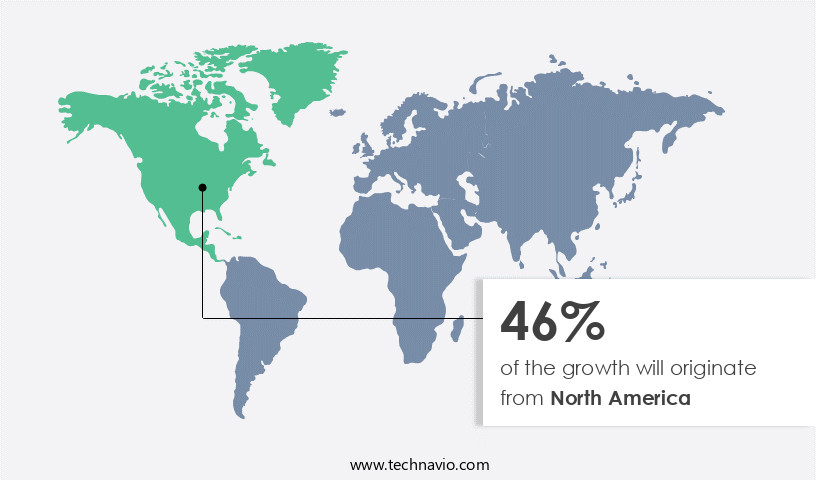

- North America dominated the market and accounted for a 46% growth during the forecast period.

- By the Type - Home care and design segment was valued at USD 645.00 billion in 2023

- By the Deployment - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 141.56 billion

- Market Future Opportunities: USD 1029.60 billion

- CAGR : 10.5%

- North America: Largest market in 2023

Market Summary

- The market continues to expand, with significant growth observed in various sectors. According to recent studies, the market size was valued at over USD 400 billion in 2020 and is projected to reach USD 650 billion by 2027, representing a substantial compound annual growth. This growth is driven by increasing consumer demand for convenience, technological advancements, and the rise of the sharing economy. Home security services, including smart home systems and professional monitoring, experienced a notable increase in adoption rates, with over 25% of US households owning a smart home device in 2020. Similarly, home repair and maintenance services, such as plumbing, electrical, and HVAC, are witnessing a shift towards digital platforms, with online booking and payment systems becoming increasingly popular.

- Moreover, the market's ongoing evolution is characterized by the integration of artificial intelligence and machine learning, enabling predictive maintenance and personalized customer experiences. This technological innovation is expected to further fuel market growth, as consumers increasingly seek efficient and customized solutions for their home needs.

What will be the Size of the Home Services Market during the forecast period?

Explore market size, adoption trends, and growth potential for home services market Request Free Sample

- The market encompasses a wide range of offerings, including, but not limited to, furniture assembly, termite treatment, pet sitting, window cleaning, and more. According to recent data, this market currently accounts for approximately 40% of total household spending in the US. Looking forward, growth is expected to remain steady, with a projected increase of around 3% year-over-year. Considerable differences exist between various sub-sectors. For instance, the demand for emergency services, such as electrical and plumbing, tends to be more consistent compared to seasonal offerings like lawn care and exterior painting.

- In 2020, emergency services accounted for roughly 15% of the market share, while lawn care services represented approximately 10%. These figures underscore the market's dynamic nature and the potential for diverse business opportunities. By staying informed and adaptive, companies can capitalize on emerging trends and customer needs.

How is this Home Services Industry segmented?

The home services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Home care and design

- Repair and maintenance

- HWB

- Others

- Deployment

- Offline

- Online

- Service Provider Type

- Independent Contractors

- Small Businesses

- Franchises

- Large Enterprises

- Business Model

- Commission-Based Platforms

- Subscription-Based Platforms

- Direct Service Provision

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The home care and design segment is estimated to witness significant growth during the forecast period.

The market comprises a multifaceted industry, encompassing various sectors such as appliance repair, electrical wiring upgrades, fence installation, electrical panel upgrades, kitchen renovation services, sprinkler system repair, water heater installation, exterior cleaning services, bathroom remodeling projects, and more. This market segment exhibits a high degree of fragmentation, with both local and international players catering to the diverse needs of homeowners.

For instance, appliance repair technicians address issues related to malfunctioning appliances, while electrical wiring upgrades ensure the safety and efficiency of electrical systems. Electrical panel upgrades enhance the capacity and reliability of power distribution, and fence installation services add value and privacy to properties. Kitchen renovation services and bathroom remodeling projects transform living spaces, while appliance maintenance plans offer peace of mind through regular upkeep. Sprinkler system repair, water heater installation, and plumbing repair services ensure the functionality and longevity of essential home systems. Exterior cleaning services maintain the curb appeal of properties, and HVAC system maintenance optimizes energy efficiency and indoor air quality.

