Leather Handbags Market Size 2024-2028

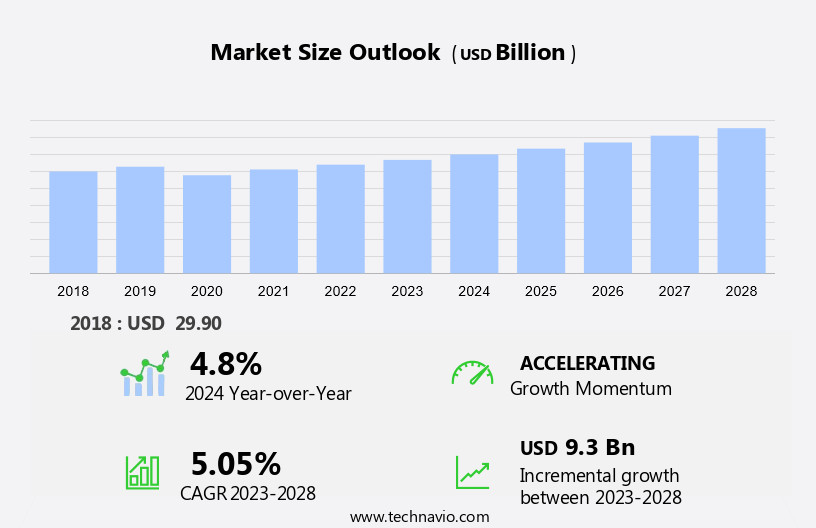

The leather handbags market size is forecast to increase by USD 9.3 billion at a CAGR of 5.05% between 2023 and 2028.

- The market's growth hinges on various factors such as the personalization and customization options available for leather handbags, the impact of celebrity endorsements on consumer purchasing choices, and the durability of leather goods, which enhances product value for customers. The use of advanced technologies like automation and digital marketing can help them streamline the industry operations and reach a wider audience. The offline distribution channel generates revenue from the sale of products through specialty stores, including exclusive brand stores, multi-brand stores, apparel stores, factory outlets, airport retail stores, and personal goods stores; hypermarkets, supermarkets, convenience stores, and clubhouse stores; and department stores. These elements collectively contribute to shaping consumer preferences and driving demand within the leather handbags market. It also includes an in-depth analysis of drivers, trends, and challenges.

What will be the Size of the Market During the Forecast Period?

- In the dynamic world of fashion, leather handbags continue to be a popular choice among consumers. The raw materials used in the production of these handbags are essential, with hides and skins being the primary source. The leather is then processed through various stages, including tanning, dyeing, and finishing, to create high-quality handbags.

- The market is significant, with a growing number of consumers showing a preference for these accessories. The segment is competitive, with numerous consumers seeking out the latest fashion trends and affordable prices. Brands and manufacturers use various marketing strategies, such as social media campaigns and influencer partnerships, to reach their target audience. The handbag industry is also subject to various regulations, including design rights and intellectual property laws. Quality and durability are crucial factors in the success of leather handbags, making it essential for brands to maintain high production standards.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Shoulder bags

- Satchel bags

- Tote bags

- Sling bags

- Geography

- APAC

- China

- North America

- US

- Europe

- Germany

- UK

- France

- South America

- Middle East and Africa

- APAC

By Distribution Channel Insights

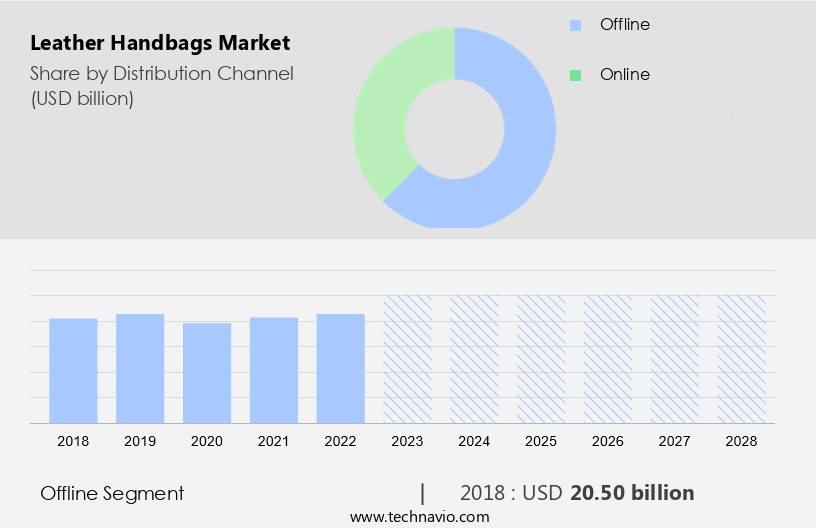

- The offline segment is estimated to witness significant growth during the forecast period. Companies operating in the organized retail sector are based on factors such as geographical presence, ease of production and inventory management, and goods transportation. Supermarkets and hypermarkets have dedicated aisles for luxury goods, including leather handbags, which increase the visibility of the latest leather products and trendy fashions.

Get a glance at the market report of share of various segments Request Free Sample

The Offline segment was valued at USD 20.50 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

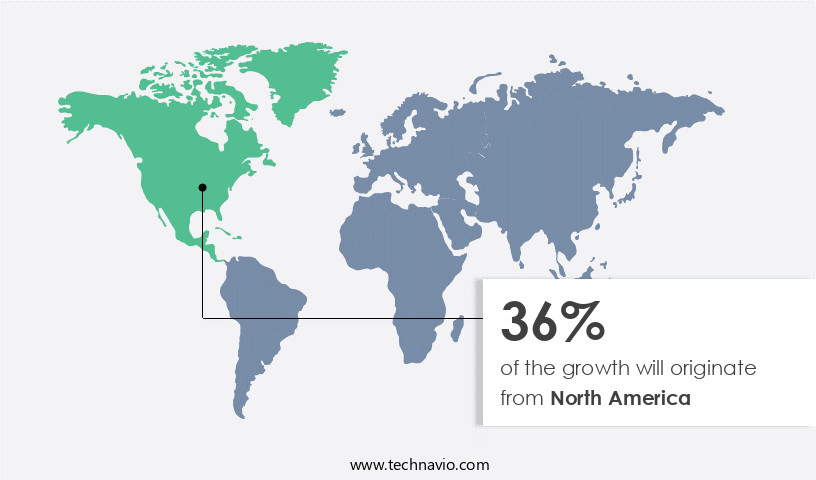

- North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The APAC region, specifically China, South Korea, Japan, and India, is experiencing substantial growth in the market. Factors contributing to this expansion include rising fashion consciousness, the replacement of price-focused consumers with fashion-focused ones, and the flourishing fashion industry. Notably, casual leather handbags are in high demand among youngsters aged 15-24 years, driven by fashion events, celebrity endorsements, and a growing population with increased disposable income.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Leather Handbags Market?

Personalization and customization of leather handbags are the key driver of the market.

- The leather handbags market is witnessing a rise in customization and personalization trends, particularly among young adults in developed and emerging countries. Rapid globalization and increasing consumer spending have fueled this demand, as individuals seek fashionable, convenient, and comfortable accessories that reflect their unique lifestyles and consumer behavior. High-quality leather handbags, known for their durability and lifespan, are a popular choice for both traditional and customized designs. Customization extends beyond straps and buckles to include embroidery, name tags, and other features. Working people and fashion-conscious consumers alike are drawn to the aesthetic appeal of these fashion accessories. E-commerce companies and startups are capitalizing on this trend, offering customized leather handbags through various distribution channels and social platforms.

- However, concerns regarding animal killing and raw material prices, as well as trade regulations, may impact the production analysis and value chain optimization of this market. Product improvement, product launches, and technological innovations continue to shape the market landscape, with emerging revenue pockets and application niches driving growth in the luxury and affordable leather handbag segments. Product approvals and brand recognition remain key factors for market players in this competitive industry.

What are the market trends shaping the Leather Handbags Market?

The introduction of different leather varieties is the upcoming trend in the market.

- Young adults, influenced by rapid globalization and changing lifestyles, are significant consumers in the market. Durability and high-quality leather are key factors in their purchasing decisions, driven by consumer behavior and fashion consciousness. Leather handbags offer convenience with compartments and pockets, making them a desirable fashion accessory for working people. Brand recognition and product portfolio are essential for market dominance. Traditional handbag manufacturers continue to improve their products, ensuring durability and lifespan, while startups offer affordable leather handbags with customized designs. Product approvals and launches, driven by technological innovations and social media platforms, are crucial for market growth. The market is subject to raw material prices, trade regulations, and production analysis.

- Value chain optimization and emerging revenue pockets, such as application niches, are essential for market expansion. Luxury consumers seek high-end, durable, and comfortable leather handbags, while e-commerce companies offer a wider distribution channel. Animal killing and ethical concerns are significant challenges in the market. Product approvals and technological innovations are essential for addressing these concerns and maintaining consumer trust. The market's application dominance and installed base continue to grow, driven by consumer spending and fashion trends.

What challenges does the Leather handbag market face during its growth?

Rising labor costs and fluctuating raw material prices a key challenges affecting the market growth.

- The leather handbag market has witnessed significant growth in the last two decades due to globalization, increasing consumer spending, and fashion consciousness among young adults. High-profile celebrities' endorsements have considerably influenced consumer behavior, making fashionable, convenient, and comfortable leather handbags a desirable commodity. companies focus on producing high-quality leather handbags with durability and a long lifespan, offering various compartments and pockets for added convenience. Working people and luxury consumers alike seek fashionable and comfortable handbags, leading companies to expand their product portfolios. Traditional handbags coexist with affordable leather handbags, with product improvement and innovation driven by technological advancements and social platforms.

- Startups and e-commerce companies have disrupted distribution channels, while customized leather handbags offer brand recognition. However, ethical concerns regarding animal killing and raw material prices, as well as trade regulations, impact production analysis and value chain optimization. Emerging revenue pockets include application niches, product approvals, and product launches, with technological innovations shaping the market's application dominance and installed base.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alexander McQueen Trading Ltd.

- Burberry Group Plc

- Capri Holdings Ltd.

- Cole Haan International B.V.

- CraftShades

- Dooney and Bourke Inc.

- Fossil Group Inc.

- Guess Inc.

- Hennes and Mauritz AB

- Hermes International

- Hidesign

- Kering SA

- Lefty Production Co.

- LVMH Group

- Prada Spa

- Stefano Ricci S.p.A.

- Steven Madden Ltd.

- Tapestry Inc.

- Ted Baker PLC

- Tory Burch LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

In the consumer goods industry, leather handbags continue to be a popular choice for fashion-conscious individuals. The consumer market is a significant segment with a global presence. Rapidly changing consumer preferences and lifestyles have led to an increase in the demand for these products. The consumer preferences for leather handbags are driven by factors such as durability, style, and brand reputation. Consumers are willing to invest in high-quality leather handbags that offer longevity and a classic look. Brands like Comfortable, Durable, and Stylish (CDS) and Rapid have gained popularity for their innovative designs and affordable pricing.

The production of leather handbags involves several processes, including cutting, stitching, and embellishment. Consumers are increasingly concerned about the ethical and sustainable production of these products. Brands that adhere to ethical production practices and use high-quality materials are gaining favor in the market. The producers of leather handbags face challenges such as increasing competition, rising raw material costs, and changing consumer preferences. To stay competitive, they must focus on innovation, quality, and affordability. The use of advanced technologies like automation and digital marketing can help them streamline their operations and reach a wider audience.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.05% |

|

Market growth 2024-2028 |

USD 9.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.8 |

|

Key countries |

US, China, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch