Mobile Barber Shop Market Size 2025-2029

The mobile barber shop market size is forecast to increase by USD 1.16 billion, at a CAGR of 10.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of home salon services. This trend allows consumers to save time and enjoy personalized barbering experiences in the comfort of their own homes. Another key driver is the rising trend of hair products and hair coloring, which has become increasingly popular among consumers. However, the market also faces challenges related to the adverse effects of chemical or synthetic components used in hair styling. These components can cause damage to hair and scalp, leading some consumers to seek out natural alternatives or opt for less frequent salon visits. As a result, companies in the market must focus on offering high-quality, personalized services while addressing consumer concerns regarding the use of chemicals in their offerings.

- To capitalize on market opportunities and navigate challenges effectively, businesses should explore innovative solutions for delivering natural, chemical-free hair styling services, while maintaining the convenience and accessibility of mobile barber shops.

What will be the Size of the Mobile Barber Shop Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its growth across various sectors. Cost management is a critical factor, as operators seek to optimize fuel efficiency and minimize expenses related to inventory, salon supplies, and vehicle maintenance. Customer feedback plays a pivotal role in business success, driving the adoption of mobile apps for appointment scheduling and client retention. Brand loyalty is fostered through exceptional customer service, with barbers utilizing mobile payment solutions and traffic management strategies to streamline operations. Environmental regulations necessitate adherence to safety and hygiene protocols, including sterilization equipment and safety and hygiene supplies.

The target audience for mobile barber shops is diverse, with operators catering to various demographics and preferences. Business models vary, from solo operators to franchises, with some leveraging social media marketing and barber tools to expand their reach. Revenue streams are diversified, with barbers offering additional services such as beard trims, shaves, and styling using styling products and hair dryers. Vehicle branding and route optimization help attract customers and maximize earnings. Online reviews and accessibility compliance are essential for maintaining a strong online presence and ensuring accessibility to all clients. In the ever-changing mobile barber shop landscape, operators must remain agile, adapting to emerging trends and evolving customer needs.

The market's continuous dynamism is reflected in the adoption of mobile app development, licensing and permits, and the integration of barber chairs, towel warmers, parking permits, and electric razors into their mobile units.

How is this Mobile Barber Shop Industry segmented?

The mobile barber shop industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- HSS

- Others

- Application

- Adults

- Children

- Gender

- Men

- Women

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Service Insights

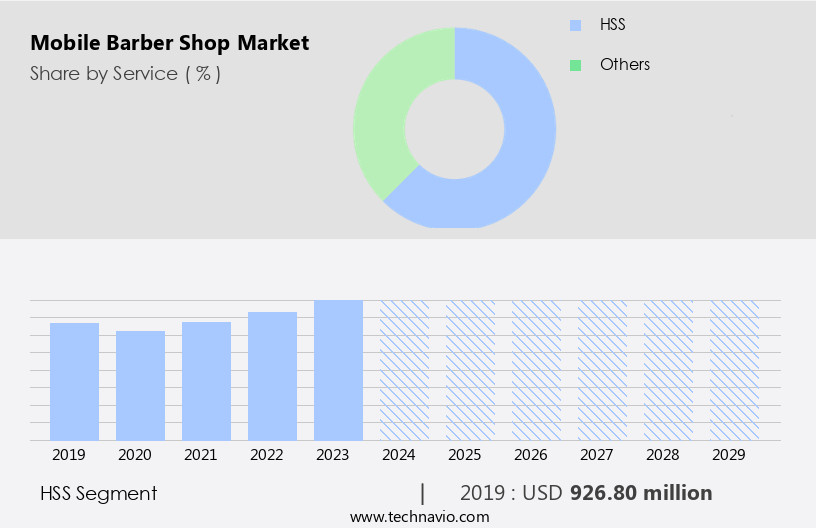

The HSS segment is estimated to witness significant growth during the forecast period.

In today's society, personal grooming has taken on new importance, with individuals in both urban and rural areas seeking expert hair care services. Mobile barber shops cater to this demand by providing a range of services, from traditional haircuts to gender-specific treatments like facials, manicures, and pedicures. The use of specialized hair styling equipment and products is essential for these mobile businesses, which have seen significant growth in recent years. Mobile barber shops employ various pricing strategies to attract clients, including competitive rates and discounts for repeat customers. Effective marketing and advertising are crucial for these businesses, with social media platforms and mobile apps used to reach their target audience.

Mobile payment solutions enable seamless transactions, enhancing customer satisfaction and retention. Sterilization equipment is a vital investment for maintaining hygiene and safety, while licensing and permits ensure compliance with local regulations. Salon supplies, such as hair clippers, barber chairs, styling products, and safety and hygiene equipment, are essential for day-to-day operations. Inventory management is crucial for efficient business operations, with appointment scheduling software and mobile barber units optimized for route planning and vehicle maintenance. Customer feedback is closely monitored to improve services and build brand loyalty. Cost management is a constant concern, with fuel efficiency and environmental regulations impacting the bottom line.