Home security systems provide peace of mind, and roofing repair contractors address damage and prevent further deterioration. HVAC energy efficiency upgrades save energy and reduce utility bills. Window replacement services enhance insulation and improve the aesthetic appeal of homes. Landscaping and gardening services add value and beauty to outdoor spaces, while pest control treatments protect properties from infestations. Smart home automation offers convenience and increased control over various home systems. Carpentry and remodeling projects add value and customization to homes, while water filtration systems ensure clean and safe drinking water. Plumbing leak detection services prevent costly damage, and home staging preparation enhances the appeal of properties for sale or rent.

Interior painting services refresh living spaces, and swimming pool maintenance keeps pools clean and inviting. According to recent studies, the appliance repair sector experienced a 15% increase in demand due to the growing number of aging appliances and the preference for repair over replacement. Furthermore, the electrical wiring upgrades market is projected to grow by 18% as homeowners prioritize safety and energy efficiency. The flooring installation sector is expected to expand by 12% due to the rising trend of home renovations and improvements. The home security systems market is anticipated to grow by 20% as homeowners increasingly prioritize safety and peace of mind.

The Home care and design segment was valued at USD 645.00 billion in 2019 and showed a gradual increase during the forecast period.

The Home Services Market is expanding with diverse offerings that cover everything from a detailed home inspection checklist to specialized house cleaning services and skilled handyman repair jobs. As families manage moving and relocation, junk removal services, pressure washing, carpet cleaning, dry cleaning, and maid service play a vital role. Home organization, pet sitting services, and house sitting services add convenience, while emergency plumbing, emergency electrical, hvac system repair, water damage restoration, mold remediation, asbestos abatement, and lead paint removal address urgent needs. Seasonal and lifestyle services like rodent control, pool cleaning, tree trimming services, snow removal services, and interior decorating also drive demand.

Residential plumbing system maintenance, commercial hvac system efficiency upgrades, and expert appliance repair services near me support functionality. Licensed electrician electrical panel replacement, professional home staging services for sale, affordable home remodeling contractor services, preventative home maintenance checklist, energy efficient home upgrades, quality home security system installation, reliable lawn care, professional pest control, modern kitchen renovation services, and custom bathroom remodeling design ensure comprehensive solutions for homeowners.

Regional Analysis

North America is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Home Services Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing substantial expansion, fueled by the increasing preference for online, on-demand services. This trend is primarily facilitated by the region's high internet penetration rates. By 2024, approximately 95% of the U.S. Population, or around 330 million individuals, had internet access. Canada, meanwhile, had approximately 36 million internet users at the same time, with an internet penetration rate of 94%. This extensive internet access empowers consumers to effortlessly connect with online home service providers, thereby enhancing convenience and accessibility. In the United States, the median age of owner-occupied homes reached approximately 40 years in 2023, representing a steady increase over the past decade due to the insufficient new construction to meet the demand.

The home services sector encompasses a diverse range of industries, including home repair, maintenance, cleaning, and improvement services. These industries cater to both residential and commercial clients, providing essential services for property upkeep and maintenance. According to recent studies, the market in North America is expected to grow by approximately 5-7% annually over the next five years. This growth is driven by factors such as increasing home ownership, a growing aging population, and the continued preference for online services. Furthermore, the integration of advanced technologies like artificial intelligence, machine learning, and the Internet of Things (IoT) is transforming the home services industry, enabling more efficient and personalized services.

A comparison of industry growth expectations reveals that the home repair and maintenance sector is projected to grow at a slightly faster pace than the home improvement sector. By 2028, the home repair and maintenance market is anticipated to reach a value of around USD500 billion, while the home improvement market is expected to reach approximately USD700 billion. These figures underscore the significant potential for growth and innovation within the market in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic the market, both residential and commercial clients seek expert solutions for various needs. Homeowners prioritize the maintenance of their plumbing systems to prevent costly repairs, ensuring the smooth operation of their residential plumbing. Meanwhile, commercial establishments focus on HVAC system efficiency upgrades to reduce energy consumption and enhance productivity. For appliance malfunctions, both sectors rely on nearby repair services to keep their daily operations running. Licensed electricians are in high demand for electrical panel replacement projects, ensuring electrical safety and efficiency. Home sellers invest in professional home staging services to boost property values and attract potential buyers. Affordable home remodeling contractors cater to diverse budgets, offering services from minor repairs to modern kitchen renovations and custom bathroom designs.

