Direct Current (Dc) Motor Market Size 2024-2028

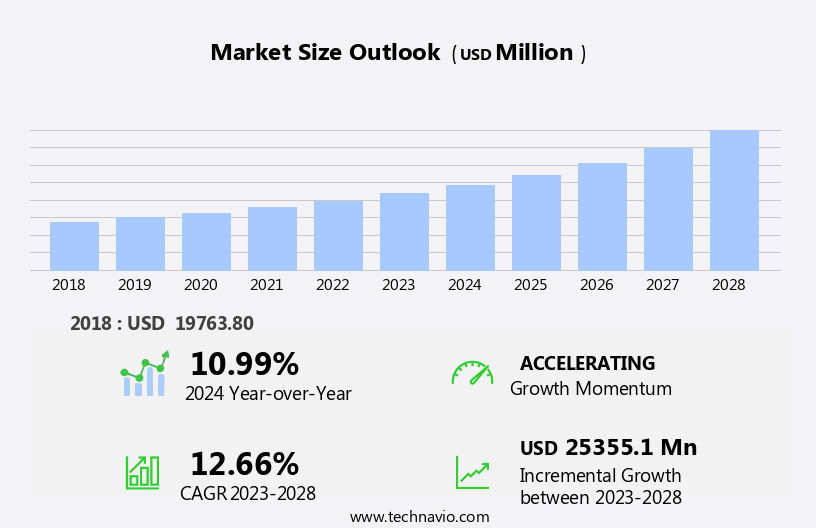

The direct current (dc) motor market size is forecast to increase by USD 25.36 billion at a CAGR of 12.66% between 2023 and 2028.

What will be the Size of the Direct Current (Dc) Motor Market During the Forecast Period?

How is this Direct Current (Dc) Motor Industry segmented and which is the largest segment?

The direct current (dc) motor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Power Output

- Less than 750 W

- 750 W to 375 kW

- More than 375 kW

- Type

- Brushed DC motors

- Brushless DC motors

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Power Output Insights

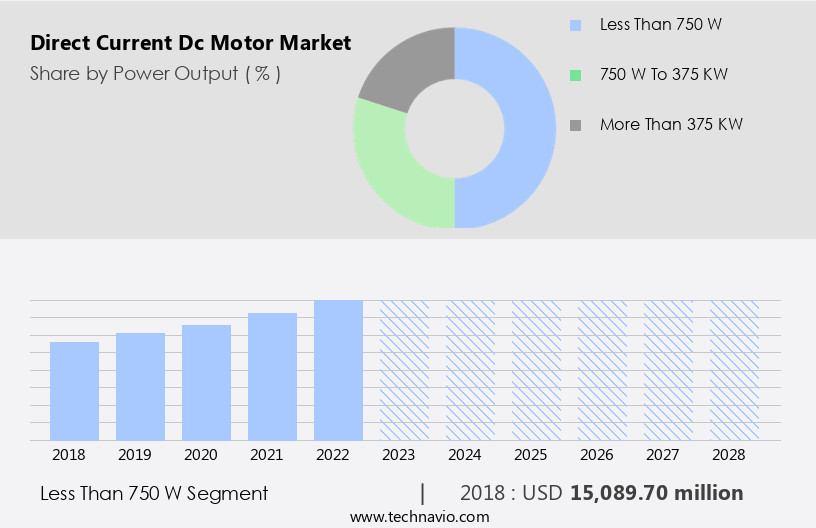

- The less than 750 w segment is estimated to witness significant growth during the forecast period.

DC motors serve various sectors with their power-efficient and dependable performance. For instance, Maxon's RE 450 W DC motor, delivering up to 550 W of power, is a preferred choice in robotics, medical technology, and aerospace industries due to its high torque and compact size. In contrast, Faulhaber's 2232 SR DC motor, with a power rating of up to 460 W, caters to diverse applications, including automation equipment and scientific research instruments. DC motors, such as these, contribute significantly to industries like HVAC, power windows, computer peripherals, discrete industry, and electric vehicles, among others. Additionally, advancements in technology have led to the emergence of energy-efficient motors like BLDC and torque motors, which are increasingly adopted in powertrain systems, chassis, safety fittings, urbanization, lifestyle, electric vehicles, and industrial robots.

The global market for DC motors is experiencing growth due to factors like urbanization, lifestyle changes, and the increasing demand for energy-efficient solutions in consumer electronics, healthcare, automobiles, IoT, artificial intelligence, and various industries. Key applications include appliances, HVAC systems, and variable speed drives in air handling units (AHUs) and electric vehicles. The US government's focus on energy efficiency and the increasing popularity of electric vehicles are expected to further boost the market. However, challenges like overload and harmonic distortion require containment measures, which may impact the market's growth.

Get a glance at the Direct Current (Dc) Motor Industry report of share of various segments Request Free Sample

The Less than 750 W segment was valued at USD 15.09 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

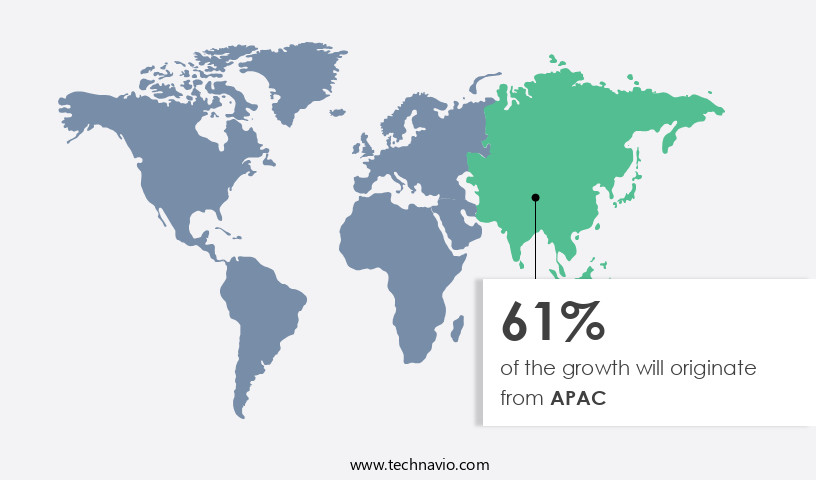

- APAC is estimated to contribute 61% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region is a significant contributor to the global DC motors market, fueled by industrialization, urbanization, and the increasing demand for energy-efficient technologies. DC motors find extensive usage In the APAC manufacturing industry, particularly in machinery applications such as pumps, compressors, and conveyor belts. The region's industrial sectors, including automotive and construction, have experienced rapid growth, leading to increased demand for DC motors. Furthermore, the APAC region's shift towards renewable energy sources, including wind, solar, and hydropower, is driving the adoption of DC motors in power generation systems. Energy-efficient motors, such as Brushless DC (BLDC) and torque motors, are gaining popularity due to their ability to minimize energy losses and improve overall system efficiency.

DC motors are also increasingly used in electric vehicles (EVs) and other applications, including HVAC systems, consumer electronics, industrial robots, and powertrain systems. The APAC market for DC motors is expected to grow significantly due to these trends and the region's expanding economic influence.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Direct Current (Dc) Motor Industry?

Rising factory automation and use of industrial robots is the key driver of the market.

What are the market trends shaping the Direct Current (Dc) Motor Industry?

Development of sensor-less BLDC motor is the upcoming market trend.

What challenges does the Direct Current (Dc) Motor Industry face during its growth?

Excessive heat generation leading to subdued DC motor performance is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The direct current (dc) motor market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the direct current (dc) motor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, direct current (dc) motor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB Ltd. - The DC motor market encompasses various motor types, including DMI DC motors, which deliver consistent power and efficiency. These motors are characterized by their unidirectional flow of electric current, making them suitable for applications requiring precise speed control and high torque. The DC motor market caters to diverse industries, including transportation, renewable energy, and manufacturing, with applications ranging from electric vehicles to industrial machinery. The demand for DC motors is driven by factors such as energy efficiency, reliability, and ease of control. As technology advances, DC motors continue to evolve, offering improved performance and enhanced functionality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Allied Motion Technologies Inc.

- Altra Industrial Motion Corp.

- AMETEK Inc.

- ASSUN MOTOR Pte Ltd.

- ElectroCraft Inc.

- Johnson Electric Holdings Ltd.

- maxon motor AG

- MinebeaMitsumi Inc.

- Mitsubishi Electric Corp.

- Nidec Corp.

- North American Electric Inc.

- OMRON Corp.

- Oriental Motor Co. Ltd.

- Regal Beloit Corp.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Teknic Inc.

- Yaskawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Direct Current (DC) Motors: Market Overview and Trends Direct Current (DC) motors have been a vital component of various industries for decades. These motors convert electrical energy into mechanical energy through the interaction between the motor's magnetic field and current-carrying conductors. DC motors offer several advantages, such as easy speed control, high starting torque, and simple construction. This article provides an in-depth analysis of the DC motor market, focusing on market dynamics and trends. The DC motor market is influenced by several factors, including technological advancements, energy efficiency, and industrial automation. Technological innovations in DC motor designs, such as Brushless DC (BLDC) motors and permanent magnet motors, have gained significant traction due to their energy efficiency and longer operational life.

These motors have found applications in various sectors, including consumer electronics, automobiles, and industrial automation. Energy efficiency is a critical factor driving the growth of the DC motor market. As the global energy economy evolves, there is a growing emphasis on energy-efficient solutions. DC motors offer energy savings compared to traditional AC motors, making them an attractive option for industries looking to reduce their energy consumption. Additionally, the increasing adoption of renewable energy sources and the integration of smart grids are expected to further boost the demand for DC motors. Industrial automation is another significant market for DC motors.

The manufacturing industry relies heavily on automation for efficient production processes. DC motors offer several advantages in industrial automation applications, such as precise speed control, high power density, and easy integration with control systems. The growing trend of Industry 4.0 and the Internet of Things (IoT) is expected to further increase the demand for DC motors in industrial automation. The DC motor market is also influenced by various trends, such as the increasing adoption of electric vehicles (EVs) and the development of variable speed drives. The automotive industry is witnessing a shift towards electric vehicles, which use DC motors for propulsion.

The growing popularity of electric vehicles is expected to drive the demand for DC motors In the automotive sector. Additionally, the development of variable speed drives for DC motors has led to their increased use in HVAC systems, pumps, and fans, among other applications. The DC motor market is subject to several challenges, including overload and harmonic distortion. Overload can cause damage to the motor and reduce its operational life. Harmonic distortion can affect the overall efficiency of the power system and lead to increased energy consumption. To address these challenges, containment measures such as overload protection devices and harmonic filters are being developed and adopted.

In conclusion, the DC motor market is driven by several factors, including technological advancements, energy efficiency, and industrial automation. The market is expected to grow significantly due to the increasing adoption of DC motors in various applications, such as electric vehicles, industrial automation, and HVAC systems. However, challenges such as overload and harmonic distortion need to be addressed to ensure the efficient and reliable operation of DC motors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.66% |

|

Market growth 2024-2028 |

USD 25355.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.99 |

|

Key countries |

China, US, Japan, Germany, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Direct Current (Dc) Motor Market Research and Growth Report?

- CAGR of the Direct Current (Dc) Motor industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the direct current (dc) motor market growth of industry companies

We can help! Our analysts can customize this direct current (dc) motor market research report to meet your requirements.