Jet Bridge Market Size 2025-2029

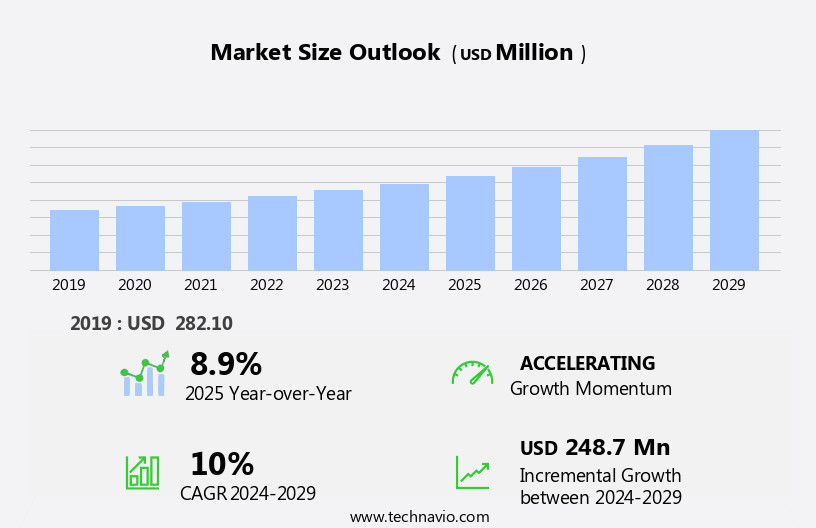

The jet bridge market size is forecast to increase by USD 248.7 million, at a CAGR of 10% between 2024 and 2029.

- The market is experiencing significant growth, driven by the steady increase in air travel and passenger volumes. This trend is expected to continue, as the aviation industry continues to expand and meet the rising demand for efficient and convenient airport infrastructure. Another key driver in the market is the increasing adoption of automated jet bridges, which offer numerous advantages such as faster turnaround times, improved safety, and reduced operational costs. However, the long product lifecycle of jet bridges poses a challenge for market growth, as replacement cycles are lengthy and investments in new technology can be costly.

- Companies seeking to capitalize on market opportunities must stay informed of the latest trends and technologies, while also navigating the challenges presented by the long product lifecycle. Effective operational planning and strategic investments in automation and innovation will be crucial for success in the market.

What will be the Size of the Jet Bridge Market during the forecast period?

The market is characterized by continuous evolution and dynamism, with ongoing unfolding of market activities and evolving patterns. Airport gates serve as crucial infrastructure, linking aircraft to terminal buildings, and the maintenance costs associated with these structures are a significant consideration. Safety regulations, a key aspect of airport operations, necessitate regular bridge inspections and upgrades to ensure passenger safety and compliance with international standards. The bridge lifecycle encompasses design, installation, operation, maintenance, and eventual replacement, with each stage presenting unique challenges and opportunities for innovation. Airport logistics and structural engineering play integral roles in optimizing bridge performance and enhancing passenger experience, while data analytics and bridge monitoring enable real-time insights into bridge health and operational efficiency.

Civil engineering advances, such as energy efficiency, bridge automation, and technology integration, are transforming the jet bridge landscape. Bridge operation and bridge safety are paramount concerns, with material handling and bridge components requiring constant attention to ensure optimal throughput and minimal downtime. Accessibility features, passenger flow, and passenger boarding bridges cater to diverse passenger needs and preferences. Telescopic bridges, aircraft boarding bridges, and air bridge systems are integral components of airport infrastructure, with design considerations ranging from aircraft types to operational efficiency and passenger flow. Bridge control systems, hydraulic systems, and electric motors are essential elements of bridge functionality, while bridge installation and bridge infrastructure development continue to shape the market.

Beyond safety and operational efficiency, environmental impact and bridge security are increasingly important considerations in the market. Gate equipment and gate capacity are essential factors in managing airport operations, while airport operations and passenger flow are influenced by bridge design and accessibility features. Throughput optimization and baggage handling are critical aspects of airport logistics, with bridge maintenance and cost optimization essential for long-term sustainability.

How is this Jet Bridge Industry segmented?

The jet bridge industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Electro-mechanical

- Hydraulic

- Product

- Apron drive bridge

- Nose-loader bridge

- Dual jet bridge

- Others

- End-user

- Commercial airports

- Military airports

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Technology Insights

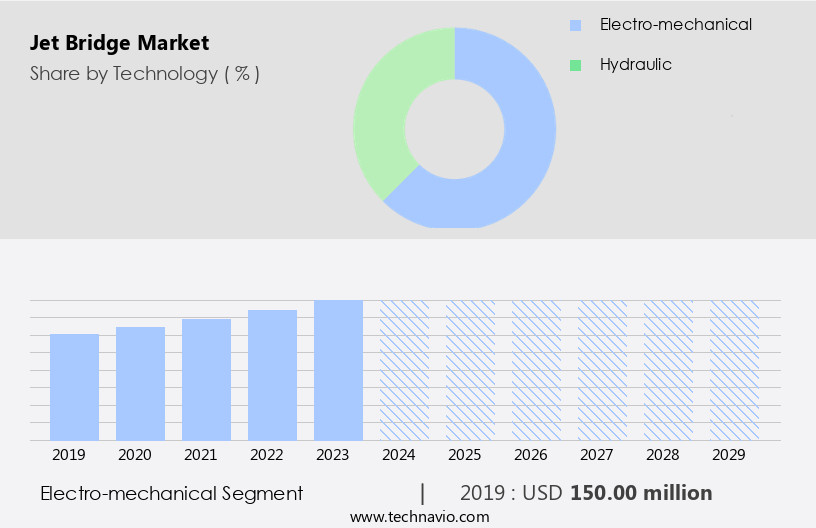

The electro-mechanical segment is estimated to witness significant growth during the forecast period.

The electro-mechanical segment dominates the market, offering a comprehensive solution for efficient passenger boarding and disembarkation. These bridges integrate electrical and mechanical systems, ensuring a seamless connection between the terminal and aircraft. Safety and smooth passenger transitions are prioritized through advanced engineering and adaptability to various aircraft types and sizes. Electro-mechanical jet bridges promote operational efficiency, energy efficiency, and accessibility features, aligning with international safety regulations and airport operations. Through data analytics and bridge monitoring, maintenance costs are optimized, and bridge components are replaced during their lifecycle. Bridge automation and technology integration enhance the passenger experience, while bridge control systems facilitate bridge installation and operation.

Hydraulic and electric motors power these bridges, enabling telescopic extensions and adjustments to accommodate different aircraft types. Bridge infrastructure, including passenger conveyor systems and baggage handling, is streamlined for optimal throughput. Bridge security and environmental impact are addressed through robust design and material handling systems. Overall, the electro-mechanical segment's versatility and adaptability make it an essential component of modern airport logistics.

The Electro-mechanical segment was valued at USD 150.00 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 58% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth and innovation, fueled by the increasing demand for efficient and advanced airport infrastructure. Jet bridges play a crucial role in facilitating smooth passenger boarding and disembarkation processes, particularly in the high-traffic North American aviation market. Airports are under pressure to optimize operations and enhance the passenger experience, leading to a surge in demand for technologically advanced jet bridges. These structures must accommodate various aircraft types while minimizing time and space utilization. Safety regulations and bridge lifecycle considerations are also key factors influencing the market. Structural engineering and data analytics are essential in ensuring bridge safety and operational efficiency.

Energy efficiency and bridge automation are also important trends, as airports strive to reduce environmental impact and streamline operations. Bridge integration and bridge operation systems, including bridge monitoring and control panels, are also critical components of modern jet bridge systems. Throughput optimization, baggage handling, and bridge security are additional considerations for airport operations. Civil engineering and aeronautical engineering expertise are necessary for bridge design and installation, while international standards ensure consistency and safety. Hydraulic and electric motor systems power the bridge components, including passenger conveyor systems and aircraft boarding bridges. Telescopic bridges offer flexibility in accommodating different aircraft sizes, further enhancing operational efficiency.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Jet Bridge Industry?

- The consistent growth in air travel, as evidenced by increasing passenger volumes, serves as the primary market driver.

- The market has witnessed significant growth due to the increasing air travel and passenger volumes worldwide. Factors such as globalization, economic growth, and enhanced connectivity have driven this trend. In 2024, global passenger traffic reached an all-time high of 8.7 billion, marking a 30.6% increase from 2022 and approaching 95% of pre-pandemic levels. Airports are responding to this surge by investing in efficient infrastructure, including jet bridges. These structures bridge the gap between the aircraft and terminal, facilitating seamless passenger flow and reducing the need for external buses.

- They offer numerous advantages, including improved baggage handling, increased gate capacity, and enhanced accessibility features. Moreover, telescopic bridges can be adjusted to fit various aircraft sizes, ensuring operational efficiency. Aeronautical engineering and advanced control panels enable jet bridges to operate smoothly and safely, prioritizing both passenger comfort and security.

What are the market trends shaping the Jet Bridge Industry?

- The trend in the aviation industry is toward greater adoption of automated jet bridges. This modernization not only enhances efficiency but also improves passenger experience.

- Automated jet bridges are gaining significant traction in the international aviation industry due to their ability to enhance operational efficiency and enhance the passenger experience. Equipped with advanced sensors, cameras, and control systems, these systems enable precise docking and alignment with aircraft, thereby reducing turnaround times and streamlining the boarding and disembarking process. The integration of automation technology in jet bridges also minimizes human error and allows for remote control of operations from a central control room. For instance, Gatwick Airport in the UK initiated a trial of smart stands in December 2024, which enables remote control of aircraft docking and jet bridge operations, eliminating the need for on-site personnel during disembarkation.

- Overall, the adoption of automated jet bridges is a harmonious blend of technology and aviation, emphasizing the importance of innovation and efficiency in the aviation sector.

What challenges does the Jet Bridge Industry face during its growth?

- The prolonged product lifecycle of jet bridges poses a significant challenge to the growth of the industry. Jet bridges, which bridge the gap between the aircraft and the terminal, have a longer lifespan compared to other airport infrastructure. This prolonged lifecycle can hinder the adoption of new technologies and innovations, limiting the industry's ability to evolve and expand efficiently. Consequently, addressing the challenge of updating and replacing jet bridges in a timely and cost-effective manner is crucial for the continued growth and progression of the airport industry.

- Jet bridges are essential airport infrastructure, linking aircraft to terminals in a safe and efficient manner. Due to their intricate design and substantial size, jet bridges have extended lifespans, often serving airports for decades. However, this lengthy product lifecycle presents challenges for manufacturers and suppliers in The market. Safety regulations mandate regular maintenance to ensure jet bridges remain operational and compliant. Structural engineering and data analytics play significant roles in optimizing bridge maintenance and extending their service life. Airport logistics are also impacted, as jet bridges must accommodate varying aircraft sizes and configurations. Cost optimization is a critical consideration for airport operations, and jet bridge manufacturers face pressure to provide cost-effective solutions.

- Civil engineering advancements, such as modular designs and lightweight materials, can help reduce maintenance costs and improve overall efficiency. Despite the challenges, the market continues to evolve, with innovations in bridge design and technology driving growth. Manufacturers and suppliers must stay abreast of these advancements to meet the evolving needs of airports and airlines. In conclusion, jet bridges are vital components of airport infrastructure, requiring ongoing maintenance and investment to ensure safety and efficiency. The long product lifecycle presents challenges for manufacturers and suppliers, but also offers opportunities for innovation and cost optimization. By focusing on safety, maintenance, and cost-effectiveness, The market will continue to serve the needs of the aviation industry.

Exclusive Customer Landscape

The jet bridge market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the jet bridge market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, jet bridge market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ADELTE Group SL - The company specializes in supplying jet bridges, including T bridges and Commuter bridges, enhancing airport efficiency and passenger experience. These bridges facilitate seamless boarding and disembarkation processes, bridging the gap between aircraft and terminal. Engineered for durability and functionality, they optimize turnaround times and contribute to overall airport productivity.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADELTE Group SL

- ALPHA CIM

- Avicorp Middle East

- Aviramp Ltd.

- China International Marine Containers Group Ltd.

- East Island Aviation Services Inc.

- ElectroAir Ground Power Units

- FMT Aircraft Gate Support Systems AB

- HUBNER GmbH and Co. KG

- Inox Tech group

- John Bean Technologies Corp.

- Mitsubishi Heavy Industries Ltd.

- Oshkosh AeroTech

- Oversys LLC

- PT Bukaka Teknik Utama Tbk

- Seawing PBB US Inc.

- ShinMaywa Industries Ltd.

- TK Elevator GmbH

- UBS airport system

- vataple group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Jet Bridge Market

- In March 2023, Airbus and Safran signed a Memorandum of Understanding (MoU) to collaborate on the development and production of electrically-heated jet bridges, aiming to reduce the environmental impact of ground handling operations at airports

- In July 2024, Jetway Systems, a leading jet bridge manufacturer, announced the launch of its new electrically-powered jet bridge model, the JET-E, which is expected to reduce airport carbon emissions by up to 90% compared to traditional jet bridges

- In November 2024, Collins Aerospace, a subsidiary of Raytheon Technologies, secured a contract worth over USD100 million from the U.S. Federal Aviation Administration (FAA) to manufacture and deliver 25 new jet bridges to various airports across the United States

- In February 2025, the European Union Aviation Safety Agency (EASA) approved the use of hydrogen fuel cells as a power source for jet bridges, paving the way for a significant shift towards more sustainable ground handling solutions

Research Analyst Overview

- The market encompasses various solutions designed to enhance airport infrastructure, including modular construction for airport expansion, real-time monitoring systems for terminal operations, and queue management solutions. Retrofit solutions cater to the upgrading of existing bridges to meet accessibility standards and incorporate passenger safety systems. Airport security remains a critical focus, with the integration of biometric identification and advanced security screening technologies. Seismic design and wind load considerations are essential in bridge engineering, while finite element analysis and stress analysis ensure structural integrity. Aircraft ground handling and air traffic management require low-emission systems and bridge automation for efficient operations. Sustainable design and terminal design are increasingly important trends, with a focus on bridge replacement and upgrading using engineering simulation and remote control technologies.

- Passenger flow optimization and airport infrastructure development continue to drive market growth, with a priority on passenger safety and airport security. Ground support equipment and airport infrastructure investments remain significant, as airports strive to improve passenger experience and operational efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Jet Bridge Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10% |

|

Market growth 2025-2029 |

USD 248.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.9 |

|

Key countries |

US, Canada, Germany, UK, China, France, Italy, The Netherlands, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Jet Bridge Market Research and Growth Report?

- CAGR of the Jet Bridge industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the jet bridge market growth of industry companies

We can help! Our analysts can customize this jet bridge market research report to meet your requirements.