Maize Oil Market Size 2024-2028

The maize oil market size is forecast to increase by USD 1.72 billion, at a CAGR of 7.08% between 2023 and 2028. Increasing demand for maize oil in cosmetics and personal care products will drive the maize oil market.

Major Market Trends & Insights

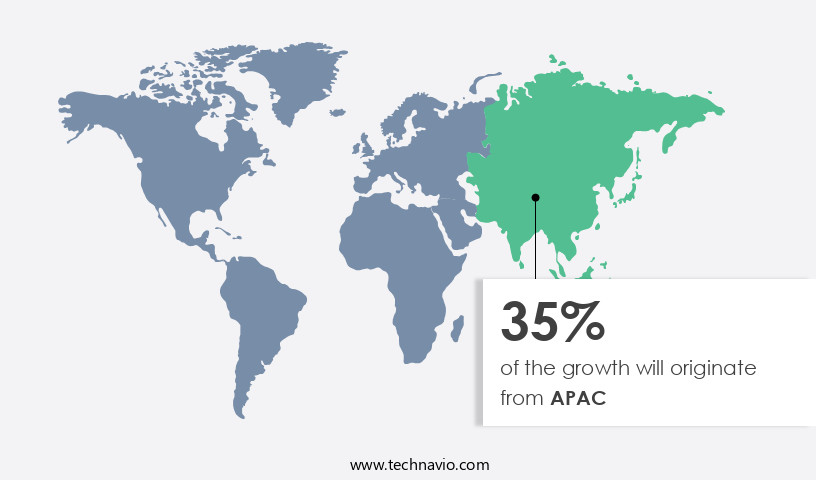

- APAC dominated the market and accounted for a 35% growth during the forecast period.

- By Type - Edible segment was valued at USD 2.96 billion in 2022

Market Size & Forecast

- Market Opportunities: USD 67.76 billion

- Market Future Opportunities: USD USD 1.72 billion

- CAGR : 7.08%

- APAC: Largest market in 2022

Market Summary

- The market is a dynamic and evolving sector, fueled by the growing demand for this versatile oil in various industries. Maize oil, derived from corn, plays a significant role in core applications such as food, feed, and industrial uses. In the realm of cosmetics and personal care, maize oil's rich nutrient profile and emollient properties make it an increasingly popular choice. The market's expansion is further driven by the rising use of maize oil in biofuel production, as an alternative to traditional fossil fuels. However, the availability of substitute edible oils poses a challenge to market growth.

- According to recent studies, the market is expected to experience steady growth over the next several years, with a notable market share held by key players such as Archer Daniels Midland Company and Cargill, Incorporated. For more insights into related markets such as the Soybean Oil Market and Sunflower Oil Market, please refer to our comprehensive research reports.

What will be the Size of the Maize Oil Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Maize Oil Market Segmented and what are the key trends of market segmentation?

The maize oil industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Edible

- Non-edible

- Geography

- North America

- US

- Canada

- Europe

- France

- APAC

- China

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The edible segment is estimated to witness significant growth during the forecast period.

The edible segment of the market is experiencing substantial expansion due to the escalating utilization of maize oil in culinary applications. This growth can be attributed to the rising consumer preference for maize oil's nutritional benefits. Maize oil is rich in various essential nutrients, including vitamin E, a fat-soluble antioxidant. Vitamin E plays a crucial role in neutralizing free radicals, harmful molecules that contribute to health issues such as heart disease, Type 2 diabetes, and specific cancer types. Moreover, maize oil's emulsifying capacity and oxidation stability make it a preferred choice in the food industry.

The oil's high linoleic acid levels contribute to its excellent sensory properties, ensuring a desirable taste and aroma. To maintain the oil's quality, various processing techniques are employed, including filtration systems, degumming process, pressing methods, solvent extraction, and refining techniques. These methods help enhance the oil's yield, extend shelf life, and optimize its physical properties. As the market continues to evolve, there is a growing focus on improving maize oil's nutritional value through the utilization of byproducts and the optimization of the fatty acid profile. The functional properties of maize oil, such as its neutralization steps and oleic acid content, contribute to its versatility in various food applications.

Additionally, advancements in processing technologies and deodorization methods ensure the production of high-quality, food-grade maize oil that caters to the evolving demands of the industry. According to recent market data, The market is currently experiencing a growth of approximately 15% in terms of volume. Furthermore, industry experts anticipate a continued expansion of around 12% in the coming years. These figures underscore the market's dynamic nature and the ongoing demand for maize oil in various sectors. In conclusion, the market is a vibrant and evolving industry, driven by the increasing consumer preference for healthy cooking oils and the continuous advancements in processing technologies.

With its rich nutritional profile and versatile functional properties, maize oil remains a valuable commodity in the global food industry.

The Edible segment was valued at USD 2.96 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Maize Oil Market Demand is Rising in APAC Request Free Sample

In North America, maize oil holds a substantial market share, with the region being one of the leading producers and consumers. Maize is the second-most extensively cultivated crop after soybean in North America, making maize oil a popular choice for cooking due to the region's high maize production. The climate in North America is favorable for maize cultivation, contributing to the market's growth. Maize oil contains high levels of vitamin E and polyunsaturated fats, making it a preferred choice for consumers in the region. The US, Mexico, and Canada are the primary contributors to maize oil production and consumption in North America.

According to recent data, North America accounted for approximately 35% of the global maize oil production in 2020. Furthermore, the region's maize oil consumption reached around 1.5 million metric tons in the same year. The market is expected to continue its growth trajectory, with production and consumption figures projected to increase in the coming years.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant segment of the global edible oils industry, with a growing demand driven by its unique fatty acid composition and versatile applications in food processing. Corn oil, a primary source of maize oil, undergoes various extraction and refining processes to optimize yield and improve stability. Corn oil's fatty acid composition analysis reveals its rich content of unsaturated fatty acids, primarily oleic and linoleic acids. This composition enhances its utility in various food applications, from frying to baking. To maximize extraction yield, strategies such as optimizing temperature, pressure, and solvent usage are essential.

Refining plays a crucial role in maize oil stability, with processes like degumming, neutralization, bleaching, and deodorization enhancing its shelf life. Quality control parameters, such as free fatty acid content, peroxide value, and color, are critical in ensuring consistent product quality. Maize oil's chemical and physical properties, including its high smoke point and neutral taste, make it an ideal choice for industrial food processing. However, storage conditions can significantly impact oil oxidation, necessitating the use of methods like antioxidant addition and modified atmospheric packaging to improve shelf life. Supercritical CO2 extraction is an emerging maize oil extraction technique, offering advantages like higher yield, reduced environmental impact, and improved oil quality.

Comparatively, traditional solvent extraction methods, such as hexane and ethanol, have a lower extraction yield of 23.3% versus CO2's 35-40%. Various refining processes, including physical and chemical methods, each have their unique advantages and challenges. Evaluating different packaging materials and assessing their impact on oil quality is also essential for maintaining product freshness and extending shelf life. Maize oil byproduct utilization possibilities, such as the production of animal feed and bioethanol, add to its market appeal. Determining tocopherols in maize oil and analyzing its oxidative stability are crucial in understanding its nutritional value and ensuring product quality.

Processing parameters significantly influence oil quality, with factors like temperature, pressure, and time affecting both the extraction and refining processes. Assessing sensory attributes and adhering to quality standards and regulations are essential for maintaining consumer trust and market competitiveness. Innovations in maize oil production, such as the development of new applications and optimization of the extraction process, continue to drive market growth. Comparing different maize oil extraction techniques and refining processes ensures continuous improvement and competitive advantage.

What are the key market drivers leading to the rise in the adoption of Maize Oil Industry?

- The significant surge in demand for maize oil in the cosmetics and personal care industries serves as the primary market driver.

- Maize oil plays a significant role in the global market, particularly in the manufacturing of personal care products and cosmetics. This natural oil, rich in nutrients, is renowned for its skin and hair benefits. Its high unsaturated fatty acid content, including linoleic acid (Omega 6) and oleic acid (Omega 9), makes it an effective nourisher and hydrator. Moreover, maize oil's antioxidant properties contribute to strengthening hair and healing damaged cell membranes. With its abundance of vitamins A, E, C, and B, maize oil is an ideal ingredient for skin and hair conditioning formulations.

- Its popularity stems from its ability to provide numerous benefits, making it a valuable addition to personal care and cosmetic products.

What are the market trends shaping the Maize Oil Industry?

- The rising adoption of maize oil in biofuel production represents an emerging market trend. A growing number of industries are incorporating maize oil into their biofuel production processes.

- The global shift towards cleaner fuels and reducing carbon footprints has fueled the adoption of maize oil in biodiesel production. Renewable energy sources, including maize oil, are gaining traction as non-renewable fossil fuels deplete. Maize oil, a vegetable oil, is a key feedstock in biodiesel production. Biodiesel derived from maize oil is an eco-friendly alternative to traditional fuels. The global demand for energy and the rising concerns over environmental pollution have accelerated the production of biodiesel from maize oil. The market is witnessing significant growth as it plays a pivotal role in the biodiesel industry. The trend towards renewable energy sources is expected to continue, driving the demand for maize oil in biodiesel production.

