Baby Fashion Accessories Market Size 2024-2028

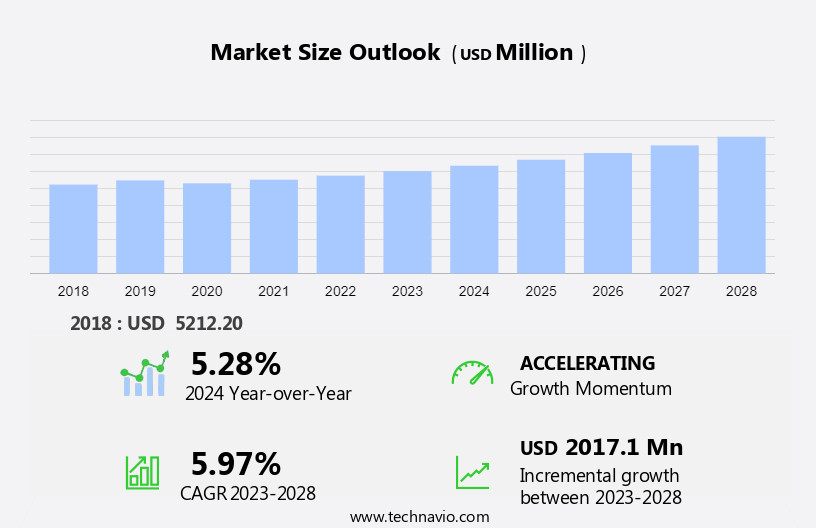

The baby fashion accessories market size is forecast to increase by USD 2.02 billion at a CAGR of 5.97% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The first trend is the increasing urbanization, leading to a rise in disposable income and a growing awareness of fashion among parents. Another trend is the innovation in designs and patterns, which cater to the unique tastes and preferences of modern parents. However, the market is also facing challenges such as declining fertility and birth rates, which may impact the demand for baby accessories. Despite these challenges, the market is expected to continue its growth trajectory, driven by the increasing focus on child safety and comfort, and the growing popularity of personalized and eco-friendly products. The market is subject to strict regulations concerning chemicals and materials, with a focus on natural materials like cotton, wool, organic cotton, and hemp, and leasing practices, including re-commerce and renting. Overall, the market offers ample growth opportunities, with a strong focus on innovation, quality, and sustainability.

What will be the size of the Baby Fashion Accessories Market During the Forecast Period?

- The market caters to the needs of parents seeking to enhance their infants' and toddlers' clothing ensembles with stylish and functional items. This market is driven by various factors, including cultural practices, social differentiation, and gender. Ethnicity plays a role In the demand for accessories that reflect diverse backgrounds and traditions. Product innovation, such as designer collaborations and eco-friendly clothes, continues to shape the market. Per capita income influences the affordability of soft, non-essential items like bonnets, bibs, and booties from brands like Bonpoint, Clayre and Eef, Gerber Childrenswear, and Roberto Cavalli Spa. Retail stores and digital sales channels cater to the growing product demand.

- Sustainable clothing and eco-friendly clothes are gaining popularity, with brands like Royal Apparel, Sckoon, The Bonnie Mob, and The Children's Place leading the way. Smart baby apparel, such as breathing wear from Nanit Brand, adds functionality to the market. Overall, the children-wear industry remains a vibrant and evolving sector, with trends in social practices and technological innovation shaping its future.

How is this Baby Fashion Accessories Industry segmented and which is the largest segment?

The baby fashion accessories industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Baby clothing accessories

- Baby hosiery or knitwear accessories

- Baby winter wear

- Baby jewellery

- Others

- Geography

- APAC

- China

- North America

- US

- Europe

- Germany

- France

- South America

- Middle East and Africa

- APAC

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

The market in 2023 predominantly relied on offline distribution channels, with retail formats such as specialty stores, hypermarkets, departmental stores, convenience stores, supermarkets, and warehouse clubs accounting for the largest market share. Specialty stores, which include exclusive brand stores, multi-brand stores, apparel stores, and personal goods stores, were a significant segment within offline distribution. These outlets cater to a wide range of baby fashion accessories from various brands and price points. Brand specialty retail stores are crucial for companies, enabling them to allocate resources for marketing, advertising, promotions, brand development, training, and IT support.

Get a glance at the market report of share of various segments Request Free Sample

The Offline segment was valued at USD 3.57 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In Asia Pacific (APAC), the market experiences slower penetration compared to developed markets. Factors such as urbanization, changing lifestyles, the increase in dual-income households, and the growth of nuclear families propel market expansion in APAC more rapidly than in developed regions. Major contributors to the market in APAC include China, Japan, South Korea, India, and Australia. The emphasis on children's appearance and convenience drives demand for premium baby fashion accessories. companies will target emerging markets in APAC due to their growth potential.

The market is influenced by industry influencers and social media, with fashion trends shaping the children-wear industry. Sustainable clothing, such as eco-friendly clothes, is gaining popularity. Retail stores, digital sales, and offers and discounts are essential channels for product demand. Smart baby apparel, such as Nanit brand's Breathing Wear, caters to the needs of newborns. Infant mortality rates and medical sciences, including in-vitro fertilization and surrogacy, influence market trends.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Baby Fashion Accessories Industry?

Increasing urbanization is the key driver of the market.

- The market encompasses a wide range of products, including hemp clothing, tops and bottoms for both boys and girls, such as bodysuits, trousers or leggings, skirts, and gym wear. This market is witnessing significant trends, with leasing practices and re-commerce gaining popularity. Leasing practices allow parents to rent clothing items for a specified period, reducing the overall cost of raising a child.

