Motor Vehicle Insurance Market Size 2024-2028

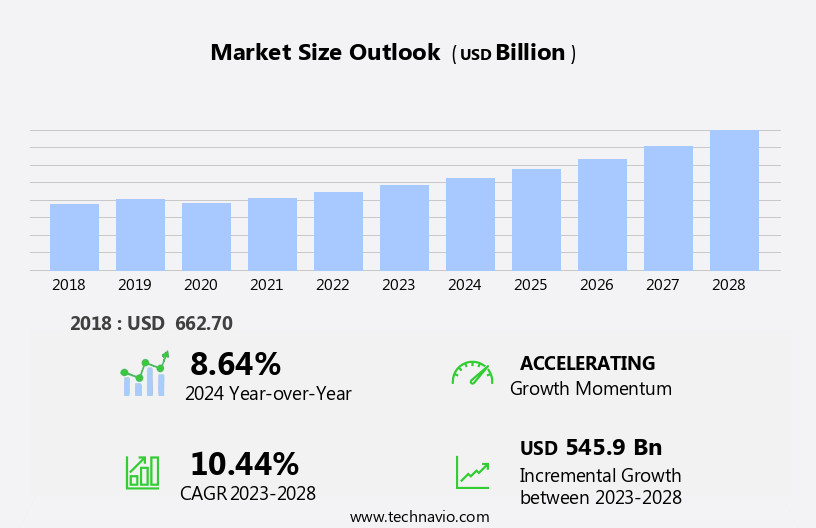

The motor vehicle insurance market size is forecast to increase by USD 545.9 billion, at a CAGR of 10.44% between 2023 and 2028.

- The market is experiencing significant shifts driven by increasing government regulations on mandatory insurance coverage in developing countries and the digitalization of the industry. These factors are shaping the market's strategic landscape, presenting both opportunities and challenges for insurance players. Government regulations in developing countries are pushing for mandatory insurance coverage, expanding the potential customer base for motor vehicle insurers. This trend is particularly noticeable in Asia Pacific and Latin America, where economic growth and urbanization are leading to increased car ownership. However, this regulatory environment also tightens the competitive landscape, as more players enter the market and compliance becomes a priority.

- Simultaneously, the digitalization of the motor vehicle insurance industry is transforming the way insurers engage with customers and manage risk. Digital platforms enable real-time underwriting, claims processing, and customer service, enhancing the overall customer experience. However, this digital shift also brings challenges, such as data security concerns and the need for robust IT infrastructure. To capitalize on opportunities and navigate challenges effectively, insurers must stay abreast of regulatory changes and invest in digital capabilities.

What will be the Size of the Motor Vehicle Insurance Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, shaped by dynamic market forces and advancements in technology. AI-powered claims processing streamlines underwriting and settlement negotiations, while digital insurance platforms offer convenience and personalized pricing. Data analytics and credit scoring inform risk assessment and customer segmentation, shaping insurance regulations and product offerings. Collision coverage and liability limits are subject to ongoing adjustments, influenced by factors such as driving record and insurable interest. Third-party administrators (TPAs) and legal counsel facilitate dispute resolution, ensuring regulatory compliance and comparative negligence assessments. Fraud detection and independent verification are essential components of claims processing, with advanced predictive modeling and accident reconstruction techniques aiding in claims investigation and policy administration.

How is this Motor Vehicle Insurance Industry segmented?

The motor vehicle insurance industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Personal

- Commercial

- Distribution Channel

- Brokers

- Direct

- Banks

- Others

- Vehicle Age

- New Vehicles

- Old Vehicles

- New Vehicles

- Old Vehicles

- Coverage Type

- Liability Insurance

- Collision Insurance

- Comprehensive Insurance

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

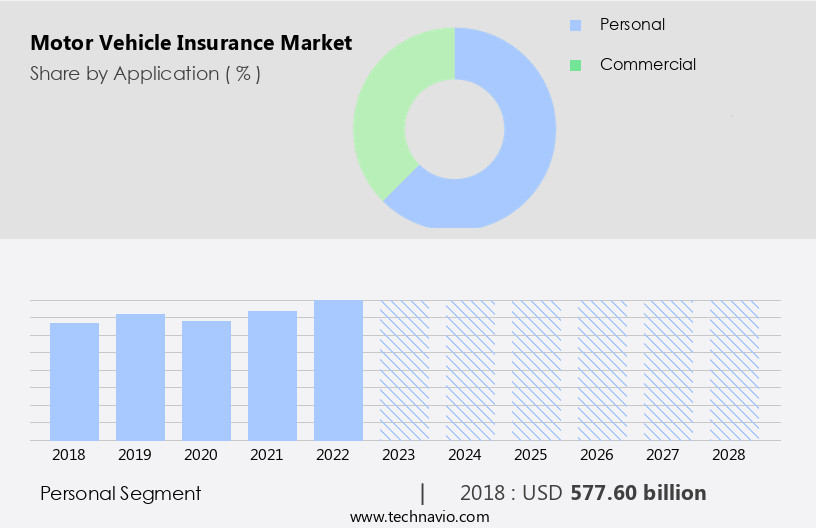

The personal segment is estimated to witness significant growth during the forecast period.

Motor vehicle insurance is a crucial financial protection for vehicle owners and drivers. The insurance policy, which is a compulsory requirement under the Motor Policy, offers coverage for both comprehensive and third-party liability packages. Personal insurance, an optional add-on cover, safeguards the owner or driver against accidental injuries. Insurance agents and brokers play a significant role in advising clients on coverage limits and policy options. Actuarial modeling and predictive analytics are used to assess risk and determine personalized pricing. Liability coverage, including property damage and bodily injury, is a key component of motor vehicle insurance. Fraud detection and independent verification are essential for dispute resolution and maintaining regulatory compliance.

Digital insurance platforms and ai-powered claims processing streamline the claims management process. Data analytics and customer segmentation help insurers tailor policies to individual needs. Usage-based insurance and mobile apps provide real-time data for risk assessment and customer retention. Insurance regulations mandate coverage for medical payments and accident reconstruction, as well as policy administration and claims processing. Policy cancellation, claims investigation, and reinstatement of policy are also important aspects of motor vehicle insurance. Comparative fault and comparative negligence are considered in settlement negotiations and claims adjudication. Expert witness testimony and legal counsel are sought in cases of bodily injury liability and claims disputes.

The Personal segment was valued at USD 577.60 billion in 2018 and showed a gradual increase during the forecast period.

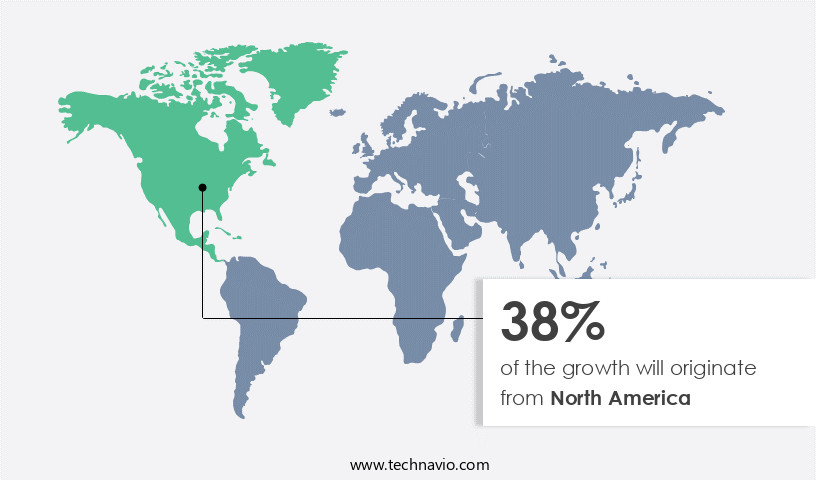

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is a substantial sector in the global insurance industry, shaped by elevated vehicle ownership rates, intricate regulatory frameworks, and innovative technology integration. The United States and Canada lead this market, with the U.S. Holding the largest market share due to its extensive population and substantial vehicle fleet. Insurers in North America employ telematics, artificial intelligence (AI), and data analytics to refine underwriting, minimize fraud, and create customized policies. Regulatory bodies, such as the National Association of Insurance Commissioners (NAIC), enforce stringent compliance standards, maintaining market equilibrium and consumer safeguards. Competition among major players, including State Farm, Allstate, and Progressive, intensifies, resulting in diverse product offerings and competitive pricing.

Actuarial modeling and predictive analytics are crucial tools for insurers to assess risk, price policies, and manage claims efficiently. Fraud detection and independent verification are integral parts of the claims process, ensuring accurate settlement negotiations. Digital insurance platforms streamline policy administration, while third-party administrators (tpas) handle claims processing and reinstatement of policies. Medical payments coverage, bodily injury liability, and property damage liability are common coverages, with collision coverage and comprehensive coverage offering additional protection. Usage-based insurance (UBI) and comparative negligence are emerging trends, enabling insurers to tailor policies based on individual driving habits and fault determination. Regulatory compliance and risk management are essential aspects of the industry, with accident reconstruction, expert witness testimony, and claims management playing vital roles in dispute resolution.

Loss ratio and combined ratio are essential metrics for insurers to evaluate underwriting performance and profitability. Policy cancellations, policy exclusions, and comparative fault are factors influencing policy renewals and customer retention. Credit scoring is another tool insurers use to assess risk and price policies. Insurers also leverage mobile apps, driver history, insurable interest, and policy administration systems to enhance customer engagement and streamline operations.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and competitive the market, providers offer various coverage options to meet diverse customer needs. These include comprehensive, collision, liability, personal injury protection, uninsured motorist, underinsured motorist, and rental reimbursement insurance. Additionally, innovative solutions like telematics, usage-based insurance, and pay-as-you-go plans are transforming the industry. Consumers can compare quotes online, utilizing tools like comparison websites and insurance calculators. Factors influencing premiums include vehicle make and model, driver age, driving record, location, and coverage levels. Effective risk assessment and claims management are crucial for insurers to maintain profitability and customer satisfaction in this competitive the market.

What are the key market drivers leading to the rise in the adoption of Motor Vehicle Insurance Industry?

- In developing countries, the implementation of stringent government regulations mandating insurance coverage serves as the primary catalyst for market growth.

- In various countries, including India and China, motor vehicle insurance is a mandatory requirement for vehicles operating on public roads. For instance, in the United States, such as Maine, vehicle owners or operators must carry a minimum insurance coverage as mandated by law. This includes uninsured/underinsured motorist coverage, with a minimum of USD50,000 per person or USD100,000 per accident. The increasing economic growth in developing countries and the subsequent expansion of the automotive market are driving the growth of the market. Actuarial modeling and predictive analytics play a crucial role in determining coverage limits and setting personalized pricing for insurance policies.

- Insurance agents, brokers, and companies employ these techniques to assess risk and offer comprehensive coverage. Fraud detection and independent verification are essential components of the insurance process, ensuring fair dispute resolution. Settlement negotiations are handled professionally and efficiently, maintaining a harmonious balance between the insured and the insurer.

What are the market trends shaping the Motor Vehicle Insurance Industry?

- The digitalization of the motor vehicle insurance industry is an emerging market trend. This shift involves the integration of technology to streamline processes, enhance customer experience, and improve operational efficiency.

- The market has experienced substantial transformation in recent years due to insur digitalization. This shift has led to the development of ai-powered claims processing, digital insurance platforms, and data analytics, enhancing customer experience and retention. Insurance regulations continue to evolve, with an increasing focus on customer segmentation and credit scoring to determine premiums based on driving record and other factors. Collision coverage remains a key offering, with third-party administrators (tpas) and legal counsel playing crucial roles in claim processing and settlement.

- The combined ratio, a critical performance metric, indicates the profitability of insurers. Digitalization has enabled more immersive and harmonious interactions between customers and insurers, emphasizing convenience and personalization. The future of the motor vehicle insurance industry lies in continued innovation and adaptation to evolving customer needs and regulatory requirements.

What challenges does the Motor Vehicle Insurance Industry face during its growth?

- The insurance industry faces significant growth constraints due to the increasing regulatory scrutiny and complex compliance requirements.

- In the US the market, regulatory bodies such as the National Association of Insurance Commissioners (NAIC) play a crucial role in implementing uniform rules and regulations. The NAIC recently introduced the Own Risk and Solvency Assessment (ORSA), an internal process for insurers to evaluate their risk management capabilities. This add-on to the existing assessment framework is mandatory for insurers, agents, and insurance groups. Mobile apps have become increasingly popular in the motor vehicle insurance industry, allowing policyholders to access their driver history, manage policies, and file claims. Policy administration systems enable insurers to process applications, issue policies, and manage policy cancellations and reinstatements.

- Medical payments coverage is another essential aspect of motor vehicle insurance, providing financial assistance for medical expenses resulting from an accident. Accident reconstruction and claims investigation are critical components of the claims processing stage. Policy exclusions may apply in specific situations, limiting coverage for certain risks. Comparative fault rules determine the percentage of fault for each party involved in an accident, affecting the claims payout. In conclusion, the US the market is subject to ongoing regulatory changes and technological advancements. Regulatory bodies like the NAIC introduce new frameworks like ORSA to ensure insurers' risk management capabilities are adequate.

