Mini PCs Market Size 2024-2028

The mini PCs market size is forecast to increase by USD 17.4 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing use of these compact devices in educational institutions. With the rapid penetration of internet-enabled devices in educational institutes, mini PCs have become an essential tool for delivering digital learning experiences. However, this trend also brings challenges, particularly inadequate cybersecurity measures. As more schools and universities adopt mini PCs for remote learning and digital classrooms, ensuring strong security protocols becomes crucial to protect sensitive student data.

- Additionally, mini PCs offer cost-effective solutions for businesses and individuals seeking powerful yet compact computing devices, further fueling market growth. In healthcare, mini PCs are being used in telemedicine and digital health technologies, enabling data transfer and patient care in space-constrained environments such as patient rooms and mobile healthcare units. Overall, the mini PC market is poised for continued expansion, driven by educational sector adoption and the need for portable, efficient computing solutions.

What will the Mini Pcs Market Size During the Forecast Period?

- The market is witnessing significant growth due to the increasing demand for compact computing devices that offer high data processing capabilities. These devices, often smaller than a standard desktop computer, come equipped with advanced features such as AI and IoT integration, 5G connection, and machine learning capabilities. Mini PCs are becoming increasingly popular for on-the-go computing, remote working, and digital signage technologies. Mini PCs are available in various form factors, from sticks to small boxes, making them highly portable. They come with CPUs, solid-state drives, and communication ports that enable seamless connectivity to monitors, keyboards, and other peripherals.

- Operating systems like Windows, Linux, and Chrome OS power these devices, providing users with a familiar computing experience. Mini PCs are popular among millennials, the educational sector, healthcare professionals, and smart city projects. With the ability to deliver VR experiences, gaming, and high-speed data processing, mini PCs are becoming an essential tool for those who require powerful computing on the go. Portable computer devices are available in bags, making it convenient for users to carry them around. The mini PC market is expected to continue its growth trajectory, driven by the increasing need for portable and powerful computing devices.

How is this market segmented and which is the largest segment?

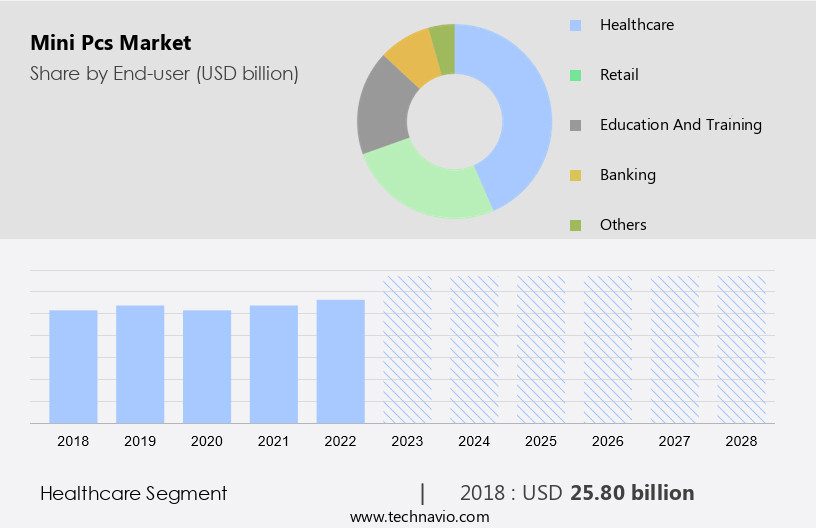

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Healthcare

- Retail

- Education and training

- Banking

- Others

- Application

- Home Entertainment

- Gaming

- Digital Signage

- Industrial Automation

- Others

- Component

- Processor

- Memory

- Storage

- GPU

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- UK

- South America

- Middle East and Africa

- APAC

By End-user Insights

The healthcare segment is estimated to witness significant growth during the forecast period. Mini PCs, a category of compact and energy-efficient computers, are gaining significant traction in various sectors due to their portability, versatility, and advanced features. In the realm of consumer electronics, mini PCs are increasingly being used for home entertainment, office work, and digital media consumption. They come with powerful processors, ample memory, and storage, enabling seamless data processing, machine learning, and AI capabilities. Moreover, mini PCs are revolutionizing industries such as healthcare, retail, manufacturing, education, and digital signage, among others. In healthcare, they facilitate the storage and accessibility of electronic health records (EHRs), enhancing the quality of patient care.

In retail, they power digital signage solutions and self-checkout systems. In manufacturing, they are utilized for industrial automation and quality control. Mini PCs are also integral to the smart home ecosystem, enabling IoT technologies to connect various smart home devices such as thermostats, lighting systems, and security cameras. With the advent of 5G connection, mini PCs offer uninterrupted streaming services, making them an essential component of the corporate and budget-conscious individual's digital transformation journey. With connectivity options galore, mini PCs are the future of hardware components in an increasingly digital world.

Get a glance at the share of various segments. Request Free Sample

The healthcare segment was valued at USD 25.80 billion in 2018 and showed a gradual increase during the forecast period.

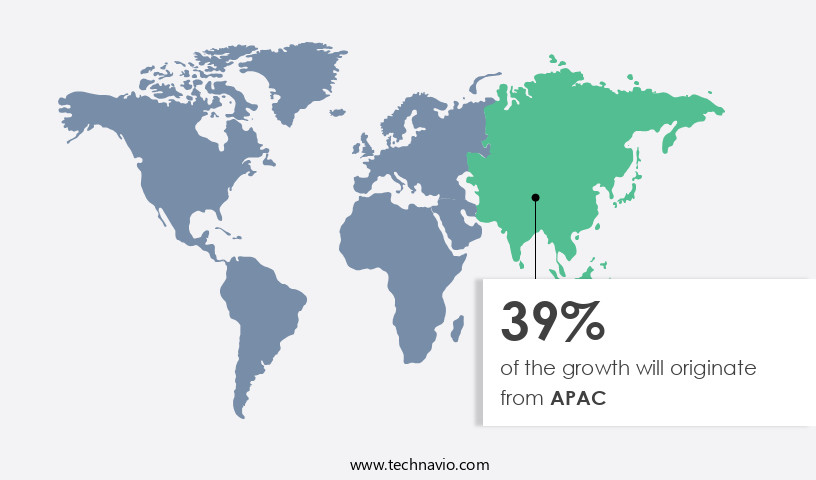

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is experiencing significant growth due to the increasing demand for compact computing devices in various sectors. IoT devices have become integral to modern homes, leading to an increased need for unified interfaces for media centers and content streaming. Smart homes are becoming more commonplace, with home automation, personalized schedules, and routines relying on automated tasks. In commercial offices, remote work and virtual meetings require dependable computing devices that offer multimedia capabilities and communication requirements. The hybrid work models of today have led to a rise in demand for portable computer devices, including mini PCs, smartphones, tablets, and laptops.

Medical practices require computing capabilities to manage patient records, medical imaging, and diagnostic tools. The primary challenges in the mini PC market include ensuring data transfer and connectivity in healthcare networks and meeting the multimedia and communication requirements of various sectors. Millennials, who prioritize convenience and mobility, are a significant market for mini PCs, with applications ranging from digital signage technologies to mobile computing. Overall, the mini PC market is poised for growth as it addresses the needs of diverse industries and user demographics.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Mini Pcs Market?

Increasing use of mini PC in educational institutions is the key driver of the market.

- Mini PCs have gained significant traction across various sectors, including education, healthcare, smart city projects, business offices, media entertainment, commercial workplaces, e-sports, retail, and banking. In the educational sector, mini PCs are increasingly being used in schools and universities due to their affordability, wireless connectivity, and ease of use. These devices enable students to take notes, collaborate with peers, write and edit documents, manage assignments, and participate in interactive learning. The rise of virtual classrooms and online courses from providers like Coursera, edX, and Udemy further boosts the demand for mini PCs in education. Similarly, healthcare professionals are adopting tablet PCs and iPads for their portability and functionality, which is crucial for managing patient records and telemedicine services.

- In the realm of smart city projects, mini PCs are employed for surveillance, traffic management, and public utility services. The business office and media entertainment sectors leverage mini PCs for multitasking and content creation. E-sports and gaming enthusiasts prefer mini PCs for their compact size and high-performance capabilities. The retail sector utilizes mini PCs for point-of-sale systems and inventory management, while the banking sector employs them for ATM services and teller machines. Lastly, the transportation sector uses mini PCs for real-time monitoring and data analysis, contributing to the overall growth of the market.

What are the market trends shaping the Mini Pcs Market?

Rapid penetration of Internet-enabled devices in educational institutes is the upcoming trend in the market.

- The market is witnessing significant growth due to the increasing preference for portable devices in various sectors, including education and healthcare. In the educational sector, the availability of customized digital content and the convenience of accessing it on-the-go have led to a shift from traditional textbooks. Mini PCs, such as tablet PCs and iPads, have become popular choices for learners and educational institutions. Similarly, in the healthcare sector, mini PCs are being used to improve patient care and streamline administrative tasks. In the commercial workplace, mini PCs are being adopted for media entertainment and e-sports applications. The retail sector is leveraging mini PCs for digital signage and point-of-sale systems.

- The banking sector is using mini PCs for ATMs and other financial transactions. Smart city projects are integrating mini PCs into transportation systems and government services. companies in the mini PC market are partnering with providers of digital content to offer preloaded applications and content, making these devices more attractive to consumers. The cost-effectiveness and ease of use of mini PCs have made them a preferred choice for businesses and individuals across various sectors.

What challenges does the Mini Pcs Market face during the growth?

Inadequate cybersecurity measures is a key challenge affecting the market growth.

- The mini PC market has experienced significant growth in various sectors, including education, healthcare, smart city projects, media entertainment, commercial workplaces, e-sports, retail, banking, and transportation. Mini PCs and tablets, such as iPads, have become essential digital tools in these industries, enabling remote work, online learning, telemedicine, and advanced technology applications.

- However, the increasing use of these devices brings about cybersecurity concerns. With the digitization of sectors like education, the protection of software, hardware, and data becomes crucial. Cybersecurity threats, including unauthorized access and data breaches, pose a significant challenge to the growth of the mini PC market. Institutions and businesses must prioritize strong security measures to safeguard sensitive information and maintain user privacy.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acer Inc.

- Advanced Micro Devices Inc.

- Apple Inc.

- ASRock Inc.

- ASUSTeK Computer Inc.

- Azulle Tech Inc.

- Beelink

- Dell Technologies Inc.

- Elbit Systems Ltd.

- Elitegroup Computer Systems Co. Ltd.

- Gigabyte Technology Co. Ltd.

- HP Inc.

- Intel Corp.

- Lenovo Group Ltd.

- Micro Star International Co. Ltd.

- NZXT Inc.

- Shenzhen Maxtang Computer Corp. Ltd.

- Shenzhen Shenzhou Computer Co. Ltd.

- Zotac Technology Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Mini PCs have been gaining popularity in recent years due to their portability, energy efficiency, and versatility. These compact devices offer powerful data processing capabilities, making them suitable for various applications, from home entertainment and office work to digital signage, industrial automation, and education. Mini PCs come with advanced hardware components, including processors, memory, and storage, that support machine learning, AI, and 5G connection. They also offer connectivity options, enabling seamless integration with streaming services, digital media consumption, and IoT technologies. The mini PC market caters to diverse industries and user groups, including consumer electronics, corporate, retail, manufacturing, and medical electronics.

Furthermore, for budget-conscious individuals, mini PCs provide an affordable alternative to high-end desktops and laptops. Enterprises use them for digital transformation initiatives, while smart home ecosystems leverage mini PCs to power smart home devices such as thermostats, lighting systems, and security cameras. Mini PCs offer great VR experiences for gaming enthusiasts and support GPU for high-performance graphics. They are also energy-efficient, making them an eco-friendly choice for home entertainment and office work. With their small footprint and diverse applications, mini PCs are poised to revolutionize the way we consume digital media and automate processes in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 17.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.24 |

|

Key countries |

US, China, Japan, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch