Metaverse Market In Fashion Size 2025-2029

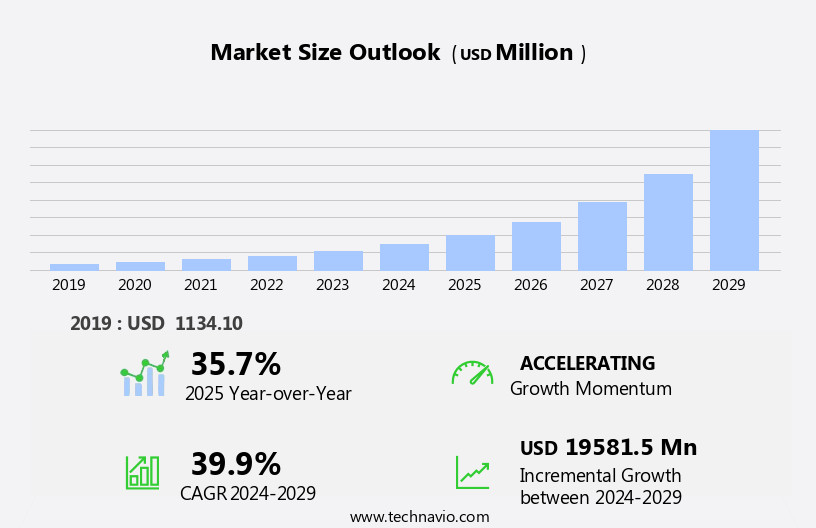

The metaverse market in fashion size is forecast to increase by USD 19.58 billion, at a CAGR of 39.9% between 2024 and 2029.

- The market is witnessing significant growth with an increasing number of fashion brands venturing into this digital space. Brands are capitalizing on the opportunity to create highly personalized digital experiences for consumers, offering them unique and immersive shopping journeys. However, this burgeoning market is not without challenges. Privacy and security concerns loom large as users share personal information and engage in virtual transactions. Brands must prioritize robust security measures and transparent data handling practices to build trust and ensure consumer confidence. Navigating these challenges while capitalizing on the opportunities presented by the market requires a strategic approach and a deep understanding of the evolving digital landscape.

- Companies seeking to succeed in this market must focus on delivering engaging, secure, and personalized experiences to their customers. By addressing privacy concerns and ensuring a secure environment, fashion brands can establish a strong presence in the Metaverse and capitalize on the growing demand for immersive digital shopping experiences.

What will be the Size of the Metaverse Market In Fashion during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with virtual events becoming a norm for showcasing collections and showcasing sustainable fashion. Decentralized platforms enable the trade of NFT wearables, fostering a circular economy in the industry. Virtual fashion weeks offer immersive experiences through spatial computing and game engines, allowing consumers to explore digital fashion shows and engage with virtual fitting rooms. Consumer behavior shifts as personalized avatars and haptic technology enable customizable and interactive experiences. Blockchain integration ensures secure digital asset management and licensing agreements. Metaverse platforms facilitate customer engagement, data analytics, and e-commerce integration. Digital textile printing, 3D modeling, and texture mapping revolutionize fashion design, while smart fabrics and sensor integration enhance the functionality of digital garments.

User-generated content (UGC) and virtual influencers contribute to community building and brand storytelling. Privacy concerns and data security remain crucial as the market penetration grows. Market dynamics continue to unfold, with continuous innovation in virtual try-on technology, digital showrooms, and virtual influencer collaborations. The ongoing integration of wearable technology and supply chain management further propels the metaverse market forward.

How is this Metaverse In Fashion Industry segmented?

The metaverse in fashion industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Platform

- Computer

- Mobile

- Headset

- Device

- VR or AR devices

- Computing devices

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Platform Insights

The computer segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with virtual events and circular economy initiatives driving innovation. Decentralized platforms and virtual fashion weeks are revolutionizing the industry, allowing for sustainable fashion practices and social commerce opportunities. NFT wearables and licensing agreements enable digital asset management and monetization, while data analytics and personalized avatars enhance customer engagement. E-commerce integration and virtual stores offer seamless shopping experiences, and spatial computing and game engines create immersive experiences. Consumer behavior is shifting towards virtual try-on technology and user-generated content, with haptic technology and 3D printing providing new textile innovation. Blockchain integration and metaverse platforms facilitate secure data management and community building, while digital textile printing and virtual influencers offer brand storytelling opportunities.

Virtual fashion shows and digital garments showcase wearable technology and sensor integration, addressing privacy concerns and market penetration. User experience is prioritized through customizable avatars, interactive experiences, and texture mapping, while 3D modeling and virtual fitting rooms streamline the design process. Smart fabrics and supply chain management optimize production, and digital fashion design tools enable seamless collaboration. Overall, the market is evolving rapidly, offering endless possibilities for innovation and growth.

The Computer segment was valued at USD 560.50 billion in 2019 and showed a gradual increase during the forecast period.

