Hydrogen Fuel Cell Stacks Market Size 2024-2028

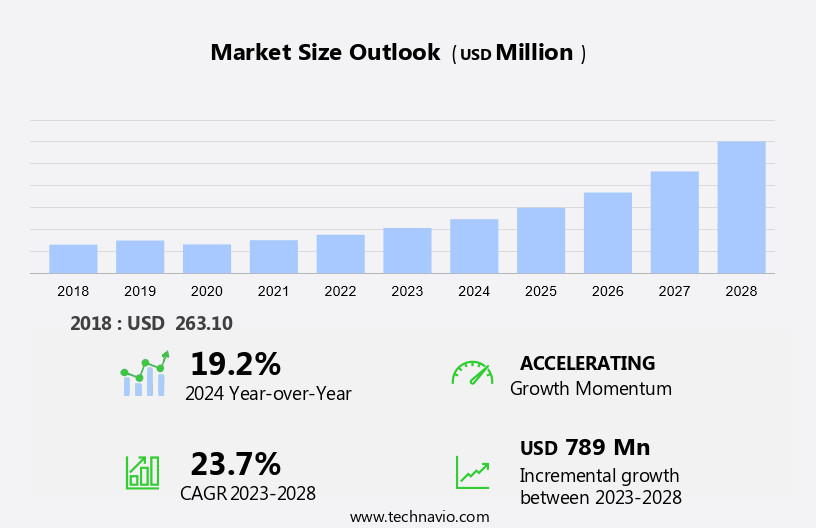

The hydrogen fuel cell stacks market size is forecast to increase by USD 789 million at a CAGR of 23.7% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing adoption of fuel cell technology in various industries, particularly in material handling equipment and transportation sectors. Fuel cells, which convert hydrogen fuel into electricity through a chemical reaction, are gaining popularity as a clean and renewable energy source. Key drivers include the growing incentives to increase the adoption of fuel cell vehicles (FCVs) and the rising strategic partnerships and research and development activities in this field. However, the high cost of fuel cell development and adoption remains a major challenge. In the material handling sector, hydrogen fuel cell stacks are being used to power forklifts and other equipment in industries such as manufacturing and logistics.

What will be the Size of the Hydrogen Fuel Cell Stacks Market During the Forecast Period?

- The hydrogen fuel cell stack market is experiencing significant growth due to the increasing demand for clean and sustainable energy solutions. Fuel cell stacks, a crucial component of fuel cell systems, convert chemical energy from hydrogen fuel into electricity through an electrochemical process. Polymer electrolyte membrane (PEM) fuel cell stacks are currently the most widely used technology due to their high efficiency and ability to operate at low temperatures. In the transportation sector, hydrogen fuel cell buses are being introduced in several cities as a clean alternative to traditional diesel buses. Hydrogen can also be produced from natural gas through a process called steam methane reforming, making it an attractive option for industries with access to this resource. Additionally, the integration of hydrogen fuel cells with solar panels can lead to the creation of a greenhouse gas-free energy system, further boosting the market's growth. Overall, the market is expected to continue its growth trajectory, driven by the increasing demand for clean and renewable energy sources and advancements in technology. The market's expansion is driven by various factors, including advancements in stack efficiency, declining costs, and the integration of renewable energy sources, such as solar power, into fuel cell systems.

How is this Hydrogen Fuel Cell Stacks Industry segmented and which is the largest segment?

The hydrogen fuel cell stacks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Transport

- Stationary

- Portable

- Geography

- North America

- Canada

- Mexico

- US

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- North America

By Application Insights

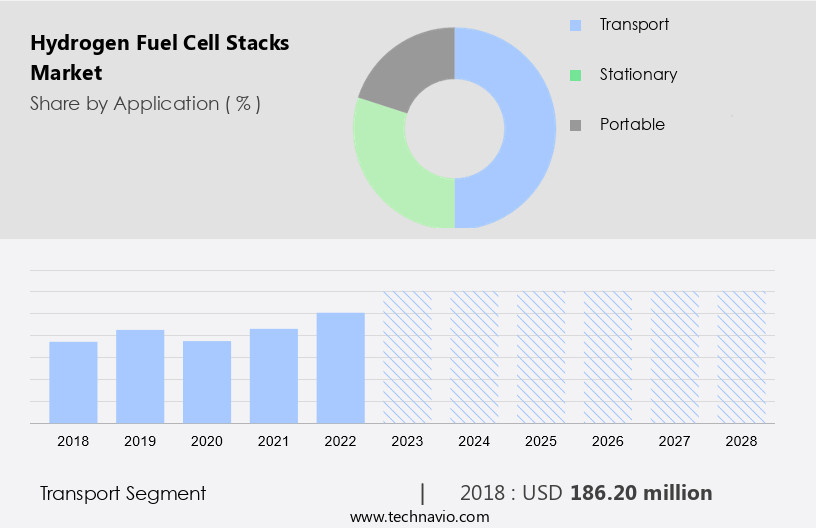

- The transport segment is estimated to witness significant growth during the forecast period.

The transport sector, which accounted for a quarter of global final energy demand in 2021 according to the International Energy Agency (IEA), is experiencing a significant increase in energy demand. Traditionally, this sector has relied heavily on fossil fuels, particularly petroleum products, leading to a 16.2% share of CO2 emissions from fuel combustion. Road vehicles, including cars, buses, trucks, and two- and three-wheelers, contribute nearly three-quarters of these emissions. To address this issue, there is a growing emphasis on decarbonization and the adoption of clean energy solutions. Hydrogen fuel cell technology is gaining popularity due to its potential as a sustainable and efficient alternative to traditional fossil fuels.

Fuel cell stacks, a crucial component of hydrogen fuel cells, offer high power density, durability, and performance. Technological advancements in materials science have led to the development of low-cost stacks and durable catalysts, making hydrogen fuel cell stacks a cost-effective solution for backup power systems, distributed generation, marine applications, and automotive and transportation applications. High-temperature membranes have also improved the efficiency and performance of fuel cell stacks, making them a viable option for stationary power generation. Overall, hydrogen fuel cell stacks represent a promising solution for sustainable energy and environmentally friendly transportation applications.

Get a glance at the market report of share of various segments Request Free Sample

The transport segment was valued at USD 186.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

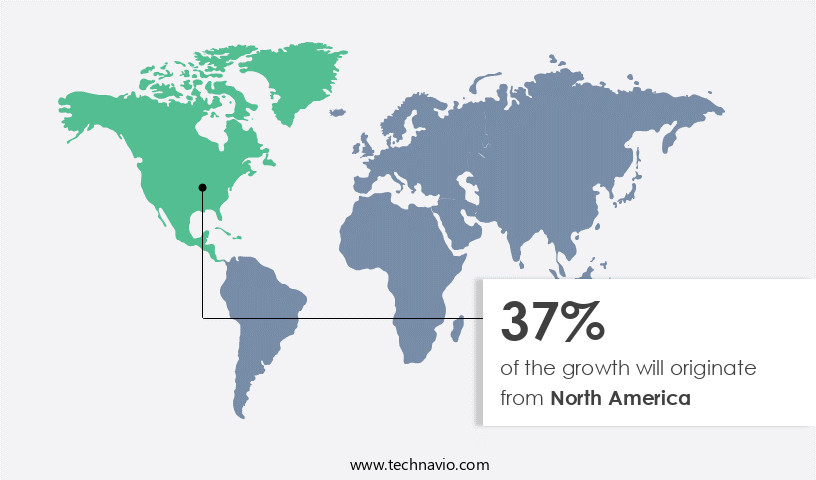

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The US market holds a significant share In the global hydrogen fuel cell stacks industry due to government initiatives and incentives. Fuel cells are increasingly being adopted In the US for various applications, including heavy-duty fuel cell electric vehicles (FCEVs) and material handling equipment. At the state and local levels, fuel cells contribute to environmental goals, reliability, and resiliency, providing constant power and saving costs for both taxpayers and industries. Deployed in both stationary and transport applications, the US market's growth is driven by government support and the need for clean, sustainable energy solutions.

Additionally, technological advancements in fuel cell stack efficiency, durability, and the development of high-temperature membranes and durable catalysts further boost the market's growth. Hydrogen fuel cell stacks provide a cost-effective, clean energy solution for backup power systems, distributed generation, and decarbonization, making them an attractive option for renewable energy sources and sustainable energy applications. Additionally, the growing popularity of hydrogen fuel cell-powered electric vehicles and marine applications further expands the market's potential.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Hydrogen Fuel Cell Stacks Industry?

Growing incentives to increase adoption of FCVs is the key driver of the market.

- The transport sector, which accounted for approximately 26% of global CO2 emissions in 2020 due to the combustion of fossil fuels, is a significant contributor to decarbonization efforts. Road vehicles, including buses, cars, trucks, and two-wheelers, accounted for around three-quarters of transport sector emissions. The increasing preference for larger, heavier vehicles in regions like North America, Asia, and Europe has further exacerbated this issue. In response, environmentally sustainable technologies, such as fuel cells, are gaining traction In the transport sector. The adoption of fuel cell vehicles (FCVs) is contingent upon the availability and expansion of hydrogen infrastructure. Fuel cells convert hydrogen into electricity through a chemical reaction, producing only water as a byproduct, making them a clean energy solution.

- Technological advancements, including the development of durable catalysts, high-power nanostructured catalysts, and high-temperature membranes, have led to cost-effective and efficient fuel cell stacks. These advancements have also improved stack durability and increased power density, making fuel cells a viable option for various applications, including backup power systems, distributed generation, marine applications, automotive applications, and stationary power generation. The use of fuel cells in sustainable energy solutions offers environmentally friendly alternatives to traditional power generation methods.

What are the market trends shaping the Hydrogen Fuel Cell Stacks Industry?

Rising strategic partnerships and research and development activities is the upcoming market trend.

- The market is witnessing significant growth due to increasing collaborations among industry players, governments, and stakeholders. These collaborations aim to advance technology, enhance efficiency, and decrease costs, making hydrogen fuel cell stacks a more viable and cost-effective solution for clean energy applications. Key market participants, such as General Motors Co. And Honda Motor, are investing heavily In the development of hydrogen fuel infrastructure. Their recent joint venture, totaling USD 85 million, is focused on mass producing fuel cell systems by 2020. By combining their hydrogen fuel cell intellectual property and integrated development teams, they aim to create affordable commercial solutions for fuel cells and hydrogen storage systems.

- Hydrogen fuel cell stacks are gaining traction as sustainable energy solutions in various sectors, including backup power systems, distributed generation, and decarbonization. Technological advancements, such as high-temperature membranes and durable catalysts, are improving performance and power density, making fuel cell stacks increasingly competitive with traditional power generation methods. Moreover, the use of nanostructured catalysts and novel materials is driving the development of high-power fuel cell stacks for marine applications, automotive applications, and stationary power generation. As the market continues to evolve, the focus on creating sustainable, efficient, and environmentally friendly energy solutions is expected to remain a key market trend.

What challenges does the Hydrogen Fuel Cell Stacks Industry face during its growth?

High cost of fuel cell development and adoption is a key challenge affecting the industry growth.

- Fuel cells, a clean energy technology in use since the 1960s, have gained significant traction in commercial and industrial applications during the 1990s. The declining cost of natural gas production in various countries, including the US, has contributed to the affordability of hydrogen, a primary fuel for fuel cells. However, the high cost of fuel cell stacks remains a significant barrier to widespread adoption. Technological advancements in materials science, such as the development of durable catalysts and high-temperature membranes, have improved stack durability and efficiency. This, coupled with the increasing demand for sustainable solutions in backup power systems, distributed generation, decarbonization, and renewable energy sources, has fueled the research and development of cost-effective, high-power fuel cell stacks.

- The focus on sustainable energy and environmentally friendly solutions has led to the exploration of novel materials and nanostructured catalysts to enhance power density and performance. These advancements have shown promising results in various applications, including marine and automotive applications, stationary power generation, and transportation applications for zero-emission vehicles. Despite these advancements, the production costs of fuel cell stacks remain a challenge. Continued research and development efforts are necessary to create low-cost, high-performance fuel cell stacks that can compete with alternative power generation technologies.

Exclusive Customer Landscape

The hydrogen fuel cell stacks market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hydrogen fuel cell stacks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hydrogen fuel cell stacks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advent Technologies Holdings Inc.

- Ballard Power Systems Inc.

- Beijing SinoHytec Co. Ltd.

- Ceres Power Holdings plc

- Cummins Inc.

- ElringKlinger AG

- Freudenberg FST GmbH

- Honda Motor Co. Ltd.

- Nedstack Fuel Cell Technology BV

- Niterra Co. Ltd.

- Nissan Motor Co. Ltd.

- Nuvera Fuel Cells LLC

- Palcan Energy Corp.

- Plug Power Inc.

- PowerCell Sweden AB

- PRAGMA INDUSTRIES

- Proton Motor Fuel Cell GmbH

- Toyota Motor Corp.

- TW Horizon Fuel Cell Technologies

- Xinyuan Power Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The hydrogen fuel cell market is experiencing significant growth as the global shift towards clean energy continues. Fuel cell stacks, a crucial component of hydrogen fuel cells, are gaining increasing attention due to their potential to provide cost-effective, sustainable solutions for various applications. Fuel cell stacks convert chemical energy from hydrogen fuel into electricity through a chemical reaction. The clean energy produced is ideal for backup power systems and distributed generation, contributing to decarbonization efforts and the integration of renewable energy sources. Technological advancements in materials science have led to the development of low-cost fuel cell stacks, enhancing their appeal to businesses and consumers. Stack durability is a critical factor In the adoption of fuel cell technology. Production costs have been a significant barrier to widespread use, but recent improvements in materials and manufacturing processes have led to more affordable options. High-temperature membranes, for instance, have shown promise in increasing efficiency and reducing costs.

Performance is another essential aspect of fuel cell stacks. Sustainable energy solutions require high power density, and fuel cell stacks must deliver consistent, reliable power to meet the demands of various applications. Marine applications, automotive uses, and stationary power generation are just a few areas where fuel cell stacks are being explored for their potential. Durable catalysts are essential for optimal performance and longevity. Researchers are continuously investigating nanostructured catalysts and novel materials to improve catalyst durability and efficiency. The development of these advanced materials could lead to even more cost-effective, high-performing fuel cell stacks. The hydrogen fuel cell market is poised for growth as the world seeks sustainable energy solutions. Fuel cell stacks offer a promising avenue for clean, efficient power generation, and their potential applications span various industries, including transportation and energy production. As technological advancements continue, we can expect to see further improvements in fuel cell stack performance, durability, and cost-effectiveness.

The Hydrogen Fuel Cell Stacks Market is witnessing significant growth due to the increasing demand for clean energy solutions. Fuel cell startups and innovations are driving the market forward with advancements in fuel cell technology, such as direct methanol fuel cell stacks and solid oxide fuel cell stacks. These new developments offer enhanced performance and flexibility, making fuel cells a viable alternative to traditional energy sources. Fuel cell performance enhancement is a critical focus area, with researchers working on improving efficiency and durability. The environmental impact of fuel cells is also a significant consideration, as they produce only water as a byproduct. Fuel cell system integration is another challenge, requiring careful consideration of safety standards and manufacturing processes. Fuel cell education and training are essential for the industry's growth, with a need for skilled professionals in design optimization, safety, and manufacturing. Fuel cell infrastructure development is also progressing, with investments in hydrogen production, storage, and distribution networks. Cost reduction and durability testing are key priorities for fuel cell manufacturers, with alkaline fuel cell stacks and other advanced designs offering potential solutions. Fuel cell safety standards continue to evolve, ensuring the technology's safe and reliable operation. Overall, the hydrogen fuel cell stacks market is poised for continued growth, driven by technological advancements and the urgent need for clean energy solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23.7% |

|

Market growth 2024-2028 |

USD 789 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

19.2 |

|

Key countries |

US, China, Japan, Canada, India, Mexico, South Korea, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hydrogen Fuel Cell Stacks Market Research and Growth Report?

- CAGR of the Hydrogen Fuel Cell Stacks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hydrogen fuel cell stacks market growth of industry companies

We can help! Our analysts can customize this hydrogen fuel cell stacks market research report to meet your requirements.