Isophorone Market Size 2025-2029

The isophorone market size is forecast to increase by USD 414.7 million at a CAGR of 5.1% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for high-performance coatings in various industries. Isophorone is a versatile chemical used in the production of these coatings, which offer superior properties such as heat resistance, industrial coating , chemical resistance, and excellent adhesion. This trend is expected to continue, as the demand for durable and long-lasting coatings increases. Another key driver for the market is the shift toward renewable isophorone-based products. Traditional isophorone production relies on non-renewable resources, but the development and adoption of renewable alternatives is gaining momentum. This not only addresses environmental concerns but also offers cost advantages and potential regulatory compliance.

- However, the market also faces challenges. Stringent environmental regulations, particularly in Europe, are driving up production costs due to the need for more expensive, compliant processes. Additionally, the market is subject to price volatility due to the dependence on raw materials derived from non-renewable sources. Companies operating in the market must navigate these challenges to effectively capitalize on the growth opportunities presented by the increasing demand for high-performance coatings and the shift toward renewable alternatives.

What will be the Size of the Isophorone Market during the forecast period?

- Isophorone, a versatile organic compound, plays a significant role in various industries due to its unique properties and applications. The market encompasses a broad spectrum of products, including plastics, inks, paints, coatings, specifications, polymers, adhesives, technology, additives, production intermediates, and solvents. These entities are intricately linked, with each segment influencing and being influenced by the others. Isophorone plastics, for instance, offer superior thermal stability and chemical resistance, making them ideal for automotive and electrical applications. In the ink sector, isophorone contributes to high-performance inks, ensuring vibrant colors and excellent print quality. Isophorone paints and coatings provide excellent adhesion and durability, while isophorone specifications ensure compliance with industry standards.

- The isophorone industry continues to evolve, with ongoing research and development efforts aimed at enhancing the performance and sustainability of isophorone-based products. Isophorone polymers, for example, are being developed for use in biodegradable polymer plastics, addressing the growing demand for eco-friendly alternatives. Isophorone adhesives are being researched for their potential use in renewable energy applications, such as solar panels and wind turbines. Isophorone technology is at the forefront of these advancements, with innovations in catalysts, formulation, and synthesis methods driving the development of new applications. The market is a dynamic and interconnected web of entities, with each segment influencing and being influenced by the others, ensuring a continuous and evolving market landscape.

How is this Isophorone Industry segmented?

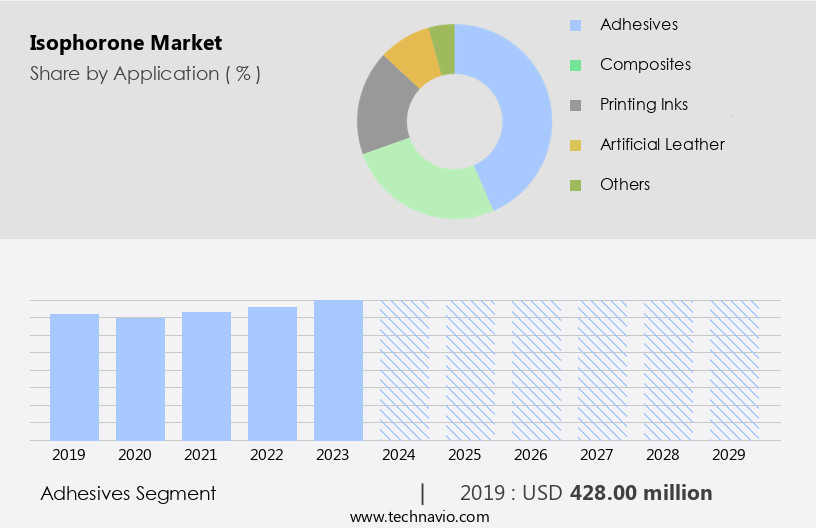

The isophorone industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Adhesives

- Composites

- Printing inks

- Artificial leather

- Others

- Grade Type

- Industrial grade

- Reagent grade

- Lab grade

- Distribution Channel

- Direct Sales

- Distributors

- Online Platforms

- Type

- Liquid Isophorone

- Solid Isophorone

- End-User

- Construction

- Automotive

- Agrochemicals

- Healthcare

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The adhesives segment is estimated to witness significant growth during the forecast period.

Isophorone is a versatile chemical compound that significantly contributes to various industries, including adhesives and sealants. Its applications span across sectors such as construction, automotive, aerospace, packaging, and electronics. Isophorone-based adhesives exhibit unique properties, making them desirable for applications requiring durability and reliability. Their high thermal and chemical resistance sets them apart, enabling their use in extreme environments where other adhesives may falter. In industries like automotive and aerospace, isophorone adhesives are employed to bond materials with exceptional strength and durability. These adhesives can withstand high temperatures and exposure to harsh chemicals, ensuring the longevity and safety of critical components.

The isophorone industry encompasses the production of isophorone intermediates, solvents, resins, polymers, and additives. Isophorone synthesis is a critical process in the industry, with various catalysts and precursors employed to produce isophorone ketone. The market is driven by its diverse applications, including isophorone inks, paints, coatings, varnishes, and dyes. Isophorone derivatives, such as methyl isophorone, isophorone alcohol, and isophorone diisocyanate, are also integral to the industry. The isophorone industry adheres to stringent regulations and standards to ensure safety, sustainability, and compliance. Isophorone's role in various industries continues to evolve, with ongoing research and development focusing on improving its properties, pricing, and applications.

The Adhesives segment was valued at USD 428.00 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, fueled by the automotive, aerospace, and construction industries. The US, Canada, and Mexico are the primary contributors to this market, with a strong focus on high-performance and eco-friendly solutions. The automotive industry is a major driver, with leading manufacturers such as Ford, General Motors, and Tesla utilizing isophorone plastics, inks, paints, coatings, and adhesives in their production processes. In 2023, automotive production in the region increased by approximately 12%, leading to a surge in demand for isophorone-based products. The aerospace industry also plays a crucial role, using isophorone polymers, resins, and additives in the production of aircraft components.

The construction sector employs isophorone coatings, varnishes, and sealants for various applications. The isophorone industry in North America is continually innovating, with research and development efforts focused on improving the sustainability and safety of isophorone products. Regulations and standards, such as those related to isophorone ketone and isophorone solvents, are strictly enforced to ensure compliance. The market in North America is expected to continue its growth trajectory, driven by the industrial gases landscape and economic activities in the region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing steady growth, fueled by its versatile applications across coatings, adhesives, construction, and specialty chemicals. Isophorone solvent for protective coatings is widely used for its excellent penetration and durability, especially in industrial and marine environments. Rising environmental awareness is driving demand for bio-based isophorone for adhesives and low-VOC isophorone for printing inks, reducing emissions and enhancing sustainability. Isophorone diisocyanate for polyurethanes is essential in flexible foams, elastomers, and coatings, while eco-friendly isophorone for agrochemicals supports safer, more sustainable farming. The pharmaceutical sector benefits from high-purity isophorone for pharmaceuticals in API synthesis. Automotive and construction sectors are adopting green isophorone for automotive refinishing and sustainable isophorone for construction, respectively. Meanwhile, isophorone diamine for composite materials and energy-efficient isophorone production reflect the market's shift toward high-performance, eco-conscious solutions.

The advancing through innovation and environmental responsibility. Bio-based isophorone is gaining traction as industries seek renewable alternatives to petrochemical solvents. Demand for low-VOC solvents continues to grow, especially in coatings and inks, aligning with stricter environmental regulations. High-purity isophorone supports pharmaceutical and electronic applications requiring precision and safety. Innovations in eco-friendly synthesis and energy-efficient production are reducing the environmental footprint of manufacturing. The market is also exploring recyclable intermediates to enhance circularity. Use of smart catalysts is improving yield and reducing waste. In end-use sectors, green coating additives, sustainable adhesives, and advanced polymer blends highlight isophorone's role in creating high-performance, eco-conscious materials, making it a vital component in future-focused chemical and material industries.

What are the key market drivers leading to the rise in the adoption of Isophorone Industry?

- The surge in demand for high-performance coatings serves as the primary market driver, as industries continue to seek advanced protective coating and decorative solutions for their products.

- The market is experiencing significant growth due to the increasing demand for high-performance coatings, particularly in industries such as automotive, aerospace, construction, and marine. Isophorone-based coatings, including polyurethane and epoxy, offer superior chemical resistance, durability, and mechanical strength, making them indispensable for applications where traditional coatings may fail under extreme conditions. In the automotive sector, isophorone-based coatings are extensively used for vehicle exteriors, interiors, and under-the-hood components to enhance durability, corrosion resistance, and aesthetics. With the rising production of electric vehicles (EVs) and the increasing use of lightweight materials, the need for advanced coatings with heat and chemical resistance is escalating.

- Isophorone derivatives, such as methyl isophorone, serve as essential precursors in the production of these high-performance coatings. Isophorone safety regulations are stringently enforced to ensure the safe handling, storage, and transportation of this chemical. Isophorone composites material, formulated with isophorone alcohol and catalysts, provide excellent adhesion, UV resistance, and weatherability, making them a preferred choice for various industries. The global market for isophorone is expected to continue its growth trajectory due to the increasing demand for high-performance coatings and the continuous development of new applications.

What are the market trends shaping the Isophorone Industry?

- The trend in the market is moving towards the production and adoption of isophorone-based products derived from renewable sources. The market is experiencing a notable shift towards sustainable isophorone-based products, driven by the growing emphasis on sustainability and environmental responsibility. This trend gained momentum on March 1, 2022, when Evonik introduced the world's first sustainable isophorone-based products, derived entirely from renewable acetone. This groundbreaking launch marks a significant milestone in the chemical industry, underscoring the potential of renewable raw materials to replace traditional petrochemical sources. Evonik's expansion of its isophorone portfolio with the introduction of the eCO series under its Crosslinkers brand on March 1, 2022, further underscores this trend. The eCO series includes VESTASOL IP eCO (isophorone), VESTAMIN IPD eCO (isophorone diamine), and VESTANAT IPDI eCO (isophorone diisocyanate).

- These innovative products offer the same high-performance properties as traditional isophorone-based products but with the added benefit of being fully renewable. Isophorone's unique properties, including its high reactivity and resistance to heat, make it an ideal choice for various applications, including sealants, resins, and dyes. The demand for isophorone-based products continues to grow due to their excellent performance and versatility. Producers and consumers alike are increasingly seeking out isophorone products that meet the highest compliance standards, ensuring a responsible and sustainable supply chain. Handling and processing isophorone requires careful attention due to its reactive nature. Research and development efforts are ongoing to improve handling methods and reduce the environmental impact of isophorone production.

- As the market for isophorone continues to evolve, stakeholders can expect new innovations and advancements that will further enhance the value and sustainability of this versatile chemical.

What challenges does the Isophorone Industry face during its growth?

- Strict environmental regulations pose a significant challenge to the industry's growth. Adhering to these regulations adds to the operational costs and complexities, requiring continuous investment in research and development to meet evolving standards.

- The market is subject to regulatory challenges due to the classification of isophorone as a volatile organic compound (VOC). Strict regulations imposed by authorities such as the US Environmental Protection Agency (EPA), European Chemicals Agency (ECHA), and China's Ministry of Ecology and Environment (MEE) limit VOC emissions and mandate cleaner production processes. Isophorone, used in plastics, inks, paints, coatings, polymers, adhesives, technology, and additives, is a significant contributor to air pollution and potential health risks.

- Compliance with these regulations often involves high costs for manufacturers, posing challenges to market growth. Despite these hurdles, the isophorone industry continues to innovate, developing new technologies and production methods to meet evolving regulatory requirements and customer demands.

Exclusive Customer Landscape

The isophorone market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the isophorone market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, isophorone market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arkema S.A. - Isophorone is a versatile chemical compound with wide applications in numerous industries. These industries include agrochemicals, fine chemistry, coatings, inks, epoxy systems, and isocyanates. Isophorone's unique properties make it an essential ingredient in various products and processes. In the agrochemical sector, it serves as an intermediate in the production of pesticides and herbicides.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arkema S.A.

- BASF SE

- Bayer AG

- CHT Group

- Covestro AG

- Dow Chemical

- Eastman Chemical

- Evonik Industries

- Huntsman Corporation

- INEOS Group

- KH Chemicals

- LyondellBasell

- Mitsubishi Chemical

- Mitsui Chemicals

- Perstorp

- Prasol Chemicals

- SI Group

- Solvay

- Vencorex

- Wanhua Chemical

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Isophorone Market

- In February 2024, BASF SE, a leading global chemical producer, announced the expansion of its isophorone production capacity at its Ludwigshafen site in Germany. This expansion aimed to cater to the growing demand for isophorone and its derivatives in various industries, including coatings, adhesives, and specialty chemicals (BASF Press Release, 2024).

- In October 2025, DuPont de Nemours, Inc. And Corbion NV entered into a strategic collaboration to develop and commercialize bio-based isophorone and its derivatives. This partnership combined DuPont's expertise in chemical manufacturing and Corbion's knowledge in biotechnology to create more sustainable isophorone production methods (DuPont Press Release, 2025).

- In March 2024, INEOS Styrolution, the world's leading styrenics supplier, and SABIC, a global chemicals manufacturer, joined forces to construct a new production facility for isophorone and its derivatives in the United States. This joint venture aimed to enhance their market presence and cater to the increasing demand for these chemicals in the North American market (INEOS Styrolution Press Release, 2024).

- In July 2025, the European Chemicals Agency (ECHA) approved the renewal of the registration of isophorone under the European Union's REACH regulation. This approval ensured the continued use of isophorone and its derivatives in various applications while adhering to the stringent environmental, health, and safety standards set by the EU (ECHA Press Release, 2025).

Research Analyst Overview

The market encompasses a range of applications for isophorone monomer, isophorone oligomer, and isophorone polymers. Isophorone's flexibility in polymerization and crosslinking processes makes it a versatile choice for various industries. The competitive landscape of the market is shaped by factors such as isophorone's viscosity, toxicity, and flammability. Isophorone's biodegradability and environmental impact are increasingly important considerations in the industry. Isophorone's high performance and durability contribute to its growth potential. Isophorone alternatives, such as those derived from renewable sources, are gaining attention due to their potential to reduce isophorone's volatility and improve transparency. Isophorone's resistance to chemicals and temperature, along with its color stability, are key selling points.

The market analysis indicates a steady increase in demand for isophorone due to its use in adhesives, coatings, and resins. The market forecast projects continued growth, driven by advancements in isophorone's curing technology and increasing awareness of its environmental benefits. Isophorone's density and resistance to moisture and heat further expand its applications. The isophorone industry trends reflect a focus on improving isophorone's sustainability and reducing its production costs. Isophorone's recycling and reuse are also gaining traction as a means to enhance its market size and reduce its environmental footprint.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Isophorone Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 414.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Isophorone Market Research and Growth Report?

- CAGR of the Isophorone industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the isophorone market growth of industry companies

We can help! Our analysts can customize this isophorone market research report to meet your requirements.