Micro Packaging Market Size and Trends

The micro packaging market size is forecast to increase by USD 1.26 billion, at a CAGR of 16% between 2023 and 2028. The market is experiencing significant growth due to its increasing application in various industries, particularly in the beverage sector. This market is driven by the demand for product protection and consumer resistance, especially for perishable goods and beverages. Clay particles are increasingly being used in micro packaging due to their toughness and ability to provide excellent hygiene. Moreover, the trend towards smart labels and renewable fibers and bio-based materials for packaging is gaining momentum. However, the use of nanotechnology in food packaging raises concerns regarding potential hazards, which may hinder market growth. In the pharmaceutical industry, micropackaging is essential for ensuring product efficacy and patient safety. As consumer preferences shift towards eco-friendly and sustainable packaging solutions, the market for micro packaging is expected to continue its growth trajectory. Key challenges include regulatory compliance and consumer acceptance of new packaging technologies.

The market is witnessing significant advancements due to the increasing demand for compact, efficient, and sustainable packaging solutions. This market caters to various industries, including food and beverage, pharmaceuticals, and electronics, among others. One of the primary drivers for the micro packaging market is the focus on extending product shelf life. Packaging with advanced barrier properties, such as air, light, heat, and oxidation control, is increasingly being adopted to preserve the quality and freshness of perishable goods. Lightweight and compact packaging designs also contribute to reducing food waste and enhancing logistical efficiency. Sustainability is another crucial factor influencing the market. Biodegradable and recyclable materials, as well as nanotechnology applications, are gaining popularity due to their eco-friendly nature. Nanomaterial safety and toxicity concerns, however, necessitate rigorous research and regulatory compliance. Packaging design trends include the integration of active components, such as antimicrobial agents and antioxidants, to control microbial growth and maintain food quality. Intelligent packaging systems, which offer real-time monitoring of product condition and expiration, are also gaining traction.

Packaging regulations and marketing strategies play a significant role in the market. Compliance with food safety and packaging standards is essential to ensure consumer safety and brand reputation. Automation and optimization of packaging processes are crucial for cost efficiency and competitiveness. Innovations in micro packaging technology continue to emerge, with a focus on improving product protection, reducing waste, and enhancing consumer convenience. These advancements are expected to drive the growth of the market in the coming years. In conclusion, the market is witnessing continuous evolution, driven by the need for extended shelf life, sustainability, and advanced functionality. The integration of nanotechnology, intelligent systems, and eco-friendly materials are key trends shaping the future of this market.

Market Segmentation

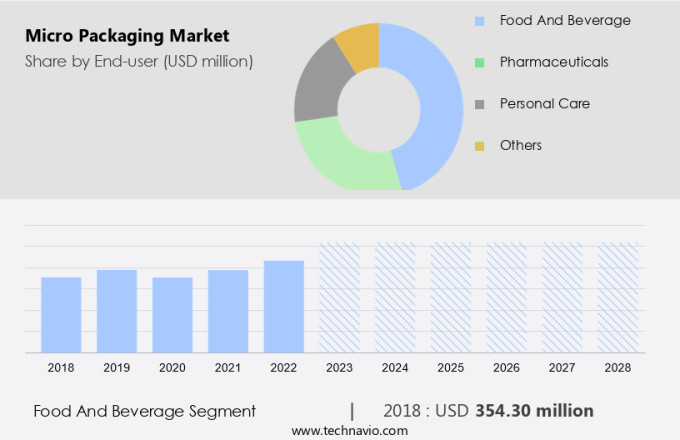

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- End-user

- Food and beverage

- Pharmaceuticals

- Personal care

- Others

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- North America

By End-user Insights

The food and beverage segment is estimated to witness significant growth during the forecast period. Micro packaging has gained significant attention in the food and beverage industry due to its ability to maintain product freshness and extend shelf life during transit. This innovative packaging solution is available in various forms, including paper bags, pouches/sachets, glass and liquid cartons, and strip packs. The materials used to manufacture these packages consist of cast polypropylene (CPP), biaxially oriented polypropylene (BOPP), low-density polyethylene (LDPE), high-density polyethylene (HDPE), polyethylene terephthalate (PET), coated polypropylenes, polyesters, cast polyamide (CPA), paper, cardboard, and aluminum. Micro packaging offers several advantages, such as anti-mist treatment to eliminate moisture, ultraviolet (UV) filtration for UV-sensitive products, laminated films suitable for pasteurization, sterilization, and microwave use, and micro-perforation to control product permeability with the atmosphere, thereby enhancing the product's shelf life.

Get a glance at the market share of various segments Download the PDF Sample

The food and beverage segment was valued at USD 354.30 million in 2018. Moreover, there is a growing trend towards using recyclable plastics in micro packaging to address consumer needs for sustainable solutions. Plastics with antimicrobial features are also gaining popularity due to their ability to prevent bacterial growth and ensure food safety. The supply chain of micro packaging involves various stages, from raw material sourcing to manufacturing, conversion, and distribution. Packaging science plays a crucial role in the development of micro packaging solutions, with a focus on thin-coating polymers and micro-fabrication techniques to enhance the functionality and performance of these packages. By implementing these advanced packaging solutions, food and beverage companies can meet the evolving needs of consumers while reducing waste and minimizing the environmental impact of their operations.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market in North America is experiencing significant growth due to the expanding food and beverage industry and increasing demand from the pharmaceutical sector. The consumption of processed RTE food items and RTD beverages is on the rise in countries like the United States and Canada. Additionally, there is a substantial market for baked goods, confectionery, instant, and convenient food and dairy products in the region. For instance, the US bread production industry reported a 7% increase in exports of bakery products in 2020, according to the American Bakers Association. This trend is expected to continue, driving the demand for micro packaging solutions in the region.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Micro Packaging Market Driver

Increasing usage in pharmaceutical industry is notably driving market growth. Micro packaging plays a significant role in the pharmaceutical sector, ensuring product safety and extending the shelf life of medications. New biochemical compounds necessitate advanced protection against external factors, including heat, moisture, oxygen, light, and mechanical stress. Micro packaging solutions, such as nanocoatings and nanocomposite-based films, provide optimal protection. These materials offer advantages like delaying oxidation, controlling microbial growth, and enhancing tamper visibility.

Innovative technological advances in micro packaging, like smart packaging and environmentally friendly alternatives, cater to economic factors and health concerns. The use of nanocoatings and mechanical strength in micro packaging is expected to drive growth in the industry. By addressing various health issues and offering lightweight, air-tight solutions, micro packaging is set to revolutionize the pharmaceutical industry. Thus, such factors are driving the growth of the market during the forecast period.

Micro Packaging Market Trends

Usage of renewable fibers and bio-based materials for packaging is the key trend in the market. The beverage industry's shift towards sustainable packaging solutions has led to an increase in the use of bio-based materials for packaging. These eco-friendly alternatives are derived from natural sources such as starch, cellulose, chitosan, proteins, and polymers produced from renewable vegetal sources. The availability of abundant raw materials for manufacturing bio-based packaging is driving its adoption in various industries, including beverages, pharmaceuticals, and perishable goods. Companies like Tetra Pak International S.A. are at the forefront of this trend, providing a diverse range of sustainable packaging options.

For instance, their plant-based milk cartons are made from plant-based polymers, which can be traced back to their sugarcane origin. The versatility of these materials offers excellent product protection, hygiene, and consumer resistance. With growing regulations in the packaging industry, the demand for bio-based packaging is expected to continue its upward trajectory. Thus, such trends will shape the growth of the market during the forecast period.

Micro Packaging Market Challenge

Hazards of nanotechnology in food packaging is the major challenge that affects the growth of the market. Micro packaging, a segment of the packaging industry, is witnessing significant advancements with the integration of nanotechnology. Nanomaterials such as silver nanoparticles (AgNPs), copper nanoparticles (CuNPs), and titanium dioxide nanoparticles (TiO2NPs) are increasingly being used in thin-film polymers and nanocoatings for micro packaging applications. These materials offer benefits like enhanced food safety, abrasion resistance, and anti-counterfeit protection. However, the use of nanotechnology in micro packaging also raises concerns regarding the potential health risks associated with the transfer of these nanoparticles to food products.

Sustainable production methods and the elimination of chemical preservatives are essential considerations in the development of nanotechnology-based micro packaging. Pharmaceutical packaging is another sector that significantly benefits from nanotechnology, with applications including controlled drug release and improved stability of active ingredients. The market is evolving, with traditional packaging methods giving way to advanced, smart packaging solutions. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amcor Plc - The company offers products such as MicroPrint.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aera SA

- Amerplast Ltd.

- A-ROO Co. LLC

- Avery Dennison Corp.

- Avient Corp.

- Bayer AG

- Berry Global Inc.

- Bollore Inc.

- Chengde Technology Co. Ltd.

- FlexPak Services LLC

- Graham Packaging Co. LP

- Honeywell International Inc.

- Mondi Plc

- ProAmpac Holdings Inc.

- TCL Packaging Ltd.

- Tetra Laval SA

- Thermo Fisher Scientific Inc.

- UFlex Ltd.

- Ultraperf Technologies Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Micro packaging is a rapidly evolving segment in the global packaging industry, driven by technological advances and consumer needs. This innovative packaging solution offers enhanced product safety and protection, particularly for perishable goods and pharmaceuticals. The use of nanocoatings and thin-film polymers provides superior barrier properties against air, moisture, and contaminants, ensuring the freshness and integrity of the contained products. Environmentally friendly and lightweight micro packaging is gaining popularity due to economic factors and consumer resistance towards single-use plastics. Nanomaterials, such as clay particles and nanocoatings, offer increased mechanical strength and abrasion resistance, making them ideal for various industries, including the beverage industry and consumer electronics.

The micro packaging market is witnessing significant growth due to the increasing demand for smaller, more efficient, and sustainable packaging solutions. One key trend in this market is the use of micro packaging for carbonation preservation in beverages, ensuring longer shelf life and consumer satisfaction. Another trend is the adoption of biodegradable packaging materials, which aligns with consumer perception of eco-friendly and sustainable packaging. Advancements in technology, such as nanotechnology in packaging, offer antimicrobial properties, heat and light barrier protection, and extended shelf life. However, concerns over nanomaterial toxicity and environmental impact are driving research into safer and more sustainable alternatives. Food packaging innovation is a major focus in the micro packaging market, with active packaging and lightweight materials reducing food waste and enhancing brand identity. Active food packaging, which includes microbial growth control and oxygen scavenging, extends the shelf life of perishable goods.

Packaging and logistics are also crucial aspects of the micro packaging market, with the need for durable and protective packaging solutions to ensure product safety and reduce damage during transportation. As consumer behavior and brand identity continue to influence packaging choices, packaging materials research and marketing strategies remain key drivers of growth in the micro packaging market.

Sustainable production and e-commerce have fueled the growth of micro packaging, as it offers versatility in packaging solutions for various applications. Regulations and health concerns have led to the development of smarter packaging, including smart labels, hygiene indicators, and freshness sensors, to ensure product safety and quality. Micro-fabrication and micro-assembly have enabled the production of advanced packaging solutions, such as edible packaging and targeted delivery systems, which offer improved bio-availability and consumer acceptance. The use of antimicrobial features and antimicrobial activity in micro packaging is also gaining traction in the pharmaceutical and food industries to ensure drug safety and maintain the nutritional content of ready-to-eat meals.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16% |

|

Market Growth 2024-2028 |

USD 1.26 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

14.0 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 35% |

|

Key countries |

US, China, Japan, Germany, France, Canada, India, South Korea, UK, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aera SA, Amcor Plc, Amerplast Ltd., A-ROO Co. LLC, Avery Dennison Corp., Avient Corp., Bayer AG, Berry Global Inc., Bollore Inc., Chengde Technology Co. Ltd., FlexPak Services LLC, Graham Packaging Co. LP, Honeywell International Inc., Mondi Plc, ProAmpac Holdings Inc., TCL Packaging Ltd., Tetra Laval SA, Thermo Fisher Scientific Inc., UFlex Ltd., and Ultraperf Technologies Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.