Methyl Methacrylate Adhesives Market Size 2024-2028

The methyl methacrylate adhesives market size is forecast to increase by USD 549.4 million, at a CAGR of 7.08% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing demand from developing countries, particularly in Asia Pacific, is driving market expansion. Additionally, the rise in research and development activities aimed at improving product performance and sustainability is fueling innovation. Furthermore, MMA adhesives are utilized in the bonding of metals, including aluminum, steel and stainless steel in various industries. However, stringent regulations and policies pose challenges to market growth. Producers must comply with regulations to ensure product safety and environmental sustainability. Despite these challenges, the future looks promising for the market, with opportunities arising from increasing applications in various industries such as construction, automotive, and electronics. This market analysis report provides a comprehensive study of these trends and their impact on the market, offering valuable insights to stakeholders and industry participants.

What will be the Size of the Methyl Methacrylate Adhesives Market During the Forecast Period?

- The market encompasses the production and supply of polymethyl methacrylate (PMMA) adhesives, which are widely used in various industries due to their superior bonding capabilities and resistance to harsh environments. Key end-use sectors include automotive and transportation, where MMA adhesives are employed in manufacturing automotive components such as deflectors, bumpers, roofs, composite tanks, and car seats. Additionally, MMA adhesives find applications in the production of polymers like ABS, PVC, and acrylics, as well as In the electronics industry for bonding smart phone screens and electronics parts.

- The global MMA adhesives market is expected to grow significantly due to increasing demand from these end-use sectors, as well as the ongoing shift towards lightweight and durable materials in various industries. The market's expansion is also driven by the growing production of plastic waste, which is being repurposed into new products using MMA adhesives.

How is this Methyl Methacrylate Adhesives Industry segmented and which is the largest segment?

The methyl methacrylate adhesives industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Automotive and transportation

- Construction

- Marine

- Others

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By End-user Insights

- The automotive and transportation segment is estimated to witness significant growth during the forecast period.

Methyl methacrylate adhesives offer strong bonding solutions for metal and composite materials, finding extensive applications in various industries. In automotive manufacturing, these adhesives are used for bonding wheel arches, bumpers, roof panels, and internal fixtures, contributing to weight reduction, increased fuel efficiency, and enhanced aesthetic appeal. The aerospace industry utilizes methyl methacrylate adhesives for honeycomb filling, shimming, and structural bonding of aircraft components, fostering market growth. Additionally, these adhesives are employed in wind energy applications, construction, engineering, and electronics industries, offering benefits such as eco-friendliness, non-toxicity, and high performance. Polymers like ABS, PVC, acrylics, aluminum, stainless steel, and steel are common substrates for methyl methacrylate adhesives. The paints and coatings industry and medical sector also leverage these adhesives for their bonding needs.

Get a glance at the market report of share of various segments Request Free Sample

The automotive and transportation segment was valued at USD 509.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

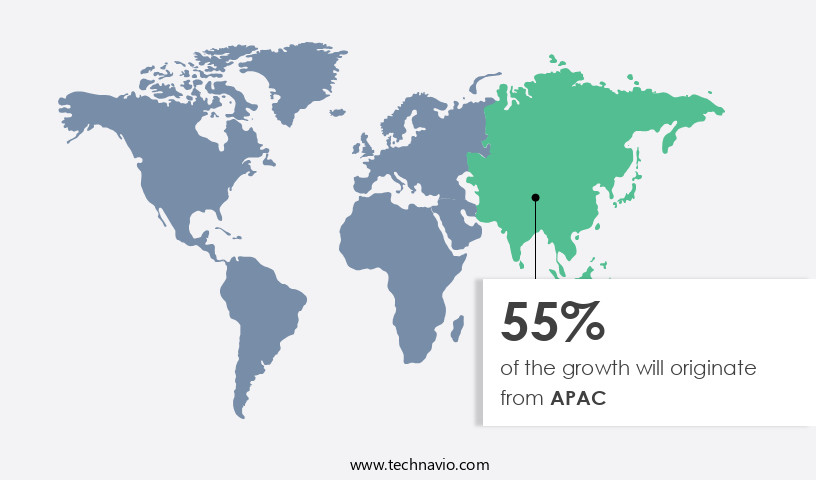

- APAC is estimated to contribute 55% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Methyl methacrylate adhesives play a significant role in various industries, including automotive, construction, and marine. The expansion of these sectors in Asia Pacific countries such as China, India, Japan, South Korea, and Indonesia is anticipated to propel the regional market. The proliferation of automotive manufacturing plants is a primary driver of market growth. APAC leads the global automotive production and is poised to maintain its dominance. Furthermore, the rise in infrastructure and residential construction In the region is expected to boost the market.

Applications of these adhesives include metal, composites, deflectors, bumpers, roofs, composite tanks, blades, car seats, instrument panels, trucks, cars, rails, buses, tanks, wind energy, building & construction, lightweight vehicles, energy-efficient vehicles, high-performance vehicles, construction products, engineering adhesives, and various industries such as paints and coatings, medical, and wind energy. Polymers like ABS, PVC, acrylics, and metals, including aluminum, stainless steel, and steel, are common substrates for methyl methacrylate adhesives. The market is expected to grow due to the increasing demand for eco-friendly, non-toxic, and sustainable adhesives.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Methyl Methacrylate Adhesives Industry?

Increasing demand from developing countries is the key driver of the market.

- Methyl methacrylate adhesives, derived from polymethyl methacrylate, play a vital role in various industries, including metal and composite manufacturing, automotive, and construction. Developing countries like China, India, Indonesia, Brazil, and Mexico are major contributors to the global methyl methacrylate market due to factors such as the availability of raw materials, inexpensive labor, ample land, and lower transportation costs. These factors, coupled with less stringent regulations, make these countries attractive locations for methyl methacrylate adhesives production. The construction industry's growth, driven by urbanization and improved living standards in APAC, significantly impacts the demand for methyl methacrylate adhesives. In the automotive sector, these adhesives are used for bonding composite tanks, car seats, instrument panels, rails, and other components in trucks and cars.

- In the wind energy industry, methyl methacrylate adhesives are employed for manufacturing wind turbine blades. Additionally, the production of lightweight vehicles and energy-efficient and high-performance vehicles necessitates the use of lightweight adhesives, further boosting market growth. The methyl methacrylate market also caters to the needs of the eco-friendly, non-toxic, and sustainable adhesives sector. In the composite materials industry, methyl methacrylate adhesives are used as engineering adhesives for bonding ABS, PVC, acrylics, metals (aluminum, stainless steel, and steel), and other substrates. Furthermore, methyl methacrylate adhesives find applications In the paints and coatings industry, electronics, and medical industry.

What are the market trends shaping the Methyl Methacrylate Adhesives Industry?

An increase in R&D activities is the upcoming market trend.

- Methyl methacrylate adhesives, also known as Polymethyl methacrylate (PMMA) adhesives, are gaining significant traction in various industries due to their versatility and superior bonding properties. In the US, Germany, the UK, and Canada, technological advancements are driving the growth of this market. For instance, 3D vision systems are increasingly being used to inspect adhesive applications that cannot be examined by 2D systems. While 2D machines can measure the footprint of adhesives, 3D systems provide accurate volume determination and feature analysis. In October 2018, Sika, a leading adhesive manufacturer, launched two new structural methyl methacrylate adhesives, Sikafast-306 and Sikafast-308, for industrial assembly and transportation applications.

- These adhesives, based on toughened methyl methacrylate technology, offer excellent adhesion to various substrates, including metals (aluminum, stainless steel, steel), composites, and plastics (ABS, PVC, acrylics). Methyl methacrylate adhesives find extensive applications in various sectors, including automotive (car seats, instrument panels, rails, bumpers, trucks, and cars), building & construction (roofs, composite tanks, and windows), wind energy, and general assembly industries. They are also used In the production of paints and coatings, electronic parts, and medical equipment. The increasing demand for lightweight, energy-efficient, and high-performance vehicles and construction products is further fueling the growth of the market. Additionally, the shift towards eco-friendly, non-toxic, and sustainable adhesives is expected to create new opportunities for market participants.

What challenges does the Methyl Methacrylate Adhesives Industry face during its growth?

Stringent regulations and policies are a key challenge affecting the industry growth.

- Methyl methacrylate adhesives, derived from polymethyl methacrylate, play a significant role in various industries, including metal, composites, and automotive. Applications range from deflectors, bumpers, roofs, composite tanks, blades, car seats, instrument panels, trucks, cars, rails, buses, tanks, and wind energy. However, stringent regulations on the volatile organic compound (VOC) content in adhesives by the Environmental Protection Agency (EPA) and REACH pose challenges to market growth. In the US, for instance, the Massachusetts Department of Environmental Protection (MassDEP) introduced Regulation 310 CMR 7.18(30) in August 2013, setting VOC limits for industrial and commercial adhesives and adhesive primers. Europe's EU-No 10/2011 regulation focuses on plastic materials and articles, including adhesives, in indirect food additives.

- These regulations and policies may hinder market expansion during the forecast period. In the automotive sector, lightweight vehicles, energy-efficient vehicles, and high-performance vehicles require eco-friendly, non-toxic, and sustainable adhesives. Substrates like ABS, PVC, acrylics, metals (aluminum, stainless steel, steel), and paints & coatings are common In the industry. The market serves the wind energy, building & construction, and general assembly industries, among others. companies must comply with these regulations to remain competitive.

Exclusive Customer Landscape

The methyl methacrylate adhesives market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the methyl methacrylate adhesives market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, methyl methacrylate adhesives market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Arkema SA

- Chemique Adhesives

- DELO Industrie Klebstoffe GmbH and Co. KGaA

- EMME ESSE M.S. Srl

- Engineered Bonding Solutions LLC

- H.B. Fuller Co.

- Henkel AG and Co. KGaA

- Hernon Manufacturing Inc.

- Huntsman Corp.

- IPS Corp.

- ITW Performance Polymers

- Kisling AG

- L and L Products Inc.

- NOVA Chemicals Corp.

- Parker Hannifin Corp.

- Parson Adhesives Inc.

- Permabond LLC

- Scott Bader Co. Ltd.

- Sika AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Methyl methacrylate (MMA) adhesives have gained significant traction in various industries due to their versatile properties and ability to bond different materials effectively. These adhesives are widely used In the manufacturing of metal and composite components in sectors such as automotive, transportation, construction, and wind energy. In the automotive industry, MMA adhesives play a crucial role In the production of deflectors, bumpers, roofs, composite tanks, blades, car seats, and instrument panels. They provide strong bonding solutions for metals like aluminum, stainless steel, and steel, ensuring the durability and strength required for these applications. In addition, MMA adhesives are increasingly being used In the production of lightweight vehicles, energy-efficient vehicles, and high-performance vehicles, contributing to the reduction of plastic waste and the promotion of sustainability.

Further, the transportation sector also benefits from MMA adhesives In the manufacturing of rails, buses, and trucks. These adhesives ensure the efficient bonding of various materials, contributing to the overall strength and durability of these structures. Furthermore, In the wind energy industry, MMA adhesives are utilized extensively In the production of wind turbine blades, providing reliable bonding solutions for the composite materials used in blade manufacturing. MMA adhesives are also widely used In the building & construction industry for general assembly applications. They offer excellent bonding capabilities for a range of substrates, including engineering adhesives, plastics like ABS, PVC, and acrylics, and various metals.

In addition, their eco-friendly, non-toxic, and sustainable properties make them an attractive option for the construction industry, where environmental concerns are increasingly important. The paints and coatings industry also benefits from MMA adhesives, with their use In the production of smart phone screens and electronics parts. The adhesives provide strong, reliable bonds while ensuring the flexibility and durability required for these applications. The global production capacity for MMA adhesives continues to grow, driven by the increasing demand for lightweight, durable, and eco-friendly bonding solutions across various industries. The market for MMA adhesives is expected to expand further as more industries recognize their benefits and as technological advancements continue to improve their performance and sustainability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market Growth 2024-2028 |

USD 549.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Key countries |

China, US, Japan, Germany, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Methyl Methacrylate Adhesives Market Research and Growth Report?

- CAGR of the Methyl Methacrylate Adhesives industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the methyl methacrylate adhesives market growth of industry companies

We can help! Our analysts can customize this methyl methacrylate adhesives market research report to meet your requirements.