- Mobile apps, policy administration systems, medical payments coverage, accident reconstruction, claims investigation, and policy exclusions are essential elements of the motor vehicle insurance landscape.

Exclusive Customer Landscape

The motor vehicle insurance market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the motor vehicle insurance market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, motor vehicle insurance market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allstate Corporation (United States) - Bajaj Allianz, a leading insurance provider, offers motor vehicle insurance solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allstate Corporation (United States)

- State Farm Mutual Automobile Insurance Company (United States)

- Geico (United States)

- Progressive Corporation (United States)

- Liberty Mutual Insurance (United States)

- Zurich Insurance Group Ltd. (Switzerland)

- AXA S.A. (France)

- Allianz SE (Germany)

- Ping An Insurance Group Co., Ltd. (China)

- China Pacific Insurance Co., Ltd. (China)

- Tokio Marine Holdings Inc. (Japan)

- Sompo Japan Insurance Inc. (Japan)

- Aviva plc (United Kingdom)

- Direct Line Insurance Group plc (United Kingdom)

- RSA Insurance Group (United Kingdom)

- Mapfre S.A. (Spain)

- Erie Insurance Group (United States)

- Nationwide Mutual Insurance Company (United States)

- Travelers Companies Inc. (United States)

- AIG (United States)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Motor Vehicle Insurance Market

- In January 2024, Allstate Insurance Company announced the launch of its new telematics-based auto insurance product, "Drivewise 360," which uses both driving behavior data and vehicle data to offer personalized insurance premiums (Allstate Press Release).

- In March 2024, Liberty Mutual Insurance and State Farm Insurance, two major players in the market, formed a partnership to collaborate on data analytics and underwriting strategies, aiming to enhance their risk assessment capabilities (Liberty Mutual Press Release).

- In April 2025, Lemonade, a technology-driven insurance company, raised USD300 million in a Series E funding round, bringing its valuation to USD8 billion. The funds will be used to expand its motor vehicle insurance offerings and enhance its AI and machine learning capabilities (TechCrunch).

- In May 2025, the European Union passed the Insurance Distribution Directive 2 (IDD2), which mandates insurers to provide clearer and more detailed information to consumers, strengthens the regulatory framework for insurance intermediaries, and introduces new conduct of business rules (EU Commission Press Release).

Research Analyst Overview

- In the dynamic the market, underwriting guidelines play a crucial role in assessing risk and determining premiums. Data privacy is a significant concern, with insurers implementing robust security measures to protect policyholders' personal information from data breaches. Risk mitigation strategies, such as claims documentation and adjuster training, help insurers manage product liability, legal fees, and accident severity. Motorcycle insurance, RV insurance, and commercial auto insurance each present unique challenges, requiring specialized underwriting approaches. Insurance fraud, tort law, and contract law add complexity to the claims process, necessitating effective complaint resolution and driving habit analysis. Policy bundling, including multi-policy discounts, offers cost savings for customers.

- Mobile apps and driver history data further enhance customer engagement and risk management. Policy renewals, cancellation, and reinstatement are influenced by loss ratio, comparative fault, and claims management. Regulatory compliance and expert witness testimony are integral to maintaining a combined ratio that reflects a sustainable business model. Usage-based insurance (UBI) and policy exclusions add complexity to the market, requiring continuous risk assessment and comparative negligence evaluations. The market's continuous unfolding necessitates a robust understanding of these evolving patterns and their applications across various sectors.

- Product recall, warranty claims, and vehicle repair costs can lead to substantial financial losses, emphasizing the importance of loss prevention and cyber liability insurance. Compliance audits, workers compensation insurance, medical expenses, and fleet insurance are essential components of a comprehensive risk management strategy. Professional liability insurance shields insurers from claims related to pain and suffering and lost wages. General liability, liability for third-party property damage, and accident-related legal fees are common exposures, necessitating effective claims handling and legal expertise.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Motor Vehicle Insurance Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.44% |

|

Market growth 2024-2028 |

USD 545.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.64 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Motor Vehicle Insurance Market Research and Growth Report?

- CAGR of the Motor Vehicle Insurance industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the motor vehicle insurance market growth of industry companies

We can help! Our analysts can customize this motor vehicle insurance market research report to meet your requirements.