Malic Acid Market Size 2025-2029

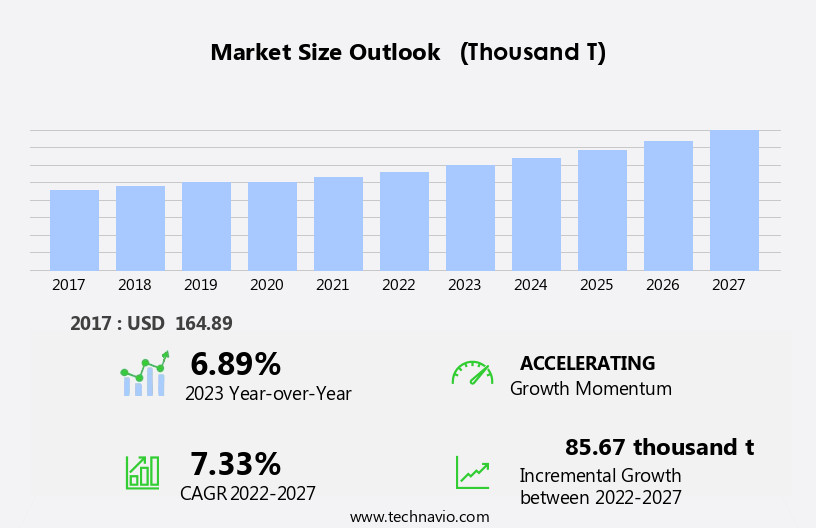

The malic acid market size is forecast to increase by USD 70.1 million, at a CAGR of 4.9% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand in the food and beverage industry. Malic acid, a key ingredient in various food and beverage applications, is gaining popularity due to its ability to enhance taste, improve texture, and extend shelf life. Legal factors, such as regulations on food additives and waste management, also impact profit margins. This trend is expected to continue as consumers increasingly seek healthier and more natural food and beverage options. However, the market faces challenges due to the price volatility of raw materials. Malic acid is derived from apples, corn, or other fruits, and the cost of these raw materials can fluctuate significantly based on supply and demand dynamics.

- This price volatility can impact the profitability of malic acid producers and end-users alike. Additionally, the shift toward bio-based malic acid is gaining momentum as consumers and regulatory bodies push for more sustainable and eco-friendly production methods. Companies seeking to capitalize on market opportunities must navigate these challenges effectively by implementing supply chain strategies, exploring alternative raw materials, and investing in research and development to improve production efficiency and reduce costs. In feed additives, it improves the nutritional value and digestibility of animal feed.

What will be the Size of the Malic Acid Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by its diverse applications across various sectors. L-malic acid, a key player in the market, finds extensive use in food and beverage industries as a flavor enhancer and food preservative. In the dairy and meat sectors, malic acid is employed for ph control and improving shelf life. Simultaneously, its role extends to dietary supplements, where it serves as a chelating agent and aids in enhancing nutrient absorption. Beyond food and beverage applications, malic acid's significance is felt in the pharmaceutical industry, where it is used as a pH control agent and in the production of certain drugs.

The renewable resources-based production of malic acid is gaining traction, offering a sustainable alternative to chemical synthesis. Moreover, malic acid's applications stretch to animal nutrition, personal care products, and even in the production of fumaric acid. The ongoing focus on safety standards and quality control ensures that malic acid production remains a priority for manufacturers. Gas chromatography plays a crucial role in the analysis and purification processes of malic acid, ensuring its consistent quality. Malic acid's role in ph control and food preservation continues to be a significant factor in its demand, with the environmental impact of production being a growing concern.

The market dynamics of malic acid are influenced by various factors, including the availability of raw materials, technological advancements, and regulatory requirements. The evolving nature of these factors necessitates continuous adaptation and innovation in the malic acid industry.

How is this Malic Acid Industry segmented?

The malic acid industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- L-malic acid

