Matting Agents Market Size 2024-2028

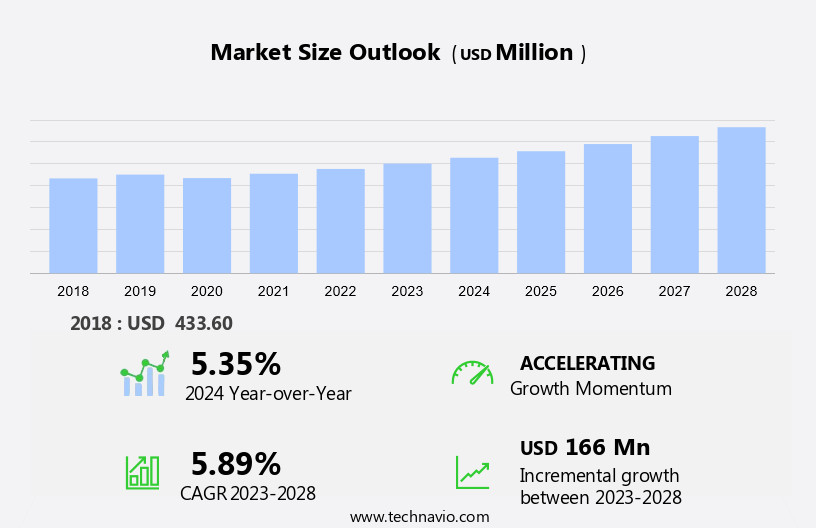

The matting agents market size is forecast to increase by USD 166 million at a CAGR of 5.89% between 2023 and 2028.

- The market is witnessing significant growth due to rising automotive production and increasing demand from the coatings industry. Matting agents play a crucial role in enhancing the aesthetic appeal and functional properties of coatings, making them an essential component in various end-use industries. However, the high cost of matting agents remains a major challenge for market growth. Despite this, the market is expected to continue its expansion, driven by the increasing demand for eco-friendly and high-performance agents.

- Additionally, the growing trend towards sustainable manufacturing processes and the development of advanced agents with improved properties are expected to provide significant opportunities for market participants. Prefabricated construction and sustainable construction, including green building technology, are key areas of focus. Overall, the market is poised for steady growth, with key trends including the increasing demand for eco-friendly and high-performance matting agents and the development of advanced manufacturing processes.

What will be the Size of the Market During the Forecast Period?

- The market within the furniture industry has experienced significant growth due to increasing demand for scratch-resistant and high-water-resistance coatings. Decorative paints and flooring manufacturers prioritize the use of matting agents to enhance the ease of use and antiglare property of their products. Wood strainers and emulsion paints are popular applications, providing businesses with a competitive edge in infrastructure projects and urbanization. Technology implementation, business model remodeling, and sustainability trends are driving the market. Waterborne are gaining popularity due to their shorter drying time and lower environmental impact compared to solvent-borne type.

- However, the market faces challenges from high humidity and freezing conditions, which can affect the flow properties of coatings. The automotive industries also utilize them for automotive interiors, requiring high scratch resistance and antiglare properties. Overall, the market is expected to continue growing, driven by the need for durable, sustainable, and functional coatings in various industries.

