Liquid Sand Paper Market Size 2024-2028

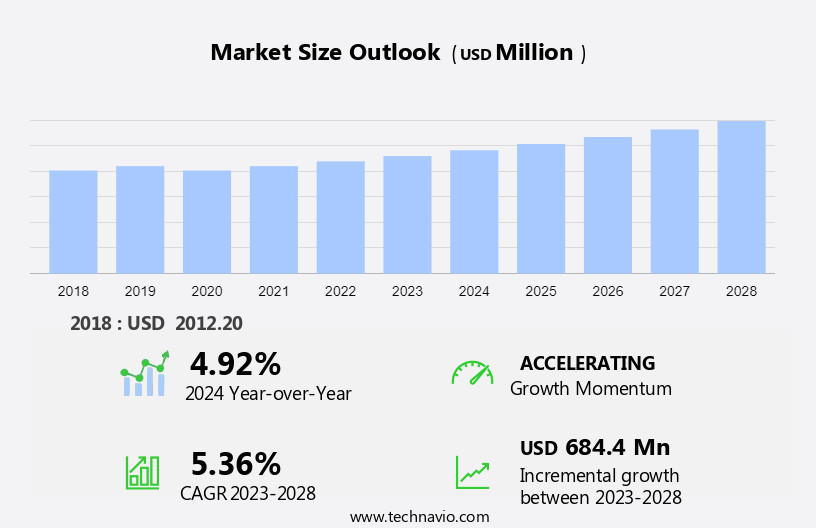

The liquid sand paper market size is forecast to increase by USD 684.4 million at a CAGR of 5.36% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One of the primary drivers is the increasing number of infrastructure projects worldwide, leading to a rise in demand for efficient and effective sanding solutions. Another trend influencing the market is the rising adoption of eco-friendly painting tools, as consumers and regulatory bodies push for more sustainable practices in the construction industry. The market comprises deglossers used in DIY projects, paints, plastics, fertilizers, medicines, and raw materials. However, the market also faces challenges, such as the volatility in the cost of raw materials required to manufacture painting tools. This can impact the profitability of manufacturers and may lead to price fluctuations in the market. Overall, the market is expected to witness steady growth in the coming years, driven by these factors and the ongoing demand for high-quality surface finishing solutions.

What will be the Size of the Liquid Sand Paper Market During the Forecast Period?

- The market encompasses a range of abrasive solutions used for surface preparation before coating applications in various industries. These solutions, available in solvent- and water-based formulations, cater to diverse substrates such as paints, plastics, fertilizers, medicines, and raw materials. Key drivers for market growth include the increasing demand for high-performance coatings in the construction and industrial sectors and the ongoing shift towards water-based products due to environmental concerns. Major applications include the preparation of substrates for varnish, lacquer, enamel, polyurethane, and other coatings. Solvent-based liquid sandpaper solutions typically utilize naphtha, toluene, and methylene chloride as carriers, while water-based alternatives rely on ethyl alcohol.

- The market is expected to witness steady expansion due to the growing need for efficient and effective surface preparation methods across multiple industries.

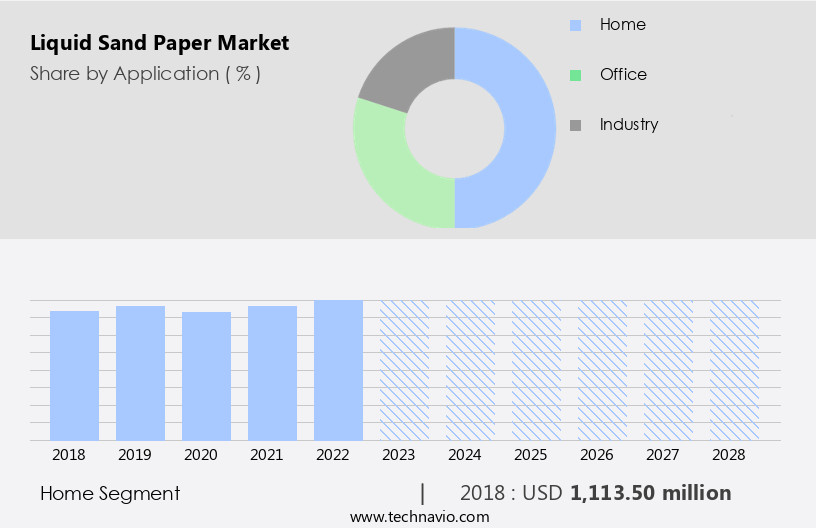

How is this Liquid Sand Paper Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Home

- Office

- Industry

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Europe

- Germany

- South America

- Middle East and Africa

- North America

By Application Insights

- The home segment is estimated to witness significant growth during the forecast period.

