Mixed Reality Market In Healthcare Sector Size 2025-2029

The mixed reality market in healthcare sector size is forecast to increase by USD 3.33 billion at a CAGR of 46.4% between 2024 and 2029.

- Mixed Reality (MR) technology is revolutionizing the healthcare sector, offering immersive training and education experiences. The market is witnessing significant growth due to the increased demand for advanced training methods and educational tools. Key players in the industry are launching new MR solutions to cater to this demand. However, the high initial cost of implementing MR technology remains a challenge for many healthcare organizations. Despite this, the benefits of MR technology, such as improved patient outcomes and enhanced training experiences, are driving its adoption in North America. The market is expected to grow at a steady pace due to these trends and challenges.

- Moreover, MR technology enables healthcare professionals to visualize and interact with 3D models of organs and tissues, providing a more effective and engaging learning experience. Furthermore, MR technology can be used for surgical planning and simulation, enabling surgeons to practice complex procedures in a risk-free environment. As the technology becomes more accessible and cost-effective, it is poised to transform healthcare education and training in the US and beyond.

What will be the Size of the Market During the Forecast Period?

- In the dynamic and evolving landscape of healthcare, the integration of mixed reality technology into medical practices is revolutionizing various aspects of patient care. Mixed reality, a fusion of virtual and real-world environments, offers computer systems the ability to provide medical professionals with real-time information during medical procedures. This real-time visualization aids surgeons in making informed decisions, enhancing surgical safety and accuracy. The application of mixed reality in healthcare extends beyond the operating room. It offers a multidimensional perspective for medical training, enabling individualized treatment plans and customized experiences for patients. Medical information and digital images can be accessed and analyzed in real-time, leading to improved diagnosis accuracy and rehabilitation plans.

- Furthermore, the infrastructure required for implementing mixed reality in healthcare includes specialized hardware and software. Funding and regulatory policies play a crucial role in the adoption of this technology. While the advantages of mixed reality in healthcare are significant, potential technical glitches and human effort required for implementation are challenges that need to be addressed. Healthcare professionals across various disciplines, including pharmacy care management, can benefit from mixed reality technology. It offers a more productive approach to patient care management, enabling healthcare providers to deliver better services, especially in complex scenarios. The integration of artificial intelligence in mixed reality systems further enhances the capabilities of this technology, allowing for more accurate and efficient decision-making processes.

- In conclusion, mixed reality technology offers a unique opportunity to transform the healthcare sector by providing a more immersive and personalized experience for patients. It enables healthcare providers to offer individualized treatment plans, improve patient interactions, and enhance the overall quality of care. The potential for mixed reality in healthcare is vast, and ongoing research and innovation will continue to push the boundaries of what is possible in this field.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Hardware

- Software

- Services

- End-user

- Hospitals and healthcare providers

- Medical educational institutions

- Patients

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Asia

- China

- India

- Japan

- Rest of World (ROW)

- North America

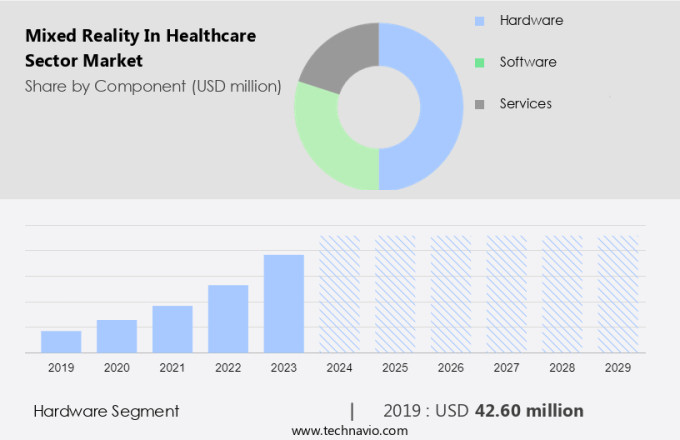

By Component Insights

- The hardware segment is estimated to witness significant growth during the forecast period.

The mixed reality market in the healthcare sector is driven by the adoption of advanced technology in patient-centered healthcare and medical education. The hardware segment, consisting of devices such as headsets, AR glasses, VR devices, and specialized equipment, plays a significant role in this market. For instance, Oculus' DigiLoupe, launched in January 2024, is an AR headset with XR and pancake lens technology, offering high-resolution visualization and precise imaging for complex surgical procedures. This technology is poised to revolutionize healthcare by enhancing medical training and improving patient experiences. The integration of mixed reality technology in healthcare policy, medical research, and medical education is expected to further fuel market growth.

Get a glance at the market report of share of various segments Request Free Sample

The hardware segment was valued at USD 42.60 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The mixed reality market in healthcare is experiencing notable expansion, with North America leading the way due to its propensity for adopting advanced technologies. Applications of mixed reality in healthcare span from medical training and surgical planning to patient care and equipment maintenance. In medical training, mixed reality technologies offer immersive learning experiences for healthcare professionals, enabling them to gain expertise in the operation and maintenance of medical devices. For instance, Arvizio's recently introduced AR capabilities automate workflows for medical organizations, enhancing training programs for healthcare professionals and technicians. Surgical planning benefits from mixed reality by providing real-time guidance and surgical precision, while patient care experiences are enriched through interactive and engaging educational materials.

However, healthcare operations are optimized through mixed reality's ability to integrate medical devices, improve healthcare interoperability, and bolster telemedicine adoption. Additionally, the collection of biometric data in a mixed reality environment enhances patient engagement and contributes to cost optimization in healthcare. Mixed reality's integration with healthcare cybersecurity measures ensures secure data transmission and patient privacy.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Mixed Reality Market In Healthcare Sector?

Increased demand for immersive training and education is the key driver of the market.

- The mixed reality market in the healthcare sector is experiencing notable growth due to the increasing demand for immersive training and education. This trend is exemplified by the establishment of advanced VR and AR training facilities, such as the VR Skill Training Lab created through a collaboration between Medisim VR and the Sri Ramachara Institute of Higher Education and Research (SRIHER) in Chennai, India. These state-of-the-art facilities provide medical and nursing students, faculty, and allied healthcare professionals with an immersive and realistic training environment. Biometric data collection and telemedicine adoption are also driving the market, enabling remote patient monitoring and real-time guidance for healthcare professionals.

- Furthermore, healthcare cybersecurity, medical device integration, and patient engagement platforms are crucial components of the mixed reality market, ensuring healthcare cost optimization, interoperability, and patient experience improvement. Surgical precision, MR software, surgical robotics advancements, wearable health technology, and digital health solutions are also significant contributors to the market's growth. Precision medicine, immersive healthcare, and virtual reality therapy are also gaining popularity for pain reduction, patient engagement, and medical ethics.

- In conclusion, the market is further fueled by healthcare technology trends, healthcare investment, and healthcare policy, as well as medical research, patient-centered healthcare, medical education, and medical tourism. Mixed reality medical applications, including surgical planning, medical simulation, and medical imaging technology, are revolutionizing healthcare, leading to medical device innovation and medical education technology. The global mixed reality market in the healthcare sector is poised for continued growth, offering sustainable healthcare solutions for cancer treatment, surgery training, and medical development.

What are the market trends shaping the Mixed Reality Market In Healthcare Sector?

Product launches are the upcoming trend in the market.

- The mixed reality market in the healthcare sector is experiencing notable expansion due to the introduction of innovative solutions and strategic collaborations among key players. Advanced mixed reality technologies, such as virtual reality (VR), augmented reality (AR), and mixed reality (MR), are being integrated into various healthcare applications, including medical training, patient care, and research. For instance, Amrita Hospital unveiled an XR-supported ecosystem in June 2023, combining MR, VR, and AR technologies to revolutionize medical education, research, and patient care. This development underscores the growing importance of immersive technologies in healthcare settings, offering more effective and interactive training environments for medical professionals and improving patient outcomes.

- Moreover, the integration of biometric data collection, telemedicine adoption, and healthcare cybersecurity in mixed reality applications is driving the market's growth. The use of AI-powered diagnostics, remote patient monitoring, surgical simulation software, and medical imaging technology further enhances the potential of mixed reality in the healthcare sector. Healthcare interoperability, real-time guidance, surgical precision, and healthcare cost optimization are other significant factors contributing to the market's growth. The adoption of wearable health technology, cloud-based medical records, and precision medicine are also shaping the future of mixed reality in healthcare. Mixed reality technologies are also transforming surgical planning, virtual reality therapy, and surgical simulation, leading to improved patient experience, healthcare workforce development, and healthcare technology trends.

- In conclusion, the integration of medical device innovation, medical education technology, and medical hardware is further expanding the market's scope. The global mixed reality market in the healthcare sector is expected to continue its growth trajectory, driven by the increasing demand for advanced healthcare solutions, healthcare cost reduction, and sustainable healthcare practices.

What challenges does Mixed Reality Market In Healthcare Sector face during the growth?

The high initial cost is a key challenge affecting the market growth.

- Mixed Reality (MR) technology, which combines elements of the physical and digital worlds, is revolutionizing the healthcare sector by offering immersive experiences, advanced medical applications, and improved patient engagement. MR solutions enable biometric data collection, telemedicine adoption, and real-time guidance, leading to healthcare cost optimization, interoperability, and surgical precision. However, the high initial cost of implementing these technologies remains a significant barrier to widespread adoption, particularly for smaller healthcare providers and institutions with limited budgets. MR software, surgical robotics advancements, wearable health technology, and digital health solutions are driving innovation in medical education, surgical planning, and virtual reality therapy.

- However, healthcare cybersecurity, medical device integration, and AI-powered diagnostics are crucial components of this ecosystem, ensuring patient data privacy and security. The global healthcare market for MR technology is expected to grow significantly, driven by healthcare technology trends, medical research, and patient-centered healthcare initiatives. This advanced technology is transforming medical facilities, enhancing the patient experience, and reducing pain, while also providing opportunities for healthcare workforce development and medical education. Sustainable healthcare, cancer treatment, and medical tourism are among the many applications of MR technology in the healthcare sector.

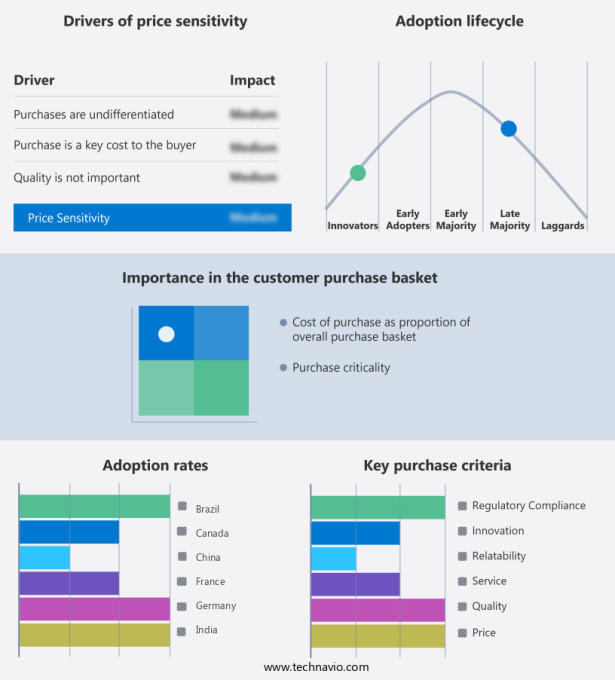

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Atheer Inc - This company offers mixed reality in healthcare by developing a platform that provides real-time information and guidance during surgeries.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AppliedVR Inc.

- Atheer Inc

- Augmedics

- EchoPixel Inc.

- Firsthand Technology Inc.

- HTC Global Services

- MACE Virtual Labs

- Medical Realities Ltd.

- Microsoft Corp.

- Osso VR Inc.

- Penumbra Inc.

- Samsung Electronics Co. Ltd.

- Surgical Theater Inc.

- ThirdEye Gen Inc.

- VOKA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Mixed reality (MR), the convergence of virtual and augmented reality, is revolutionizing the healthcare sector by enhancing patient care, medical education, and research. MR technology enables immersive experiences that blend the physical and digital worlds, offering numerous benefits for healthcare applications. One significant area of application is biometric data collection. MR technology can be used to create immersive environments for patients to provide accurate and comprehensive health data. This data can then be integrated into telemedicine platforms, enabling remote patient monitoring and real-time guidance from healthcare professionals.

Moreover, telemedicine adoption is a growing trend in healthcare, and MR technology can enhance its capabilities. MR can provide remote surgical guidance, enabling specialists to assist in complex procedures from a distance. This not only improves patient outcomes but also reduces healthcare costs by minimizing the need for travel and hospital stays. Healthcare cybersecurity is a critical concern in the digital age. MR technology can help address this challenge by providing secure cloud-based medical records and AI-powered diagnostics. These solutions ensure patient data privacy while enabling healthcare professionals to access critical information in real-time. Medical device integration is another area where MR technology can make a significant impact. MR software can be used to simulate surgical procedures, allowing medical device manufacturers to test their products in a controlled environment before deployment. This can lead to more precise and effective medical devices, ultimately improving patient care. Patient engagement is a crucial aspect of healthcare, and MR technology can help improve it. MR platforms can provide immersive educational resources, enabling patients to better understand their conditions and treatment plans. This can lead to increased patient satisfaction and better health outcomes. Healthcare cost optimization is a significant challenge, and MR technology can help address it. MR-enabled telemedicine and remote patient monitoring can reduce the need for hospital visits and procedures, leading to cost savings.

Additionally, MR simulation software can help medical professionals optimize surgical planning, leading to more efficient procedures and reduced healthcare costs. Healthcare interoperability is essential for effective patient care. MR technology can help address this challenge by enabling seamless integration of data from various medical devices and systems. This can lead to more accurate diagnoses and better patient outcomes. MR technology can also provide surgical precision, enabling surgeons to perform complex procedures with greater accuracy and reduced risk of complications. MR surgical simulation software can help medical students and professionals hone their skills, leading to improved patient care and outcomes. Medical ethics is a critical consideration in healthcare, and MR technology raises new ethical questions. These include issues related to patient privacy, data security, and the potential for MR technology to replace human healthcare professionals. It is essential that healthcare organizations and policymakers address these ethical concerns as they adopt MR technology. The global healthcare market is expected to grow significantly in the coming years, and MR technology is a key driver of this growth. MR technology is transforming healthcare by improving patient care, medical education, and research. It is essential that healthcare organizations and policymakers embrace this technology while addressing the ethical and regulatory challenges it presents.

In conclusion, MR technology is revolutionizing the healthcare sector by providing immersive experiences that blend the physical and digital worlds. It offers numerous benefits, including improved patient care, medical education, and research, as well as cost savings and increased efficiency. However, it also raises new challenges related to cybersecurity, healthcare interoperability, and medical ethics. Healthcare organizations and policymakers must address these challenges as they adopt MR technology to transform patient care and medical education.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 46.4% |

|

Market growth 2025-2029 |

USD 3.33 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

45.0 |

|

Key countries |

US, UK, China, Canada, Germany, Brazil, France, Japan, India, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch