Luxury Handbags Market Size 2025-2029

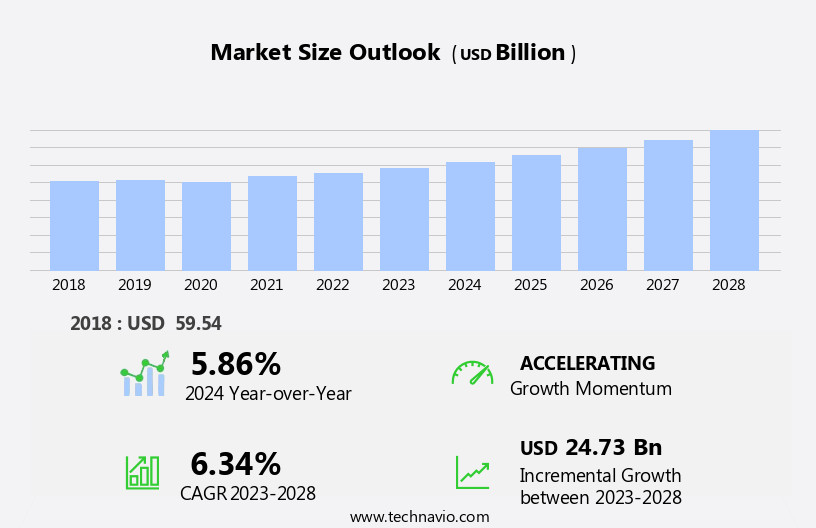

The luxury handbags market size is forecast to increase by USD 27.41 billion, at a CAGR of 6.6% between 2024 and 2029.

- The market is driven by the continuous pursuit of design and material innovation, leading to product premiumization. Brands are investing in advanced materials, such as exotic skins, metals, and high-tech fabrics, to create unique and desirable handbags. Additionally, consumers are increasingly seeking personalized and customized handbags, reflecting their individuality and status. This trend is further fueled by the growing popularity of monograms and customizable designs. Online shopping offers convenience, and brands provide VIP services, handbag repair, and concierge services to enhance the customer experience. However, the market faces significant challenges. The presence of counterfeit products remains a major obstacle, as consumers are often unable to distinguish between authentic and fake handbags.

- Furthermore, increasing production costs, due to the use of high-quality materials and labor-intensive manufacturing processes, put pressure on prices and profit margins. To succeed in this market, brands must invest in robust anti-counterfeiting measures and explore cost-effective manufacturing solutions while maintaining the exclusivity and desirability of their products. This not only harms the reputation of luxury handbag brands but also undermines consumer trust. Social media marketing plays a pivotal role in reaching consumers, with influencer collaborations and cross-promotions driving engagement.

What will be the Size of the Luxury Handbags Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, shaped by various factors including consumer preferences, materials sourcing, and fashion trends. Brands strive to meet the demands of their target market, which values ethical sourcing and artisan craftsmanship. Shoulder bags and travel bags remain popular, with closure mechanisms and interior pockets being key considerations. Quality control and brand loyalty are crucial, as consumers seek durability and distinctive designs. Leather types, machine stitching, and dyeing processes are continually refined to meet the expectations of discerning buyers. Jewelry cases, luggage tags, and finishing treatments add value, while competitor analysis informs strategic decisions. The supply chain, from leather tanning to printing techniques and stitching methods, undergoes constant innovation.

Tote bags, with their versatility and spacious interiors, are a staple. Cosmetic bags, with their compact size and functionality, cater to the growing demand for on-the-go organization. The market's dynamics are influenced by price elasticity, design trends, and customer segmentation. The market's unfolding patterns reflect the industry's commitment to delivering high-quality, desirable products that resonate with consumers.

How is this Luxury Handbags Industry segmented?

The luxury handbags industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Handbag

- Backpack

- Wallet

- Others

- Material

- Leather

- Fabric

- Synthetic

- Sustainable materials

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

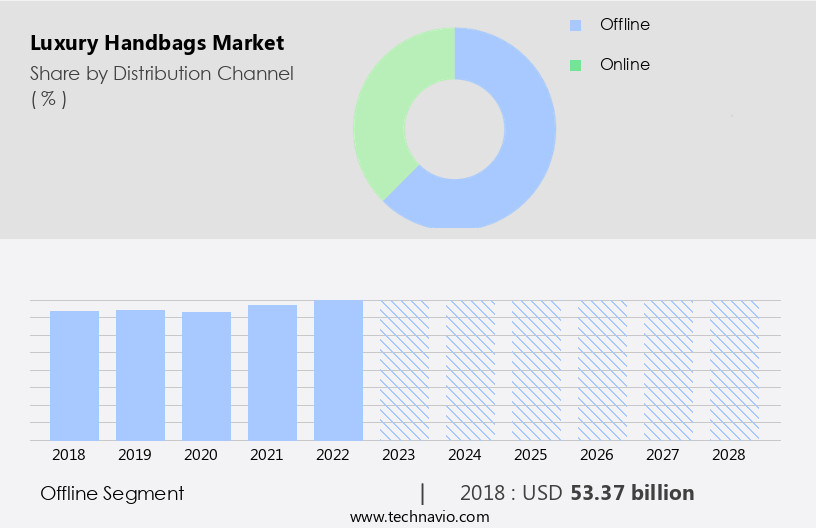

By Distribution Channel Insights

The Offline segment is estimated to witness significant growth during the forecast period. The luxury handbag market in 2024 witnessed significant sales through offline distribution channels, particularly specialty stores, hypermarkets, departmental stores, and warehouse clubs. These channels accounted for a substantial market share, catering to consumers seeking a wide range of luxury handbags from various brands and price points. Specialty stores, including brand-owned and multi-brand outlets, play a crucial role in marketing, advertising, promotions, brand building, training, and IT support for companies. Consumer preferences for ethical sourcing and sustainable materials have influenced materials selection in the luxury handbag industry. Brands are increasingly focusing on using high-quality leather types, such as calfskin, lambskin, and exotic hides, and implementing responsible sourcing practices.

The use of artisan craftsmanship and finishing treatments adds to the value and desirability of these bags. Competitor analysis is essential in the luxury handbag market, with brands constantly evaluating each other's product offerings, pricing strategies, and marketing tactics. Closure mechanisms, such as magnetic snaps, zippers, and buckles, are essential features that impact consumer preferences and brand differentiation. Travel bags and tote bags are popular categories, catering to consumers' needs for functionality and versatility. Quality control is a top priority in the luxury handbag market, with brands investing in rigorous testing and inspection processes to ensure consistent product quality. Crossbody bags, clutch bag and shoulder bags remain popular styles, while collectible handbags and exclusive limited editions cater to collectors.

Brand loyalty is strong among consumers, with many preferring to invest in high-end handbags that last for years. Interior pockets, metal hardware, jewelry cases, and luggage tags are essential features that enhance the functionality and value of luxury handbags. Fashion trends influence the design of luxury handbags, with brands often incorporating the latest styles and materials into their collections. Leather tanning, dyeing processes, printing techniques, and stitching techniques are essential production processes that impact the final product's appearance and durability. Price elasticity is a significant factor in the luxury handbag market, with consumers willing to pay a premium for high-quality, unique designs.

Customer segmentation is crucial in the luxury handbag market, with brands targeting various demographics and psychographics. Fashion-forward consumers, professionals, and travelers are among the primary target markets. Companies invest in various marketing channels, including social media, influencer partnerships, and print advertising, to reach their audience effectively.

The Offline segment was valued at USD 53.96 billion in 2019 and showed a gradual increase during the forecast period.

The Luxury Handbags Market is evolving, driven by sustainability and brand authenticity. Designers are embracing upcycled materials to craft eco-conscious collections that reflect a growing sense of social responsibility. Premium bespoke handbags cater to niche, high-end consumers seeking personalized fashion. In-store retail displays remain crucial for engaging experiences, while digital strategies like social media marketing and influencer marketing amplify brand reach. Strong public relations campaigns and robust authentication services help preserve brand prestige and consumer trust.

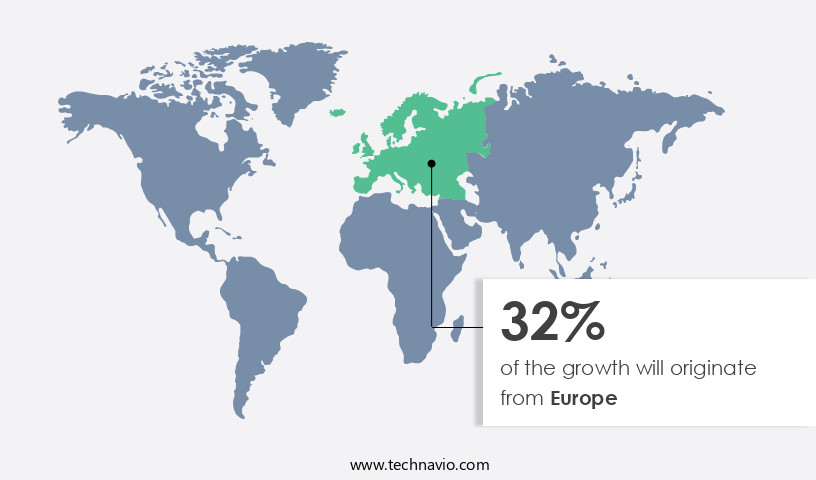

Regional Analysis

Europe is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

European countries, particularly those in Western Europe, are renowned for their luxury goods industries, with prominent brands such as Hermès International and Kering headquartered there. This abundance of personal luxury goods contributes significantly to Europe being the largest market. France holds the largest market share, followed closely by Italy and the UK. European consumers have shown a notable increase in spending on tax-free luxury goods, fueling the demand for high-end handbags. Luxury handbag makers like Louis Vuitton, Gucci, and Prada, known for their artisan craftsmanship and quality materials, dominate the market. Sourcing materials ethically and ensuring rigorous quality control are essential components of their production processes.

Consumer preferences lean towards shoulder bags and travel bags, which offer versatility and functionality. Closure mechanisms, such as magnetic snaps and zippers, add convenience and security. Design trends favor minimalist styles, with clean lines and understated elegance. Leather types, such as calfskin and lambskin, remain popular choices for their durability and texture. Machine stitching and dyeing processes ensure consistency and precision. Brand reputation and loyalty are crucial factors, with consumers willing to pay a premium for trusted names. Interior pockets, metal hardware, and finishing treatments add functionality and visual appeal. The supply chain is closely monitored to ensure ethical sourcing and timely delivery.

Tote bags and cosmetic bags are essential accessories that complement the main handbag. Jewelry cases, luggage tags, and leather tanning add to the overall luxury experience. Luxury goods, including handbags, are subject to price elasticity, with consumers often seeking discounts and promotions. Design trends and customer segmentation are crucial considerations for brands looking to expand their market reach. Printing techniques and stitching techniques add unique touches to each piece, making them desirable collectors' items.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Luxury Handbags Industry?

- Design and material innovation are crucial factors driving the premiumization of products in the market. By continuously pushing the boundaries of design and material development, companies are able to create high-end offerings that command a higher price point. This innovation-driven approach not only sets these products apart from their competitors but also enhances the overall consumer experience. In the market, travel bags continue to be a popular choice due to the increasing trend of jet-setting and business travel. To maintain quality control and customer satisfaction, companies prioritize artisan craftsmanship, finishing treatments, and interior pockets. Metal hardware adds durability and sophistication to these bags.

- The supply chain for luxury handbags is complex, requiring careful management of raw materials, production processes, and distribution networks. With the fashion industry evolving rapidly, companies must remain innovative and adaptable to meet the changing needs and preferences of their customers. The demand for luxury handbags is driven by brand loyalty and the desire for a premium feel. Companies respond to this trend by expanding their product lines to cater to various customer needs, from formal occasions to casual outings. The most luxurious handbags are made from high-quality materials such as crocodile skin, snakeskin, and lambskin.

What are the market trends shaping the Luxury Handbags Industry?

- The trend in the luxury handbag market is shifting towards personalization and customization. Professionals anticipate this trend to continue gaining momentum. The customization of luxury handbags is a growing trend in the market, with consumers seeking unique and personalized designs. This trend extends beyond leather handbags to include those made of metals and precious stones, particularly in the fashion industry. Over the past five years, customized luxury goods, including handbags, have gained popularity in developed regions such as the Americas and Europe.

- Customization options range from selecting specific leather types, such as calfskin or lambskin, to choosing dyeing processes and machine stitching. Customers can also add cosmetic bags, jewelry cases, and other accessories to their handbags. The customization process allows consumers to express their individuality and align their handbag with their personal style. Emerging economies like India and China are also experiencing a rise in demand for customized luxury items. Leading market players offer customized products, enhancing the aesthetic appeal of their offerings.

What challenges does the Luxury Handbags Industry face during its growth?

- The proliferation of counterfeit products poses a significant challenge to the industry's growth trajectory. It is crucial for businesses to implement robust anti-counterfeiting measures to safeguard their brand reputation and maintain consumer trust. The market experiences significant growth due to the increasing demand for high-end fashion products. However, this trend unfortunately fosters the proliferation of counterfeit luxury handbags, which pose risks to consumers. These counterfeit items, often made with substandard raw materials such as untreated leather, can be harmful to users' skin and health.

- This situation negatively impacts genuine companies by eroding market shares and damaging their reputation. Design trends and customer segmentation continue to shape the market, with various printing and stitching techniques employed to enhance the appeal of these products. Price elasticity remains a crucial factor in the market, as consumers' purchasing decisions are influenced by the price point of luxury handbags. The expansion of e-commerce platforms broadens the reach of counterfeit products, making it challenging for consumers to distinguish between authentic and imitation items. The affordability of counterfeit handbags, despite their inferior quality, fuels their demand.

Exclusive Customer Landscape

The luxury handbags market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the luxury handbags market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, luxury handbags market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3.1 Phillip Lim - The company specializes in luxury handbags and offers handcrafted, high-end collections, including the elegant Vintage Check Boucle Mini Lola Bag.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3.1 Phillip Lim

- Burberry Group Plc

- Capri Holdings Ltd.

- Chanel Ltd.

- Compagnie Financiere Richemont SA

- Dolce and Gabbana Srl

- Fendi

- Giorgio Armani SpA

- Hermes International SA

- Kering SA

- Maus Freres SA

- Mulberry Group Plc

- Prada Spa

- PVH Corp.

- Ralph Lauren Corp.

- Rebecca Minkoff LLC

- Sungjoo Group

- Tapestry Inc.

- The LVMH group

- Tory Burch LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Luxury Handbags Market

- In January 2024, Hermès International, a leading luxury goods company, announced the launch of its new limited-edition handbag collection, the 'Hermès Jardin Secret,' in collaboration with artist Elsa Mora (Reuters). This collection marked a significant departure from traditional handbag designs, incorporating botanical motifs and intricate embroidery.

- In March 2024, LVMH Moët Hennessy Louis Vuitton, the world's largest luxury goods group, entered into a strategic partnership with Rimowa, the German luggage manufacturer, to expand its presence in the travel goods market (Bloomberg). This collaboration allowed LVMH to leverage Rimowa's expertise in premium luggage and expand its product offerings beyond handbags.

- In April 2025, Chanel, the iconic French fashion brand, secured a major regulatory approval from the Chinese authorities to open its first flagship store in Shanghai's prestigious IAPM Mall (Wall Street Journal). This expansion marked Chanel's significant entry into the lucrative Chinese market, which is a key growth driver for the luxury handbags industry.

- In May 2025, Prada S.P.A., the Italian luxury fashion house, announced a significant investment of â¬100 million in its manufacturing facility in Italy to enhance its production capabilities and maintain its market leadership (Reuters). This investment underscores Prada's commitment to innovation and quality, ensuring it remains a major player in the market.

Research Analyst Overview

In the market, intellectual property protection is paramount for brands to safeguard their unique designs and logos. After-sales support, including repair services and authentication, enhances customer satisfaction and loyalty. Investment value is a significant factor driving the market, with many collectors seeking limited edition and vintage handbags. Digital marketing strategies, such as social media and influencer campaigns, are essential for reaching consumers. Brands also leverage data analytics to understand consumer behavior and trends. Sustainable practices, including upcycled and recycled materials, vegan leather, and fair trade, are gaining popularity among socially responsible consumers. Trade shows and fashion shows provide opportunities for brands to showcase their latest collections and build industry relationships.

Omnichannel retailing, including e-commerce platforms and mobile commerce, offers convenience and flexibility for consumers. Brand protection and competitor benchmarking are crucial for maintaining market position. Industry events, distribution networks, and online marketplaces provide opportunities for expansion and growth. The resale market for pre-owned handbags offers an additional revenue stream for brands and consumers alike. Customer service, visual merchandising, and inventory management are essential components of the luxury retail experience. Sustainable practices, such as supply chain management and trend forecasting, are becoming increasingly important for brands seeking to differentiate themselves in the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Luxury Handbags Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market growth 2025-2029 |

USD 27.41 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.1 |

|

Key countries |

US, China, France, Italy, Japan, Germany, India, UK, Spain, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Luxury Handbags Market Research and Growth Report?

- CAGR of the Luxury Handbags industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the luxury handbags market growth of industry companies

We can help! Our analysts can customize this luxury handbags market research report to meet your requirements.