Loading Dock Bumpers Market Size 2025-2029

The loading dock bumpers market size is forecast to increase by USD 132.2 million at a CAGR of 3.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing regional trade and the technological upgradation of loading docks. With the global economy becoming more interconnected, there is an increase in international trade activities, leading to an increased demand for loading dock bumpers to ensure efficient and safe cargo handling. Moreover, the technological advancements in loading dock systems, such as automated guided vehicles and automated loading and unloading systems, are driving the need for advanced and durable loading dock bumpers. However, the market is not without challenges. Timely maintenance of loading dock bumpers is crucial to ensure their longevity and effectiveness. The global marine industry, driven by shipbuilding activities, cargo shipping, and global trade along ocean routes, fuels the demand.

- Neglecting maintenance can lead to safety hazards, operational inefficiencies, and increased costs. Furthermore, the high initial investment required for purchasing and installing loading dock bumpers can be a barrier to entry for small and medium-sized enterprises. To capitalize on the market opportunities and navigate these challenges effectively, companies need to focus on providing cost-effective and durable solutions, while also emphasizing the importance of regular maintenance to their customers. By doing so, they can differentiate themselves from competitors and build long-term relationships with their clients.

What will be the Size of the Loading Dock Bumpers Market during the forecast period?

- The loading dock bumpers market encompasses the production and distribution of protective devices, including molded and laminated bumpers, used to safeguard docking structures from damage caused by trucks and other heavy machinery. Cargo handling and logistics demand further contribute to the market's growth, with a focus on dock protection, workstation safety, and dock technology. Overall, the loading dock bumper market is expected to continue expanding, driven by the need for efficient, safe, and cost-effective docking solutions. The market trends include the development of innovative materials, such as composite and aluminum, to enhance durability and reduce maintenance costs. Additionally, the integration of advanced technologies, like solar panels and automated systems, offers improved functionality and sustainability for boat docks and lifts.

How is this Loading Dock Bumpers Industry segmented?

The loading dock bumpers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Molded dock bumpers

- Laminated dock bumpers

- Steel face dock bumpers

- Material

- Rubber

- Steel

- Plastic

- Application

- Truck loading docks

- Warehouse loading docks

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- North America

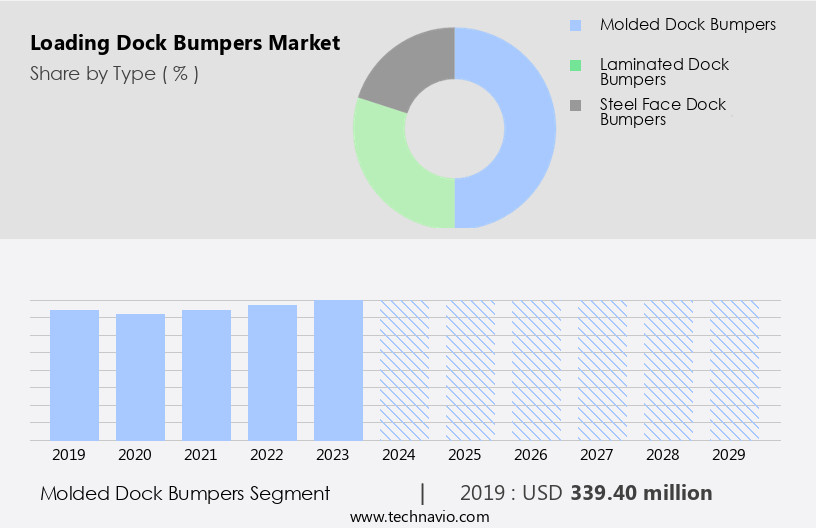

By Type Insights

The molded dock bumpers segment is estimated to witness significant growth during the forecast period. Molded dock bumpers are essential protective devices for truck loading docks and warehouse dock doors. These bumpers, manufactured from high-impact rubber and reinforced with prime rubber containing nylon and polyester, prevent damage to docks caused by trucks. Their unique design and construction offer high impact resistance, long life, and immunity to all weather conditions. Molded in one piece, they do not warp, rust, rot, or harden, ensuring a clean, neat, and attractive dock area. The rectangular model features a thick cast-in steel bar, providing additional protection to docks, levelers, and shelters from impact damage. Molded dock bumpers offer the correct amount of resilience to absorb pressure and impact shock, safeguarding both trucks and docks. Materials like metal, plastic, composite materials, and aluminum are commonly used to manufacture boat docks and lifts, ensuring durability and sustainability. The market also offers advanced dock accessories, such as smart lighting systems, automatic docking systems, and remote monitoring sensors, enhancing the overall user experience.

