Injection Molded Plastics Market Size 2025-2029

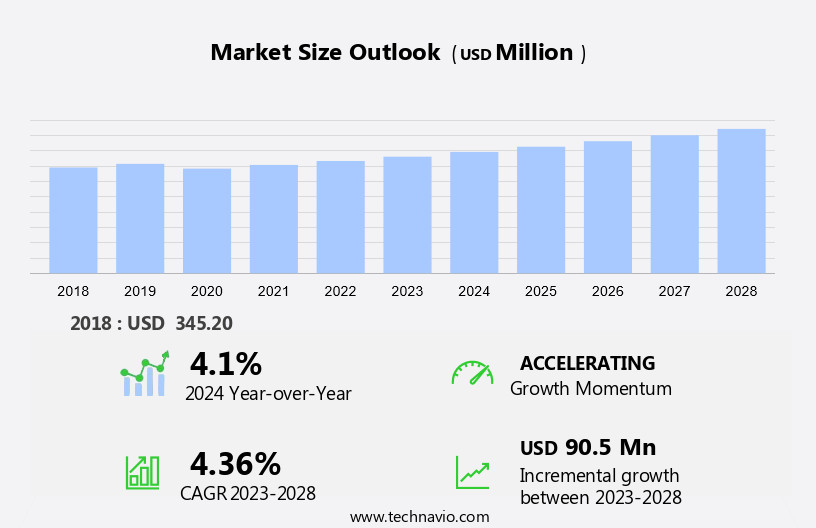

The injection molded plastics market size is forecast to increase by USD 99.8 billion, at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand from developing countries. This expanding consumer base, particularly in Asia Pacific and Latin America, is driving the market's momentum. Simultaneously, the global packaging industry is undergoing substantial innovations, creating new opportunities for injection-molded plastics. Intelligent packaging, featuring smart materials and sensors, monitors environmental changes and responds with programmed indicators, adding value to the overall supply chain. However, the market faces challenges as well.

- The market is characterized by robust growth in emerging economies, continuous innovation in the packaging industry, and intense competition from substitute products. Companies must navigate these dynamics to capitalize on opportunities and mitigate challenges effectively. The availability of substitute products, such as extruded plastics and blow-molded products, poses a threat to injection-molded plastics' market share. Rigid and flexible packaging are the primary classifications. Companies must differentiate themselves through product innovation, cost competitiveness, and value-added services to maintain their market position.

What will be the Size of the Injection Molded Plastics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Injection molded plastics continue to play a pivotal role in various industries, with their applications spanning from consumer goods and automotive to packaging and medical sectors. The market dynamics of this sector are constantly evolving, driven by advancements in technology, material science, and industry regulations. One significant trend is the increasing focus on material selection, with an emphasis on properties such as impact resistance, dimensional accuracy, and surface finish. Plastic additives, including flame retardants and UV stabilizers, are increasingly being used to enhance the performance and durability of injection molded parts. Safety standards continue to evolve, with stricter regulations governing the use of hydraulic systems and clamping forces.

Injection molding machines are becoming more sophisticated, with advanced features for process monitoring, melt flow index control, and cycle time optimization. Mold design and manufacturing have also seen significant advancements, with the use of CAD/CAM software and rapid prototyping enabling faster turnaround times and more precise part design. Industrial plastics are being used in various applications, from heavy-duty machinery to electrical components, requiring high levels of dimensional accuracy and strength. Mold defects, such as sink marks and short shots, continue to be a challenge, with ongoing research focused on optimization of the molding process and the use of advanced technologies like automated inspection and CNC machining to improve part quality.

Injection molding simulation and process monitoring are becoming increasingly important, with the use of data analytics and machine learning algorithms enabling real-time process optimization and predictive maintenance. The ongoing unfolding of market activities and evolving patterns in the market promise continued innovation and growth.

How is this Injection Molded Plastics Industry segmented?

The injection molded plastics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Packaging

- Consumer goods and electronics

- Automobile

- Others

- Product

- Polyethylene

- Polypropylene

- Polyvinyl chloride

- Others

- Technology

- Hydraulic

- Electric

- Hybrid

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

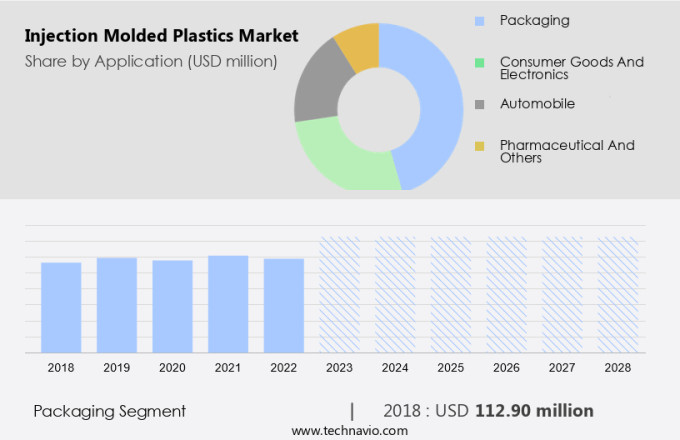

By Application Insights

The packaging segment is estimated to witness significant growth during the forecast period. Injection molded plastics play a pivotal role in various industries, with packaging leading the market in 2024. This segment caters to the food and beverage industry, producing beverage cans, food packaging, and bottle caps. The packaging industry's focus has shifted towards sustainability and recyclability, aligning with global initiatives to minimize plastic waste. Brands are adopting bio-based polymers and lightweight designs to comply with regulations and consumer preferences. The injection molding process's precision and repeatability ensure the production of tamper-evident and child-resistant packaging, essential for food safety and regulatory compliance. Material selection, a crucial aspect of injection molding, is influenced by industry regulations and consumer safety standards.

Tensile strength, impact resistance, and melt flow index are essential material properties considered during material selection. Injection molding simulation and process monitoring tools help optimize the manufacturing process, reducing cycle time and improving dimensional accuracy. Ejection systems, sink marks, and mold defects are common challenges in injection molding. Material testing and automated inspection systems ensure product quality and consistency. Flame retardants and UV stabilizers are added to plastics for enhanced safety and durability. Consumer goods, automotive, and industrial sectors also significantly contribute to the market. Rapid prototyping and part consolidation help reduce tooling costs and shorten development cycles. Injection molding machines, hydraulic systems, and CNC machining are essential tools for manufacturing these parts.

Plastic additives, such as colorants and reinforcements, are used to enhance the properties of injection-molded plastics. Mold design, gate location, and molding process optimization are critical factors in ensuring efficient manufacturing and high-quality end products. The market is driven by the packaging industry's shift towards sustainability and recyclability, with a focus on bio-based polymers and lightweight designs. Material selection, process optimization, and quality control are essential factors in the manufacturing process. Injection molding continues to be a versatile and cost-effective solution for producing various parts across industries.

The Packaging segment was valued at USD 118.80 billion in 2019 and showed a gradual increase during the forecast period.

The injection molded plastics market is expanding rapidly, driven by sustainability goals and industry-specific innovations. The rise of recycled plastics reflects growing environmental consciousness, while sectors like healthcare demand precision-engineered medical grade plastics for safety and compliance. In transportation, automotive plastics are enhancing fuel efficiency and design flexibility. Brands are also leaning on packaging plastics that combine durability with reduced environmental impact. For everyday use, consumer goods plastics remain in high demand, enabling mass production with consistent quality. A critical component of this process is the ejection system, which ensures timely and flawless removal of molded parts.

Regional Analysis

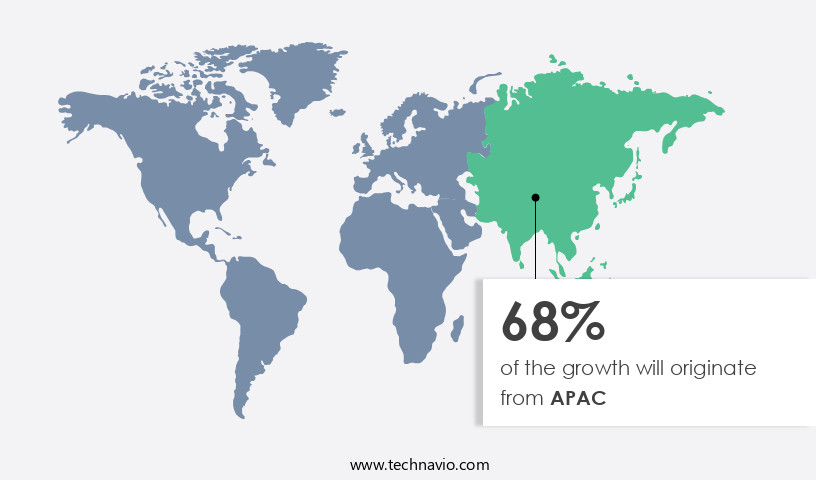

APAC is estimated to contribute 58% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth, driven by the expansion of various end-user industries, particularly e-commerce, FMCG, and pharmaceuticals. In countries like China, India, and Japan, the e-commerce sector is rapidly expanding, leading to increased demand for protective packaging solutions. Injection molded plastics are ideal for manufacturing multi-layered packaging, ensuring product safety during transportation. Moreover, the automotive and consumer goods sectors in APAC are also contributing to the market's growth. Injection molding simulation and process monitoring technologies are increasingly being adopted to optimize production and improve product quality. Tensile strength, impact resistance, and dimensional accuracy are crucial factors in material selection for various applications.

Industry regulations mandate the use of flame retardants and material testing to ensure product safety. Electric motors, hydraulic systems, and pneumatic systems are essential components of injection molding machines. CAD/CAM software and mold design play a vital role in part design and molding process optimization. Mold defects, such as sink marks and short shots, can impact product quality. Tooling costs and part consolidation are essential considerations for manufacturers to minimize production costs. Plastic additives, such as UV stabilizers, are used to enhance material properties. Automated inspection systems ensure consistent quality control. Rapid prototyping and industrial plastics applications further expand the market's scope.

The injection molding process involves various factors, including clamping force, cycle time, and gate location, which influence the overall production efficiency. Impact resistance, melt flow index, surface finish, and flexural strength are essential material properties for various applications. Injection molding machines come in various sizes, with shot size being a crucial factor in determining capacity. The market is continually evolving, with innovations in material science and technology driving advancements in injection molded plastics.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Injection Molded Plastics Industry?

- The significant demand growth for injection-molded plastics in developing countries serves as the primary market driver. The market is experiencing significant growth due to various factors. Developing countries like China, India, Mexico, Indonesia, Brazil, and South Africa are attracting many injection molded plastics companies due to advantages such as ample land, efficient raw material supply, low transportation costs, inexpensive labor, and less stringent regulations. These factors are anticipated to propel the market's expansion during the forecast period. Moreover, China and India's emergence as manufacturing hubs for packaging, consumer goods, and automobiles in the Asia Pacific region is boosting the demand for injection molded plastics. In polymer chemistry, these plastics offer excellent dimensional accuracy and short cycle times, making them ideal for various industries.

- Additionally, the integration of flame retardants into injection molded plastics enhances their safety and applicability in various sectors. Material testing is a crucial aspect of the production process to ensure the quality and durability of injection molded plastics, especially in medical grade and automotive applications. Rapid prototyping using injection molding technology also enables companies to bring new products to market faster, providing a competitive edge. Despite tooling costs being a significant investment, the benefits of injection molded plastics outweigh the costs, making them a preferred choice for numerous industries.

What are the market trends shaping the Injection Molded Plastics Industry?

- The global packaging industry is experiencing significant innovations, which is a prevailing market trend. This sector's continuous advancements reflect its commitment to meeting evolving consumer needs and expectations. Injection molded plastics play a significant role in various industries, particularly in the production of active packaging, modified atmosphere packaging (MAP), and intelligent packaging. These advanced packaging solutions incorporate oxygen scavengers, moisture absorbers, carbon dioxide absorbers, and temperature control features, reducing food contamination and ensuring product freshness in food and beverage, pharmaceuticals, and other sectors. The demand for injection molded plastics is driven by innovations in packaging design for bottles, cans, and closures, which offer enhanced functionality and protection for sensitive products.

- Quality control, safety standards, and the use of plastic additives for improved impact resistance are essential considerations in the injection molding process. Injection molding machines, hydraulic systems, and CAD/CAM software facilitate efficient manufacturing and minimize mold defects, ensuring consistent product quality.

What challenges does the Injection Molded Plastics Industry face during its growth?

- The growth of the industry is significantly influenced by the presence of substitute products and the resulting challenge of maintaining market share. The market experiences growth driven by various factors, including part consolidation and the use of additives like UV stabilizers for improved durability. Molding process optimization and automated inspection ensure product consistency and quality. However, the increasing adoption of alternatives such as metals in high-end applications, particularly in the automotive, electrical and electronics, and medical industries, may hinder market expansion. These metal components offer superior flexural strength and surface finish, making them suitable for demanding applications.

- Injection molding, however, remains the most widely used technique due to its efficiency and versatility. CNC machining and pneumatic systems are often employed in post-molding processes to enhance the functionality and precision of injection molded parts. Short shots and other defects can be addressed through process optimization and material selection. The market continues to evolve, with ongoing research and development focusing on improving material properties, reducing production costs, and enhancing sustainability. Besides injection molding, other plastic component manufacturing techniques include rotational molding, extrusion molding, thermoforming, and vacuum casting. Each process offers unique advantages, such as rotational molding's ability to create hollow or complex shapes.

Exclusive Customer Landscape

The injection molded plastics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the injection molded plastics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, injection molded plastics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ALPLA Werke Alwin Lehner - The company specializes in injection-molded plastics, producing cartridge plungers, needle shields, ETFE film-coated vial stoppers, syringe plungers, and other precision-molded components.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALPLA Werke Alwin Lehner

- AptarGroup Inc.

- BASF SE

- Berry Global Inc.

- Braskem SA

- China Petrochemical Corp.

- DuPont de Nemours Inc.

- Eastman Chemical Co.

- Exxon Mobil Corp.

- Huntsman Corp.

- INEOS Group Holdings S.A.

- LyondellBasell Industries NV

- Mitsubishi Chemical Corp.

- Saudi Basic Industries Corp.

- Silgan Holdings Inc.

- The Dow Chemical Co.

- Versalis S.p.A

- Westlake Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Injection Molded Plastics Market

- In January 2024, BASF Corporation, a leading global chemical producer, announced the launch of Ultramid TG3, a new high-performance polyamide grade for injection molding applications. This innovative material offers improved mechanical properties and reduced emissions, making it an attractive option for the automotive industry (BASF press release).

- In March 2024, LG Chem and SABIC, two major players in the chemical industry, announced their strategic collaboration to develop and commercialize innovative injection-molded polymers. The partnership aims to combine LG Chem's battery materials expertise with SABIC's injection molding capabilities, targeting the electric vehicle market (LG Chem press release).

- In May 2024, Covestro AG, a leading global supplier of high-tech polymer materials, announced the acquisition of Polyplastics Co. Ltd., a Japanese manufacturer of engineering thermoplastics. This acquisition strengthens Covestro's position in the Asian market and expands its product portfolio (Covestro press release).

- In February 2025, Sabic and TotalEnergies announced a joint venture to build a large-scale facility for the production of circular polymers using recycled feedstock. The new facility, set to be operational by 2027, will produce injection-molded polymers from recycled materials, contributing to the circular economy (TotalEnergies press release).

Research Analyst Overview

Injection molded plastics continue to dominate the manufacturing sector due to their versatility and cost-effectiveness in high-volume production. Consumers' preferences for lightweight, durable, and customized products fuel the demand for advanced molding techniques, such as precision molding, aluminum molds, and co-injection molding. Mold repair and maintenance are crucial aspects of the industry, ensuring optimal mold life and product quality. Mold cleaning and secondary operations, including material science and engineering design, are integral to the production process. Technological advancements in blow molding, extrusion molding, compression molding, transfer molding, and micro-injection molding enhance efficiency and reduce costs. Tool steel and cost analysis play significant roles in supply chain management, ensuring timely delivery and quality control.

Continuous innovation in material science and mold technology drives the industry forward, with trends leaning towards sustainable and eco-friendly practices. Companies focus on improving mold life and reducing waste to remain competitive in the market. Overall, injection molded plastics remain a vital component of US businesses, offering versatility, cost-effectiveness, and endless possibilities for product design and manufacturing. Simultaneously, the global packaging industry is undergoing substantial innovations, creating new opportunities for injection-molded plastics.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Injection Molded Plastics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

236 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 99.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, China, Japan, India, South Korea, Germany, Italy, Canada, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Injection Molded Plastics Market Research and Growth Report?

- CAGR of the Injection Molded Plastics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the injection molded plastics market growth of industry companies

We can help! Our analysts can customize this injection molded plastics market research report to meet your requirements.