Hybrid PC Market Size 2025-2029

The hybrid PC market size is forecast to increase by USD 46.14 billion, at a CAGR of 16.3% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends and factors. The increasing adoption of remote work and e-learning are driving the demand for hybrid PCs, which offer the benefits of both laptops and desktops. Additionally, the introduction of new hybrid PC products is expanding the market's offerings and catering to various consumer needs. Hybrid PCs offer a range of accessories, design innovations, and performance enhancements, including laptop software recommendations, repair services, and laptop performance comparison tools. However, the high cost of hybrid PCs remains a challenge for some consumers, limiting the market's growth potential. Despite this, the future looks promising for the market as it continues to innovate and address the evolving needs of consumers and businesses.

What will be the Size of the Hybrid PC Market During the Forecast Period?

- The market represents a dynamic and evolving segment of business technology, characterized by the convergence of powerful laptops and affordable, budget devices. This market caters to various user needs, from productivity tools for digital transformation to gaming and entertainment. Hybrid learning and remote work have accelerated market growth, as online courses and interactive content become increasingly popular.

- The future of work and education is embracing mobile computing, with lightweight and portable devices offering user experience enhancements and functionality improvements. Laptop security features, warranty options, and upgrade possibilities further add value to this market. With the adoption of smart technology and the future of education, the market continues to expand, offering a diverse range of devices to meet the demands of consumers and businesses alike.

How is this Hybrid PC Industry segmented and which is the largest segment?

The hybrid PC industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Convertible

- Detachable

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- North America

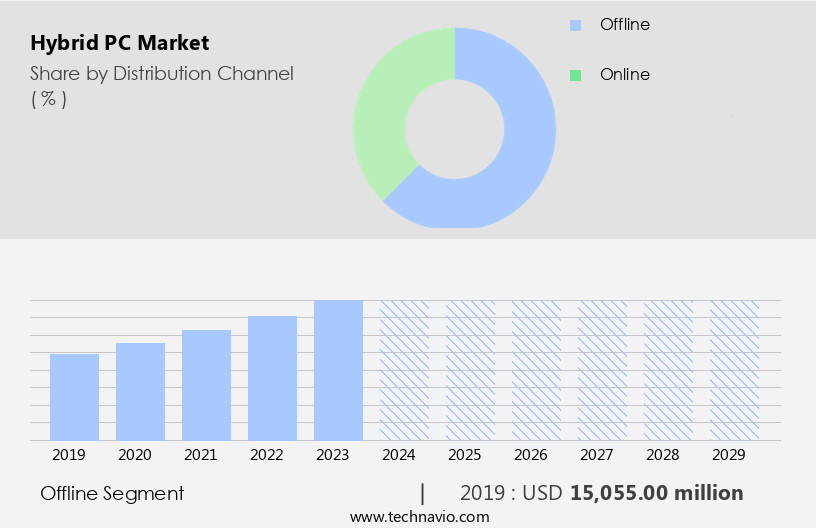

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

The market is characterized by the growing demand for high-performance computing devices that offer the versatility of tablets and the functionality of desktop computers. Digitalization and the need for productivity tools have driven this trend, with businesses and learners increasingly relying on hybrid devices for remote work, professional work, and digital learning environments. Hybrid devices, such as convertible laptops and rollable displays, offer advanced features like multimedia content creation, streaming, and document editing, making them ideal for various industries, including automotive and educational institutions.

Established brands dominate the market, providing consumers with a range of pricing options through bundling deals, promotional offers, and customized learning solutions. The market is further fueled by technological advancements, such as artificial intelligence and high-speed internet, which enable learning experiences and mobility. Offline distribution channels, including physical retail stores, remain essential, allowing customers to evaluate key features before purchasing.

Get a glance at the Hybrid PC Industry report of share of various segments Request Free Sample

The offline segment was valued at USD 15.06 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is witnessing significant growth due to various factors. The increase in disposable personal income, up by 8.1% in 2023, has enabled consumers to invest in advanced technology, including hybrid PCs. This financial flexibility, coupled with the trend of remote work, has led to a rise in demand. Approximately 27% of the US workforce worked remotely part-time as of August and September 2022 (BLS). Hybrid PCs offer the benefits of both laptops and tablets, making them versatile computing solutions for professionals and students. These devices cater to various industries, including automotive, education, and businesses, providing productivity tools and customized learning environments. With promotional offers, bundling deals, and price flexibility, hybrid devices have become an attractive option for price-sensitive consumers. The integration of artificial intelligence and learning platforms enhances the user experience, making hybrid PCs an essential tool for digital classrooms and remote work environments.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of the Hybrid PC Industry?

Increasing adoption of remote work and e-learning is the key driver of the market.

- The market is experiencing significant growth due to the digitalization of various industries and the increasing need for portable, high-performance devices. The shift towards remote work has led businesses to embrace hybrid devices, which offer versatility and flexibility for professional tasks. According to recent statistics, approximately 30% of the global workforce, equating to around 600 million people, now work remotely. This trend is expected to continue, as businesses recognize the benefits of remote work for both productivity and cost savings. Simultaneously, the education sector has undergone a digital transformation, with the adoption of e-learning platforms and online learning environments.

- Hybrid devices, with their advanced features and multimedia capabilities, are ideal for learners and students who require digital tools for content creation, document editing, and multimedia-rich learning materials. Moreover, the availability of special deals, promotional offers, and bundling deals on hybrid devices has made them an attractive option for price-sensitive consumers. The technological advancements in hybrid devices, such as long battery life, fuel efficiency, and high-speed internet compatibility, further enhance their appeal. Hybrid devices offer a range of operating systems, including Windows and macOS, catering to different user preferences. They also support rollable displays, AI, and high-definition OLED screens, making them suitable for multimedia content creation, streaming, and online gaming.

What are the market trends shaping the Hybrid PC Industry?

The introduction of new products is the upcoming market trend.

- The market is experiencing substantial growth due to the digitalization of businesses and the increasing demand for high-performance devices. At CES 2024, Lenovo unveiled the ThinkBook Plus Gen 5 Hybrid, a laptop-tablet combination catering to small and medium-sized businesses (SMBs). This versatile device offers the benefits of both Windows and Android, enabling users to work efficiently in various professional environments. Simultaneously, HP Inc. Showcased next-generation AI-powered solutions at HP Imagine, enhancing productivity and flexibility for businesses. The technological advancements in hybrid devices, such as convertible laptops and rollable displays, fuel the market's growth. Pricing flexibility, portability, and advanced features, including multimedia content creation, document editing, and streaming, are essential factors driving the adoption of hybrid devices.

- Moreover, the integration of digital platforms and e-learning platforms in educational institutions and the bring-your-own-device trend further boosts the market. Hybrid devices offer customized learning experiences, content, and mobility, making them an essential tool for students and professionals alike. Promotional offers, bundling deals, and special deals on hybrid devices from established brands attract price-sensitive consumers. The digital revolution, high-speed internet, and increasing internet penetration further fuel the market's growth. Hybrid devices cater to diverse professional needs, from remote work and professional work to multimedia-rich content creation and development.

What challenges does the Hybrid PC Industry face during its growth?

The high cost of hybrid PCs is a key challenge affecting the industry growth.

- Hybrid PCs, which offer the benefits of high-performance computing and tablet portability, continue to gain traction In the digitalization of businesses and learning environments. These versatile devices cater to the needs of professionals and learners alike, providing advanced features such as multimedia content creation, document editing, and customized learning experiences. However, the premium pricing of hybrid devices, driven by their high-end hardware components like powerful processors, touchscreens, and detachable or convertible keyboards, remains a significant challenge for price-sensitive consumers. For instance, the Microsoft Surface Pro 9 and HP Spectre x360 14, known for their advanced capabilities, start at approximately USD 999 and USD 1,149, respectively.

- Special deals, promotional offers, and bundling packages can help mitigate the cost for businesses and individuals. Technological advancements, including fuel efficiency, long battery life, and AI integration, further add value to these devices. Established brands continue to innovate, offering convertible hybrid devices, rollable displays, and different operating systems, such as Windows, macOS, and AMD-powered options. Digital platforms, e-learning platforms, and online gaming have become increasingly popular, making hybrid devices an essential tool for productivity, remote work, and digital learning.

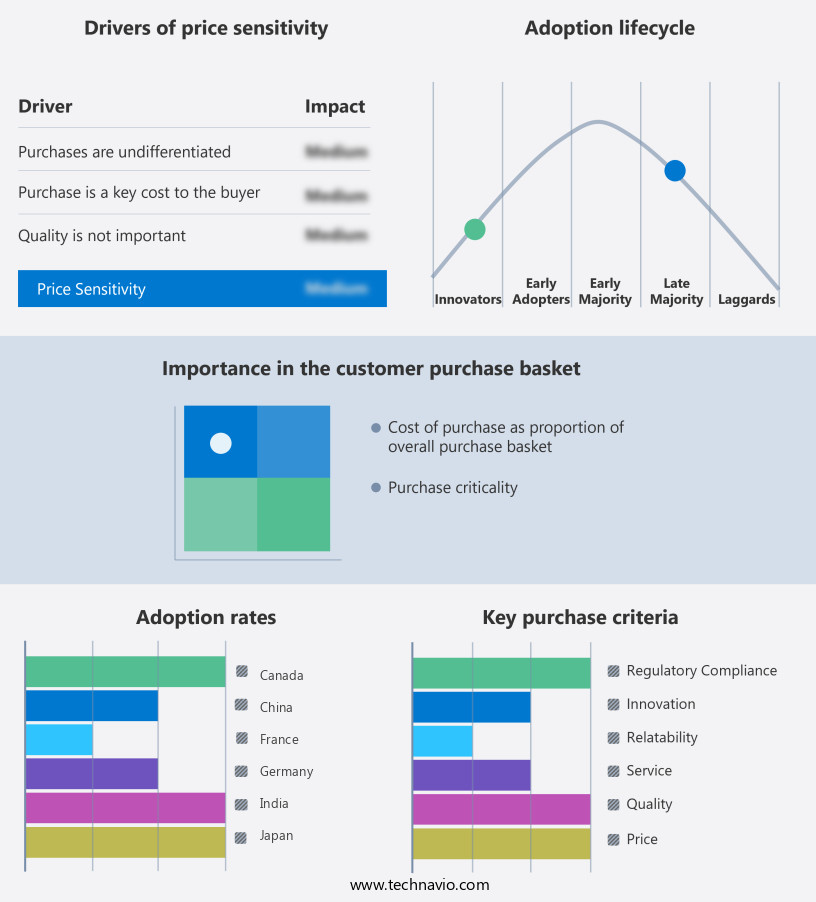

Exclusive Customer Landscape

The hybrid pc market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hybrid pc market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hybrid PC market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Acer Inc. - The company offers hybrid PC such as Spin 5 SP514-51N-78QD 2 in 1 Notebook and others.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc.

- ASUSTeK Computer Inc.

- AVITA Technologies International Co. Ltd.

- Dell Technologies Inc.

- Fujitsu Ltd.

- Google LLC

- HP Inc.

- Huawei Technologies Co. Ltd.

- Lenovo Group Ltd.

- LG Corp.

- Micro Star International Co. Ltd.

- Microsoft Corp.

- Samsung Electronics Co. Ltd.

- Smartron India Pvt. Ltd.

- Sony Group Corp.

- Toshiba Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The digitalization of various sectors has led to an increasing demand for high-performance Personal Computing Devices (PCDs) that cater to the needs of businesses and learners alike. These devices, often referred to as hybrid PCDs, offer the versatility of tablets and the power of desktop computers. Digital tools have become essential in today's professional work environments. Customer reviews suggest that hybrid PCDs provide an optimal balance between portability and performance. They are ideal for digital learning environments, enabling students to access multimedia-rich content and engage in learning experiences. Hybrid devices offer promotional deals and bundling options, making them attractive to price-sensitive consumers.

Further, businesses can benefit from these devices by enabling remote work and improving productivity. The integration of advanced features, such as artificial intelligence and high-speed internet, further enhances their utility. The automotive industry is one of the sectors that have embraced the use of hybrid PCDs. These devices offer fuel efficiency and extended battery life, making them an excellent choice for company leaders on the go. Established brands In the consumer electronics industry continue to innovate, with technological advancements leading to the development of convertible hybrid devices and rollable displays. The digital transformation has led to the proliferation of digital platforms for content creation and document editing.

In addition, hybrid PCDs offer pricing flexibility, allowing businesses and learners to choose the best solution for their needs. The use of hybrid PCDs in educational institutions has led to customized learning experiences, contributing to the digital revolution. The digital world offers a multitude of opportunities for content creation and streaming. Hybrid PCDs provide versatile computing solutions, enabling users to create and edit multimedia content with ease. Product inspection and development processes have also benefited from the use of these devices. The use of hybrid PCDs is not limited to businesses and educational institutions. They are also popular among professionals in various industries, offering mobility and advanced features for professional work.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.3% |

|

Market Growth 2025-2029 |

USD 46.14 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.9 |

|

Key countries |

US, China, Germany, UK, Taiwan, India, Canada, France, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hybrid PC Market Research and Growth Report?

- CAGR of the Hybrid PC industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hybrid pc market growth of industry companies

We can help! Our analysts can customize this hybrid pc market research report to meet your requirements.