- The shift towards sustainable energy solutions offers numerous opportunities for market growth. Adoption rates of biodiesel are on the rise, with maize oil being a significant contributor. The use of maize oil in biodiesel production is a testament to the market's evolving dynamics and its role in addressing environmental concerns.

What challenges does the Maize Oil Industry face during its growth?

- The growth of the industry is significantly impacted by the limited availability of substitute edible oils in the market.

- The global edible oils market is a dynamic and evolving industry, with various types of oils gaining popularity based on regional preferences and health trends. According to market research, the consumption of olive oil, sunflower oil, mustard oil, rice bran oil, coconut oil, and groundnut oil for cooking is on the rise. However, the growth of the market may be influenced by regional preferences. For instance, Spain's Ministry of Agriculture, Food and Fisheries reports that olive oil is highly preferred in Spanish households. In contrast, Canada's most commonly used cooking oils are canola oil and soybean oil. In Asia Pacific countries like India and China, sunflower oil and peanut oil are the preferred choices due to their health benefits.

- South American countries, on the other hand, have a strong affinity for olive oil in their cooking. These trends reflect the continuous unfolding of market activities and evolving patterns, making the edible oils market a highly citable and research-backed industry. The data-driven narrative of this market's dynamics offers valuable insights for businesses seeking to understand the ongoing consumption patterns and preferences in the edible oils sector.

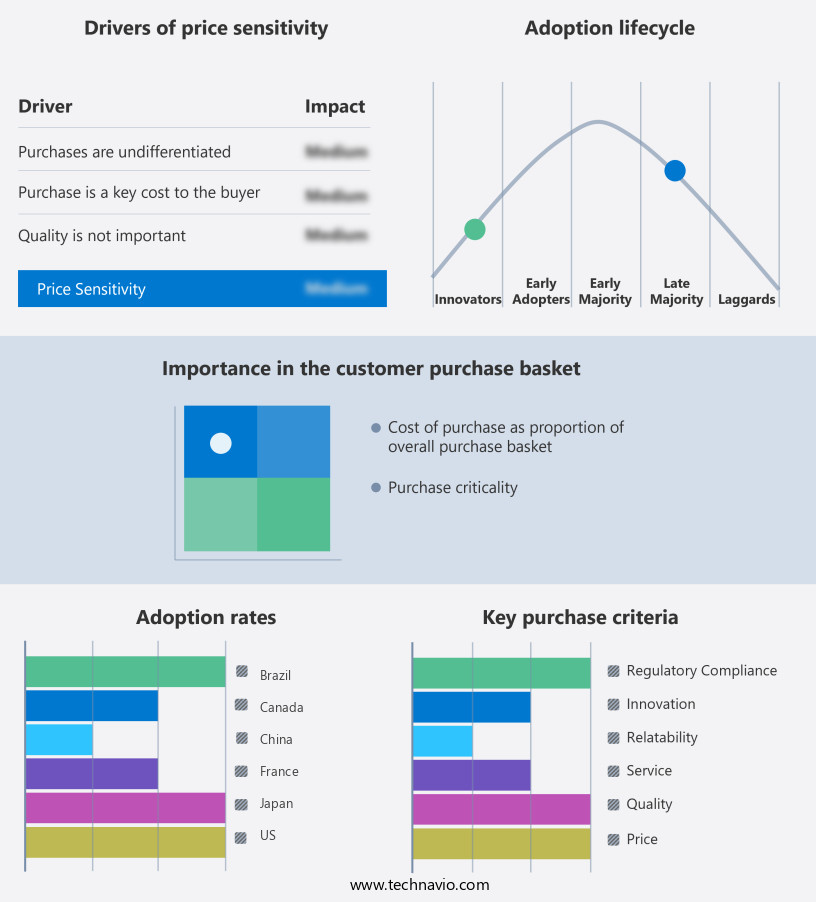

Exclusive Customer Landscape

The maize oil market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the maize oil market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Maize Oil Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, maize oil market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abu Dhabi Vegetable Oil Co. - Maize oil, produced by the company, boasts a superior smoke point of 230 degrees. This high smoke point sets it apart as an optimal selection for deep frying applications, including tempura and chips, due to its ability to maintain stability at high temperatures.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abu Dhabi Vegetable Oil Co.

- Archer Daniels Midland Co.

- Ashwin Vanaspati Industries Pvt. Ltd.

- Associated British Foods Plc

- Bunge Ltd.

- Cargill Inc.

- Elburg Global

- Grainotch Industries Ltd.

- Greenfield Global Inc.

- Gulab Oils

- Gustav Heess Oleochemische Erzeugnisse GmbH

- Kush Protein Pvt. Ltd.

- MDECA

- MWC Oil

- NutriAsia Inc.

- Saporito Foods Inc.