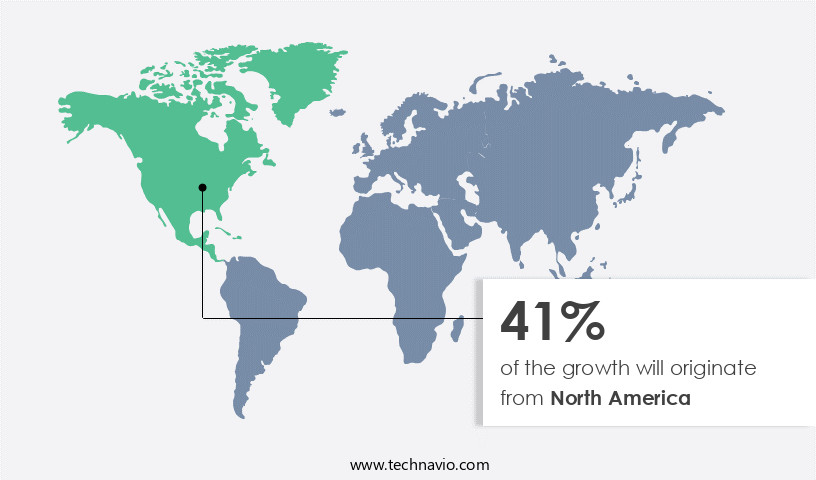

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic world of fashion, the metaverse market is revolutionizing the industry with virtual events, circular economy, and decentralized platforms. The circular economy is gaining traction through the resale and rental of virtual wearables, while sustainable fashion advocates use the metaverse for digital showrooms and digital textile printing. Social commerce thrives with licensing agreements and data analytics, enabling personalized avatars and user-generated content. E-commerce integration and digital asset management facilitate virtual stores and 3D avatars. Spatial computing, game engines, and virtual fitting rooms cater to consumer behavior, while blockchain integration ensures data security and community building.

Metaverse marketing strategies employ haptic technology, 3D printing, and body scanning technology for immersive experiences. Digital fashion design brings digital garments to life, integrating wearable technology and sensor technology. Smart fabrics and supply chain management optimize the fashion industry's efficiency. Virtual fashion weeks and virtual influencers captivate audiences, pushing market penetration and user experience. Texture mapping, 3D modeling, and virtual try-on technology enhance brand storytelling and customizable avatars. Interactive experiences and privacy concerns are key considerations for market growth. The metaverse market's evolution is an exciting intersection of technology, fashion, and consumer engagement.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the ever-evolving digital landscape, the market emerges as a pioneering space where style, technology, and immersion converge. Virtual wardrobes brim with cutting-edge digital clothing, crafted using 3D modeling and augmented reality. Fashion enthusiasts engage in avatar customization, experimenting with trendsetting virtual outfits. Metaverse fashion events unfold as immersive experiences, complete with runway shows and interactive installations. Brands leverage virtual spaces to expand their reach, offering exclusive digital merchandise. Consumers explore metaverse malls, browsing virtual boutiques and trying on digital garments. Collaborations between fashion houses and tech companies bring innovation to the forefront. Metaverse fashion is a burgeoning industry that merges the worlds of fashion and technology, offering limitless possibilities for self-expression and creativity.

What are the key market drivers leading to the rise in the adoption of Metaverse In Fashion Industry?

- The increasing presence of fashion brands in metaverse platforms serves as the primary catalyst for market growth.

- Metaverse platforms are revolutionizing the online shopping experience, particularly in the fashion industry. Brands, especially clothing apparel ones, heavily rely on attractive labels and branding for sales. In this context, 3D metaverse platforms offer an opportunity for fashion brands to enhance their online shopping experience by providing immersive virtual experiences to customers. Nike, for instance, has entered the metaverse through initiatives like Nikeland on Roblox and partnerships with Fortnite, while also launching CryptoKicks, digital versions of their sneakers using blockchain technology. Adidas, on the other hand, has adopted a community-driven approach by acquiring virtual land in The Sandbox and launching its own NFT collection through collaborations with Yuga Labs.

- These platforms also promote sustainability in fashion through circular economy practices. Virtual events, such as virtual fashion weeks, enable brands to showcase their collections in a more sustainable and cost-effective manner. Decentralized platforms provide transparency and security through digital asset management and licensing agreements. Social commerce and data analytics allow for personalized avatars and tailored recommendations, driving adoption rates. E-commerce integration ensures seamless transactions, further enhancing the shopping experience. In conclusion, metaverse platforms offer a harmonious blend of sustainability, innovation, and commerce in the fashion industry.

What are the market trends shaping the Metaverse In Fashion Industry?

- The trend in the market is shifting towards highly personalized digital experiences. As a professional virtual assistant, I am committed to delivering such experiences with expertise and knowledge.

- In the evolving landscape of e-commerce, the metaverse presents an immersive and innovative shopping experience. Consumers can now engage with clothing apparel in a virtual environment using 3D avatars. Brands that establish virtual stores in this space offer a unique, interactive experience. Spatial computing, game engines, and virtual fitting rooms enable users to try on clothes in real time. Furthermore, metaverse platforms can integrate blockchain technology for secure transactions. Haptic technology and 3D printing may also become integral parts of this shopping experience, enhancing consumer engagement.

- User-generated content plays a significant role in the metaverse, allowing for a more personalized and social shopping experience. The metaverse's impact on consumer behavior in the clothing industry is significant, offering a harmonious blend of technology and fashion.

What challenges does the Metaverse In Fashion Industry face during its growth?

- The metaverse industry faces significant growth challenges due to mounting privacy and security concerns. These concerns, which are of paramount importance to both users and regulators, necessitate robust solutions to safeguard user data and ensure secure transactions within virtual environments.

- The market offers immersive experiences that blend the lines between the physical and digital worlds. However, data security and privacy remain significant concerns for users. Metaverse platforms collect and process vast amounts of user data, raising privacy issues. These platforms may access personal information from social networking accounts and potentially expose users to privacy breaches if hackers gain access to their devices. Furthermore, the use of smart gears, such as VR and AR metaverse devices, introduces additional privacy concerns. Community building and metaverse marketing are essential aspects of the market, but ensuring data security and privacy is crucial for user trust and adoption.

- Textile innovation, digital showrooms, virtual fashion shows, digital garment design, and supply chain management are key market dynamics. Smart fabrics and digital textile printing are also transforming the fashion industry in the metaverse. Companies must prioritize data security and privacy to build trust and foster a harmonious metaverse environment.

Exclusive Customer Landscape

The metaverse market in fashion forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the metaverse market in fashion report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, metaverse market in fashion forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - This company specializes in metaverse platforms, showcasing innovative digital fashion experiences. One notable example is the Balenciaga online fashion show, which immerses users in a multi-dimensional and interactive virtual environment. By leveraging advanced technology, these platforms offer a unique blend of fashion, entertainment, and social engagement. Users can explore, create, and connect in a dynamic and visually stunning digital space. The company's commitment to originality and excellence drives continuous innovation in the metaverse fashion landscape.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Adidas AG

- Alibaba Group Holding Ltd.

- ByteDance Ltd.

- Fashable

- Kering SA

- Magic Leap Inc.

- Meta Platforms Inc.

- Microsoft Corp.

- Mobiloitte Technologies

- NetEase Inc.

- NexTech AR Solutions Corp.

- Nike Inc.

- NVIDIA Corp.

- Queppelin

- Roblox Corp.

- Tencent Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Metaverse Market In Fashion

- In January 2024, luxury fashion brand Balenciaga announced its entry into the metaverse with the launch of its virtual store on Decentraland, becoming one of the first major fashion brands to establish a presence in this emerging digital space (Balenciaga press release). In March 2024, Nike and virtual world Roblox unveiled a partnership to create a virtual sneaker marketplace, allowing users to buy, sell, and trade digital Nike sneakers (Nike press release).

- In April 2025, Gucci revealed a significant investment in virtual reality technology, acquiring a minority stake in virtual reality startup, The Fabricant, to expand its presence in the metaverse and explore opportunities in digital fashion design and production (Gucci press release). In May 2025, luxury fashion conglomerate Kering, which owns brands like Gucci and Saint Laurent, announced a strategic partnership with Epic Games, the creator of Fortnite, to launch virtual fashion collections on the popular gaming platform (Kering press release). These developments underscore the growing importance of the metaverse in the fashion industry, with major brands investing in virtual presence, partnerships, and technology to engage with consumers in this innovative digital space.

Research Analyst Overview

- In the dynamic metaverse market, fashion brands are leveraging innovative technologies to create immersive shopping experiences for consumers. Interactive fashion shows and virtual fashion collaborations offer unique opportunities for community engagement. Avatar marketplaces enable users to customize their digital identities with 3D body scanning and virtual styling. Social media integration allows for seamless sharing of virtual fashion trends and outfits. Brands are also exploring AI-powered styling and NFT-based loyalty programs to enhance the virtual shopping experience. Virtual fashion education and NFT marketplaces provide a platform for emerging designers to showcase their creations. Metaverse fashion events, such as virtual fashion week, offer a global stage for showcasing the latest digital fashion trends.

- Virtual retail is revolutionizing the way brands build their presence in the metaverse. Virtual clothing and accessories are being designed using advanced 3D modeling techniques. Cryptocurrency payments and virtual showroom design are becoming standard features in virtual retail spaces. Avatar creation tools and virtual dressing rooms allow users to try on digital outfits before making a purchase. Brands are also experimenting with virtual fashion photography and virtual fashion trends to create engaging content for their audiences. Virtual fashion styling and digital identity are becoming essential aspects of personal expression in the metaverse. The future of fashion lies in the intersection of technology and creativity in this ever-evolving digital world.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Metaverse Market In Fashion insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 39.9% |

|

Market growth 2025-2029 |

USD 19581.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

35.7 |

|

Key countries |

US, Japan, China, Germany, India, Canada, UK, France, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Metaverse Market In Fashion Research and Growth Report?

- CAGR of the Metaverse In Fashion industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the metaverse market in fashion growth of industry companies

We can help! Our analysts can customize this metaverse market in fashion research report to meet your requirements.