Automotive Plastics Market Size 2025-2029

The automotive plastics market size is valued to increase USD 15 billion, at a CAGR of 3.5% from 2024 to 2029. Increasing demand for electric and hybrid vehicles will drive the automotive plastics market.

Major Market Trends & Insights

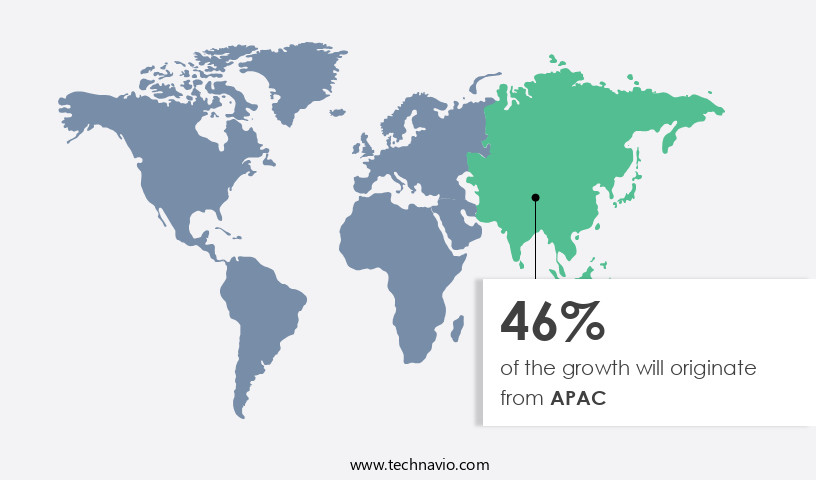

- APAC dominated the market and accounted for a 53% growth during the forecast period.

- By Material - Polypropylene segment was valued at USD 23.70 billion in 2023

- By Vehicle Type - Passenger vehicle segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 33.10 billion

- Market Future Opportunities: USD 15.00 billion

- CAGR from 2024 to 2029 : 3.5%

Market Summary

- The market is experiencing significant growth, with global revenues projected to reach USD 115.2 billion by 2026. This expansion is driven by the increasing demand for lightweight and fuel-efficient materials in the automotive industry. Complex design and engineering requirements further fuel market growth, as plastics offer versatility and durability in vehicle manufacturing. Automotive plastics provide numerous benefits, including reduced vehicle weight, improved fuel efficiency, and enhanced safety features. Their use in various applications, such as body panels, interior components, and under-the-hood components, contributes to the overall functionality and future direction of the automotive industry. Despite these advantages, challenges persist.

- Regulatory compliance and sustainability concerns are key challenges for market participants. However, advancements in recycling technologies and the development of bio-based plastics offer potential solutions. In summary, the market is poised for continued growth, driven by the need for lightweight and fuel-efficient materials in the evolving automotive landscape. Market participants must navigate regulatory requirements and sustainability concerns while capitalizing on advancements in recycling technologies and bio-based plastics to remain competitive.

What will be the Size of the Automotive Plastics Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Automotive Plastics Market Segmented ?

The automotive plastics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Polypropylene

- Polyurethane

- Polyvinyl chloride

- Others

- Vehicle Type

- Passenger vehicle

- Commercial vehicle

- Electric vehicle

- Application

- Interior components

- Exterior components

- Under bonnet

- Electrical components

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Material Insights

The polypropylene segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with polypropylene (PP) remaining a preferred choice for automakers due to its cost-effectiveness and desirable properties. Lightweight PP contributes significantly to reducing vehicle weight, enhancing fuel efficiency, and decreasing emissions. Widely utilized in interior components like instrument panels, door panels, consoles, and trims, PP offers excellent dimensional stability and resistance to wear and tear. Injection molding and blow molding processes are commonly used to create these parts, ensuring high surface finish quality and dimensional accuracy control. Exterior plastic components, such as bumpers and fenders, also benefit from PP's chemical resistance and impact strength. Polypropylene is also employed in automotive HVAC systems, air ducts, and other air management components.

The Polypropylene segment was valued at USD 23.70 billion in 2019 and showed a gradual increase during the forecast period.

Sustainable material sourcing and recycled plastic content are increasingly important considerations in the industry. Thermoplastic polyurethanes, thermoplastic elastomers, and acrylonitrile butadiene styrene are other polymers used for various automotive applications. Material flammability standards and UV resistance testing are crucial aspects of the production cycle, ensuring part durability and safety. Finite element analysis and mold flow simulation are essential in tooling design processes to optimize part design and improve production cycle time. Recent advancements include the use of electroplating processes for decorative purposes, enhancing the aesthetics of plastic parts. Color matching techniques and paint adhesion properties are also critical factors in the automotive plastic market.

The industry is continuously focusing on reducing plastic waste through recycling and reusing materials. According to recent statistics, over 50% of all plastic waste is recycled in the automotive industry, demonstrating a strong commitment to sustainability.

Regional Analysis

APAC is estimated to contribute 53% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automotive Plastics Market Demand is Rising in APAC Request Free Sample

The market experienced significant growth in recent years, with APAC leading the charge as the largest market shareholder in 2024. Key contributors to this region include China, India, Japan, and South Korea. China, as the largest automotive market in APAC, has seen substantial expansion in automobile production and sales. The Chinese government's initiatives to promote electric vehicles have further fueled the demand for automotive plastics, as they are extensively utilized in electric vehicle components. India's automotive industry is also on the rise, with automotive plastics gaining prominence due to the emphasis on fuel efficiency and lightweighting of vehicles.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for lightweighting strategies and design innovation in vehicle manufacturing. Injection molding cycle optimization plays a crucial role in reducing production costs and enhancing efficiency in the production of automotive interior trim designs. Recycled plastic automotive parts are gaining popularity as part of sustainable manufacturing initiatives, with polycarbonate blends being a preferred choice for their UV resistance and chemical resistance. Polypropylene, known for its impact strength and tensile strength, is extensively used in the automotive industry for various applications. Flammability testing of plastic parts is essential to ensure safety, while improving paint adhesion on plastics is vital for maintaining the aesthetic appeal of vehicles. UV resistance is a critical factor in the selection of plastics for automotive applications, as exposure to sunlight can degrade the material over time. Finite element analysis and mold flow simulation are essential tools for optimizing the design and manufacturing process of automotive plastic parts. Automotive plastic part assembly techniques, such as electroplating and vacuum forming, are used to enhance the durability and appearance of plastic components. Blow molding and rotational molding are preferred for large parts, while extrusion molding is commonly used for plastic profiles. Design for manufacturing principles are essential in the production of automotive plastics, ensuring that the material selection, design, and manufacturing processes are optimized for cost-effectiveness, efficiency, and quality. The market is expected to continue growing as automakers seek to reduce vehicle weight, improve fuel efficiency, and enhance the overall driving experience.

What are the key market drivers leading to the rise in the adoption of Automotive Plastics Industry?

- The surge in demand for electric and hybrid vehicles serves as the primary catalyst for market growth in this sector.

- The automotive industry's evolution has been marked by a significant shift towards electric and hybrid vehicles, driven by environmental concerns and government incentives. These alternatives to traditional internal combustion engine vehicles produce zero emissions, making them a cleaner choice. The demand for lightweight materials in electric and hybrid vehicles is on the rise to offset the weight of batteries and enhance energy efficiency. Automotive plastics have emerged as a popular choice due to their strength, durability, and low weight. According to recent studies, the market is projected to reach a value of around 110 billion USD by 2026, growing at a steady pace.

- Another report suggests that the market share in the global automotive industry is estimated to reach approximately 25% by 2028. This surge in demand for automotive plastics underscores their importance in the evolving automotive landscape.

What are the market trends shaping the Automotive Plastics Industry?

- The market trend indicates a high demand for lightweight and fuel-efficient materials. Two separate yet related trends are emerging in the market: a preference for lightweight materials and a demand for fuel efficiency.

- The automotive industry's evolution centers around the development of lighter vehicles to enhance fuel efficiency and minimize emissions. Automotive plastics have emerged as a significant solution, offering weight reduction while maintaining safety and performance. This shift is driven by increasing consumer awareness and preference for eco-friendly vehicles. For instance, LG Chem's recent innovation, an eco-friendly, flame-retardant PC/ABS plastic, caters to the demanding safety and sustainability standards of the automotive sector and other high-performance industries.

- Advanced plastics and composites are increasingly replacing heavier materials like metal, contributing to a substantial reduction in vehicle weight. This trend aligns with the growing emphasis on reducing carbon emissions and prioritizing fuel efficiency in the automotive market.

What challenges does the Automotive Plastics Industry face during its growth?

- The intricate complexities of design and engineering pose a significant challenge to the expansion of the industry.

- The market is characterized by its evolving nature, with plastic components becoming increasingly essential for modern vehicles due to their lightweight properties and ability to accommodate advanced features. Plastic parts must be meticulously designed and engineered to fit within the vehicle structure and meet functional requirements, necessitating the creation of intricate molds and tooling. Complex geometries, intricate part features, and tight tolerances can add to the complexity of tooling and production setup. Overcoming the challenges of designing and manufacturing complex plastic components requires advanced engineering capabilities and close collaboration between automakers and plastic suppliers.

- The high initial investment and extended lead times associated with tooling for complex plastic components can deter some manufacturers from incorporating plastics into their designs, potentially impacting the expansion of the market.

Exclusive Technavio Analysis on Customer Landscape

The automotive plastics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive plastics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Automotive Plastics Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, automotive plastics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AGC Inc. - This company specializes in the production and supply of advanced automotive plastics.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGC Inc.

- Avery Dennison Corp.

- BASF SE

- Berghof GmbH

- Borealis AG

- BOS GmbH and Co. KG

- Cascade Engineering

- CIE Automotive SA

- Compagnie de Saint Gobain SA

- Covestro AG

- Eastman Chemical Co.

- Evonik Industries AG

- Nifco Inc.

- Nolato AB

- Novares

- Polystar Technologies LLC.

- W. L. Gore and Associates Inc.

- Weber GmbH and Co. KG

- Yachiyo Industry Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Plastics Market

- In January 2024, BASF, a leading global chemical producer, announced the expansion of its automotive plastic production capacity at its site in Schwarzheide, Germany. This expansion aimed to meet the growing demand for lightweight and sustainable automotive solutions (BASF press release, 2024).

- In March 2024, LG Chem and SK On, two major South Korean battery manufacturers, formed a joint venture to produce automotive batteries and plastic components. This strategic collaboration aimed to combine their expertise in battery technology and plastic manufacturing to offer integrated automotive solutions (Yonhap News Agency, 2024).

- In April 2025, Covestro, a leading polymer manufacturer, launched its new Bayblend NCF series of automotive body components. These components, made from recycled materials, offer improved strength and reduced CO2 emissions, aligning with the industry's shift towards sustainability (Covestro press release, 2025).

- In May 2025, SABIC, a leading petrochemicals manufacturer, received regulatory approval for its new automotive plastic production facility in Saudi Arabia. This USD 1.5 billion project is expected to increase SABIC's automotive plastic production capacity by 50% (Arab News, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Plastics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.5% |

|

Market growth 2025-2029 |

USD 15 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.3 |

|

Key countries |

China, US, Japan, India, Germany, South Korea, Canada, UK, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with ongoing advancements in technologies and applications across various sectors. Electroplating processes are increasingly being used to enhance the surface finish quality of plastic parts, ensuring durability and improved chemical resistance. Injection molding and blow molding processes remain popular for manufacturing automotive interior parts, with a focus on sustainable material sourcing and recycled plastic content. UV resistance testing and chemical resistance testing are crucial for ensuring the longevity of exterior plastic components, such as bumpers and fenders. Polymer compounding and thermoplastic elastomers are essential in producing lightweighting materials, reducing production cycle time and improving part design optimization.

- Material flammability standards are a significant concern in the automotive industry, with finite element analysis and tensile strength analysis used to ensure safety. Acrylonitrile butadiene styrene and polypropylene compounds are commonly used in automotive decoration, while thermoplastic polyurethanes are preferred for their flexibility and impact strength. Automotive plastic recycling is gaining momentum, with a focus on reducing plastic waste and improving sustainability. Rotational molding techniques and vacuum forming processes are used to create complex shapes, while color matching techniques ensure a consistent appearance. According to industry reports, the market is expected to grow by 5% annually over the next decade.

- This growth is driven by the continuous demand for lighter, more durable, and cost-effective materials in the automotive industry. For instance, a leading automaker increased its sales by 10% by using plastic parts in place of traditional metal components.

What are the Key Data Covered in this Automotive Plastics Market Research and Growth Report?

-

What is the expected growth of the Automotive Plastics Market between 2025 and 2029?

-

USD 15 billion, at a CAGR of 3.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by Material (Polypropylene, Polyurethane, Polyvinyl chloride, and Others), Vehicle Type (Passenger vehicle, Commercial vehicle, and Electric vehicle), Application (Interior components, Exterior components, Under bonnet, Electrical components, and Others), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing demand for electric and hybrid vehicles, Complex design and engineering

-

-

Who are the major players in the Automotive Plastics Market?

-

AGC Inc., Avery Dennison Corp., BASF SE, Berghof GmbH, Borealis AG, BOS GmbH and Co. KG, Cascade Engineering, CIE Automotive SA, Compagnie de Saint Gobain SA, Covestro AG, Eastman Chemical Co., Evonik Industries AG, Nifco Inc., Nolato AB, Novares, Polystar Technologies LLC., W. L. Gore and Associates Inc., Weber GmbH and Co. KG, and Yachiyo Industry Co. Ltd.

-

Market Research Insights

- The market is a dynamic and ever-evolving industry that continues to organize and innovate. Plastics play a crucial role in automotive manufacturing, with their lightweight properties contributing to fuel efficiency and reduced emissions. According to industry reports, the market is expected to grow by 5% annually over the next decade. One notable example of market growth comes from the adoption of advanced manufacturing processes, such as 3D printing and rapid prototyping methods, which enable faster production cycles and cost reduction strategies. Additionally, the integration of performance simulation software and surface treatment methods facilitates the optimization of manufacturing processes and material selection.

- Moreover, the industry's focus on waste management solutions and plastic degradation studies is essential for addressing environmental concerns and ensuring regulatory compliance with safety standards. With the increasing emphasis on material characterization and property testing, manufacturers can assess creep behavior and fatigue life prediction to improve part lifecycle management and design verification testing. Furthermore, the implementation of additive manufacturing techniques and design for recyclability is a significant trend in the market, as it supports the reduction of emissions and the circular economy. These advancements, along with the continuous development of polymer modification techniques and supply chain management strategies, contribute to the industry's ongoing evolution.

We can help! Our analysts can customize this automotive plastics market research report to meet your requirements.