Indonesia Freight Logistics Market Size 2025-2029

The indonesia freight logistics market size is forecast to increase by USD 28.05 billion, at a CAGR of 8.3% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing export-import activities and the burgeoning e-commerce industry. The country's strategic location at the heart of the Asia-Pacific region makes it a crucial hub for international trade, leading to a surge in demand for efficient and reliable freight logistics services. Moreover, the e-commerce sector's rapid expansion is driving the need for faster and more convenient delivery solutions, further fueling market growth. However, the market faces challenges, primarily due to high infrastructure costs. The lack of adequate infrastructure, particularly in rural areas, poses significant challenges for logistics providers, increasing operational costs and limiting their ability to serve a broader customer base.

- Additionally, the complex regulatory environment and geographical diversity of the archipelago nation add to the challenges, requiring logistics companies to navigate various regulations and terrain types to efficiently serve their customers. Companies seeking to capitalize on the market's opportunities must invest in technology and infrastructure to improve operational efficiency and adapt to the evolving market landscape. Moreover, collaborating with local partners and developing strong relationships with regulatory bodies can help companies navigate the complex regulatory environment and overcome infrastructure challenges effectively.

What will be the size of the Indonesia Freight Logistics Market during the forecast period?

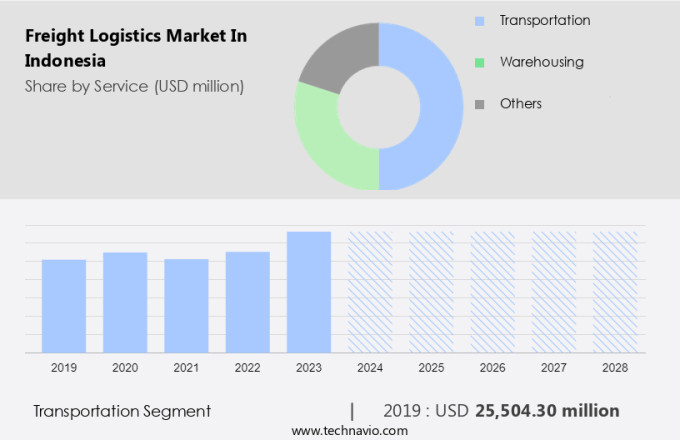

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- In the dynamic freight logistics market of Indonesia, international freight continues to play a significant role, with oversized loads requiring multimodal transportation solutions. Rail freight emerges as an attractive alternative, offering cost savings and reduced carbon emissions. Freight claims remain a concern, necessitating the implementation of advanced transportation management systems. Freight consolidation centers facilitate efficient handling of air freight, container drayage, and cross-border shipping. Specialized trucking, including heavy haul and hazmat transportation, caters to unique requirements. Predictive analytics and real-time tracking enhance capacity planning for domestic freight, long-haul trucking, and regional trucking. Cold chain logistics, with temperature-controlled shipping and reverse logistics, cater to the growing demands of perishable goods.

- Demand forecasting ensures freight visibility, enabling proactive responses to market trends.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Transportation

- Warehousing

- Others

- Application

- Manufacturing

- Automotive

- Consumer goods

- Retail industry

- Others

- Type

- 3PL

- 4PL

- Geography

- APAC

- Indonesia

- APAC

By Service Insights

The transportation segment is estimated to witness significant growth during the forecast period.

The market is characterized by the dominance of transportation, particularly sea and land freight, due to robust industrial import and export activities with key trading partners like China, India, the US, Australia, Europe, and Southeast Asian nations. Freight transportation encompasses three main types: air, sea, and road. Air freight is utilized for time-sensitive and high-value goods, while sea freight is the preferred choice for mass cargo movements. Road freight is essential for last-mile delivery and intermodal transportation. Indonesia's freight logistics sector is undergoing significant transformations through the adoption of advanced technologies such as blockchain, automation, artificial intelligence, and the Internet of Things (IoT).

These technologies enhance cargo handling, fuel efficiency, route optimization, inventory management, and customs clearance processes. Sustainability initiatives, including the use of electric trucks, alternative fuels, and carbon emissions reduction, are gaining traction in the market. Industry associations and logistics service providers are collaborating to streamline terminal handling, driver training, and compliance standards. Logistics software, network optimization, and delivery networks facilitate just-in-time delivery and freight forwarding. The integration of advanced technologies, safety regulations, and freight industry regulations ensures secure and efficient freight transportation. The market for ltl freight, containerized freight, and truckload shipping continues to evolve, with freight rates and third-party logistics playing a crucial role in shaping the competitive landscape.

Rail infrastructure development and e-commerce logistics are emerging trends in the sector. Overall, the Indonesian freight logistics market is poised for growth, driven by the increasing demand for efficient and sustainable transportation solutions.

The Transportation segment was valued at USD 25.50 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Indonesia Freight Logistics Market drivers leading to the rise in adoption of the Industry?

- Export-import activities play a crucial role in driving market growth. With increasing global trade, businesses are continually seeking to expand their reach and enhance their competitiveness by engaging in international commerce. This trend is expected to continue, as the benefits of exporting and importing goods and services become more apparent to companies of all sizes. Thus, the market dynamics are heavily influenced by the momentum of export-import activities.

- The market is experiencing significant growth due to increasing export-import activities driven by the country's expanding trade connections and economic growth. As a member of the Association of Southeast Asian Nations (ASEAN) and situated along major global shipping routes, Indonesia serves as a strategic logistics hub in the Asia Pacific region. The demand for commodities such as palm oil, coal, rubber, and textiles has fueled export activities, while the import of machinery, electronics, and raw materials for manufacturing supports domestic industries. To enhance logistics efficiency, the Indonesian government has initiated programs like the National Logistics Ecosystem (NLE), which aims to streamline processes and improve port efficiency, thereby reducing costs and accelerating trade activities.

- The implementation of advanced technologies such as blockchain, intermodal transportation, fuel efficiency, cargo handling, sustainability initiatives, terminal handling automation, driver training, internet of things, and customs clearance route optimization is transforming the market. Additionally, air cargo infrastructure development and the establishment of distribution centers along shipping lanes further strengthen the market's growth trajectory.

What are the Indonesia Freight Logistics Market trends shaping the Industry?

- The e-commerce industry is experiencing significant growth and is becoming the prevailing market trend. This sector's professional expansion is a noteworthy development in today's business landscape.

- The Indonesian freight logistics market has experienced significant growth due to the country's developing road infrastructure and the increasing importance of last-mile delivery in the e-commerce sector. Artificial intelligence and optimization technologies have played a crucial role in enhancing load optimization, inventory management, and port operations for containerized and LTL freight. The transportation infrastructure, including seaport infrastructure, has been a key focus for investments to improve efficiency and reduce compliance costs through streamlined shipping documentation and adherence to international standards.

- Flatbed trailers have gained popularity for transporting bulky goods, further expanding the market's scope. As industry associations continue to advocate for advancements in the sector, the future of freight logistics in Indonesia remains promising.

How does Indonesia Freight Logistics Market faces challenges face during its growth?

- The high infrastructure costs represent a significant challenge to the expansion and growth of the industry.

- The market is witnessing significant growth due to increasing demand for just-in-time delivery in various industries. Freight forwarding plays a crucial role in this market, enabling seamless transportation of goods through various modes, including sea, rail, and truckload shipping. Freight rates are a critical factor influencing market dynamics. To ensure timely and cost-effective delivery, third-party logistics providers are investing in advanced tracking systems and alternative fuels like electric trucks and reefer trailers to reduce carbon emissions. Regulations in the freight industry are also evolving, with a focus on data analytics and carbon emissions reduction.

- Rail infrastructure development is essential to support intermodal transportation, requiring substantial investments for installing gantry cranes and other heavy-duty equipment. E-commerce logistics is another significant market driver, with the need for efficient and reliable transportation solutions to meet growing consumer demand. The use of technology, such as data analytics, is becoming increasingly important to optimize freight operations and improve overall supply chain efficiency. In conclusion, the market is experiencing dynamic growth, driven by various factors, including the increasing demand for just-in-time delivery, e-commerce logistics, and regulatory requirements. Investments in infrastructure, technology, and alternative fuels are necessary to meet the evolving demands of the market and maintain a competitive edge.

Exclusive Indonesia Freight Logistics Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BSA Logistics Indonesia

- DB Schenker

- DHL Express Ltd.

- Dimerco Express Corp

- DSV AS

- Kuehne Nagel Management AG

- Logistics Plus Inc.

- Nippon Yusen Kabushiki Kaisha

- Pancaran Group

- POS Indonesia

- PT. Bhanda Ghara Reksa

- PT. Cipta Krida Bahari

- PT. Cipta Mapan Logistik

- PT. Dunia Express Transindo

- PT. Multimodatrans Indonesia

- PT. Tiki Jalur Nugraha Ekakurir

- Puninar Logistics

- Rhenus SE and Co. KG

- Samudera Indonesia Tangguh

- SF Express Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Freight Logistics Market In Indonesia

- In February 2023, PT Indo Freight Forwarder, a leading freight logistics company in Indonesia, announced the launch of its new digital platform, "iFreight," aimed at streamlining the freight booking process and enhancing supply chain transparency for customers (PT Indo Freight Forwarder press release). In May 2024, PT Pelindo II, Indonesia's state-owned port operator, signed a strategic partnership with DB Schenker, a global logistics provider, to expand their joint logistics services, targeting the growing e-commerce sector in Indonesia (DB Schenker press release). In October 2024, WiseTech Global, an Australian logistics technology company, secured a significant investment of USD 1.1 billion in its Series E funding round, which it plans to utilize for expanding its presence in the Indonesian market (WiseTech Global press release). In January 2025, the Indonesian government announced the implementation of a new regulation mandating the use of electronic data interchange (EDI) in freight logistics operations, aiming to digitize and modernize the sector (Indonesian Ministry of Transportation press release).

Research Analyst Overview

The market continues to evolve, shaped by dynamic market conditions and advancements in various sectors. Road infrastructure plays a crucial role, with ongoing improvements enhancing the efficiency of freight transportation. Artificial intelligence and the Internet of Things are revolutionizing cargo handling, from terminal operations to route optimization. Industry associations foster collaboration and knowledge-sharing among stakeholders, driving innovation in areas such as last-mile delivery and compliance standards. LTL freight and containerized freight are key applications, with load optimization and inventory management essential for maximizing efficiency. Seaport infrastructure and port operations are undergoing significant transformations, incorporating automation technologies and advanced shipping documentation systems to streamline processes.

Flatbed trailers and reefer trailers cater to diverse cargo needs, while compliance with safety regulations and freight industry standards ensures secure and reliable transportation. Freight forwarding, third-party logistics, and just-in-time delivery are increasingly popular services, with freight rates and insurance coverage key considerations for businesses. The integration of logistics software, network optimization, and delivery networks enables real-time tracking and data analytics, enhancing overall supply chain management. E-commerce logistics and security measures are growing priorities, with alternative fuels and carbon emissions reduction initiatives addressing sustainability concerns. Rail infrastructure and intermodal transportation are also gaining traction, offering fuel efficiency and reducing reliance on traditional truckload shipping.

Continuous improvements in freight logistics are shaping the market landscape, with a focus on enhancing efficiency, reducing costs, and ensuring the highest levels of safety and security.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Freight Logistics Market in Indonesia insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.3% |

|

Market growth 2025-2029 |

USD 28.05 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.6 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Indonesia

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch