Mobile Edge Computing Market Size 2024-2028

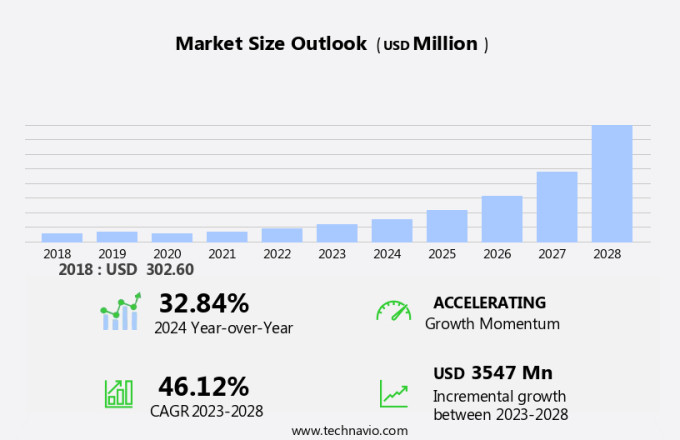

The mobile edge computing market size is forecast to increase by USD 3.55 billion at a CAGR of 46.12% between 2023 and 2028. The market is experiencing significant growth due to several key drivers. The rise in health applications and the need for real-time data processing are pushing the demand for edge computing in the healthcare sector. In the entertainment industry, computational offloading and edge-computing video caching are becoming essential for delivering high-quality streaming services. Strategic collaborations among market participants are also driving innovation in edge computing, particularly in areas like collaborative computing and connected cars. Additionally, the deployment of 5G technology is expected to increase the demand for mobile edge computing, despite its high cost. Smart venues and enterprises are also adopting edge computing for improved content delivery and enhanced operational efficiency. This market is poised for continued growth as these trends and drivers shape the future of mobile computing.

What will the size of the market be during the forecast period?

Mobile edge computing (MEC) is an innovative technology that brings computing power closer to the source of data generation, primarily in cellular networks. This approach aims to address network congestion issues and improve the quality of experience (QoE) for various applications, including healthcare, autonomous vehicles, and augmented reality (AR)/virtual reality (VR). In the IT service environment, mobile edge computing plays a crucial role in the telecommunications networking landscape. By leveraging cellular base stations as mini-data centers, MEC technology enables real-time processing of data at the edge, reducing latency and improving overall network efficiency. Further, the integration of 5G technologies and IoT solutions into the telecom industry has significantly increased the demand for mobile edge computing capabilities. As 5G networks offer faster speeds and lower latency compared to 4G networks, MEC technology becomes essential to ensure optimal performance and QoE for applications such as connected automobile infrastructure and AR/VR experiences. Cellular MEC technology is particularly beneficial for industries that require real-time data processing, such as healthcare. By processing patient data at the edge, healthcare providers can make quicker, more informed decisions, ultimately improving patient outcomes and overall care.

Moreover, mobile edge computing is an essential component of the evolving connected automobile infrastructure. With the increasing adoption of autonomous vehicles, real-time data security processing and analysis are crucial for ensuring safety and efficiency. MEC technology enables this by processing data from various sensors and systems directly at the edge, reducing latency and improving overall system performance. In the context of telecommunications networking, mobile edge computing offers significant advantages in terms of network efficiency and QoE. By processing data at the edge, network congestion is reduced, and the overall performance of the radio access network is improved. This is especially important for applications that require low latency, such as AR/VR experiences, which can be particularly demanding on network resources. In conclusion, mobile edge computing represents a significant evolution in the IT service environment, particularly in the context of cellular networks and the telecom industry. By bringing computing power closer to the source of data generation, MEC technology addresses network congestion issues, improves QoE, and enables real-time processing for various applications, ultimately driving innovation and growth in the sector.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Hardware