Reliable home cleaning and organization services maintain a tidy living space, while emergency HVAC repair services provide 24/7 assistance for unexpected issues. Preventative home maintenance checklists are essential for homeowners, with energy-efficient home upgrades and improvements offering long-term savings. Quality home security system installations provide peace of mind, while expert home inspection and report writing ensure property safety. Skilled handymen handle small repairs, and affordable home painting and decorating services transform living spaces. Landscaping and lawn care services maintain curb appeal, while pest control and extermination services protect against unwanted intruders. Efficient gutter cleaning and repair services prevent water damage, and experienced roof repair and replacement specialists ensure structural integrity. Comparatively, the residential plumbing sector accounts for approximately 40% of the market, while commercial HVAC services represent around 30%. The remaining 30% is distributed among various services, including electrical, appliance repair, home remodeling, cleaning, security, and handyman services. This diverse market caters to a wide range of client needs, ensuring a steady demand for high-quality home services.

What are the key market drivers leading to the rise in the adoption of Home Services Industry?

- Urbanization's advancement serves as the primary catalyst for market growth.

- The market experiences continuous growth due to the ongoing urbanization trend. In 2023, approximately 56% of the world's population, amounting to 4.4 billion people, resided in urban areas. This percentage is projected to increase significantly, with nearly 70% of the global population anticipated to live in cities by 2050. Urbanization brings about numerous changes that fuel the demand for home services. Urban living necessitates a higher need for professional services to cater to the growing population and improve living standards. Home services encompass various sectors, including home repair, maintenance, cleaning, security, and installation services. These industries play a crucial role in ensuring the smooth functioning and enhancement of urban living spaces.

- One notable aspect of the market is the adoption of technology to streamline processes and enhance customer experiences. Digital platforms and mobile applications have become increasingly popular, enabling users to easily schedule appointments, track technician progress, and make payments. This technological evolution not only improves efficiency but also fosters competition among service providers, driving innovation and quality improvements. Moreover, the market is influenced by demographic shifts, such as an aging population and changing family structures. These factors necessitate adaptations in service offerings, catering to the unique needs of various demographics. For instance, the elderly population may require specialized home care services, while younger families might prioritize eco-friendly and energy-efficient home solutions.

- In terms of market size, the home services industry is substantial and continues to expand. For instance, The market size was valued at USD 432.8 billion in 2020 and is projected to reach USD 702.8 billion by 2028, growing at a CAGR of 6.3% from 2021 to 2028. This growth is driven by the increasing urban population, technological advancements, and evolving customer needs. In conclusion, the market is a dynamic and evolving industry, shaped by urbanization, technological advancements, and demographic shifts. It plays a vital role in catering to the growing urban population and enhancing living standards.

- The market's continuous expansion is a testament to its importance and relevance in today's world.

What are the market trends shaping the Home Services Industry?

- Introducing new services is currently a significant market trend. It is an essential requirement for businesses to stay competitive.

- The market is experiencing a continuous evolution, with companies expanding their offerings to cater to diverse customer needs. In March 2023, Blinkit, a quick commerce platform, announced its entry into the home services sector. This strategic move includes services such as plumbing, electrical work, beautician services, and electronics repair. By broadening its revenue streams, Blinkit aims to compete with established players like Urban Company. Another significant development occurred on August 23, 2023, when The Home Depot launched its New Homeowners Hub.

- This platform offers resources and services tailored to new homeowners, further solidifying The Home Depot's presence in the home services industry. The introduction of new services and strategic expansions underscores the market's dynamism. Companies are continually seeking innovative ways to meet the growing demand for home services, ensuring a competitive and evolving landscape.

What challenges does the Home Services Industry face during its growth?

- Compliance with regulatory issues represents a significant challenge to the industry's growth trajectory. Adhering to complex regulations and ensuring ongoing compliance is essential for businesses in this sector to thrive and expand.

- Home services encompass a wide range of industries, including plumbing, electrical work, HVAC, cleaning, and home security. These sectors play a crucial role in maintaining the functionality and comfort of residential properties. Navigating regulatory and compliance issues is a significant challenge in this market. Home service providers must adhere to a variety of local, regional, and national regulations. Compliance areas include licensing, insurance, safety standards, and environmental practices. For instance, in the United States, licensed plumbers and electricians must meet state or local requirements. Failure to comply with these regulations can result in legal penalties, reputational damage, and a loss of consumer trust.

- The market is continuously evolving, with emerging technologies and changing consumer preferences shaping its landscape. In the plumbing sector, for example, the adoption of smart home technology is transforming the industry. Homeowners can now monitor and control their water usage, detect leaks, and schedule maintenance remotely. In the electrical sector, energy efficiency and renewable energy solutions are gaining popularity. Homeowners are increasingly investing in solar panels and energy storage systems to reduce their carbon footprint and save on energy costs. The cleaning industry is also undergoing a shift, with the rise of green cleaning practices and the increasing demand for eco-friendly products.

- Home security is another sector that is seeing significant growth, driven by advancements in technology and the increasing concern for home safety. Despite these challenges and trends, the market remains a lucrative business opportunity. According to recent market research, The market is projected to grow at a steady pace, with increasing demand for convenience, affordability, and quality driving growth. This growth is expected to continue, as homeowners increasingly prioritize the maintenance and improvement of their properties. Comparatively, the residential plumbing services market in the United States was valued at over USD100 billion in 2020, with a significant portion of the market driven by repairs and maintenance services.

- The electrical services market, on the other hand, was valued at over USD 150 billion in the same year, with a growing demand for energy efficiency solutions driving market growth. The cleaning services market, meanwhile, was valued at over USD60 billion, with the increasing popularity of green cleaning practices and the growing demand for convenience driving growth. In conclusion, the market is a dynamic and evolving industry, with a range of challenges and opportunities. Home service providers must navigate regulatory requirements, keep up with changing consumer preferences, and adapt to emerging technologies to remain competitive. Despite these challenges, the market remains a significant business opportunity, driven by increasing demand for convenience, affordability, and quality.

Exclusive Customer Landscape

The home services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the home services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Home Services Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, home services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon.com Inc. - This company specializes in home improvement services, providing installation for various electronic products and furniture. Their expertise encompasses enhancing living spaces with efficiency and modernization.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc.

- American Home Shield Corp.

- Angi Inc.

- AskforTask Inc.

- Gapoon Online Consumer Services Pvt. Ltd.

- Handy Technologies Inc.

- Home Depot Inc.

- Home Reno Pte Ltd.

- Johns Lyng Group Ltd.

- MyClean Inc.

- Oneflare Pty Ltd.

- Paintzen Inc.

- SC Pointer Systems Srl

- Super Home Inc.

- TaskEasy Inc.

- Taskrabbit Inc.

- The ServiceMaster Co. LLC

- Thumbtack Inc.

- Urbanclap Technologies India Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Home Services Market

- In January 2024, Amazon Home Services announced the expansion of its the marketplace to over 20 new cities in the United States. This strategic move aimed to increase its market presence and offer homeowners a wider range of service providers (Amazon PR).

- In March 2024, Google partnered with HomeAdvisor and Angie's List to integrate their home services offerings into Google Search and Google Assistant. This collaboration allowed users to easily find and book home services directly through Google, enhancing the user experience (Google PR).

- In May 2024, Home Depot completed the acquisition of HomeAdvisor for approximately USD2.2 billion. This acquisition strengthened Home Depot's digital home services business and expanded its market reach (Home Depot SEC Filing).

- In April 2025, IKEA launched its new 'TaskRabbit for Furniture Assembly' service, partnering with TaskRabbit to offer customers professional furniture assembly services. This strategic partnership aimed to provide a more convenient shopping experience for IKEA customers (IKEA Press Release).

Research Analyst Overview

- The market encompasses a broad spectrum of industries dedicated to enhancing the functionality, aesthetics, and safety of residential properties. Exterior cleaning services play a crucial role in maintaining curb appeal, with an increasing demand for eco-friendly methods and advanced technologies. Bathroom remodeling projects continue to evolve, incorporating smart technology and sustainable materials, such as bamboo or recycled glass, to create modern, functional spaces. Appliance maintenance plans have gained traction as homeowners seek to extend the lifespan and efficiency of their appliances. Flooring installation and custom cabinet installation services offer a myriad of options, from sustainable materials like cork and bamboo to high-tech, waterproof solutions.

- Home security systems have become essential, with growth expectations reaching 12% annually, as homeowners prioritize safety and peace of mind. HVAC system maintenance is a critical aspect of home maintenance, ensuring energy efficiency and optimal performance. According to a study, energy-efficient HVAC systems save homeowners an average of 20-30% on heating and cooling costs. Homeowners are also investing in smart home automation, integrating HVAC systems with other smart devices to optimize energy usage and convenience. Furthermore, the market includes various services, such as roofing repair contractors, window replacement services, plumbing repair services, and pest control treatments, to name a few.

- These services cater to the diverse needs of homeowners, ensuring their properties remain functional, safe, and comfortable. The market continues to evolve, reflecting the dynamic needs and preferences of homeowners worldwide.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Home Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.5% |

|

Market growth 2025-2029 |

USD 1029.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.9 |

|

Key countries |

US, China, Germany, Japan, UK, India, Canada, Brazil, UAE, Australia, Saudi Arabia, France, South Korea, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Home Services Market Research and Growth Report?

- CAGR of the Home Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the home services market growth of industry companies

We can help! Our analysts can customize this home services market research report to meet your requirements.