Knitting And Crochet Market Size 2025-2029

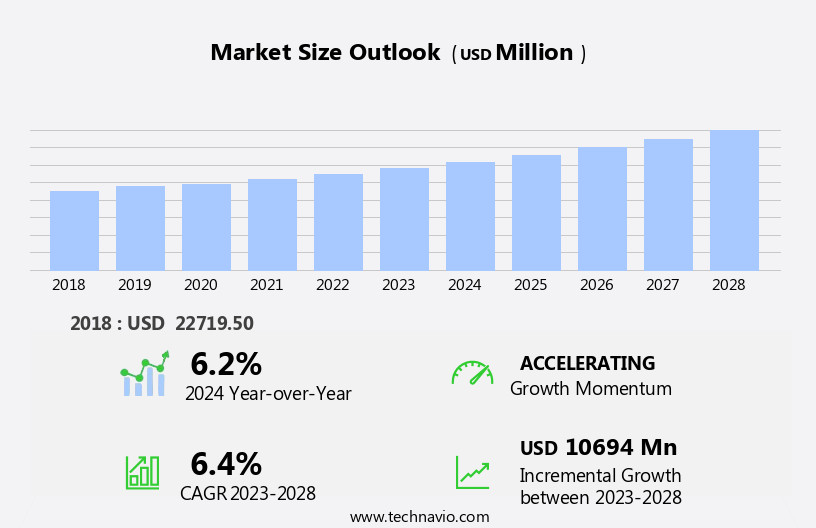

The knitting and crochet market size is forecast to increase by USD 12.28 billion, at a CAGR of 6.9% between 2024 and 2029.

- The market is characterized by ongoing initiatives for training and employment opportunities, driving growth in the sector. These initiatives are fostering a skilled workforce, enabling the production of high-quality knitted and crocheted goods. Innovations in large knitting machines continue to shape the market, with advancements in technology leading to increased efficiency and versatility. These developments are allowing manufacturers to cater to diverse consumer preferences and expand their product offerings. However, the textile industry faces significant challenges, including increasing competition from low-cost producers and the rising cost of raw materials.

- Additionally, shifting consumer trends towards sustainable and eco-friendly textiles pose a threat to traditional knitting and crochet manufacturing methods. Companies must navigate these challenges by focusing on innovation, cost reduction, and sustainability to remain competitive in the market. By embracing technological advancements and adapting to evolving consumer preferences, market participants can capitalize on opportunities and effectively address industry challenges.

What will be the Size of the Knitting And Crochet Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic trends shaping its landscape. Crochet hooks, an essential tool for creating intricate stitches, are increasingly being made from eco-friendly materials like bamboo and recycled plastics. Crocheted fabrics, once limited to table runners and doilies, now find applications in home office settings, fashion, and even activewear. Digital innovation is transforming the market, with tutorial videos and online shopping platforms making learning new stitches and purchasing supplies more accessible. Younger generations are embracing mindful crafting, leading to a surge in demand for delicate fabrics and handmade accessories. Ecological materials and recycled yarns are gaining popularity, reflecting a growing consciousness towards sustainability.

The learning curve for mastering stitches like purl and yarn over remains a challenge, but the mental health benefits of knitting and crochet make the effort worthwhile. Knitting machines and looms offer mass production solutions, while knitted fabrics in various textures and colors cater to diverse design preferences. The market is a vibrant and continuously unfolding ecosystem, where traditional techniques meet digital innovation and eco-consciousness.

How is this Knitting And Crochet Industry segmented?

The knitting and crochet industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Apparel

- Home textile

- Industrial

- Others

- Distribution Channel

- Online

- Offline

- Material

- Natural fibers

- Synthetic fibers

- Blended fibers

- Organic materials

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

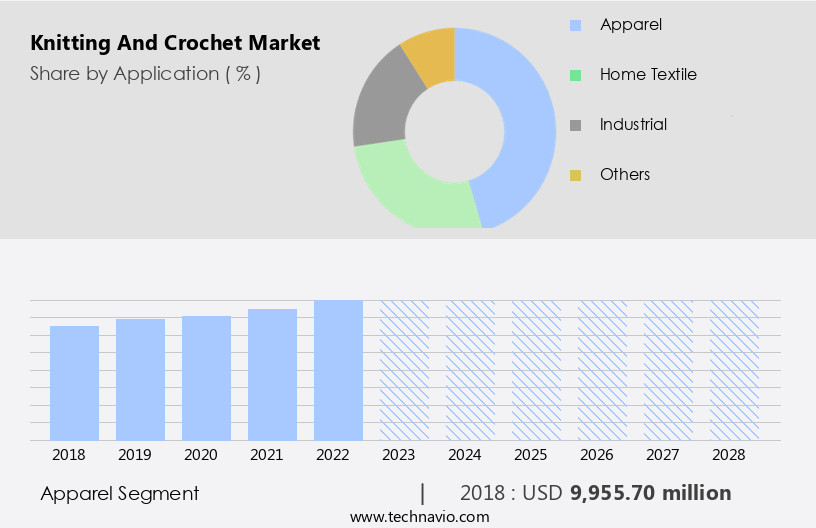

The apparel segment is estimated to witness significant growth during the forecast period.

The market showcases a vibrant apparel segment, featuring a rich assortment of garments for men, women, and children. These garments are produced using a variety of materials, including conventional and organic cotton, cotton blends, and fair-trade cotton. The segment includes categories such as casual wear, sportswear, activewear, sleepwear, and workwear, each tailored to address distinct consumer requirements and tastes. Digital innovation plays a pivotal role in the market, with e-commerce platforms facilitating online shopping for crochet sock patterns, finished products, and table runners. Younger generations are embracing the art of crochet and knitting, leading to a surge in demand for handmade accessories and mindfully crafted items.

Delicate fabrics like crocheted and knitted fabrics, bamboo yarns, and ecological materials are gaining popularity due to their sustainability and eco-friendliness. Fixing mistakes is an integral part of the crafting process, with tutorial videos and social networks offering valuable resources for learners. Knitting looms, knitting needles, and crochet hooks are essential tools for creating intricate designs, while color and design variations add to the market's appeal. The use of recycled yarns and organic yarns further caters to the growing consumer preference for eco-conscious products. The learning curve for knitting and crochet is manageable, offering mental health benefits and serving as a DIY craft for leisure time activities.

The market's growth is fueled by the increasing demand for customized, high-quality garments and the convenience of shopping online. The market is a harmonious blend of tradition and innovation, striking a chord with consumers seeking unique, handmade creations.

The Apparel segment was valued at USD 10.55 billion in 2019 and showed a gradual increase during the forecast period.

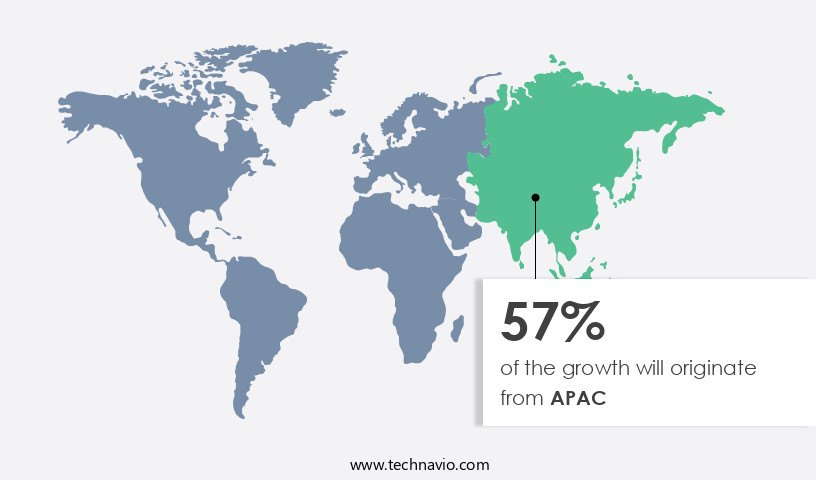

Regional Analysis

APAC is estimated to contribute 58% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market experiences significant activity and evolving trends, with e-commerce platforms playing a crucial role in its growth. Younger generations are rediscovering the art of crochet and knitting, leading to a surge in demand for crochet sock patterns, finished products, and handmade accessories. Digital innovation has made learning through tutorial videos and social networks more accessible, reducing the learning curve for beginners. Crocheted fabric, including delicate fabrics and table runners, is gaining popularity for its versatility and mindful crafting appeal. Fixing mistakes is made easier with single crochet and active yarn loops, while knitting looms and knitting machines cater to those seeking larger projects.

Color and design continue to influence consumer preferences, with organic cotton, bamboo yarns, and recycled yarns becoming increasingly popular due to their ecological benefits. Mental health benefits and DIY crafts have further fueled the market's growth. Crochet hooks and knitting needles are essential tools for creating intricate designs, while the purl stitch adds texture and dimension to projects.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Nestled within the vast realm of crafting, the market boasts a rich tapestry of creativity and innovation. Artisans worldwide weave intricate designs using yarn and needles, crafting everything from cozy sweaters and blankets to stylish scarves and hats. Sustainable materials, such as organic cotton and wool, are increasingly popular choices, reflecting consumers' growing concern for the environment. Meanwhile, technology intertwines with tradition, as digital patterns and online communities expand the reach of these time-honored crafts. Trends like texture, colorwork, and geometric designs add depth and excitement to this vibrant market, while educational resources and workshops foster continuous learning and growth. The market is a thriving, inclusive community where artistry, sustainability, and technology harmoniously coexist.

What are the key market drivers leading to the rise in the adoption of Knitting And Crochet Industry?

- The initiative for providing training and employment opportunities is a significant market driver, fostering growth and development within the workforce.

- The market is experiencing growth due to the increasing popularity of mindful crafting as a means for personal development and community engagement. One notable initiative, launched in September 2023, is a partnership between Ability Fair Trade Village (AFTV) and the Global Envirotech Initiative (GEI), which offers training programs in knitting and crochet to marginalized communities. This collaboration, in conjunction with Cambodia Knits (CK), empowers women by teaching them these skills, enabling them to create sustainable livelihoods for their families. In July and August 2023, 40 women from two villages received scholarships to participate in a comprehensive 16-day training course.

- This program not only enhances their hand-eye coordination but also provides them with the ability to create unique, colorful, and intricately designed pieces using single crochet and active yarn loops. The market continues to thrive as more individuals seek out these crafting techniques for their therapeutic and creative benefits.

What are the market trends shaping the Knitting And Crochet Industry?

- The trend in the knitting machine industry is marked by continuous innovations. The market is experiencing notable progressions, fueled by technological innovations and a growing emphasis on sustainability. At the recent ITMA event in Milan, Italy, in 2023, over 110,000 international attendees convened, underscoring the industry's dynamic growth and innovation. A significant trend is the adoption of advanced, eco-friendly materials, resulting in the production of technical textiles with a wide range of functionalities in various sectors, including fashion, sports, architecture, defense, and healthcare. Robotics and artificial intelligence (AI) are playing pivotal roles in automating knitted textiles, while 3D digitization is revolutionizing supply chains. The early implementation of AI facilitates retooling and efficiency enhancements previously unachievable, with autonomous machines broadening their capabilities.

- Crochet hooks are being replaced with innovative tools, such as computerized knitting machines, and ecological materials, like recycled yarns and bamboo yarns, are gaining popularity. Tutorial videos and online learning platforms are making it easier for individuals to learn and create crocheted and knitted fabrics from the comfort of their home offices.

What challenges does the Knitting And Crochet Industry face during its growth?

- The textile industry encounters significant challenges that hinder its growth. These issues, including but not limited to regulatory compliance, raw material costs, and technological advancements, necessitate continuous adaptation and innovation to remain competitive in the global market.

- The market encompasses the production and sale of knitted fabric and crochet thread, primarily used for creating DIY crafts and clothing. Knitting involves using knit stitches with knitting needles or crochet hooks, while crochet utilizes a hook to create fabric from a continuous loop. Mental health benefits, such as stress relief and improved focus, are associated with these activities, making them popular leisure pursuits. The market's growth is driven by the increasing popularity of DIY crafts and the rise of social networks, enabling crafters to share their creations and connect with others. Organic cotton and organic yarns are gaining traction due to their environmental sustainability and health benefits.

- The market dynamics are influenced by various factors, including raw material prices, consumer preferences, and economic conditions. For instance, political instability in significant textile-producing countries, such as Bangladesh, can impact the industry's stability and growth. Bangladesh's economy, which heavily relies on the textile sector, has been affected by ongoing political turmoil.

Exclusive Customer Landscape

The knitting and crochet market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the knitting and crochet market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, knitting and crochet market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aarti International Ltd - This company specializes in the production and distribution of a diverse range of knitted and warp knitted fabrics.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aarti International Ltd

- ABHINANDAN KNITS PVT. LTD.

- Contempora Fabrics

- KD Fabrics and Apparel

- KPR Mill Ltd.

- Laguna Fabrics Inc.

- Lenzing AG

- Loyal Textile Mills Ltd.

- Marvel Vinyls Ltd.

- Pacific Textiles Holdings Ltd.

- Pine Crest Fabrics Inc.

- Response Fabrics Pvt. Ltd.

- RSWM Ltd.

- Sahni Fabs

- Sivaraj Spinning Mills Pvt Ltd.

- TEEJAY LANKA PLC

- The LYCRA Co. LLC

- Tintex Textiles

- Toray Industries Inc.

- W.Ball and Son Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Knitting And Crochet Market

- In January 2024, Lion Brand Yarns, a leading knitting and crochet yarn manufacturer, announced the launch of their new line of eco-friendly yarns, "Eco-Worgs," made from recycled materials (Lion Brand Yarns Press Release).

- In March 2024, Patons and Swansons, a major player in the crochet market, entered into a strategic partnership with Craftsy, an online learning platform for crafts, to offer exclusive crochet courses and patterns (Patons and Swansons Press Release).

- In April 2024, Red Heart Yarns, a significant player in the knitting market, raised USD25 million in a funding round led by Quadrant Capital Partners to expand its production capacity and invest in research and development (Red Heart Yarns SEC Filing).

- In May 2025, the European Union passed the Sustainable Textiles Regulation, which sets strict rules for the use of certain chemicals in textiles, including those used in knitting and crochet yarns, effective January 2026 (European Parliament Press Release). These developments underscore the industry's focus on sustainability, innovation, and strategic partnerships.

Research Analyst Overview

- The market encompasses a diverse range of consumer goods, from apparel and home textiles to industrial products and medical textiles. Natural fibers, such as wool and cotton, remain popular choices for knitted and crocheted fabrics, while sustainable textiles, including recycled fibers and biodegradable materials, are gaining traction. Fast fashion brands increasingly incorporate knitted and crocheted fabrics into their collections, driving demand for intricate patterns and delicate fabric. Industrial knitting machines produce large quantities of knitted fabric for various industries, while hand-crafted items continue to appeal to the DIY culture. Crochet sock patterns and table runners are among the many decorative designs that showcase the versatility of these techniques.

- Digital knitting technologies and crochet hooks enable the creation of active yarn loops and interlocking loops, contributing to the growth of this market. The apparel industry relies on both knitted and crocheted fabrics for producing clothing, while the home textiles sector offers a wide range of crocheted fabric and knitted fabric products. Medical textiles, including crocheted fabric and knitted fabrics, are essential for producing bandages, surgical gowns, and other medical supplies. Overall, the market demonstrates a dynamic interplay between traditional and modern techniques, artistic expression, and industrial production.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Knitting And Crochet Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2025-2029 |

USD 12279.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

China, US, Japan, India, Australia, Germany, UK, Brazil, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Knitting And Crochet Market Research and Growth Report?

- CAGR of the Knitting And Crochet industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the knitting and crochet market growth of industry companies

We can help! Our analysts can customize this knitting and crochet market research report to meet your requirements.