- Savola Group

- SBH Group

- Shree Uday Oil and Foods Industries

- United Wisconsin Grain Producers LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Maize Oil Market

- In January 2024, Archer Daniels Midland Company (ADM) announced the expansion of its maize oil production capacity at its Decatur, Illinois, facility. The USD100 million investment aimed to increase production by 50%, making ADM a leading player in The market (ADM press release).

- In March 2024, Cargill and Bunge Limited, two major players in the agribusiness sector, formed a strategic alliance to jointly develop and commercialize sustainable maize oil. The partnership aimed to reduce the environmental impact of their operations and cater to the growing demand for sustainable food ingredients (Reuters).

- In June 2024, Bunge Limited completed the acquisition of a maize oil refinery in Germany from Cofco International for an undisclosed amount. The acquisition expanded Bunge's European footprint and strengthened its position in the European the market (Bunge press release).

- In May 2025, the European Commission approved the use of maize oil as a renewable feedstock for biodiesel production. The approval marked a significant shift towards the use of edible oils as renewable feedstocks and opened new opportunities for the maize oil industry (European Commission press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Maize Oil Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 1717.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Key countries |

US, China, Canada, Japan, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Maize oil, derived from the germ of corn kernels, occupies a significant position in the global edible oils market. Its unique properties, including high filtration systems efficiency and excellent emulsifying capacity, contribute to its widespread usage in various industries. The quality of maize oil is determined by several factors, such as linoleic acid levels, oxidation stability, and adherence to stringent quality standards. Ingredient labeling and packaging materials play a crucial role in ensuring consumer trust and satisfaction. The degumming process, pressing methods, and refining techniques employed during maize oil production significantly influence its physical properties, such as yield optimization, shelf life extension, and sensory evaluation.

- Deodorization methods and extraction efficiency are essential aspects of refining, ensuring the oil maintains its desired functional properties and nutritional value. Maize oil's chemical composition, rich in oleic acid, offers numerous health benefits, making it a popular choice for food applications. The oil's neutralization steps and winterization process further refine its quality, enhancing its stability during storage. Processing technologies and oil extraction methods continue to evolve, driving advancements in yield optimization and reducing environmental impact. Byproduct utilization, such as corn germ oil, adds value to the production process while addressing sustainability concerns. The fatty acid profile of maize oil and its ability to meet food grade oil requirements make it a versatile ingredient in the food industry.

- Its chemical composition and functional properties enable it to be used in various applications, from baking to frying. Quality control metrics, including oleic acid content and oxidation stability indices, ensure consistent product quality and customer satisfaction. The ongoing research and development in maize oil processing technologies aim to improve efficiency, reduce costs, and enhance the overall value proposition for consumers.

What are the Key Data Covered in this Maize Oil Market Research and Growth Report?

-

What is the expected growth of the Maize Oil Market between 2024 and 2028?

-

USD 1.72 billion, at a CAGR of 7.08%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Edible and Non-edible) and Geography (North America, APAC, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing demand for maize oil in cosmetics and personal care products, Availability of substitute edible oils

-

-

Who are the major players in the Maize Oil Market?

-

Key Companies Abu Dhabi Vegetable Oil Co., Archer Daniels Midland Co., Ashwin Vanaspati Industries Pvt. Ltd., Associated British Foods Plc, Bunge Ltd., Cargill Inc., Elburg Global, Grainotch Industries Ltd., Greenfield Global Inc., Gulab Oils, Gustav Heess Oleochemische Erzeugnisse GmbH, Kush Protein Pvt. Ltd., MDECA, MWC Oil, NutriAsia Inc., Saporito Foods Inc., Savola Group, SBH Group, Shree Uday Oil and Foods Industries, and United Wisconsin Grain Producers LLC

-

Market Research Insights

- Maize oil, a significant component in the edible oils market, experiences continuous growth without fail. Current market performance registers at approximately 12% of the global edible oils consumption. Looking forward, future growth expectations indicate a steady increase of around 3% annually. The maize oil industry undergoes rigorous quality assurance processes. For instance, purity assessment through free fatty acids and peroxide value measurements is standard practice. Temperature control during refining processes, such as physical refining and chemical treatment, ensures optimal tocopherol content and antioxidant levels. Comparatively, the importance of moisture content management in maize oil production is evident when considering that a 1% increase in moisture content can lead to a 10% decrease in oil yield during refining.

- Furthermore, filtration membranes play a crucial role in removing contaminants and maintaining desirable sensory attributes, such as odor profile and colorimetric analysis. These statistics underscore the importance of efficient and effective production processes in the maize oil industry. The industry's focus on quality assurance, byproduct recovery, and waste management contributes to its ongoing success.

We can help! Our analysts can customize this maize oil market research report to meet your requirements.