Intravenous Solutions Market Size 2025-2029

The intravenous (IV) solutions market size is forecast to increase by USD 5.65 billion at a CAGR of 8.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing prevalence of chronic diseases and technological advancements in IV solutions. The rising incidence of chronic conditions, such as cancer and diabetes, necessitates the frequent use of IV solutions for extended periods, thereby fueling market expansion. Moreover, technological innovations in IV solutions, including the development of smart infusion systems and advanced materials, are enhancing patient safety and improving treatment outcomes, further boosting market growth. However, the high cost of IV solutions poses a substantial challenge to market expansion.

- To capitalize on market opportunities and navigate challenges effectively, companies must focus on cost reduction strategies, such as process optimization and economies of scale, while ensuring the highest quality standards. Additionally, collaborations and partnerships with healthcare providers and insurance companies can help broaden market reach and increase affordability. The expensive production process and high raw material costs contribute to the elevated prices, making IV solutions less accessible to a significant patient population. Medical devices, such as automated dispensing cabinets and bar code scanning systems, facilitate the safe and efficient administration of IV solutions.

What will be the Size of the Intravenous (IV) Solutions Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The IV solutions market encompasses a range of products, including hypertonic, isotonic, and hypotonic solutions, used in various medical applications. Treatment efficacy is a key consideration in the selection of IV solutions, as healthcare economics and cost-effectiveness analysis play increasingly significant roles in clinical practice. Medical education and adherence to clinical practice guidelines are essential for ensuring optimal vascular access and minimizing adverse events during infusion therapy. Manufacturing processes for IV solutions must prioritize quality assurance and regulatory affairs to meet stringent industry standards. Isotonic solutions are commonly used for bolus injections and continuous infusions, while hypotonic solutions may be employed for specific medical indications.

Patient monitoring, including vital signs like oxygen saturation, respiratory rate, blood pressure, heart rate, and ECG, is crucial for assessing patient outcomes and safety profiles during infusion therapy. Cost-effective solutions and medication reconciliation are essential components of the healthcare economics landscape, with insurance coverage playing a significant role in determining patient access to IV therapies. Adverse events reporting is a critical aspect of ensuring patient safety, with regulatory bodies closely monitoring the safety profiles of IV solutions and medical devices. Infusion therapy continues to evolve, with intermittent infusions and continuous infusions offering unique benefits for various clinical applications. The integration of technology, such as automated dispensing cabinets and patient monitoring systems, enhances the safety and efficacy of IV solutions in clinical practice.

How is this Intravenous (IV) Solutions Industry segmented?

The intravenous (IV) solutions industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Partial parenteral nutrition

- Total parenteral nutrition

- Distribution Channel

- Hospital pharmacy

- Retail pharmacy

- Online pharmacy

- Formulation

- Carbohydrates

- Electrolytes and minerals

- Amino acids

- Vitamins and lipids

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

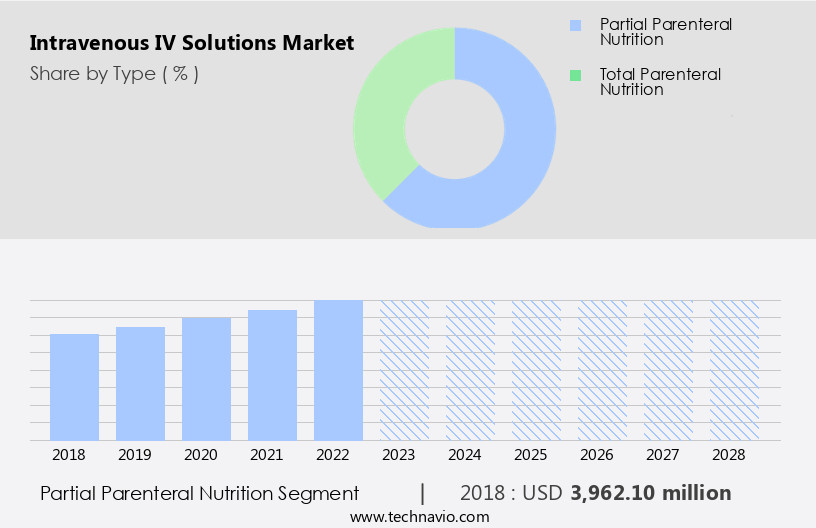

By Type Insights

The Partial parenteral nutrition segment is estimated to witness significant growth during the forecast period. Intravenous (IV) solutions play a vital role in various healthcare settings, particularly in emergency medicine, critical care, and home healthcare. The market for IV solutions encompasses a wide range of products, including IV bags, sterile compounded solutions, crystalloid solutions such as normal saline and lactated Ringer's solution, plasma expanders, and blood products. Patient safety and infection control are paramount in the production and administration of IV solutions. Crystalloid solutions are commonly used for fluid resuscitation and electrolyte imbalance correction. Plasma expanders, like colloid solutions, are utilized in shock management and volume expansion. Sterile compounding is essential for creating customized IV solutions to address individual patient needs.

IV fluids, including medications, require precise dosage calculations to ensure effective treatment and minimize medication errors. Central venous catheters offer access to larger veins for the administration of large-volume parenteral solutions and long-term nutritional support, like parenteral nutrition. Clinical trials and drug metabolism studies contribute to the development of new IV solutions and improved patient care. Quality control measures, including pyrogen testing and aseptic technique, ensure the safety and efficacy of IV solutions. Expiration dates and shelf life are crucial considerations in the supply chain management of IV solutions.

IV tubing, distribution networks, and packaging materials are essential components of the IV solutions market, ensuring the solutions reach patients in a safe and effective manner. Medication interactions and adverse drug reactions are ongoing concerns, requiring continuous monitoring and vigilance. In the ambulatory care setting, home healthcare services provide patients with IV solutions for long-term treatment and management of chronic conditions. Overall, the IV solutions market is dynamic, with ongoing research and development addressing the evolving needs of healthcare facilities and patients.

The Partial parenteral nutrition segment was valued at USD 4.21 billion in 2019 and showed a gradual increase during the forecast period.

The Intravenous (IV) Solutions Market is advancing rapidly, driven by increased demand for tailored therapies using hypertonic solutions for critical care scenarios. Hospitals and clinics are adopting flexible delivery methods including continuous infusion, intermittent infusion, and bolus injection to meet diverse patient needs. Integration with monitoring tools such as the electrocardiogram (ECG) enhances real-time assessment during IV therapy. Meanwhile, innovations in drug delivery systems are improving precision, minimizing complications, and supporting personalized treatment plans.

Regional Analysis

Asia is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market experienced significant expansion in 2024, with Asia leading the way. Major contributors to the market's growth in this region included Japan, China, Singapore, India, and South Korea. The region's rapid expansion was driven by increasing healthcare investments, rising life expectancy, and the burgeoning burden of chronic diseases such as diabetes, cardiovascular conditions, and cancer. In India, the Ministry of Health and Family Welfare highlighted that approximately two-thirds of the elderly population suffer from at least one chronic illness, emphasizing the urgent need for dependable IV therapies in both urban and rural healthcare settings. In response, hospitals like Fortis Healthcare and Singapore General Hospital have expanded their infusion therapy services.

Additionally, private and public initiatives have focused on enhancing awareness and access to treatment. Patient safety and infection control remain top priorities in the IV solutions market. Drug interactions and medication errors are significant concerns in critical care settings, leading to the adoption of advanced medication administration systems, such as infusion pumps and dosage calculation software. Home healthcare and ambulatory care settings also require small-volume parenteral solutions for fluid management, electrolyte imbalances, and parenteral nutrition. The market for IV fluids encompasses crystalloid solutions, plasma expanders, and blood products. Crystalloid solutions, such as normal saline and lactated Ringer's solution, are commonly used for fluid resuscitation.

Plasma expanders, like albumin and dextran, are essential for shock management and volume expansion. Blood products, including whole blood, plasma, and platelets, are crucial for trauma patients and those undergoing surgery. Quality control, shelf life, and packaging materials are essential factors in the IV solutions market. Colloid solutions, such as hydroxyethyl starch, have gained popularity due to their extended shelf life and improved safety profile. Aseptic technique is essential in the production and administration of IV solutions to minimize the risk of contamination and adverse drug reactions. The IV solutions market also includes large-volume parenteral solutions, such as dextrose and saline, and nutrient solutions for parenteral nutrition.

Implantable ports and central venous catheters are used for long-term administration of medications and nutrients. Pyrogen testing and distribution networks are critical components of the IV solutions supply chain management. The intravenous solutions market is a dynamic and evolving industry that plays a vital role in healthcare facilities worldwide. It caters to various applications, including emergency medicine, critical care, home healthcare, and ambulatory care. The market's growth is driven by factors such as an aging population, increasing prevalence of chronic diseases, and advancements in technology. The focus on patient safety, infection control, and quality control will continue to shape the market's trends and innovations.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Intravenous (IV) Solutions market drivers leading to the rise in the adoption of Industry?

- The rising prevalence of chronic diseases serves as the primary market driver, significantly influencing industry growth. The global IV solutions market is experiencing significant growth due to the rising prevalence of chronic diseases, such as cancer, diabetes, and cardiovascular diseases. According to the Centers for Disease Control and Prevention, six out of ten adults in the US have at least one chronic illness, leading to an increased demand for IV therapies to manage hydration, medication delivery, and nutritional support. The World Health Organization reports that over 422 million people worldwide live with diabetes, with the majority residing in low- and middle-income countries, and the disease causing 1.5 million deaths annually. This growing health burden necessitates increased use of IV solutions for glucose regulation and fluid management in diabetic patients.

- IV solutions include volume expanders, such as crystalloid solutions and plasma expanders, used to maintain or restore intravascular volume. These solutions are essential in emergency medicine, critical care, and implantable ports. In addition, sterile compounding of IV solutions is crucial for patient safety and infection control. However, drug interactions and potential complications, such as infection, phlebitis, and extravasation, require careful consideration. IV solutions play a vital role in various medical applications, including trauma, surgery, and chemotherapy. The market's growth is driven by factors such as an aging population, increasing healthcare expenditures, and technological advancements in IV solutions and delivery systems.

What are the Intravenous (IV) Solutions market trends shaping the Industry?

- The trend in the medical industry is leaning towards advancements in IV solutions, driven by technological innovations. IV solutions refer to intravenous fluids and medications administered through a needle or catheter. These advancements aim to improve patient outcomes, increase efficiency, and reduce complications. IV solutions play a vital role in modern medical practice by enabling the direct administration of medications, fluids, and nutrients into the bloodstream. The market for IV solutions has seen significant advancements, with smart infusion systems gaining wider adoption.

- ICU Medical's Clave Guard system is a notable example of this technology. Pyrogen testing remains essential to ensure the safety of IV solutions, while adverse drug reactions and dosage calculations continue to be key concerns. Drug metabolism and medication administration require precise control, making infusion pumps an indispensable tool. Blood products, fluid resuscitation, and intravenous (IV) fluids are all integral parts of the IV solutions market. These systems, such as Baxter International's Sigma Spectrum Infusion System, integrate with electronic health records and clinical decision support tools, allowing real-time adjustments to infusion rates based on patient-specific parameters. Closed system transfer devices (CSTDs) have also seen increased use, particularly in oncology, where they protect healthcare workers from exposure to cytotoxic drugs during IV preparation and administration.

How does Intravenous (IV) Solutions market faces challenges during its growth?

- The escalating costs of IV solutions pose a significant challenge to the growth of the industry. The market has experienced continuous cost increases, a trend expected to persist during the forecast period. This price escalation has significantly affected demand and accessibility, particularly in healthcare facilities serving low and middle-income populations. Constrained budgets have compelled providers to explore more affordable alternatives, such as oral medications and subcutaneous therapies, to manage treatment costs. This shift not only impacts patient access to essential IV therapies but also reduces profit margins for manufacturers and distributors. Balancing quality with affordability remains a significant challenge.

- In home healthcare settings, small-volume parenteral solutions, electrolyte imbalances, and parenteral nutrition continue to be critical areas of focus. Supply chain management and fluid management are crucial aspects of IV solutions, with packaging materials and electrolyte solutions playing essential roles. Ensuring timely delivery of IV solutions while maintaining their integrity, especially with regard to expiration dates, is vital for optimal patient care.

Exclusive Customer Landscape

The intravenous (IV) solutions market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the intravenous (IV) solutions market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, intravenous (IV) solutions market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amanta Healthcare Ltd. - The company specializes in providing intravenous (IV) solutions through its brand SteriPort.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amanta Healthcare Ltd.

- Axa Parenterals Ltd.

- B.Braun SE

- Baxter International Inc.

- Fresenius SE and Co. KGaA

- Grifols SA

- ICU Medical Inc.

- JW Pharmaceutical Corp.

- Lxir Medilabs Pvt. Ltd.

- MITS Healthcare Pvt. Ltd.

- Otsuka Holdings Co. Ltd.

- Pfizer Inc.

- Salius Pharma Pvt. Ltd.

- Schwitz Biotech

- Sichuan Kelun Pharmaceutical Co. Ltd.

- Soxa Formulations and Research Pvt. Ltd.

- Terumo Corp.

- Vifor Pharma Management Ltd.

- Vikrant Life Sciences Pvt. Ltd.

- Vitapure Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Intravenous (IV) Solutions Market

- In January 2024, Fresenius Kabi, a leading global healthcare company, announced the launch of their new line of sterile IV solutions, "Vibex," designed for use in intensive care units (ICUs) and operating rooms (ORs). This expansion bolstered their existing portfolio and catered to the growing demand for advanced sterile IV solutions (Fresenius Kabi Press Release).

- In March 2024, Baxter International, a major player in the IV solutions market, entered into a strategic partnership with the University of California, San Francisco (UCSF) Benioff Children's Hospital to develop and commercialize customized IV solutions for pediatric patients. This collaboration aimed to address the unique needs of this patient population and improve patient outcomes (Baxter International Press Release).

- In April 2025, Grifols, a leading producer of plasma-derived medicines, completed the acquisition of Talecris Biotherapeutics, a significant player in the IV solutions market. This acquisition expanded Grifols' product portfolio and strengthened their presence in the North American market (Grifols Press Release).

- In May 2025, the European Medicines Agency (EMA) approved Hospira's new IV solution, "NaturoSolution," for use in Europe. This approval marked the first-ever use of a nature-based, preservative-free IV solution in Europe and demonstrated a significant technological advancement in the IV solutions market (Hospira Press Release).

Research Analyst Overview

The market continues to evolve, driven by the diverse requirements of various sectors, including emergency medicine, critical care, home healthcare, and ambulatory care. This dynamic market encompasses a range of applications, from volume expansion with crystalloid solutions and plasma expanders, to fluid resuscitation, medication administration, and parenteral nutrition. Patient safety and infection control are paramount, with stringent regulations governing pyrogen testing, adverse drug reactions, and sterile compounding. IV tubing, clinical trials, drug metabolism, and blood products are integral components of this complex system. Fluid management, including electrolyte imbalances and expiration dates, is a critical concern, as is the shelf life of IV fluids and the importance of quality control in large-volume parenteral solutions.

The market also accommodates specialized applications, such as shock management and nutrient solutions, delivered via infusion pumps and various types of catheters. Moreover, the intravenous solutions market is influenced by ongoing advancements in technology, packaging materials, and distribution networks, ensuring the continued provision of safe, effective, and efficient IV solutions for diverse healthcare needs. Infusion pumps and peripheral intravenous catheters facilitate controlled medication administration.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Intravenous (IV) Solutions Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.5% |

|

Market growth 2025-2029 |

USD 5.65 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.7 |

|

Key countries |

US, China, Germany, India, UK, Japan, Brazil, Canada, France, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Intravenous (IV) Solutions Market Research and Growth Report?

- CAGR of the Intravenous (IV) Solutions industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Asia, North America, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the Intravenous (IV) solutions market growth of industry companies

We can help! Our analysts can customize this Intravenous (IV) solutions market research report to meet your requirements.