- Dl-malic acid

- D-malic acid

- Application

- Beverages

- Confectionaries and food

- Personal care and cosmetics

- Others

- End-user

- Food and beverage processing

- Pharmaceuticals industry

- Animal feed industry

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Middle East and Africa

- South Africa

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

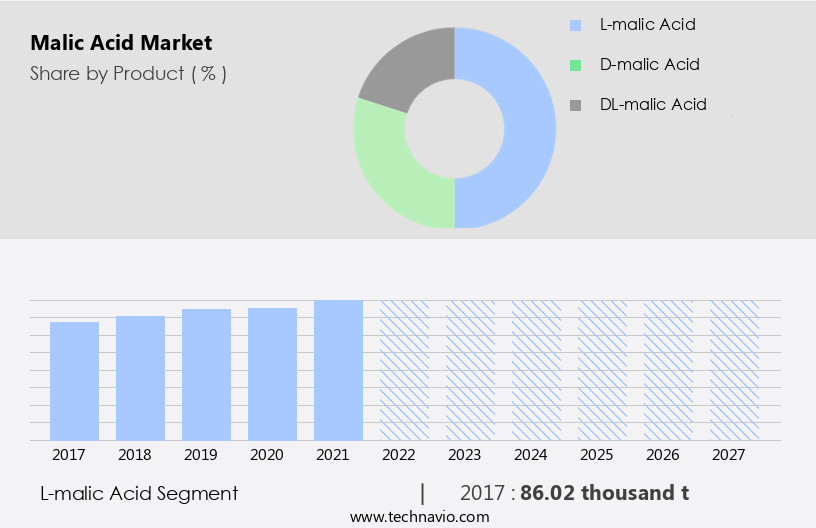

By Product Insights

The L-malic acid segment is estimated to witness significant growth during the forecast period. L-malic acid, the levorotatory isomer of malic acid, is a naturally occurring organic compound found in various fruits, including apples and grapes. This optically active compound is biocompatible and widely utilized across several industries, particularly food and beverages, pharmaceuticals, and cosmetics. In the food and beverage sector, L-malic acid functions as a flavor enhancer, improving taste profiles in candies, fruit juices, and wines with its smooth sourness and stability. In the pharmaceutical industry, it is a key ingredient in effervescent tablets and syrups, offering both functional additives and sensory benefits. The cosmetics industry values L-malic acid as a gentle alpha hydroxy acid (AHA), prized for its exfoliating properties and compatibility with sensitive skin formulations.

Food grade L-malic acid is produced through various purification processes, including chemical synthesis and enzymatic synthesis. It is used in food preservation to extend shelf life and enhance safety standards. Malic acid production also involves the use of renewable resources, such as agricultural sources, to minimize environmental impact. In the food and beverage industry, L-malic acid is often used in conjunction with other flavor enhancers, such as tartaric acid and citric acid, to create complex taste profiles. In dairy products and meat products, L-malic acid acts as a chelating agent, enhancing the nutritional value and improving the overall quality of the final product.

L-malic acid is also used in animal nutrition as a feed additive, contributing to improved digestion and growth. In the pharmaceutical sector, L-malic acid is used in the production of various pharmaceutical applications, including dietary supplements and oral care products. The supply chain for L-malic acid involves various stakeholders, including manufacturers, distributors, and end-users, ensuring a consistent and reliable supply of this versatile compound. Pharmaceutical grade L-malic acid is produced under stringent quality control measures, ensuring purity and consistency. It is used in various pharmaceutical applications, including as a pH control agent and a chelating agent. Fumaric acid, another organic compound, is sometimes used in combination with L-malic acid to enhance its functionality.

L-malic acid is a versatile and valuable compound with applications in various industries, including food and beverages, pharmaceuticals, and cosmetics. Its production involves various purification processes, including chemical synthesis and enzymatic synthesis, and the use of renewable resources to minimize environmental impact. Its functional properties, such as its ability to act as a chelating agent and a pH control agent, make it a valuable addition to various products, from food and beverages to pharmaceuticals and cosmetics. The supply chain for L-malic acid involves various stakeholders, ensuring a consistent and reliable supply of this important compound.

The L-malic acid segment was valued at USD 120.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