Mobile app development and vehicle branding help differentiate businesses in a competitive market. Customer service is prioritized, with traffic management and payment processing systems in place to ensure a smooth experience. Revenue streams include various services and product sales, with styling stations and online reviews contributing to business growth. Safety and hygiene are paramount, with electric razors and towels warmers adding to the client experience. Accessibility compliance and appointment scheduling software help attract a diverse clientele.

The HSS segment was valued at USD 926.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

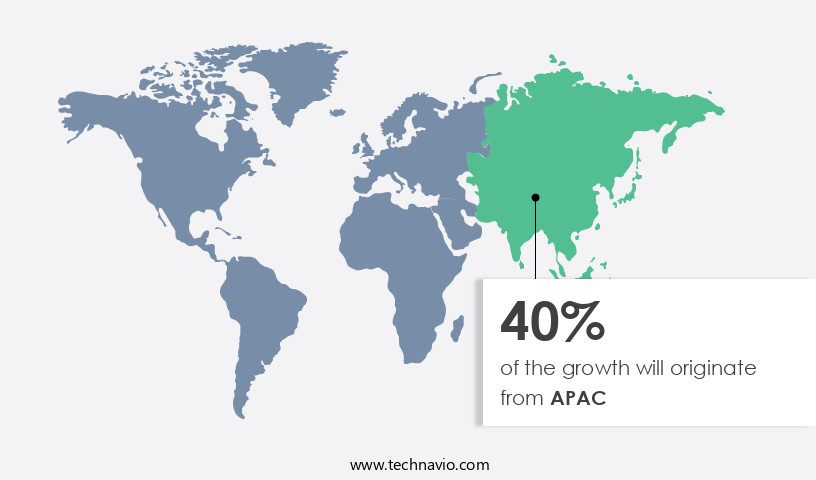

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth, with China, Japan, and India being the major revenue contributors. Urban consumers in these countries value time-efficient solutions and the convenience of on-demand services offered by mobile barber shops, which eliminate the inconvenience of traveling and long wait times at traditional barber shops. In China, the integration of digital platforms for appointment scheduling and payment processing has further boosted the popularity of mobile barber shops. In India, the adoption of similar technologies has simplified access to these services. To ensure customer satisfaction and retention, mobile barber shops invest in sterilization equipment and high-quality hair clippers.

Licensing and permits are essential for legal operation, and businesses must adhere to safety and hygiene regulations. Mobile payment solutions facilitate seamless transactions, enhancing the overall customer experience. Mobile app development, social media marketing, and appointment scheduling software are crucial tools for marketing and advertising. Inventory management, cost management, and traffic management are essential aspects of a successful business model. Brand loyalty is fostered through excellent customer service and consistent quality. Fuel efficiency and environmental regulations are critical considerations for the mobile barber unit's design and operation. Vehicle maintenance and route optimization ensure the business remains profitable and efficient.

Barber supplies, styling products, and safety and hygiene equipment are essential for daily operations. Revenue streams include on-site services, retail sales of styling products, and mobile app commissions. Online reviews and accessibility compliance are vital for attracting new customers and maintaining a strong online presence. Electric razors and other barber tools are essential for providing a complete range of services.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Mobile Barber Shop Industry?

- The increasing preference for home salon services is the primary growth factor in this market. With the growing demand for convenience and personalized services, the home salon industry is experiencing significant expansion.

- The market in North America, Europe, and APAC is experiencing notable growth with the rise of app-based home barber services. Over the past five years, the number of providers offering at-home grooming services has significantly increased. These companies use mobile applications for clients to book appointments for various hair grooming packages, such as monthly essential and monthly grooming packages, to encourage repeat business. Mobile payment solutions are integrated into these applications for seamless transactions. Client retention is prioritized through personalized services and high levels of customer satisfaction.

- Sterilization equipment and salon supplies are essential investments for maintaining hygiene and professionalism. The business model relies on licensing and permits to ensure legal operations. Companies focus on marketing and advertising to reach a wider audience and attract new clients. With convenience and flexibility, the market is expected to continue its growth trajectory.

What are the market trends shaping the Mobile Barber Shop Industry?

- The increasing popularity of hair coloring is a notable market trend. This trend signifies a significant shift in consumer preferences towards enhancing their appearance through hair coloration.

- The market is experiencing significant growth due to the increasing trend of hair coloring services. Both organic and synthetic hair colors, which are gaining popularity for their vegan and organic qualities, are driving market revenue. The demand for these hair coloring products is escalating as people seek out various hairstyles and colors for both men and women. To address the challenges of hair coloring, L'Oreal, a leading personal care company, introduced Colorsonic technology to help hair stylists achieve consistent and accurate results. Effective cost management is crucial for mobile barber shops to maintain profitability. Inventory management is essential to ensure that hair coloring products and other supplies are always available for customers.

- Customer feedback is vital for continuous improvement and brand loyalty. Excellent customer service is necessary to retain clients and attract new ones. Traffic management and payment processing systems are essential for smooth business operations. Fuel efficiency is a critical concern for mobile barber shops, as they rely on vehicles for transportation. Compliance with environmental regulations is also necessary to ensure sustainability and adhere to industry standards.

What challenges does the Mobile Barber Shop Industry face during its growth?

- The use of chemical or synthetic components in hair styling products poses a significant challenge to the industry's growth due to potential adverse effects on consumers.

- The market is experiencing significant growth due to the convenience it offers to consumers. Mobile barber units, equipped with essential barber tools such as barber chairs, towel warmers, hair dryers, and appointment scheduling software, enable barbers to provide services on-the-go. Mobile app development and social media marketing are crucial for the success of these businesses, allowing them to reach a wider audience and manage appointments efficiently. However, it's important to note that the chemicals used in hair styling products, including sulfates, parabens, and phthalates, can have adverse effects on hair and overall health. Sulfates, like sodium lauryl sulfate (SLS) and sodium laureth sulfate (SLES), can strip hair of natural oils, leading to dryness and breakage, and cause skin and eye irritation.

- Vehicle branding is also essential for mobile barber shops to establish a strong brand identity and attract customers. Parking permits are necessary to ensure the legality and safety of mobile barber shop operations. Despite these challenges, the market offers immense opportunities for entrepreneurs seeking to provide a unique and convenient service to consumers.

Exclusive Customer Landscape

The mobile barber shop market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mobile barber shop market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mobile barber shop market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Call Me Spa - The company specializes in providing expert barber services, encompassing haircuts, beard trims, and grooming.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Call Me Spa

- Dooo

- Dribbble Holdings Ltd.

- Get Groomed Ltd.

- Groupon Inc.

- LeSalon

- Luxury Mobile Barbershop

- Mks Milagro Salon

- Nextdoor Holdings Inc.

- RUUBY

- Shortcut Mobile Inc.

- The Mobile Barber Shop

- Trim IT services Ltd.

- Urban

- Yelp Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Mobile Barber Shop Market

- In September 2023, Trim-It expanded its mobile barber services into new urban markets, focusing on high-demand metropolitan areas to cater to busy professionals seeking convenient grooming solutions. This strategic geographic expansion aims to capture a larger share of the growing on-demand grooming market, projected to contribute to the market's estimated growth of USD 987.7 million from 2024 to 2028 at a CAGR of 10%.

- In March 2025, the General Presidency for the Affairs of the Two Holy Mosques in Saudi Arabia launched a trial mobile barbershop service within the Grand Mosque in Makkah during Ramadan 1446 AH. Equipped with five mobile units featuring sterilized tools, this initiative targets male pilgrims, enhancing accessibility for religious grooming obligations and reflecting a unique regional adaptation of mobile barber services.

- In August 2024, Worth and Purpose, a nonprofit led by Travis Settineri, introduced a mobile barbershop in Lakeland, Florida, offering free haircuts to individuals experiencing homelessness. This socially driven initiative leverages mobile barbering to address community needs, expanding the market's application beyond commercial services and highlighting its potential for social impact.

- In July 2024, Luxury Mobile Barbershop, Inc. announced a collaboration with a mobile technology provider to integrate advanced booking and payment systems into its service model. This technological enhancement aims to streamline operations and improve customer experience, aligning with the market's trend toward digital integration to support a projected market value growth from USD 1.7 billion in 2024 to USD 4.3 billion by 2034.

Research Analyst Overview

- The barbering industry continues to evolve, with mobile barber shops gaining significant traction in the market. This trend is driven by the convenience and flexibility offered by on-site haircut services, which cater to various sectors such as corporate clients, events, and home settings. Mobile barbering services require specialized equipment and adherence to safety regulations, making the role of barbering management crucial. Barbering associations and education institutions play a vital role in fostering innovation and setting industry standards. Barbering competitions showcase the latest techniques and styles, while sustainability remains a key focus area. Barbering business owners leverage marketing strategies to expand their reach and attract customers.

- Barbering history and culture are integral to the industry, with various styles and techniques reflecting regional influences. Barbering regulations ensure the safety and hygiene of clients, while apprenticeships provide opportunities for skill development. Barbering technology, including advanced tools and equipment, enhances efficiency and precision. Wedding barbering and event services offer lucrative opportunities for barbers, requiring expertise in various styles and techniques. Corporate barbering caters to the growing demand for professional grooming services in the workplace. Home barbering is another emerging trend, with the availability of specialized equipment and online resources. Barbering techniques and safety are paramount, with continuous education and training essential for barbers to stay updated with the latest trends and best practices.

- The mobile barbering market is dynamic, with ongoing innovation and competition shaping its future.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Mobile Barber Shop Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.7% |

|

Market growth 2025-2029 |

USD 1159.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.4 |

|

Key countries |

US, China, Japan, India, Germany, South Korea, Brazil, Australia, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mobile Barber Shop Market Research and Growth Report?

- CAGR of the Mobile Barber Shop industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mobile barber shop market growth of industry companies

We can help! Our analysts can customize this mobile barber shop market research report to meet your requirements.