Sustainable solutions, such as recycled rubber and bio-based polymers, are increasingly used in their production, aligning with e-commerce sector growth and safety regulations. Supply chain efficiency and construction activities further drive the demand for these energy-absorbing materials.

Get a glance at the market report of share of various segments Request Free Sample

The Molded dock bumpers segment was valued at USD 339.40 million in 2019 and showed a gradual increase during the forecast period.

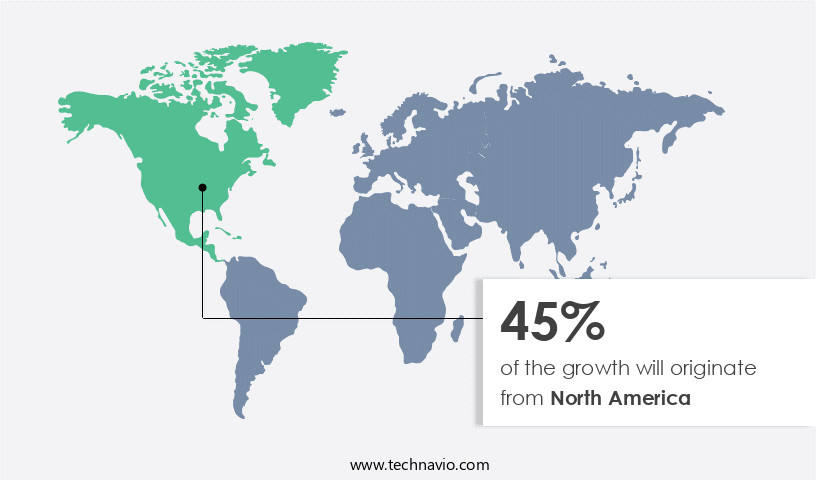

Regional Analysis

North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market is experiencing steady growth due to the increasing demand for docking solutions in the region's bustling ports. With a significant number of imports and exports, particularly in the US, the need for dock bumpers to protect against impact damage and prevent up and down movement during loading and unloading is paramount. Key industries, including warehouses, distributors, and retail businesses, rely on these protective devices to ensure workplace safety and supply chain efficiency. The market is further driven by safety regulations and the retrofitting of older facilities.

Sustainable solutions, such as energy absorbing bumpers made from recycled rubber or bio-based polymers, are gaining popularity due to their environmental benefits. IoT technology, sensors, and energy absorbing materials are also integral to modern docking systems. The market is expected to continue its growth trajectory as industries prioritize sustainability and customer-centric solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Loading Dock Bumpers Industry?

- Increase in regional trade is the key driver of the market. The global increase in international sea-borne trade, driven by an expanding network of free trade agreements, has resulted in a heightened demand for loading dock bumpers. These essential components absorb impact and protect the structure of goods during the loading and unloading process in warehouses and ports. With the rise of globalization, the number of daily warehousing and port activities has grown significantly, necessitating the use of heavy-duty vehicles for efficient cargo handling. The market for loading dock bumpers has experienced consistent growth as a result, as these structures play a crucial role in safeguarding merchandise from potential damage during transit.

- This market is driven by the construction and expansion of ports, distribution centers, and warehouses, particularly in the e-commerce sector. Safety regulations and workplace safety concerns are key factors fueling demand for these products. Supply chain efficiency and sustainability are also significant trends, with an increasing focus on the use of rubber and polyurethane materials, IoT technology, and durable designs. International trade and regional trade agreements also impact the market's direction, as does the retrofitting of older facilities to meet modern safety standards and laws.

What are the market trends shaping the Loading Dock Bumpers Industry?

- Technological upgradation of loading docks is the upcoming market trend. Loading dock safety has gained significant importance in the industrial sector due to the high incidence of accidents at these busy areas. According to recent research, approximately 25% of all industrial accidents occur at loading docks, with each accident accompanied by around 600 near-misses. Traditional loading dock bumpers, commonly made of rubber or similar materials, have been upgraded to provide better protection and productivity for workers. Older models often featured deep cracks in the rubber surface and fewer pads, resulting in insufficient shock absorption.

- Today, advanced loading dock bumpers incorporate new technology and smart upgrades to ensure worker safety. These modern bumpers offer superior shock absorption, durability, and resistance to environmental elements. By absorbing the impact of heavy loads and preventing collisions, these upgraded bumpers help reduce the number of accidents and near-misses at loading docks. This not only enhances worker safety but also increases overall productivity and efficiency in the industrial sector.

What challenges does the Loading Dock Bumpers Industry face during its growth?

- Timely maintenance requirement is a key challenge affecting the industry growth. Dock bumpers play a crucial role in protecting docks from damages caused by trucks. Mounted on both sides of dock levelers, they prevent potential harm to vehicles and structures. The primary causes of wear and tear include the friction between trucks and bumpers, the crawling of trucks, and the repeated impact forces during the loading and unloading process. These factors result in significant damage over time, necessitating regular maintenance or replacement. Knowing the market dynamics of dock bumpers involves recognizing these challenges and seeking solutions to enhance their durability and efficiency.

- Safety regulations are a critical factor influencing the market's dynamics. As international trade continues to expand, the need for standardized and compliant loading dock bumpers becomes increasingly important. Various materials, such as rubber, polyurethane, plastic, laminated, molded, extruded, and steel, are used to manufacture these protective devices, each offering unique benefits in terms of impact resistance, durability, and sustainability. Rubber dock bumpers are a popular choice due to their energy absorbing properties, making them ideal for mitigating the impact of trucks and other heavy machinery on dock structures. Polyurethane and plastic dock bumpers offer similar benefits, while steel dock bumpers provide increased durability and resistance to heavy loads.

Exclusive Customer Landscape

The loading dock bumpers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the loading dock bumpers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, loading dock bumpers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Beacon Industries Inc. - The company provides loading dock protection solutions, including economical bumpers, ensuring safety and efficiency in material handling operations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Beacon Industries Inc.

- Blue Giant Group Marketing

- Campisa Srl

- Chalfant Sewing Fabricators

- Deesawala Rubber Industries

- Dockright Regeneration Ltd.

- Durable Corp.

- Honesty Group

- Latham Australia

- McCue Corp.

- Metro Dock

- Nani Verladetechnik GmbH and Co. KG

- Pentalift Equipment Corp.

- Pioneer Dock Equipment

- Rite Hite Corp.

- Rotary Products Inc.

- Senneca Holdings

- Stellar Industrial Supply

- The Chamberlain Group LLC

- West American Rubber Co. LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The loading dock bumpers market encompasses a range of protective devices designed to ensure safety and efficiency in ports and construction activities. These essential components are utilized in various settings, including truck loading docks and warehouse dock doors. The market exhibits significant growth due to the increasing demand for safety regulations, supply chain efficiency, and sustainable solutions. The construction sector plays a pivotal role in driving the market's expansion. As new facilities are built and older ones are retrofitted, the need for durable and effective loading dock bumpers becomes paramount. The e-commerce sector's burgeoning influence also contributes to the market's growth, as the sector's reliance on efficient logistics and supply chain management necessitates the use of reliable protective devices.

Laminated dock bumpers offer a combination of strength and flexibility, making them a versatile option for various applications. Sustainability is a growing concern in the loading dock bumper market, with a focus on the use of sustainable materials, such as recycled rubber and bio-based polymers. Energy absorbing materials, such as sensors and IoT technology, are also gaining popularity as they enhance the efficiency and safety of loading dock operations. The market's competitive landscape is characterized by a focus on customer-centric solutions, with manufacturers and suppliers continually striving to meet the evolving needs of their clients. As the market continues to evolve, it is expected to remain a dynamic and innovative sector, driven by advancements in technology, materials, and regulatory requirements.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 132.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, Canada, Germany, UK, China, France, Italy, Japan, The Netherlands, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Loading Dock Bumpers Market Research and Growth Report?

- CAGR of the Loading Dock Bumpers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the loading dock bumpers market growth of industry companies

We can help! Our analysts can customize this loading dock bumpers market research report to meet your requirements.