Liquid sand paper, a versatile painting tool, is essential for preparing and refinishing surfaces before the application of paints, varnishes, or lacquers. This product is particularly useful for small surfaces and hard-to-reach areas, enabling the removal of excess paint, old layers of glue, rust, and varnish. Liquid sand paper effectively addresses issues such as blistered coatings and damaged surfaces, transforming them into smooth, decorative finishes. The DIY segment, specifically in the paint industry, is a significant consumer of liquid sandpaper. The ethyl alcohol segment, a key raw material, is also experiencing growth due to the increasing popularity of DIY projects during lockdowns.

Online classes, work from home, and e-commerce platforms have further fueled demand for liquid sand paper among Americans. In the building and construction sector, infrastructure projects and the shift towards eco-friendly painting tools are upcoming trends. company analysis, industry data, and reports from reputable sources like Technavio and Reportlinker indicate a positive global market scenario for liquid sand paper. Solvent-based and water-based liquid sand papers, including those made from naphtha, toluene, methylene chloride, and ethyl alcohol, are widely used. Industry influencers continue to drive profit, pricing, and promotional strategies in this market.

Get a glance at the market report of share of various segments Request Free Sample

The Home segment was valued at USD 1.11 billion in 2018 and showed a gradual increase during the forecast period.

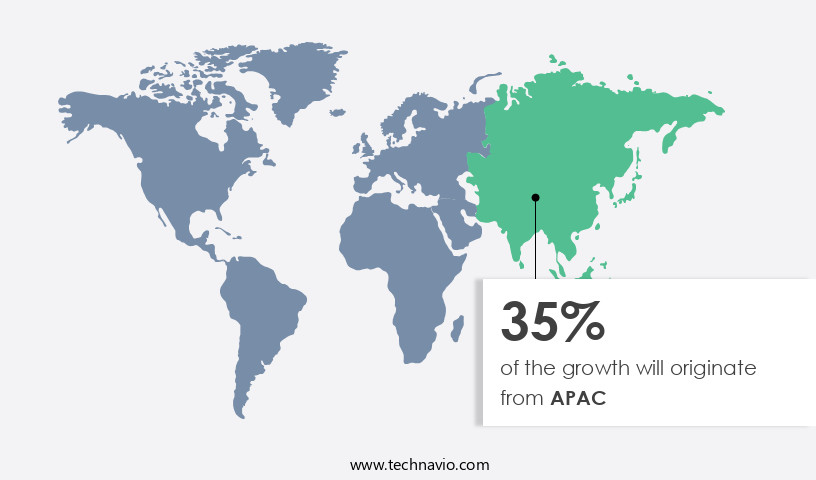

Regional Analysis

- APAC is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market is experiencing significant growth, driven primarily by the US and Canada. The construction and infrastructure sectors in these countries are witnessing substantial investments, leading to increased demand for liquid sand paper. According to the US Census Bureau, over 1.6 million private housing unit building permits were authorized in October 2021. This rising residential and public infrastructure development is boosting construction spending in the US, thereby fueling the demand for liquid sand paper. Additionally, the DIY trend continues to gain popularity, with Americans focusing on home improvement projects such as shelving, cabinetry, house painting, garden decoration, and bathroom and bedroom renovations.

Online classes, work from home, and coupon offers have further increased the demand for liquid sand paper in various applications, including DIY projects and painting. company analysis indicates that the ethyl alcohol and paint segments dominate the market. Upcoming trends include the shift towards eco-friendly painting tools and water-based and solvent-free alternatives. Key industry influencers include Deglosser, DIY projects, Paints, Plastics, Fertilizers, Medicines, Raw materials, Solvent-based, Water-based, Naphtha, Toluene, Methylene Chloride, and Ethyl Alcohol. The global market scenario is expected to remain positive, with profitability, pricing, and promotions playing crucial roles in the industry's growth. Infrastructure projects, conventional paints, and eco-friendly painting tools are expected to provide significant opportunities for market expansion.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Liquid Sand Paper Industry?

The increasing number of infrastructure projects is the key driver of the market.

- The market is experiencing growth due to the rise in infrastructure projects worldwide. The increasing population and government support for construction initiatives in developing countries such as the UAE, Saudi Arabia, India, and China are driving market expansion. For instance, this population growth necessitates an increase in residential and commercial building construction. Additionally, some countries are increasing their construction spending to meet their people's needs.

- The market offers both solvent-based and water-based options, with key ingredients including naphtha, toluene, methylene chloride, and ethyl alcohol. These products are used as substrates in various applications, including paints (paints segment), varnish, lacquer, enamel, and polyurethane. The market's growth is influenced by factors such as the rise in DIY projects, the shift to eco-friendly painting tools, and upcoming trends like online classes, work from home, and coupon promotions. company analysis, industry data, and reports from reputable sources like Technavio and Reportlinker provide valuable insights into the market scenario.

What are the market trends shaping the Liquid Sand Paper Industry?

Rising adoption of eco-friendly painting tools is the upcoming market trend.

- The market is witnessing significant growth due to the increasing demand for eco-friendly painting tools. With a growing focus on reducing environmental pollution, end-users are preferring low volatile organic compounds (VOCs) and environmentally friendly paints. This trend extends to painting tools and cleaning solutions, as improper disposal of plastic-based products can contribute to environmental pollution. As a result, companies are shifting their focus towards biodegradable alternatives, which use tapioca and potato starch for their scrapers and paint mixers.

- This rising availability of eco-friendly painting tools is expected to boost the demand for liquid sand paper during the forecast period. DIY projects, home improvement, and infrastructure projects in sectors like Building and Construction continue to drive the market. The Paint segment and Ethyl Alcohol segment are expected to dominate the market, with profitability and pricing playing crucial roles in company analysis.

What challenges does the Liquid Sand Paper Industry face during its growth?

Volatility in the cost of raw materials required to manufacture painting tools is a key challenge affecting the industry growth.

- The market is experiencing growth, yet faces challenges from the volatile pricing of essential raw materials. Manufacturers use naphtha, ethyl acetate, and ethyl alcohol to produce liquid sand paper, while scrapers are made from stainless steel and wood. The fluctuating price of crude oil impacts the cost of these raw materials, affecting companies' profitability. The DIY segment, including paints, plastics, fertilizers, medicines, and various industries like building and construction, uses liquid sand paper for deglossing surfaces before painting with varnish, lacquer, enamel, or polyurethane. Upcoming trends include the ethyl alcohol segment in the paint industry and the shift towards eco-friendly painting tools.

- Despite challenges, the market offers opportunities for profit through effective pricing, promotions, and industry influencer partnerships. company analysis, global market scenario, infrastructure projects, and conventional paints continue to drive demand for liquid sandpaper. Online classes, work from home, and DIY projects during lockdowns have further increased its usage for shelving, cabinetry, house painting, garden, and bathroom or bedroom decoration.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABSOLUTE RESURFACING PTY Ltd

- Akzo Nobel NV

- Allied Piano and Finish LLC

- Ballistic Bowling

- Formax Manufacturing

- Heinrich Konig GmbH and Co. KG

- Konig UK

- KWH Group Ltd

- Neo Tac Inc

- RPM International Inc.

- Sevens Paint and Wallpaper Co

- Swing Paints Ltd

- The Savogran Co.

- Univar Solutions Inc.

- W.M. BARR Co. Inc.

- Wilson Imperial Co

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of abrasive products utilized in various industries for surface preparation and finishing applications. These products are essential in numerous sectors, including paints, plastics, fertilizers, medicines, and raw materials. The market exhibits significant dynamics, driven by the demand for efficient and effective sanding solutions. Solvent-based and water-based liquid sandpapers are the two primary types available in the market. Solvent-based sandpapers offer high-performance capabilities, making them popular in industries where rapid material removal is required. Conversely, water-based sandpapers are gaining traction due to their eco-friendly properties and compatibility with a broader range of substrates.

Moreover, the paints industry is a significant consumer of liquid sandpaper, as it necessitates thorough surface preparation before painting. DIY projects, particularly in the home sector, contribute significantly to the demand for these products. With the increasing trend of lockdowns and work-from-home arrangements, Americans have been focusing on home improvement projects, leading to a rise in demand for sandpaper. In the building and construction industry, infrastructure projects and the need for eco-friendly painting tools have been driving the market's growth. Upcoming trends include the increasing popularity of varnish, lacquer, enamel, and polyurethane finishes, which require specific sanding techniques and tools.

Furthermore, the ethyl alcohol segment is a crucial raw material in the production of water-based liquid sandpapers. Its availability and pricing significantly impact the market's profitability. Promotions and industry influencers play a vital role in driving sales, with platforms like CouponFollow offering discounts and deals to consumers. company analysis reveals a competitive landscape with key players focusing on product innovation and expansion. The global market scenario is influenced by factors such as raw material availability, pricing, and consumer preferences. The market's future growth is expected to be influenced by ongoing trends, including the increasing demand for eco-friendly products and the continued shift towards DIY projects.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.36% |

|

Market growth 2024-2028 |

USD 684.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.92 |

|

Key countries |

US, China, India, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Liquid Sand Paper Market Research and Growth Report?

- CAGR of the Liquid Sand Paper industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the liquid sand paper market growth of industry companies

We can help! Our analysts can customize this liquid sand paper market research report to meet your requirements.