How is this industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Organic

- Inorganic

- Technology

- Water based

- Solvent based

- Others

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- Italy

- Middle East and Africa

- South America

- APAC

By Product Insights

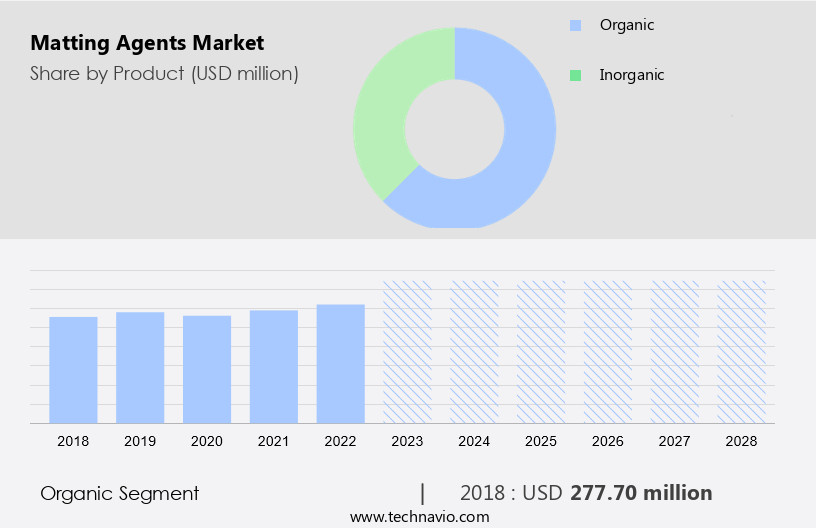

- The organic segment is estimated to witness significant growth during the forecast period.

The organic segment of The market is experiencing significant growth due to the increasing demand for sustainable and eco-friendly solutions in various industries, including paints and coatings, automotive, and construction. Organic type, derived from natural sources such as plant-based materials, offer several advantages, including a low environmental impact, reduced carbon footprint, and compatibility with eco-friendly formulations. In the coatings industry, these agents are preferred for their superior matting efficiency and ability to meet stringent regulatory requirements for volatile organic compounds (VOCs).

Furthermore, key drivers for the market include increasing consumer awareness and government regulations promoting the use of environmentally friendly products. Silica suppliers, including Precipitated Silica and Pyrogenic Silica, as well as waxes and chemicals, are major contributors to the production. Water-borne agents, a type of organic matting agent, are also gaining popularity due to their lower VOC content and ease of application. The market is expected to continue its growth trajectory in the coming years.

Get a glance at the Industry report of share of various segments Request Free Sample

The organic segment was valued at USD 277.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

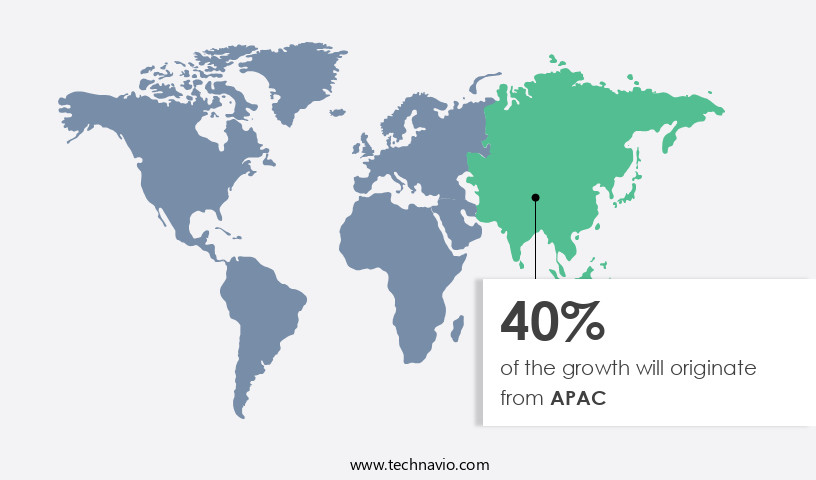

- APAC is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in the APAC region is experiencing significant growth due to the expanding industries of automotive, construction, and electronics. These sectors require a diverse range of coatings with varying degrees of gloss and surface finishes, making it essential components. In the construction and real estate sectors, there is a growing demand for coatings that offer both protective and decorative properties. This contributes to the achievement of these desired visual and tactical effects, leading to increased demand in the region.

Moreover, the APAC market's growth is further driven by the water resistance and scratch resistance properties, which are crucial in various industries. Matting agents' ease of use and ability to enhance the appearance of decorative paints, wood stains, flooring, and emulsion paints also contribute to their popularity. Overall, the APAC market's growth is a result of the region's economic expansion and the increasing demand for high-quality coatings with specific surface finishes.

Market Dynamics

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption?

Rising automotive production is the key driver of the market.

- The market is experiencing significant growth, particularly in the furniture industry and infrastructure projects, driven by urbanization and technology implementation. These agents are essential in various coatings applications, including decorative paints, flooring, and emulsion paints, due to their scratch resistance, high water resistance, ease of use, and antiglare properties. Matting agents are also utilized in architectural and industrial coatings, printing inks, and automotive industries for their flow properties and ability to adapt to high humidity and freezing conditions. Silica-based products, such as precipitated silica and pyrogenic silica, are commonly used as matting agents. Waxes and chemicals are also employed due to their unique properties. These play a crucial role in achieving the desired aesthetic and functional characteristics, allowing businesses to cater to diverse preferences and requirements. In the automotive industry, this enables manufacturers to produce finishes ranging from high-gloss to matte, enhancing the visual appeal of vehicles and components. In the furniture industry, these agents ensure the durability and resistance of coatings, while in infrastructure projects, they contribute to sustainable construction and green building technology.

- Furthermore, the coatings industry, including water-borne and solvent-borne formulations, is a significant consumer of matting agents. The market is segmented into inorganic and organic segments, with silica-based products dominating the inorganic segment. Innovative technologies, such as thermoplastic agents, are also gaining popularity due to their shorter drying time and improved particle size and pore distribution in waterborne formulations. In summary, the market is a vital component of various industries, including furniture, automotive, and construction, due to their role in enhancing the functionality and aesthetics of coatings. The market is expected to continue growing, driven by sustainability trends, prefabricated construction, and the increasing demand for sustainable and green building technology.

What are the market trends shaping the Matting Agents Industry?

Growing demand for matting agents in the coatings industry is the upcoming market trend.

- Water-based coatings, a popular choice in various industries including automotive and construction, offer several advantages over solvent-borne coatings. These coatings function as effective primers due to their superior resistance to heat and abrasion, providing excellent adhesion properties. Water-based coatings are less toxic and emit fewer hazardous pollutants, contributing to reduced air emissions. Matting agents play a crucial role in enhancing the performance of water-based coatings, particularly in terms of scratch resistance, high water resistance, ease of use, and antiglare property. in the furniture industry, waterborne type are used to improve the flow properties of decorative paints and emulsion paints. In the flooring sector, they are employed to enhance the appearance and durability of coatings, while in industrial coatings, they contribute to the overall performance and sustainability of the final product. Matting agents are also used in architectural coatings to achieve a matte finish and in automotive interiors for scratch resistance and antiglare properties. The infrastructure projects, urbanization, technology implementation, business model remodeling, sustainability trends, prefabricated construction, and sustainable construction sectors are driving the demand for waterborne agents.

- Moreover, green building technology, drying time, particle size, pore distribution, and waterborne formulation are some of the key factors influencing the market dynamics of waterborn. Silica-based products, thermoplastic agents, and formulations are the major segments in the market. Waterborne type are gaining popularity due to their eco-friendly nature, shorter drying time, and improved flow properties, even in high humidity and freezing conditions. The coatings industry, particularly the water-based inks and powder coating formulations segments, are major consumers of waterborne matting agents. The inorganic segment dominates the market, while the organic segment is expected to witness significant growth due to the increasing demand for sustainable and eco-friendly products. In summary, the market is expected to grow substantially due to the increasing demand for water-based coatings in various industries.

- Thus, the advantages of waterborne matting agents, such as scratch resistance, high water resistance, ease of use, and antiglare property, are driving their adoption in different end-user segments. The market is influenced by several factors, including drying time, particle size, pore distribution, and waterborne formulation. The major segments in the market are inorganic and organic, with silica-based products and thermoplastic agents being the key players.

What challenges does Matting Agents Industry face during the growth?

The high cost is a key challenge affecting the industry's growth.

- Matting agents play a significant role in the production of coatings and finishes within the furniture industry and other sectors. These additives, which control gloss levels and surface characteristics, contribute to the overall cost of coatings. High-priced agents can increase production expenses, potentially impacting profit margins and pricing products out of reach for certain market segments. Factors such as scratch resistance, high water resistance, ease of use, and decorative properties are essential considerations for businesses in the coatings industry. Matting agents are used in various applications, including furnishings, flooring, and architectural coatings. In the furniture industry, they contribute to the scratch resistance and durability of finished products. In flooring, they enhance the surface texture and improve slip resistance. In architectural coatings, they provide antiglare properties and contribute to the overall aesthetic appeal. Two types are commonly used: waterborne and solvent-borne. Waterborne agents, which are gaining popularity due to their sustainability and environmental benefits, offer advantages such as shorter drying times and lower humidity sensitivity.

- Additionally, solvent-borne agents, on the other hand, provide excellent flow properties and are suitable for high-performance coatings in industries like automotive and industrial applications. The market is influenced by various trends, including urbanization, infrastructure projects, business model remodeling, and sustainability trends. Prefabricated construction and sustainable construction, which rely on green building technology, are driving demand for waterborne matting agents. Additionally, technology implementation, such as innovative coatings and formulations, is expected to impact market growth. Matting agents are used in various industries, including coatings, flooring, automotive, and printing inks. Raw material suppliers, such as silica producers, play a crucial role in the supply chain. Silica-based products, including precipitated silica and pyrogenic silica, are commonly used as matting agents. Other materials, such as waxes and chemicals, are also used to create matte finishes.

- Thus, the cost of matting agents is a critical consideration for manufacturers aiming to produce cost-effective coatings and finishes. The choice between waterborne and solvent-borne matting agents depends on the specific application and desired properties. The market is influenced by various trends and factors, including urbanization, technology implementation, and sustainability trends. Manufacturers must balance the cost of production with the desired visual and performance characteristics of their coatings to remain competitive in their respective markets.

Exclusive Customer Landscape

The matting agents market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the matting agents market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, matting agents market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry. The matting agents industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akzo Nobel NV

- Arkema SA

- Axalta Coating Systems Ltd.

- Baltimore Innovations Ltd

- BASF SE

- Berkshire Hathaway Inc.

- CHT Germany GmbH

- Deuteron GmbH

- Evonik Industries AG

- Huntsman Corp.

- Imerys S.A.

- J M Huber Corp.

- Michelman Inc.

- PPG Industries Inc.

- PQ Group Holdings Inc.

- Standard Industries Inc.

- Thomas Swan and Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Matting agents, a crucial component in coatings formulations, play a significant role in enhancing the visual and functional properties of various types of coatings. These microscopic particles modify the surface appearance and texture, providing desirable attributes such as scratch resistance, high water resistance, ease of use, and antiglare property. The coatings industry, driven by infrastructure projects, urbanization, business model remodeling, and technology implementation, has witnessed substantial growth in recent years. Matting agents, as essential additives, have been integral to this expansion. In this context, it is essential to explore the market dynamics and their applications in diverse sectors. Matting agents are used extensively in decorative paints, flooring, and architectural coatings. Their role in enhancing the aesthetic appeal and functionality of these coatings is vital. For instance, in furniture industry applications, this contributes to the scratch resistance and ease of use of the coatings. In the case of automotive interiors, it provides high water resistance and antiglare properties, ensuring a comfortable and visually appealing driving experience. The coatings industry is undergoing a shift towards sustainability trends, with a growing focus on prefabricated construction, sustainable construction, and green building technology.

Additionally, matting agents, as part of this transition, are being developed to meet the evolving needs of the industry. Waterborne matting agents, for example, offer advantages such as shorter drying times, lower VOC emissions, and improved flow properties, making them a preferred choice for many applications. The market is diverse, with applications ranging from industrial coatings and printing inks to automotive industries and wood strainers. The choice depends on factors such as the specific application requirements, environmental conditions, and cost considerations. For instance, high humidity environments may necessitate the use with excellent water resistance, while freezing conditions may require agents with good flow properties. Matting agents are available in various forms, including waterborne and solvent-borne formulations.

Furthermore, waterborne matting agents, which are gaining popularity due to their environmental benefits, are derived from raw materials such as silica, waxes, and chemicals. These agents can be further classified into precipitated silica, pyrogenic silica, and thermoplastic matting agents. The choice of matting agent formulation depends on factors such as particle size, pore distribution, and the desired coating properties. In summary, the market is a dynamic and evolving one, driven by the needs of various industries and the ongoing transition towards sustainable coatings. Matting agents play a crucial role in enhancing the visual and functional properties of coatings, making them an essential component of the coatings industry. As the industry continues to grow and adapt to changing market conditions, the demand for innovative matting agent technologies and formulations is expected to increase.

|

Matting Agents Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.89% |

|

Market growth 2024-2028 |

USD 166 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.35 |

|

Key countries |

US, China, Japan, Germany, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Matting Agents Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and market trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.