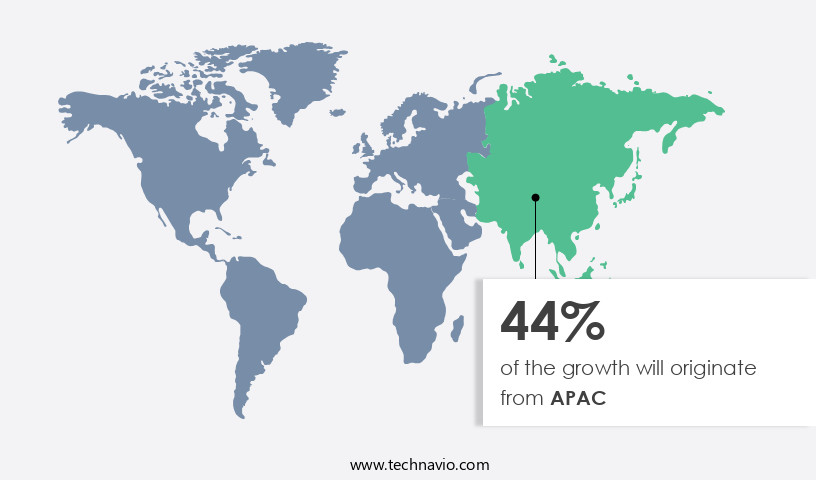

APAC is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, with the Asia-Pacific (APAC) region leading the charge. Rapid industrialization and expanding sectors in food and pharmaceuticals are key drivers of this trend. China, in particular, plays a pivotal role, serving as both the largest producer and consumer of malic acid. In 2024, China accounted for approximately half of the world's malic acid and lactic acid production, encompassing both synthetic (DL-malic acid) and natural (L-malic acid) forms. The food production sector in China grew by 2.9% in value in 2023, surpassing average industrial growth. Malic acid is used extensively in food applications, including as a flavor enhancer in dairy products, meat products, and bakery items, as well as a preservative in beverages and fruit juices.

It also finds use in pharmaceutical applications, animal nutrition, and personal care products. Malic acid can be produced through various methods, including chemical synthesis and enzymatic synthesis, with renewable resources increasingly being utilized to reduce environmental impact. Malic acid production requires stringent quality control measures, including ph control and safety standards, to ensure product purity and safety. Additionally, malic acid functions as a chelating agent, extending the shelf life of various products. The market's growth is further fueled by its use as a feed additive and its potential applications in fumaric acid production. The global malic acid supply chain is complex, with various players involved in production, distribution, and sales.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Malic Acid Industry?

- The food and beverage industry's expanding demand serves as the primary market driver. The food and beverage sector holds significant market share due to malic acid's ability to provide a tart, fruit-like taste profile, making it an ideal ingredient for processed foods and beverages. This trend is particularly noticeable among younger demographics, who exhibit a growing preference for sour and tangy flavors. Consequently, malic acid is extensively used in confectionery, dairy, and beverage products, including sour gummies, hard candies, and flavored carbonated drinks. Beyond food and beverage applications, malic acid finds use in other industries such as animal nutrition, pharmaceuticals, and personal care products.

- In animal nutrition, it functions as a feed additive, contributing to improved digestion and growth. In pharmaceuticals, it serves as an intermediate in the synthesis of various drugs. Lastly, in personal care products, malic acid acts as a preservative and pH adjuster. Two primary production methods exist for malic acid: chemical synthesis and enzymatic synthesis. Chemical synthesis involves the reaction of ethylene glycol and carbon dioxide, while enzymatic synthesis uses malic acid dehydrogenase to convert malate to malic acid. The choice of production method depends on factors such as cost, yield, and environmental impact.

What are the market trends shaping the Malic Acid Industry?

- The trend in the market is moving towards the use of bio-based malic acid. The market is experiencing a significant shift towards bio-based production using renewable resources. This trend is driven by increasing consumer and regulatory demand for sustainable ingredients in the food, pharmaceutical, and personal care industries. Bio-based malic acid, specifically the L-isomer, is gaining popularity as a viable alternative to synthetically produced variants, offering comparable functionality with reduced ecological impact. Anhui Huaheng Biological Co., Ltd. Recently introduced a low-carbon, bio-based L-malic acid using advanced fermentation technology. This innovation aligns with global sustainability goals and supports the growing preference for green consumption. Gas chromatography is used extensively in the production and quality control of malic acid to ensure ph control and maintain safety standards.

- The bio-based production method also enhances the overall quality of the product. The shift towards renewable resources is expected to continue, as it aligns with the global move towards sustainable and eco-friendly production methods. The use of bio-based malic acid not only benefits the environment but also offers competitive advantages in terms of brand image and consumer preference. In summary, malic acid is a versatile organic compound with a wide range of applications across various industries. Its role as a flavor enhancer and acidulant in the food and beverage sector continues to drive demand, while its use in animal nutrition, pharmaceuticals, and personal care products further expands its market potential. Both chemical synthesis and enzymatic synthesis offer viable production methods, each with its advantages and considerations.

What challenges does the Malic Acid Industry face during its growth?

- The price volatility of raw materials poses a significant challenge to the industry, potentially impeding its growth and requiring robust supply chain management strategies to mitigate potential risks. The market is influenced by several factors, primarily the price volatility of key raw materials. Synthetic malic acid, derived from maleic anhydride, is subject to fluctuations in crude oil markets. Geopolitical tensions, supply chain disruptions, and energy market instability can lead to unpredictable cost increases, posing challenges for manufacturers in terms of budget planning and procurement strategies. Natural malic acid, sourced from fruits, is also subject to seasonal variability and agricultural uncertainties. Malic acid is a widely used chelating agent in various industries, including food preservation and feed additives.

- Malic acid is also used in the pharmaceutical industry as a stabilizer and excipient. Despite these challenges, the demand for malic acid remains strong due to its essential role in various applications. The market is expected to continue growing, driven by increasing consumer awareness of food safety and the need for sustainable and natural food preservatives. However, efforts to reduce the environmental impact of malic acid production and use are gaining momentum, with a focus on developing more sustainable production methods and reducing waste. In food preservation, it acts as a sequestrant, preventing the formation of unwanted chemical reactions and extending the shelf life of food products.

Exclusive Customer Landscape

The malic acid market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the malic acid market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, malic acid market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anhui Sealong Biotechnology Co. Ltd. - The company specializes in providing malic acid, including DL-malic acid, as a functional additive for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anhui Sealong Biotechnology Co. Ltd.

- Bartek Ingredients Inc.

- Changmao Biochemical Engineering Co. Ltd.

- Corbion N.V.

- Fuso Chemical Co. Ltd.

- Guangzhou ZIO Chemical Co. Ltd

- Isegen South Africa Pty Ltd.

- Lonza Group Ltd.

- Muby Chem Ltd.

- NACALAI TESQUE INC

- Nanjing Lile Biotechnology Co. Ltd

- Polynt SpA

- Prinova Group LLC

- Thirumalai Chemicals Ltd.

- YONGSAN CHEMICALS

- Zhonglan Industry Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Malic Acid Market

- In January 2024, DuPont Nutrition & Biosciences, a leading global biotech company, announced the expansion of its malic acid production capacity at its manufacturing site in Tate, Georgia, USA. This expansion aimed to meet the growing demand for malic acid in the food and beverage industry (DuPont Press Release, 2024).

- In March 2024, Archer Daniels Midland Company (ADM) and BioAmber Inc., a leading producer of renewable chemicals, entered into a strategic partnership to produce bio-malic acid. This collaboration aimed to commercialize bio-malic acid, a sustainable alternative to conventionally produced malic acid (ADM Press Release, 2024).

- In May 2024, Corbion, a leading biobased technology company, announced the acquisition of Verenium, a US-based industrial biotech company. This acquisition strengthened Corbion's position in the market, providing access to Verenium's proprietary fermentation technology (Corbion Press Release, 2024).

- In April 2025, the European Food Safety Authority (EFSA) re-evaluated malic acid and confirmed its safety for use as a food additive. This approval boosted market confidence in malic acid's safety and regulatory compliance (EFSA Press Release, 2025).

Research Analyst Overview

In the market, sales volume is influenced by various factors, including applications in cosmetics, health benefits, and consumer preferences. Environmental factors play a significant role in market dynamics, with a growing emphasis on sustainable production and reducing the carbon footprint. Technological advancements, including emerging sensory analysis techniques and circular economy practices, are shaping the competitive landscape analysis. Economic factors, political instability, and social trends are additional influences on market growth. Salt formation during production and nutritional value are key considerations for manufacturers seeking to differentiate their brands and build customer loyalty. The antioxidant properties of malic acid contribute to its popularity in various industries, from food and beverages to pharmaceuticals.

The future outlook for the market is promising, with ongoing research into new applications and production methods. Distribution channels continue to evolve, with e-commerce and direct-to-consumer models gaining traction. Overall, the market is a complex and dynamic arena, shaped by a diverse range of factors. The Malic Acid Market is evolving rapidly due to shifting flavor profiles demanded by consumers across regions. Rising production costs push manufacturers to seek efficiency, while brands focus on building brand loyalty and strategic customer acquisition. Regional differences influence application trends, especially in food and beverage industries. Broader political factors and social factors from regulatory policies to lifestyle shifts also shape market dynamics. Meanwhile, technological factors like advanced processing and emerging technologies in fermentation and bio-based production are opening new frontiers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Malic Acid Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

232 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.9% |

|

Market growth 2025-2029 |

USD 70.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.7 |

|

Key countries |

China, US, India, Germany, Mexico, Japan, France, South Korea, Brazil, and South Africa |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Malic Acid Market Research and Growth Report?

- CAGR of the Malic Acid industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the malic acid market growth of industry companies

We can help! Our analysts can customize this malic acid market research report to meet your requirements.