- Software

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Component Insights

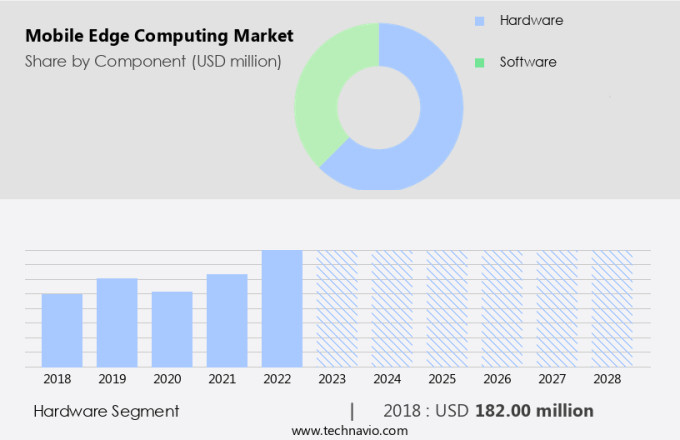

The hardware segment is estimated to witness significant growth during the forecast period. Mobile edge computing refers to the processing of data and applications on devices or servers located closer to the source of data, rather than relying on remote servers. This approach is gaining popularity in various industries, particularly in sectors that require real-time data processing and low latency, such as Health and Entertainment. The hardware components necessary for mobile edge computing include processors, servers, switches, routers, and end devices. The selection and size of these components depend on the specific use cases and industries. For instance, in the Health sector, rugged hardware with high performance and resistance to harsh environments is essential.

Additionally, the global market for mobile edge computing hardware is expected to witness significant growth during the forecast period due to the increasing demand for real-time data processing and low latency applications. The market is driven by various factors, including the growing adoption of IoT devices, the increasing popularity of cloud computing, and the need for improved network efficiency. In conclusion, mobile edge computing is a promising technology that is transforming various industries, from Health and Entertainment to Smart Venues and Enterprises. The hardware components required for mobile edge computing include rugged and high-performance processors, servers, switches, routers, and end devices.

Get a glance at the market share of various segments Request Free Sample

The hardware segment accounted for USD 182.00 million in 2018 and showed a gradual increase during the forecast period. In the Entertainment industry, high-speed processors and servers are required for content delivery and edge video caching. Collaborative computing and connected cars are other areas where mobile edge computing is making an impact. In collaborative computing, edge servers can help reduce network traffic and improve response times. In connected cars, edge computing enables real-time data processing and analysis, leading to improved safety and efficiency. Smart venues and enterprises are also adopting mobile edge computing for content delivery and computational offloading. Edge video caching can help reduce the load on remote servers and improve the user experience. Moreover, edge computing can help enterprises save on bandwidth costs and improve overall efficiency.

Regional Insights

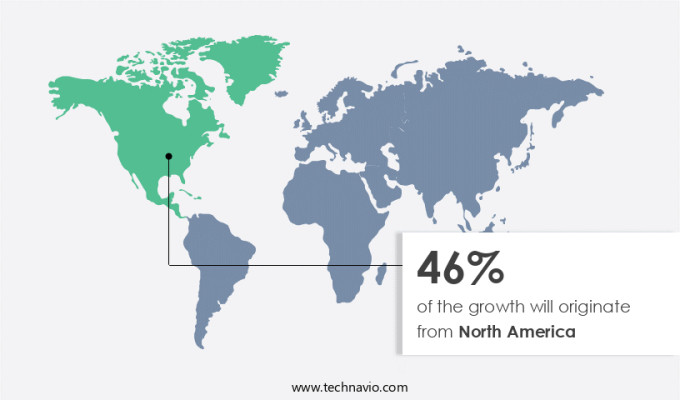

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Mobile edge computing is experiencing significant growth in North America, particularly in the US and Canada, where various industries are adopting this technology for their operations. In the US, the telecommunications sector is anticipated to undergo considerable expansion during the forecast period. The proliferation of the Internet of Things (IoT) in the US is a primary catalyst fueling the expansion of the market in this region. End-user industries in the US are enhancing performance and productivity by implementing diverse IoT technological advancements, including mobile edge computing for real-time data processing. Hyper-connectivity between edge devices and professional associations is a key trend in this market. University studies and micro-experts are contributing to the development of mobile edge computing, ensuring high Quality of Experience (QoE) for users.

Moreover, autonomous vehicles and connected automobile infrastructure are significant applications of mobile edge computing, as they require real-time data processing for optimal functionality. Virtual Reality (VR) is another area where mobile edge computing is gaining traction due to its ability to provide low-latency processing for real-time visualizations. In summary, the market in North America, specifically in the US, is poised for growth due to the increasing adoption of IoT technology and the need for real-time data processing in various industries.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

An increase in data traffic is the key driver of the market. Mobile edge computing is revolutionizing the way industries utilize technology with the integration of IoT devices and 5G technologies. This innovative approach allows mobile devices, such as routers, integrated access devices, routing switches, multiplexers, cloud services, and resources, to access and utilize computing capabilities at the network edge. By enabling direct connectivity between software applications and local content, real-time information about network conditions becomes accessible.

Additionally, in industries like Manufacturing, Government and defence, Energy and utilities, and Mobile Network Operators, mobile edge computing simplifies data analytics and processing. It also allows for the deployment of IoT solutions, caching content at the network edge, and executing compute-intensive applications in real-time. The integration of 5G networks further enhances the potential of mobile edge computing by providing faster data transfer rates and lower latency. Overall, mobile edge computing offers a more efficient and effective solution for industries seeking to leverage the power of cloud computing capabilities while maintaining proximity to their data.

Market Trends

Strategic collaboration among market participants is the upcoming trend in the market. Participants in various industries, including information technology solutions, telecommunication network infrastructure, banking and finance, healthcare, utilities, and semiconductor integrated circuits, are actively investing in mobile edge computing technology. The deployment of 5G technology, in collaboration with governments, is anticipated to accelerate the growth of this market. Mobile cloud computing, a mobile edge computing service, is expected to be highly valued by mobile users due to its ability to provide quicker processing power and smaller form factors by moving processing to the cloud via mobile cloud computing nodes.

Further, the transmission speeds offered by 5G technology are significantly higher than those of 4G networks. This technological advancement can greatly benefit mobile users by improving their overall experience and reducing network congestion at cellular base stations. The radio access network and cellular networks are integral components of this technology, making it a significant development in the realm of information technology and telecommunications networking.

Market Challenge

The high deployment cost of 5G technology is a key challenge affecting the market growth. The integration of 5G networks and mobile edge computing in the Telecom industry holds significant potential for the Internet of Things (IoT) and Cloud services. However, the high investment required for implementing both technologies presents a challenge for market growth. The combined expense for mobile edge computing and 5G connectivity to manage the entire workload is substantial, acting as a restraining factor during the forecast period. Furthermore, the installation cost of small cell networks and the limited security for outdoor power systems in remote locations pose concerns for the expansion of 5G technology. In the US market, organizations must comply with stringent regulations set by telecommunication standard bodies.

Despite these challenges, the advantages of edge computing, such as reduced latency and increased bandwidth, make it an attractive option for handling data-intensive applications. The implementation of Artificial Intelligence (AI) at the edge is also expected to boost market growth. Organizations can leverage edge computing to process data locally, reducing the reliance on data centers and enhancing overall efficiency.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ADLINK Technology Inc. - The company offers mobile edge computing services such as 5G which is 10 times faster than its predecessor and drives latency down to 1ms.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advantech Co. Ltd.

- AT and T Inc.

- COMSovereign Holding Corp.

- GigaSpaces Technologies Ltd.

- Huawei Technologies Co. Ltd.

- Intel Corp.

- Juniper Networks Inc.

- Nokia Corp.

- SK Telecom Co. Ltd.

- SMART Global Holdings Inc.

- TelcoDR Inc.

- Telefonaktiebolaget LM Ericsson

- Verizon Communications Inc.

- Vodafone Group Plc

- ZTE Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Mobile edge computing is a revolutionary IT service environment that brings computing capabilities closer to the source of data generation, primarily cellular networks. This approach mitigates network congestion by enabling computational offloading, content delivery, and edge video caching at cellular base stations. The technology, known as Cellular MEC (Multi-Access Edge Computing), is transforming various industries such as healthcare, entertainment, and manufacturing. Edge computing enhances the Quality of Experience (QoE) in media and entertainment by enabling real-time processing of AR (Augmented Reality) and VR (Virtual Reality) content. It also powers smart venues, smart enterprises, and connected cars through collaborative computing. The telecom industry is embracing edge computing to optimize 4G and 5G networks, offering cloud computing capabilities to IoT deployments.

Further, hardware and software advancements, professional associations, and university studies are driving the adoption of edge computing in various sectors. Edge devices, such as sensors and micro-expert systems, are integral to this technology. The hyper-connectivity enabled by edge computing is revolutionizing industries like healthcare, energy and utilities, government and defense, and manufacturing. Mobile network operators are investing in edge computing to improve service delivery and offer innovative solutions. The telecom industry's shift towards edge computing is a response to the growing demand for real-time data processing and low latency services. The Internet of Things (IoT) and 5G technologies are fueling the growth of edge computing, enabling autonomous vehicles, connected automobile infrastructure, and smart grids. Edge computing is poised to transform the IT and telecom landscape, offering a future of seamless connectivity and efficient service delivery.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 46.12% |

|

Market growth 2024-2028 |

USD 3.55 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

32.84 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 46% |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ADLINK Technology Inc., Advantech Co. Ltd., AT and T Inc., COMSovereign Holding Corp., GigaSpaces Technologies Ltd., Huawei Technologies Co. Ltd., Intel Corp., Juniper Networks Inc., Nokia Corp., SK Telecom Co. Ltd., SMART Global Holdings Inc., TelcoDR Inc., Telefonaktiebolaget LM Ericsson, Verizon Communications Inc., Vodafone Group Plc, and ZTE Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch