India Edible Meat Market Size 2024-2028

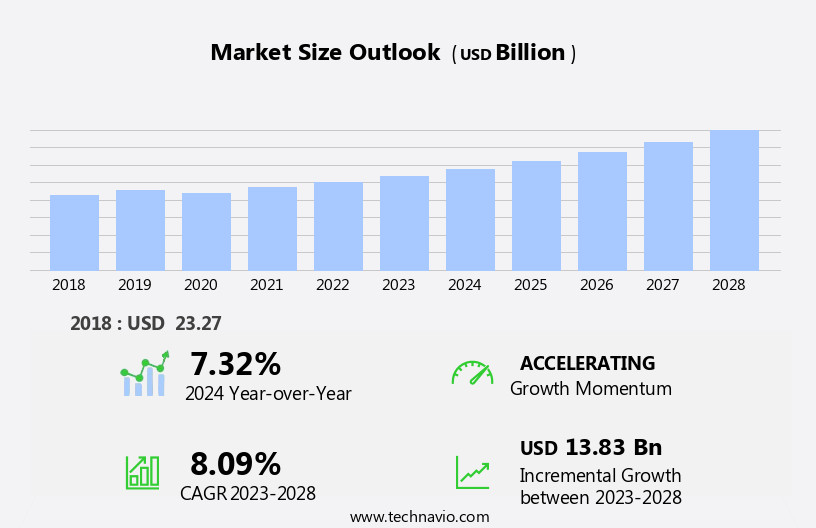

The India edible meat market size is forecast to increase by USD 13.83 billion at a CAGR of 8.09% between 2023 and 2028.

- The Indian edible meat market is experiencing significant growth due to several key trends. The first trend is the increased online penetration, which is driving the sales of meat products through e-commerce platforms and food delivery services. Another trend is the robust demand for organic meat, as consumers become more health-conscious and prefer meat that is free from antibiotics and hormones.

- Seafood and edible meat by-products, such as liver and kidneys, also hold a notable presence In the market. The Indian meat market is subject to dynamic trends, with increasing consumer awareness towards health and sustainability influencing demand for leaner, ethically-sourced meats.

What will be the size of the India Edible Meat Market during the forecast period?

- The market is a significant segment of the global food industry, encompassing various types of meat including beef, mutton, pork, poultry, lamb, and others such as duck meat. Meat products are consumed in various forms, including fresh or chilled, frozen, canned, and processed. The market caters to both the off-trade and on-trade sectors, with a diverse range of offerings from muscle tissues to internal organs.

- Cattle, pigs, and other animals are the primary sources of these meats, providing essential nutrients such as proteins, amino acids, and iron. Red meats, including beef and mutton, are popular choices for their high protein content, while poultry and pork offer more affordable options. The market is expected to continue growing, driven by rising protein requirements and the expanding middle class population.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Poultry

- Sheep and goats

- Beef

- Pork

- Others

- Distribution Channel

- Offline

- Online

- Form

- Canned

- Fresh / Chilled

- Frozen

- Processed

- Geography

- India

By Product Insights

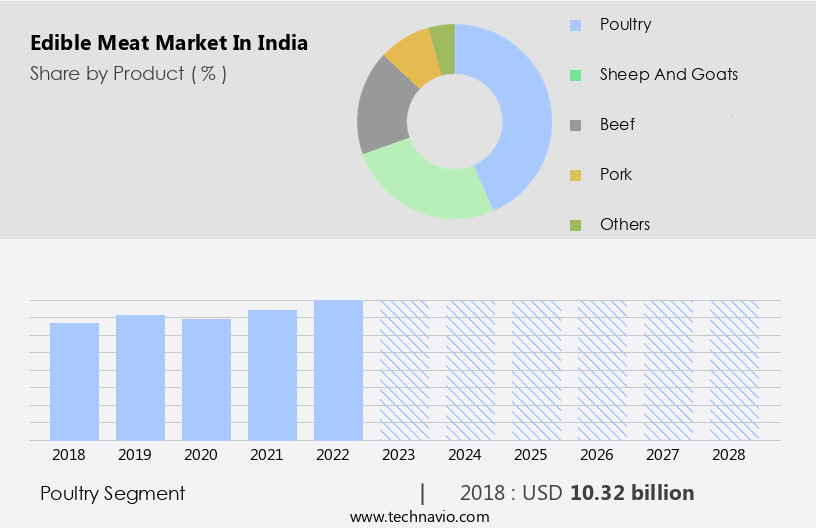

- The poultry segment is estimated to witness significant growth during the forecast period.

Poultry meat is the preferred choice for many consumers due to its affordability, accessibility, and ease of production compared to other edible meats such as beef, mutton, pork, lamb, and seafood. The increasing purchasing power in emerging markets, driven by economic growth, has resulted in a significant rise in meat consumption. Poultry, being relatively affordable, caters to a larger consumer base seeking protein sources. The health-conscious population is increasingly aware of the nutritional benefits of poultry meat, which is perceived as a lean and low-fat protein option. Sustainability is a growing concern, and poultry production is generally considered more environmentally friendly compared to beef or pork production.

Chicken is a versatile meat used in various cuisines including Mediterranean and Middle Eastern, and is available in fresh, processed, canned, frozen, and organic forms. Essential nutrients like proteins, amino acids, and omega-3 fatty acids are found in meat products, making them an important part of a balanced diet. Animal welfare and sustainable practices are crucial considerations in modern meat production. Alternative meat products are also gaining popularity among consumers with dietary preferences. Packaged and frozen meat products offer convenience and longer shelf life. Meat production involves various processing methods and strict regulations to ensure food safety and quality. Animal sources such as cattle, pigs, chickens, sheep, and fish provide a range of meat options, each with unique taste profiles and nutritional benefits.

Get a glance at the market share of various segments Request Free Sample

The Poultry segment was valued at USD 10.32 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of India Edible Meat Market?

Increased online penetration is the key driver of the market.

- The market encompasses a variety of options, including Beef, Mutton, Pork, Poultry, Lamb, Seafood, and alternative meat products. Consumers can choose from Fresh meat, Processed meat, Canned, and Frozen meat products. Dietary preferences influence the demand for specific meat types, with some opting for red meats from cattle, pigs, chickens, sheep, and duck, while others prefer Plant-based or Organic meat production. Online platforms have revolutionized the meat industry, enabling consumers to browse, compare prices, and order meat products from the comfort of their homes. Convenience stores and supermarkets also stock a wide range of packaged meat products, including steaks, burgers, stews, bacon, sausages, ham, and chicken.

- Seafood, rich in omega-3 fatty acids, is another significant segment of the market. Mediterranean and Middle Eastern cuisines heavily feature Fish and Shellfish. Processing and stringent regulations ensure the highest quality and safety standards for all meat products. Sustainable practices and animal welfare are increasingly important considerations in meat production. Alternative meat products cater to those with specific dietary requirements or ethical concerns. Essential nutrients, such as Proteins, Amino acids, and various Essential nutrients, are derived from Meat by-products, including Liver, Kidneys, and Heart. The market dynamics are influenced by factors such as consumer preferences, pricing, and regulatory requirements.

- Animal sources continue to dominate the market, but the demand for Plant-based and alternative meat products is on the rise. Processing techniques, such as the use of Preservatives like Nitrates and Nitrites, impact the taste and shelf life of meat products. Spices add Complex taste and Authentic taste to various meat dishes.

What are the market trends shaping the India Edible Meat Market?

Robust demand for organic meat is the upcoming trend In the market.

- The market encompasses a range of products including Beef, Mutton, Pork, Poultry, Canned, Frozen, and Processed meat. Consumers exhibit diverse dietary preferences, leading to the demand for various types of meat. Lamb, Seafood, and Game meat are also popular choices. Protein, an essential nutrient, is derived primarily from muscle tissues and internal organs. Fresh meat is a staple in Mediterranean and Middle Eastern cuisines, while Processed meat such as Steaks, Burgers, Stews, Bacon, Sausages, Ham, and Chicken products cater to the convenience-driven consumer. Organic meat production, free from synthetic chemicals, hormones, antibiotics, and GMOs, is gaining traction due to increasing health consciousness.

- Sustainable practices, including minimizing the use of synthetic pesticides and fertilizers, are integral to organic meat production. Seafood, rich in Omega-3 fatty acids, is another significant segment. Packaged and Frozen meat products offer extended shelf life and convenience. Alternative meat products, derived from plant-based sources, are emerging as viable options for those with dietary restrictions or ethical concerns. The market dynamics are influenced by stringent regulations, animal welfare concerns, and the rising prevalence of African swine fever. In conclusion, the market is diverse, dynamic, and evolving. Consumers seek premium-quality meat products, driving demand for organic, sustainable, and alternative meat options.

- The market is subject to rigorous regulations, ensuring the production and distribution of safe and high-quality meat products.

What challenges does India Edible Meat Market face during the growth?

Increasing vegan food consumption is a key challenge affecting the market growth.

- The market encompasses various types of meat products. Consumers in India have diverse dietary preferences, with some favoring red meats like beef, mutton, and lamb, while others opt for pork, poultry, or seafood. Meat products are essential sources of protein, which are crucial for muscle tissue growth and development. Proteins are also rich in amino acids, which are vital for various bodily functions. Meat production involves raising cattle, pigs, chickens, sheep, and fresh fish and seafood for their meat. Feedstock, Energy, and Water are significant inputs in meat production.

- Some consumers prefer Organic meat production, which adheres to stricter regulations and emphasizes Animal welfare. The demand for meat products is influenced by cultural and culinary traditions, such as Mediterranean and Middle Eastern cuisine, which feature Shellfish, Omega-3 fatty acids, and other Seafood delicacies. Alternative meat products, such as plant-based or lab-grown meat, are gaining popularity due to their potential environmental benefits and alignment with some consumers' ethical beliefs. However, concerns regarding the environmental impact of meat production and Animal welfare have led some consumers to reduce their meat consumption or opt for alternative sources of Protein. The market dynamics are further influenced by factors such as Price, Availability, and Preservatives, including Nitrates and Nitrites, used in Processed meat products.

- The market offers a range of Packaged and Frozen meat products for convenience, with some consumers prioritizing Sustainable practices and avoiding Additives and Preservatives.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Buccellati

- Bulgari

- Cartier

- Chanel

- Chopard

- Chow Tai Fook

- GRAFF

- H. Stern

- Harry Winston Inc.

- Louis Vuitton SE (LVMH)

- Pandora

- Rajesh Exports Ltd

- Richemont

- SHR Jewelry Group

- Signet Jewelers Limited

- Swarovski AG

- Boucheron

- The Swatch Group AG

- Tiffany & Co.

- Van Cleef & Arpels

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market: An In-depth Analysis the market is a significant sector withIn the country's agricultural and food processing industries. This market encompasses various types of meat, including beef, mutton, pork, poultry, and others, such as lamb, game meat, and edible meat by-products. The market caters to diverse consumer preferences and culinary traditions, with meat being an essential component of many diets. Meat consumption in India has been growing steadily due to increasing urbanization, changing consumer lifestyles, and rising disposable incomes. The market is segmented into off-trade and on-trade channels. Off-trade channels include supermarkets, hypermarkets, and convenience stores, while on-trade channels consist of restaurants, hotels, and institutional buyers.

Meat products in India come in various forms, such as fresh meat, processed meat, canned meat, frozen meat, and packaged meat products. These products cater to different consumer needs and preferences, with fresh meat being popular for its authentic taste and nutritional value. Processed meat, on the other hand, offers convenience and longer shelf life, making it a preferred choice for many consumers. The Indian meat market is influenced by several factors, including dietary preferences, cultural traditions, and stringent regulations. Consumers in India have diverse dietary needs and preferences, with some preferring processed red meat, such as beef and mutton, while others opt for poultry or fish.

Cultural traditions also play a role in meat consumption, with certain communities favoring specific types of meat or meat preparations. Stringent regulations govern the production and processing of meat in India, ensuring animal welfare and food safety. These regulations cover aspects such as animal feedstock, energy usage, processing methods, and the use of preservatives, such as nitrates and nitrites. Compliance with these regulations is essential to maintain consumer trust and confidence In the meat industry. The Indian meat market is also influenced by global trends, such as the demand for sustainable practices and alternative meat products. Consumers are increasingly conscious of the environmental impact of animal agriculture and are seeking out more sustainable options.

Alternative meat products, such as plant-based meat substitutes, are gaining popularity in India, offering consumers a more ethical and environmentally-friendly alternative to traditional meat sources. Market dynamics In the Indian meat industry are shaped by various factors, including consumer preferences, production capacity, and supply chain efficiency. The market is characterized by intense competition, with various players vying for market share. Processing and logistics efficiency, product innovation, and sustainability are key differentiators In the market. The Indian meat industry faces several challenges, including the impact of diseases, such as African swine fever, on livestock production and the availability of raw materials.

The industry also faces regulatory challenges, with stringent regulations governing animal welfare, food safety, and environmental sustainability. In conclusion, the market is a dynamic and complex sector, influenced by various factors, including consumer preferences, cultural traditions, regulations, and global trends. The market offers significant opportunities for growth, driven by increasing urbanization, changing consumer lifestyles, and rising disposable incomes. However, the industry also faces challenges, including the impact of diseases, regulatory compliance, and competition from alternative meat products. To succeed in this market, players must focus on innovation, sustainability, and efficiency, while adhering to stringent regulations and meeting the evolving needs and preferences of consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

119 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 13.83 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across India

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch