Inline Printing Market Size 2024-2028

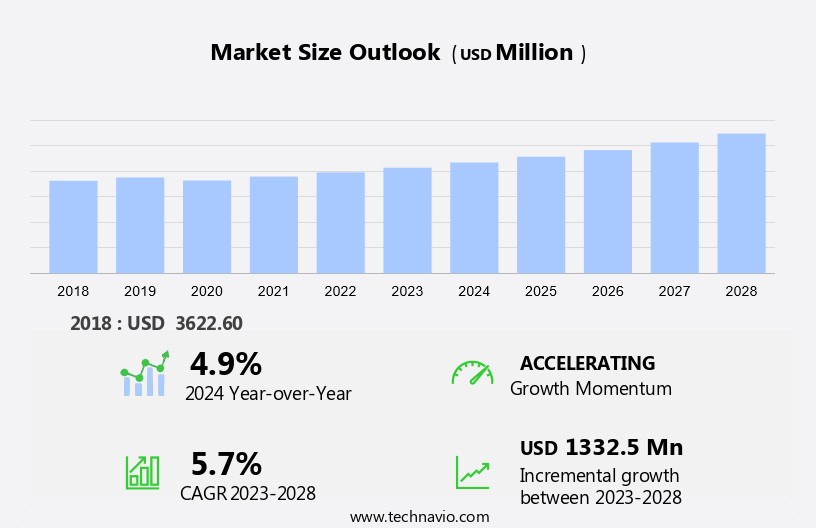

The inline printing market size is forecast to increase by USD 1.33 billion at a CAGR of 5.7% between 2023 and 2028.

- The market is experiencing significant growth, driven by increasing product launches and innovation from companies. This trend is fueled by the demand for customized and personalized products, particularly in industries such as fashion, pharmaceuticals, and electronics. Inline printing also supports lean packaging solutions, reducing waste, and offering customized packaging options for daily life, gift packaging bags, jewelry merchants, and various brand logos. The market encompasses various manufacturing processes, including flexo printing units, raw materials like printed roll paper and non-woven fabric, and plastic film. Labor and machine costs, as well as space requirements, are essential considerations. However, the market faces challenges from stringent government regulations, which require companies to ensure traceability and compliance with safety standards. Additionally, the market is witnessing a shift towards digitalization and automation, as companies seek to improve efficiency and reduce costs. Overall, the market is expected to continue its growth trajectory, driven by these trends and the increasing demand for customized and regulated products.

What will be the Size of the Inline Printing Market During the Forecast Period?

- The market encompasses the production of labels, packaging, and other printed materials directly during the manufacturing process. This approach offers several advantages, including time efficiency, cost savings, and the ability to accommodate late-stage customization and personalization. The market is driven by the growing demand for consumer convenience and the need for time-sensitive information, such as sale prices, ingredient information, and warning labels. Design changes and tracking and tracing capabilities are also key trends In the market, as brands seek to adapt quickly to market shifts and ensure the accuracy and transparency of their supply chains. Package printing, labeling, branding, and converting processes all benefit from inline printing technology, which allows for flexibility and the ability to handle unique surfaces and labeling variations.

- Moreover, inline printing enables late-stage customization, allowing for advertising, promotional designs, and personalized messaging to be added during the manufacturing process. The market is further fueled by the increasing importance of language and instruction support, as global brands expand into new markets and seek to meet the needs of diverse consumer populations. Overall, the market is poised for continued growth, as businesses seek to streamline their operations, improve their branding, and meet the evolving demands of consumers.

How is this Inline Printing Industry segmented and which is the largest segment?

The inline printing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Packaging

- Labels

- Textiles

- Others

- Technology

- Flexographic printing machines

- Digital printing machines

- Gravure printing machines

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By End-user Insights

- The packaging segment is estimated to witness significant growth during the forecast period.

The market encompasses various industries, with packaging being a significant segment. Innovative and efficient packaging solutions are propelling advancements in inline printing technology, notably in sectors like food and beverage, pharmaceuticals, personal care, and cross-industry automation. At PACK EXPO Las Vegas 2023, Coesia showcased its dedication to automation and sustainability, highlighting integrated equipment solutions designed for the evolving packaging industry. Notable innovations included a pharmaceutical-specific pouch machine featuring inline printing technology. This technology enhances the production process by integrating printing functions, labeling, branding, and ingredient/warning information into the converting and filling stages. Additionally, it enables time-sensitive information, sale prices, late-stage customization, flexibility, and agility.

Get a glance at the Inline Printing Industry report of share of various segments Request Free Sample

The packaging segment was valued at USD 1.67 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The APAC region is experiencing notable growth In the market due to industrialization, increasing demand for superior printing solutions, and technological innovations. Various sectors, including packaging and textiles, are integrating advanced printing technologies to boost efficiency and cater to evolving consumer preferences. In October 2024, Prakash printers and Coaters, located in Ahmedabad, India, became the first company In the country to install the Lombardi Invicta i2 press. This installation signifies the Lombardi i2 press's debut in Asia, reflecting the region's growing fascination with advanced printing technologies. Renowned for its precision, versatility, and efficiency, the Lombardi Invicta i2 press is an excellent fit for diverse printing applications.

Key markets in APAC, such as retail, design, track and trace, package printing, supply chain, labeling, branding, ingredient information, warning information, converting process, filling stage, time-sensitive information, sale prices, late-stage customization, flexibility, preprinted packages, advertising, promotional designs, personalization, manufacturing, unique surfaces, labeling variations, languages, instructions, expiration dates, batch numbers, agility, lean packaging solutions, and reduce waste, are embracing inline printing to enhance their offerings and stay competitive.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Inline Printing Industry?

Increasing product launches is the key driver of the market.

- The market is experiencing substantial growth, driven by the continuous introduction of innovative products. In August 2022, a significant advancement was made with the launch of the Gallus One, a digital inline label press built on the Gallus Labelmaster platform. This new press boasts a 340-mm wide roll-to-roll UV inkjet system, capable of printing at a maximum speed of 70 meters per minute with a resolution of 1,200 dpi. It supports four colors plus white, delivering high-quality printing solutions. While the Labelfire remains a leading hybrid inline printing machine, the Gallus One offers automation features and efficiency improvements. In the retail markets, inline printing is essential for design changes, track and trace, package printing, and branding. It enables the inclusion of important information such as ingredient information, warning information, and expiration dates. The converting process and filling stage require time-sensitive information, making inline printing an agile solution. Inline printing offers flexibility with late-stage customization, allowing for personalization, advertising, and promotional designs.

- Furthermore, it is also suitable for manufacturing unique surfaces and labeling variations in various languages, instructions, and batch numbers. Lean packaging solutions, which help reduce waste, are increasingly popular, making inline printing a valuable asset In the supply chain. With the option for customized packaging, inline printing caters to daily life needs, gift packaging bags, and jewelry merchants, ensuring brand logos and printing functions are accurately represented. The inline printing process involves a flexo printing unit, raw material, and printed roll paper, which are then fed into a bag forming unit. The mode of operation can be adjusted based on optional colors and materials, including non-woven fabric and plastic film. The labor cost and machine cost, along with space requirements, are essential considerations for businesses adopting inline printing solutions.

What are the market trends shaping the Inline Printing Industry?

Increasing innovation by market players is the upcoming market trend.

- The market is experiencing significant innovation, driven by companies' commitment to boost production capabilities and cater to varying customer requirements. One such advancement is the integration of sophisticated booklet makers with high-performance digital presses. In April 2023, Plockmatic International introduced a new line of production booklet makers, specifically designed for compatibility with leading digital toner presses. These booklet makers accommodate mid- to high-volume production, enabling the creation of both landscape and portrait format booklets. Key features include square-back folding and full-bleed three-side trimming, ensuring neat, professional edges on folded sheets. The new series offers staple or stitcher heads in 50- and 35-sheet configurations.

- This development underscores the market's agility in addressing the needs of retail markets, particularly in sectors like labeling, branding, and packaging. Inline printing's ability to accommodate design changes, track and trace, and provide time-sensitive information, such as sale prices, late-stage customization, and ingredient/warning information, further enhances its value In the supply chain. Additionally, its flexibility in accommodating unique surfaces, labeling variations, languages, instructions, expiration dates, batch numbers, and agility in lean packaging solutions contributes to its appeal. The market's focus on reducing waste, offering customized packaging, and catering to daily life, gift packaging bags, jewelry merchants, and various brand logos through the printing function, flexo printing units, raw material, printed roll paper, and bag forming unit, positions it as a vital component In the manufacturing process.

What challenges does the Inline Printing Industry face during its growth?

Stringent government regulations is a key challenge affecting the industry growth.

- The market experiences regulatory challenges, particularly in relation to environmental and safety standards. Notably, the Environmental Protection Agency (EPA) is focusing on the regulation of chemical compounds, such as polyfluoroalkyl substances (PFAS) and perfluorooctane sulfonate (PFOS), commonly used in printing processes. The potential designation of these chemicals as superfund-classified substances would significantly impact reporting requirements and regulatory compliance for the industry. This regulation primarily affects players In the food packaging and apparel sectors. Despite these challenges, the market offers advantages such as track and trace capabilities, late-stage customization, and agility. These benefits are crucial for businesses in retail markets seeking to provide time-sensitive information, including ingredient and warning information, branding, and expiration dates.

- Inline printing also enables flexibility through the use of various converting processes, filling stages, and labeling variations, accommodating unique surfaces, languages, and instructions. Lean packaging solutions, such as customized packaging, daily life items, gift packaging bags, and jewelry merchants, can reduce waste and offer personalization opportunities. Manufacturing costs include labor and machine costs, while space requirements vary depending on the mode of operation, optional color choices, and the use of non-woven fabric or plastic film.

Exclusive Customer Landscape

The inline printing market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the inline printing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, inline printing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BELL-MARK

- ChangHong Printing Machinery Co Ltd.

- EKOFA FLEXO

- Eles Plastik Makina Otomasyon San. ve Tic. Ltd. Sti

- Elried Markierungssysteme GmbH

- Heidelberger Druckmaschinen AG

- KETE GROUP Ltd

- Konica Minolta Inc.

- Kuen Yuh Machinery Engineering Co. Ltd.

- Label Source Printing Machine CO LTD

- PPS

- REA Elektronik GmbH

- Ronald Web Offset Private Limited.

- Sahil Graphics

- Sneed Coding Solutions

- TRESU

- Windmoller and Holscher KG

- Zhejiang Zhongte Machinery Technology Co., Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a dynamic industry focused on integrating various printing functions directly into the manufacturing process of packaging. This approach offers numerous benefits, including increased agility, reduced lead times, and the ability to accommodate time-sensitive information. Design changes are a critical aspect of the market. With the capability to print labels, branding, and ingredient or warning information on the spot, companies can quickly adapt to market demands or regulatory requirements. This flexibility is particularly valuable in industries where product offerings frequently evolve, such as consumer goods or food and beverage. Track and trace capabilities are another essential feature of inline printing. By integrating printing technology into the manufacturing process, companies can ensure accurate and up-to-date labeling for their products. This is crucial for maintaining supply chain efficiency and meeting consumer expectations for transparency. Package printing plays a significant role In the market. From preprinted packages to late-stage customization, the ability to print directly onto packaging materials offers numerous advantages. This includes reduced waste, leaner manufacturing processes, and the ability to produce unique surfaces and labeling variations for various markets and languages. The converting process, which involves transforming raw materials into finished packaging, is another area where inline printing excels.

By integrating printing functions into the converting process, companies can save time and labor costs. Additionally, the ability to print on various substrates, such as non-woven fabric or plastic film, allows for greater versatility In the types of packaging that can be produced. The filling stage is another area where inline printing can add value. By printing directly onto containers or bottles, companies can ensure accurate and consistent labeling, reducing the risk of errors and improving overall efficiency. This is particularly important for time-sensitive information, such as sale prices or expiration dates. Agility is a key driver of the market.

With the ability to accommodate late-stage customization and make design changes on the fly, companies can quickly respond to market demands and stay competitive. This is especially important in industries where trends and consumer preferences shift rapidly. Lean packaging solutions are another area where inline printing can add value. By reducing the need for separate printing and labeling processes, companies can save on machine costs and labor. Additionally, the ability to print directly onto packaging materials can help reduce overall waste and improve sustainability. Customized packaging is another area where inline printing shines. By integrating printing functions into the manufacturing process, companies can produce packaging that is tailored to specific products or markets.

This can help differentiate brands and improve consumer engagement. In daily life, inline printing is used in a variety of applications, from gift packaging bags to jewelry merchants' branded packaging. The ability to print on various substrates and produce unique designs and labeling variations makes inline printing an essential tool for businesses looking to stand out in crowded markets. The printing function itself is a critical component of inline printing systems. Flexo printing units are commonly used due to their ability to print on various substrates and produce high-quality images. However, other printing technologies, such as digital printing, may also be used depending on the specific application and substrate requirements.

The mode of operation for inline printing systems varies depending on the specific application and manufacturing process. Some systems may be continuous, while others may be batch-oriented. Optional color capabilities and space requirements also depend on the specific application and desired output. Thus, the market is a dynamic and evolving industry that offers numerous benefits for businesses looking to streamline their manufacturing processes, reduce waste, and produce customized packaging. By integrating printing functions directly into the manufacturing process, companies can improve efficiency, reduce lead times, and stay competitive in rapidly changing markets.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2024-2028 |

USD 1.33 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.9 |

|

Key countries |

US, Germany, China, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Inline Printing Market Research and Growth Report?

- CAGR of the Inline Printing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the inline printing market growth of industry companies

We can help! Our analysts can customize this inline printing market research report to meet your requirements.