- Similarly, strict regulations are in place to ensure the safety of these accessories, particularly with regard to the use of chemicals like wool and cotton. Top brands like Gymboree offer a variety of options in this market, catering to the diverse needs of parents and children alike. The market for baby fashion accessories is expected to continue its growth trajectory, with the convenience and affordability of renting and leasing practices contributing to its expansion.

What are the market trends shaping the Baby Fashion Accessories Industry?

Innovative designs and patterns are the upcoming market trend.

- The market encompasses a wide range of products, including hemp clothing, tops and bottoms for both boys and girls, such as bodysuits, trousers or leggings, skirts, and gym wear. This market is witnessing significant trends, with leasing practices and re-commerce gaining popularity. Leasing practices allow parents to rent clothing items for a specified period, reducing the overall cost of raising a child. Strict regulations are in place to ensure the safety of these accessories, particularly with regard to the use of chemicals like wool and cotton. Brands like Gymboree are at the forefront of this market, offering high-quality, stylish, and sustainable options for parents.

- Furthermore, the trend towards eco-friendly materials, such as hemp, is also influencing the market, as consumers become increasingly conscious of the environmental impact of their purchases. Overall, the market is a dynamic and evolving industry, catering to the diverse needs and preferences of parents and children alike.

What challenges does the Baby Fashion Accessories Industry face during its growth?

Declining fertility and birth rates is a key challenge affecting industry growth.

- The market encompasses a wide range of products, including hemp clothing, tops and bottoms for both boys and girls, such as bodysuits, trousers or leggings, skirts, and gym wear. This market is witnessing significant trends, with leasing practices and re-commerce gaining popularity. Leasing practices allow parents to rent clothing items for a specified period, reducing the overall cost of raising a child.

- However, strict regulations are in place to ensure the safety of these accessories, particularly with regard to the use of chemicals like wool and cotton. Top brands like Gymboree offer a variety of options in this market, catering to the diverse needs of parents and children alike. The market for baby fashion accessories is expected to continue its growth trajectory, with the convenience and affordability of renting and leasing practices contributing to its expansion.

Exclusive Customer Landscape

The baby fashion accessories market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the baby fashion accessories market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, baby fashion accessories market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BabyVision Inc.

- Bonpoint

- Carters Inc.

- Clayre and Eef

- Crummy Bunny Inc.

- Gerber Childrenswear

- Hi Style Manufacturing Co.

- Lefty Production Co.

- Lovedbaby LLC

- Mamas and Papas Ltd.

- Mothercare in Ltd.

- Nature Baby Ltd.

- Ningbo Younker Fashion Accessory Industrial Corp.

- Ralph Lauren Corp.

- Roberto Cavalli Spa

- Royal Apparel

- Sckoon Inc.

- The bonnie mob

- The Childrens Place Inc.

- The Gap Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products designed to complement and enhance the outfits of infants and toddlers. This market caters to the needs and preferences of parents and caregivers, who seek to provide their little ones with stylish and functional accessories that reflect their unique identities and social contexts. Baby fashion accessories include a diverse array of items such as hosiery, winter wear, jewelry, hair accessories, glasses, and bags. Hosiery includes socks and leggings, which provide warmth and comfort to infants while adding a touch of style to their outfits. Winter wear includes jackets, hats, and boots, which protect infants from the elements and keep them cozy during colder months.

Jewelry, hair accessories, and glasses are popular accessories that add a personal touch to baby outfits. Baby jewelry includes bracelets, necklaces, and anklets, often adorned with charms or other decorative elements. Hair accessories include bows, headbands, and clips, which help keep hair out of infants' eyes and add a feminine touch to their looks. Glasses, which may be prescribed for medical reasons or simply for fashion, are an essential accessory for some babies. Bags are another essential category of baby fashion accessories. diaper bags, which are designed to carry diapers, wipes, and other essentials, are a must-have for parents and caregivers.

Fashionable and functional, these bags come in various styles and sizes, allowing parents to express their personalities while ensuring they have all they need for their little ones. The market is influenced by various factors, including lifestyle changes, social trends, and demographic shifts. The rise of dual-income households and nuclear families has led to increased demand for convenient and functional accessories that make parents' lives easier. Urbanization and changing birth rates have also impacted the market, as more infants are born in urban areas and families seek out unique and stylish accessories to reflect their urban lifestyles. Designer brands and influencers play a significant role in shaping trends In the market.

Social media platforms, such as Instagram and Pinterest, provide a space for parents and caregivers to share ideas and inspiration, driving demand for the latest styles and designs. Sustainable clothing and eco-friendly materials, such as organic cotton and hemp, are also gaining popularity as consumers become more conscious of their environmental impact. The market is subject to strict regulations to ensure the safety and quality of products. Regulations cover areas such as chemicals, leasing practices, and product safety. Retail stores and online platforms offer a wide range of options for consumers, from affordable options to high-end designer brands. Digital sales and offers and discounts are also becoming increasingly popular, making it easier for parents and caregivers to access the latest trends and styles.

The market is a dynamic and evolving industry that caters to the needs and preferences of parents and caregivers. Influenced by various factors, including lifestyle changes, social trends, and demographic shifts, the market offers a diverse range of products that add style and functionality to baby outfits. Regulations ensure the safety and quality of products, while retailers and online platforms provide a wide range of options for consumers. Sustainable and eco-friendly materials are gaining popularity, reflecting consumers' increasing awareness of their environmental impact.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.97% |

|

Market growth 2024-2028 |

USD 2017.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.28 |

|

Key countries |

US, China, Germany, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Baby Fashion Accessories Market Research and Growth Report?

- CAGR of the Baby Fashion Accessories industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the baby fashion accessories market growth of industry companies

We can help! Our analysts can customize this baby fashion accessories market research report to meet your requirements.