Hydrogen Electrolyzers Market Size 2024-2028

The hydrogen electrolyzers market size is forecast to increase by USD 94.9 billion at a CAGR of 5.65% between 2023 and 2028. The hydrogen economy is gaining momentum as a sustainable fuel solution, with hydrogen electrolyzers playing a crucial role in its production. Renewable electricity sources are increasingly being integrated with hydrogen electrolyzers to generate carbon-free hydrogen, aligning with the global shift towards clean energy. Strategic partnerships among key players are strengthening the supply chain resilience in the hydrogen market. However, competition from alternate hydrogen production technologies poses a challenge to the growth of the market. In the US, the focus on sustainable fuel solutions and the growing demand for fuel cell vehicles are driving the adoption of hydrogen electrolyzers. Key players in the market are investing in advanced electrolyzer technology to improve efficiency and reduce costs. Additionally, the production of green ammonia through hydrogen electrolysis is gaining traction as a sustainable alternative to traditional ammonia production methods. Overall, the market is expected to experience steady growth due to these market trends and challenges.

The market is witnessing significant growth due to the increasing demand for carbon-free hydrogen. Electrolysis, a process that uses an electric current to split water molecules into hydrogen and oxygen, is at the heart of this trend. Renewable sources, such as wind and solar energy, are increasingly being used to power electrolysis, making hydrogen an attractive alternative to traditional fossil fuels. This shift towards renewable energy sources is a key factor driving the market growth. At the core of an electrolyzer are the anode and cathode, which facilitate the electrochemical reaction that produces hydrogen.

Moreover, the membrane, a critical component, separates the hydrogen and oxygen gases. The resulting hydrogen is a sustainable fuel, with potential applications in various industries, including transportation, industrial operations, power generation, and energy storage. Carbon emissions, a major concern for the environment, can be significantly reduced by using hydrogen as an energy carrier. In the production of ammonia, for instance, traditional methods using fossil fuels can be replaced with carbon-free hydrogen produced through electrolysis. Fertiglobe, a leading nitrogen fertilizer producer, is one such company exploring this avenue. Green ammonia, produced using renewable hydrogen, is gaining popularity due to its carbon-neutral nature.

Similarly, the market is expected to grow as more industries adopt this sustainable fuel. Electrolyzer technology continues to evolve, with advancements in materials science and engineering leading to more efficient and cost-effective systems. High-quality hydrogen, produced through these advanced electrolyzer systems, is essential for various applications, including fuel cells and industrial processes. The market is poised for growth, driven by the increasing demand for sustainable energy solutions. As the world transitions away from fossil fuels, hydrogen, produced through electrolysis, is set to play a crucial role in this transformation.

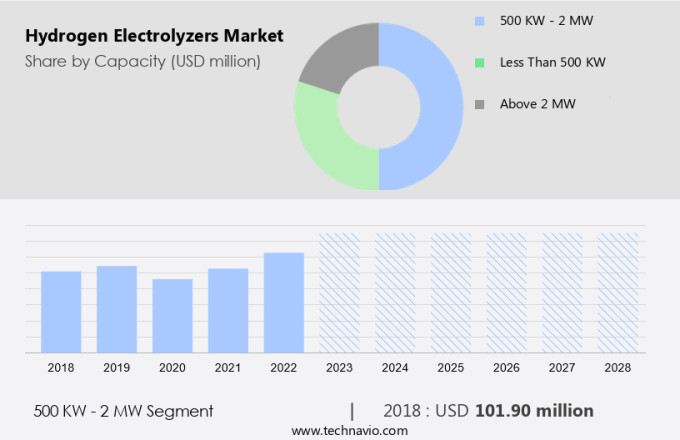

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Capacity

- 500 kW - 2 MW

- Less than 500 kW

- Above 2 MW

- Type

- Alkaline electrolyzers

- PEM electrolyzers

- Geography

- North America

- Canada

- US

- Europe

- Germany

- Sweden

- APAC

- Japan

- Middle East and Africa

- South America

- North America

By Capacity Insights

The 500 kw - 2 mw segment is estimated to witness significant growth during the forecast period. Medium-sized hydrogen electrolyzers, with a capacity ranging from 500 kW to 2 MW, are experiencing significant demand due to their versatility and efficiency. These electrolyzers are frequently installed on-site, enabling businesses to generate both electricity and hydrogen directly at their facilities. The hydrogen produced can serve as a valuable industrial energy source or be used as feedstock for various applications, making it an essential resource. One of the primary benefits of these electrolyzers is their ability to reduce greenhouse gas emissions, aligning with global sustainability objectives. Consequently, numerous businesses are integrating these medium-sized electrolyzers into their operations to boost productivity while contributing to environmental preservation.

As a result, the 500kW - 2MW segment is projected to experience growth during the forecast period. Hydrogen production through electrolysis is increasingly becoming a crucial component of renewable energy strategies as businesses seek to mitigate the variability of solar and wind energy. The transition towards net zero emissions is driving the demand for hydrogen as a clean energy alternative, particularly in the transportation sector. The electrolyzer market is poised for expansion as more industries adopt hydrogen as a sustainable energy solution.

Get a glance at the market share of various segments Request Free Sample

The 500 kW - 2 MW segment was valued at USD 101.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is primarily driven by the United States and Canada due to their significant investments in renewable energy and industrial hydrogen production. The US, in particular, is a major player in the transportation sector with a focus on fuel-cell electric vehicles (FCEVs), fuel-cell electric buses, and material-handling vehicles. The country's commitment to decarbonization and grid balancing is further boosted by the use of hydrogen electrolyzers for energy efficiency. The US government's initiatives and incentives are crucial factors fueling the market's growth. Green hydrogen projects are gaining traction as a means to integrate renewable energy into the power grid and provide energy security at the state and local levels. Medium-capacity electrolyzers are increasingly being adopted for their cost-effectiveness and efficiency. The market in North America is expected to continue its growth trajectory, making it an attractive investment opportunity for businesses and governments alike.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Integration of renewables with hydrogen electrolyzers is the key driver of the market. Hydrogen electrolyzers play a crucial role in the production of carbon-free hydrogen through the process of electrolysis. This method involves passing an electric current through water, causing it to split into hydrogen and oxygen at the anode and cathode respectively. The electrolyte membrane facilitates this separation, ensuring high output efficiencies exceeding 99.999%. The cleanliness of hydrogen generation depends on the source of electricity used. Renewable energy sources, such as solar PV and wind energy, produce zero carbon emissions during electrolysis, making hydrogen a desirable alternative to fossil fuels like coal and natural gas. The increasing adoption of renewable energy for hydrogen generation is driving market growth as more organizations seek to reduce their carbon footprint. Hydrogen electrolyzers are essential devices for the production of hydrogen from water, providing a reliable and efficient solution for carbon-neutral energy production.

Market Trends

Increasing strategic partnerships for clean hydrogen generation is the upcoming trend in the market. The shift towards clean energy sources has gained significant traction in the energy sector, with the hydrogen economy gaining prominence as a sustainable alternative to traditional fossil fuels. Fuel cell vehicles and the production of green ammonia through electrolysis of water are key applications driving the demand for hydrogen electrolyzers. The need for supply chain resilience and the integration of renewable electricity sources into the hydrogen production process are crucial factors fueling the market growth. Strategic partnerships among stakeholders, including end-users and companies, are essential to establish a sustainable hydrogen ecosystem and maintain market positions. These collaborations will lead to advancements in electrolyzer technology and the production of carbon-free ammonia, further boosting the demand for hydrogen electrolyzers. Investments, contracts, and agreements are vital components of these strategic alliances, ensuring a strong product portfolio and long-term growth in the market.

Market Challenge

Competition from alternate technologies of hydrogen production is a key challenge affecting the market growth. Hydrogen can be generated through various methods, including electrolysis, thermochemical processes, photolytic processes, and biological processes. Among these, electrolysis-based hydrogen production faces significant competition from thermochemical processes due to electrolysis accounting for only approximately 4% of the total hydrogen generation sources. Notable thermochemical processes include steam methane reforming (SMR) and coal gasification. SMR is a widely used technology for hydrogen production, employing high-temperature steam to generate hydrogen from methane, a natural gas component. Coal gasification is another significant process for hydrogen generation due to the extensive coal usage and reliance of several countries. Green hydrogen, produced through renewable energy sources, is gaining traction to reduce the carbon footprint of hydrogen fuel cells. Hydrogen can be utilized in various sectors, including transportation, refining, and electronics, as an alternative to fossil fuels. Additionally, hydrogen can be converted into ammonia and methanol for storage and transportation. Outlet pressure is a crucial factor in hydrogen production, as it impacts the efficiency and cost of the process.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Cockerill JingL Hydrogen- The company offers hydrogen electrolyzers such as Ultra-high purity hydrogen generators. Also, this segment focuses on designing, developing, manufacturing, and sales of hydrogen production equipment for various end-user industries.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asahi Kasei Corp.

- Cockerill JingLi Hydrogen

- Cummins Inc.

- ELTRA GmbH

- Enapter S.r.l.

- Frames Energy Systems BV

- Gaztransport and Technigaz SA

- Giner Inc.

- Hitachi Zosen Corp.

- Idroenergy Spa

- ITM Power PLC

- Kobe Steel Ltd.

- McPhy Energy SA

- Nel ASA

- Shandong Saikesaisi Hydrogen Energy Co., Ltd.

- Siemens AG

- SwissHydrogen SA

- Teledyne Technologies Inc.

- TianJin Mainland Hydrogen Equipment

- Yangzhou Zhongdian hydrogen production

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Hydrogen electrolyzers play a crucial role in the production of carbon-free hydrogen from renewable sources. Electrolysis, the process used by these devices to separate hydrogen from water, is a key technology in the transition toward a carbon-neutral economy. An electrolyzer consists of an anode, cathode, and a membrane. The anode and cathode facilitate the separation of hydrogen and oxygen ions, while the membrane allows the selective passage of hydrogen ions. The demand for hydrogen is driven by its use as a clean energy carrier in various sectors, including refining, electronics, energy, and transportation. Hydrogen can be produced from renewable energy sources such as solar and wind energy, resulting in a reduced carbon footprint.

Moreover, green hydrogen, produced through renewable energy, is becoming increasingly popular due to its potential to help achieve net-zero emissions. Hydrogen electrolyzers are used to electrolyze water and produce hydrogen fuel cells, which can be used for power generation, industrial operations, and as a sustainable fuel in transportation. The electrolyzer market is expected to grow due to the increasing focus on decarbonization and the integration of renewable energy into the power grid. Medium-capacity electrolyzers are particularly important for renewable energy integration and grid balancing. The production of hydrogen through electrolysis also offers opportunities for the production of green ammonia, a sustainable alternative to traditional ammonia produced from fossil fuels.

Furthermore, this can be used as a clean energy solution in various industries, including fertilizer production. However, there are technological and logistical challenges associated with the production and distribution of hydrogen, including the costs of renewable energy and the need for infrastructure development. In summary, hydrogen electrolyzers are essential for the production of carbon-free hydrogen from renewable sources, and their use is becoming increasingly important in various sectors as the world transitions towards a carbon-neutral economy. The electrolyzer market is expected to grow due to the increasing focus on decarbonization and the integration of renewable energy into the power grid. However, there are challenges associated with the production and distribution of hydrogen that need to be addressed to fully realize its potential as a sustainable fuel.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.65% |

|

Market Growth 2024-2028 |

USD 94.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.24 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 40% |

|

Key countries |

US, Germany, Sweden, Japan, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Asahi Kasei Corp., Cockerill JingLi Hydrogen, Cummins Inc., ELTRA GmbH, Enapter S.r.l., Frames Energy Systems BV, Gaztransport and Technigaz SA, Giner Inc., Hitachi Zosen Corp., Idroenergy Spa, ITM Power PLC, Kobe Steel Ltd., McPhy Energy SA, Nel ASA, Shandong Saikesaisi Hydrogen Energy Co., Ltd., Siemens AG, SwissHydrogen SA, Teledyne Technologies Inc., TianJin Mainland Hydrogen Equipment, and Yangzhou Zhongdian hydrogen production |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch