What is the Intumescent Coatings Market Size?

The Intumescent Coatings Market size is forecast to increase by USD 376.8 million, at a CAGR of 5.3% between 2024 and 2029. The market is witnessing significant growth due to expanding research and development facilities and collaborations and partnerships in the industry. These initiatives are leading to the development of advanced intumescent coatings with improved fire protection and other desirable properties. Additionally, health concerns associated with intumescent coatings are driving the market as manufacturers focus on producing eco-friendly and non-toxic coatings to meet regulatory requirements and consumer demand. This market analysis report provides a comprehensive study of the key trends, growth drivers, and challenges shaping the market. Stay informed about the latest market developments and future growth prospects with our in-depth analysis.

What will be the size of the Market during the forecast period?

Request Free Intumescent Coatings Market Sample

Market Segmentation

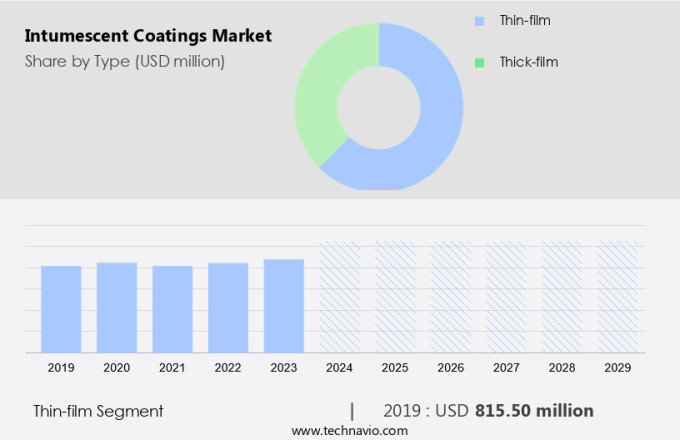

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019 - 2023 for the following segments.

- Type

- Thin-film

- Thick-film

- End-user

- Construction and infrastructure

- Oil and gas

- Manufacturing

- Others

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- Europe

- Germany

- UK

- France

- Italy

- South America

- Brazil

- Middle East and Africa

- North America

Which is the largest segment driving market growth?

The thin-film segment is estimated to witness significant growth during the forecast period. Thin-film intumescent coatings are a specialized category within the intumescent coatings market, recognized for their exceptional fire safety features. These coatings are designed to expand upon heat exposure, creating a protective char layer that shields underlying materials from fire damage. In contrast to conventional fireproofing techniques that necessitate substantial applications, thin-film intumescent coatings are applied in thin layers, ranging from 0.5 to 3 millimeters. This feature offers a significant advantage as it ensures effective fire hazard mitigation without compromising the visual or structural quality of the coated structures.

Get a glance at the market share of various regions. Download the PDF Sample

The thin-film segment was valued at USD 815.50 million in 2019. The increasing emphasis on fire safety regulations and the need for buildings to adhere to stringent safety standards is driving the demand for thin-film intumescent coatings. Moreover, their hydrocarbon and solvent-based formulations offer excellent performance and durability, making them a preferred choice for various industries. Water-based alternatives are also gaining popularity due to their eco-friendly properties, further expanding the market's scope. With their ability to maintain color retention and provide long-lasting protection, thin-film intumescent coatings are poised to play a pivotal role in the construction sector.

Which region is leading the market?

For more insights on the market share of various regions, Request Free Sample

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional market trends and drivers that shape the market during the forecast period. Intumescent coatings have gained popularity in North America due to their ability to reinforce heat-resistant layers in various industries. These coatings are essential for fire protection in commercial buildings, particularly those with sensitive equipment and materials. This innovative product is specifically designed for use in advanced manufacturing facilities, such as semiconductor plants, electric vehicle battery factories, data centers, and other critical infrastructure. The demand for advanced fire protection solutions is increasing due to the potential damage and downtime that fires can cause in these facilities. The solvent-based coating is suitable for use in high-tech environments and offers decorative finishes, making it an attractive option for facility managers seeking both functionality and aesthetics. The use of intumescent coatings in North America is expected to continue growing as the need for fire protection in commercial buildings and industrial facilities becomes increasingly important.

How do company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co. - The company offers intumescent coatings such as Scotchkote SPX 710, Scotchkote SPX 710, Scotchkote SPX 720, and others.

Technavio provides the ranking index for the top 20 companies along with insights on the market positioning of:

- Akzo Nobel NV

- BASF SE

- Carboline

- Contego International Inc.

- Hempel AS

- Hydron Protective Coatings Ltd.

- Isolatek International

- Jotun AS

- No-Burn Inc

- Nullifire

- PPG Industries Inc.

- Promain UK Ltd

- Rudolf Hensel GmbH

- Sika AG

- The Sherwin Williams Co.

- Tor-Coatings

Explore our company rankings and market positioning. Request Free Sample

How can Technavio assist you in making critical decisions?

What is the market structure and year-over-year growth of the Market?

|

Market structure |

Fragmented |

|

YoY growth 2024-2025 |

4.0 |

Market Dynamics

The market has emerged as a significant trend in the fireproofing industry, offering effective fire protection for industrial structures. These coatings, which are light-weight and can be applied as thin films, provide essential passive fire protection, enhancing the safety of buildings and structures. The fireproofing market is witnessing a rise in demand for intumescent coatings due to their ability to resist fire, corrosion, and other environmental hazards. These coatings work by expanding when exposed to high temperatures, forming a protective char that insulates the underlying substrate from the heat. Fireproofing certification is a crucial aspect of the fireproofing industry, ensuring that all fireproofing solutions adhere to stringent safety standards. Intumescent coatings undergo rigorous testing to meet these standards, providing peace of mind for building owners and occupants. Fire retardant and fireproofing materials are essential components of intumescent coatings. These materials enable the coatings to provide superior fire resistance, ensuring that structures remain safe during a fire. The fireproofing industry offers various fireproofing services, including application, inspection, and maintenance, to ensure the effectiveness of these coatings. Fireproofing design plays a vital role in the successful implementation of intumescent coatings.

Proper design considerations, including the type and thickness of the coating, application method, and fire safety engineering principles, are essential to ensure optimal performance. Fireproofing training is crucial for professionals involved in the application, inspection, and maintenance of intumescent coatings. This training ensures that they have the necessary knowledge and skills to implement these coatings effectively and safely. Fireproofing research and technology continue to advance, leading to the development of new and innovative intumescent coatings. Water-based and solvent-based coatings are among the latest offerings in the market, providing additional benefits such as reduced environmental impact and improved application efficiency. Fire safety management is a critical aspect of any industrial building, and intumescent coatings play a significant role in this process. Fire safety audits, inspections, and consulting services are essential to ensure that all fireproofing measures are up to par and that buildings remain compliant with relevant fire safety standards. Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the primary factors driving the market growth?

Expanding research and development facilities is notably driving the market growth. The market is witnessing significant growth due to the increasing demand for fire protection solutions in various industries, particularly in offshore oil & gas exploration and commercial buildings. These coatings provide heat resistant layers that act as an insulation barrier and fireproofing for uncovered steel structures. The market is driven by the expansion of research and development facilities by key players to enhance product capabilities and innovate new fire protection technologies. The use of intumescent coatings is essential for passive fire protection, risk reduction, and fire safety regulations compliance. These coatings come in various forms, including solvent-based, epoxy-based, and water-based, catering to different industry requirements.

Further, intumescent coatings offer aesthetic appeal, water resistance, and durability, making them a preferred choice for construction projects. The market also includes cellulosic and silicone-based intumescent coatings, suitable for marine and concrete structures, respectively. The market is expected to grow further due to the increasing exploration activities, complex shapes in construction, and stringent fire safety regulations. The market also offers opportunities for innovation in low heat intumescent coatings, multicellular charred layer technology, and binder systems for improved heat transfer and performance.

What are the significant trends being witnessed in the market?

Collaboration and partnerships is an emerging trends shaping market growth. The market is experiencing growth due to the increasing demand for advanced fire protection solutions in various industries. Offshore exploration and production activities in the oil & gas sector, as well as commercial building construction, are major drivers for this market. Intumescent coatings provide heat resistant layers, enhancing fire safety and passive fire protection for uncovered steel structures and complex shapes. These coatings can be applied via spray or brush methods and offer fire resistance, insulation, and water resistance. Key players in the market are focusing on strategic collaborations and partnerships to reinforce their positions and expand offerings. The market also caters to tight gas and LNG industries, as well as marine applications, where fire hazard mitigation is crucial.

Regulations and safety concerns continue to influence the market, as fire safety regulations become increasingly stringent. Intumescent coatings provide a cost-effective and efficient solution for maintaining the integrity of building structures and reducing risk in fire-prone environments. Innovations in intumescent coatings, such as cellulosic, silicone, and bio-based green filter coatings, offer improved heat transfer, carbonaceous charring, and water resistance. Overall, the intumescent coatings market is a dynamic and evolving industry, providing essential fire protection solutions for various industries and applications.

What are the major market challenges?

Health concerns associated with intumescent coatings is a significant challenge hindering the market growth. Intumescent coatings play a crucial role in enhancing fire safety for various structures, including commercial buildings and offshore installations. These coatings form heat-resistant layers upon exposure to fire, acting as an insulation barrier and fireproofing solution. Intumescent coatings are available in both solvent-based and water-based formulations, with the former posing health concerns due to the release of volatile organic compounds (VOCs) during application and curing. Exposure to VOCs can lead to respiratory problems, headaches, and dizziness, with prolonged inhalation potentially causing liver damage and cancer. To address these concerns, the market for intumescent coatings is witnessing innovations in the form of low VOC and VOC-free alternatives. Epoxy-based intumescent coatings offer better water resistance and durability compared to their solvent-based counterparts.

Additionally, water-based intumescent coatings are gaining popularity due to their lower environmental impact and improved color retention. Fire safety regulations mandate the use of intumescent coatings in construction projects to ensure passive fire protection and risk reduction. Intumescent coatings are essential for fire hazard mitigation, especially in complex structures such as uncovered steel structures, tight gas processing facilities, and marine structures. The exploration and production sector, including oil & gas and LNG facilities, also heavily rely on intumescent coatings for fire protection during exploration activities and steel fabrication. Intumescent coatings offer aesthetic appeal in addition to their functional benefits.

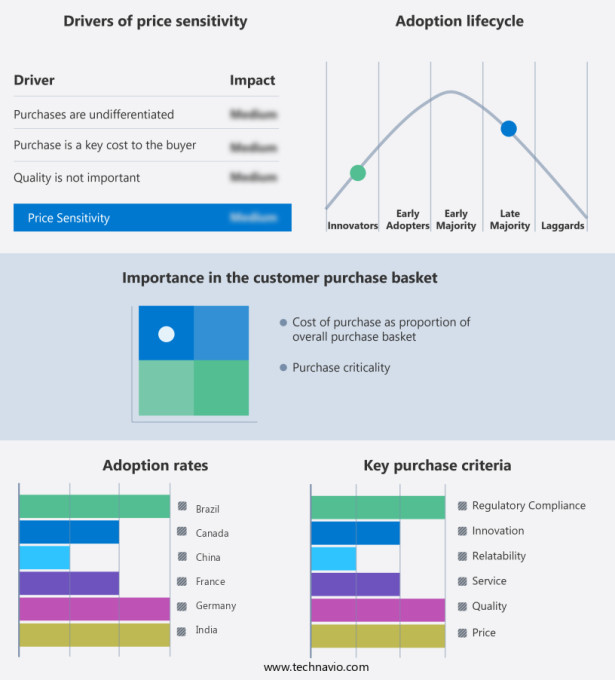

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market research and growth, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

The market have emerged as a crucial component in enhancing fire safety and protection for various industries, particularly in commercial buildings and offshore structures. These protective coatings offer heat resistance and insulation, acting as a vital barrier against fire hazards. The market encompasses a wide range of applications, including reinforcement of heat-resistant layers for steel structures, fireproofing of complex shapes, and passive fire protection for construction projects. The market caters to diverse industries, such as oil & gas, marine, and construction, where fire safety regulations are stringent. Intumescent coatings come in various forms, including solvent-based and water-based, catering to different application requirements. Solvent-based intumescent coatings offer high durability and heat resistance, making them suitable for industrial applications. In contrast, water-based intumescent coatings are more eco-friendly and are gaining popularity in green building practices.

Also, the market also includes epoxy-based coatings, which offer additional benefits such as water resistance and low heat transfer. These coatings are widely used for fire protection solutions in commercial buildings and offshore structures. Intumescent paints, another variant, provide an aesthetic aspect while ensuring fire resistance. The oil & gas industry is a significant consumer of intumescent coatings, particularly for fire protection in exploration activities and fire hazard mitigation in uncovered steel structures. Intumescent coatings play a crucial role in reducing risks associated with oil combustion and ensuring the integrity of LNG tanks. Intumescent coatings are applied using various methods, including spray application and brush application, depending on the specific requirements of the application.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019 - 2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market Growth 2025-2029 |

USD 376.8 million |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 47% |

|

Key countries |

US, China, Germany, Canada, Japan, UK, India, France, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Akzo Nobel NV, BASF SE, Carboline, Contego International Inc., Hempel AS, Hydron Protective Coatings Ltd., Isolatek International, Jotun AS, No-Burn Inc, Nullifire, PPG Industries Inc., Promain UK Ltd, Rudolf Hensel GmbH, Sika AG, The Sherwin Williams Co., and Tor-Coatings |

|

Market Segmentation |

Type (Thin-film and Thick-film), End-user (Construction and infrastructure, Oil and gas, Manufacturing, and Others), and Geography (North America, APAC, Europe, South America, and Middle East and Africa) |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the market forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies