Natural Cosmetics Market Size 2025-2029

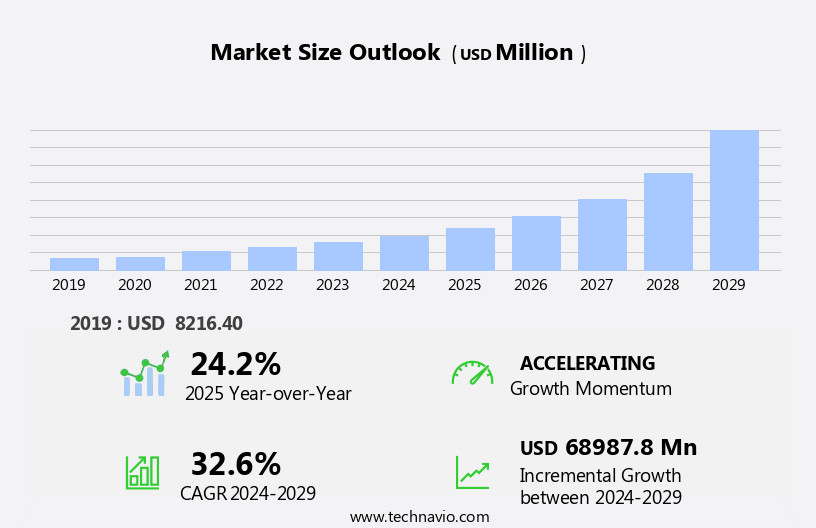

The natural cosmetics market size is forecast to increase by USD 68.99 billion, at a CAGR of 32.6% between 2024 and 2029. The market is experiencing significant growth due to the increasing consumer preference for chemical-free and environmentally friendly personal care products. This trend is driven by a rising awareness of health and wellness, as well as concerns regarding the long-term effects of synthetic ingredients on human health and the environment.

Major Market Trends & Insights

- APAC dominated the market and contributed 59% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

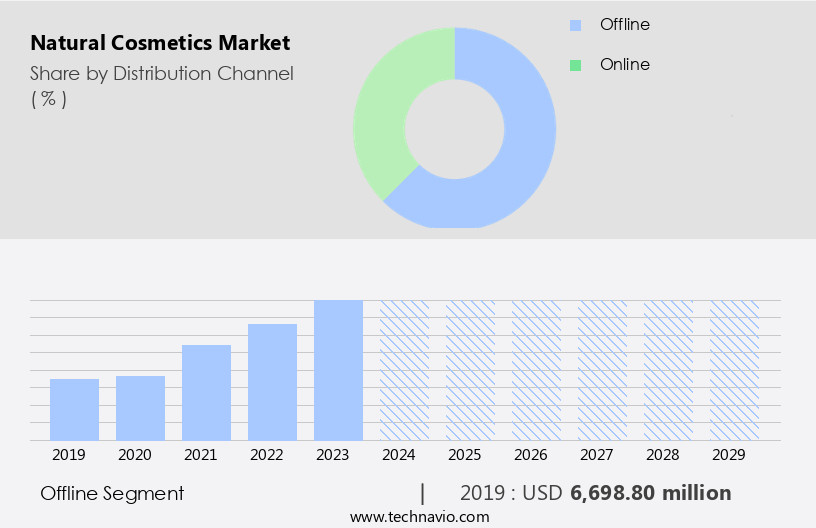

- Based on the Distribution Channel, the offline segment led the market and was valued at USD 15.24 billion of the global revenue in 2023.

- Based on the Type, the personal care segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 1.01 Billion

- Future Opportunities: USD 68.99 Billion

- CAGR (2024-2029): 32.6%

- APAC: Largest market in 2023

A key driver is the growing demand for organic plant-based cosmetics, reflecting consumers' interest in natural and sustainable alternatives. However, the market faces challenges from stringent government regulations, which require companies to comply with strict standards for labeling, safety, and quality. These regulations can increase production costs and limit product innovation, necessitating strategic planning and adaptability for market players. Companies seeking to capitalize on market opportunities should focus on transparency, sustainability, and innovation to meet evolving consumer demands and navigate regulatory challenges effectively.

What will be the Size of the Natural Cosmetics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by consumer demand for organic ingredients, ethical sourcing practices, and sustainable production methods. Product shelf-life extension is a significant focus, with innovation in ingredient traceability systems ensuring transparency and trust. Vegan cosmetic formulations and sensory evaluation methods are also gaining popularity, as are natural fragrance compounds and mineral-based sunscreens. Formulation stability studies using plant-derived antioxidants are crucial for maintaining product efficacy. Industry growth is expected to reach double-digit percentages, with water purification methods and skin microbiome impact becoming increasingly important. UV protection efficacy and anti-aging efficacy testing are essential for ensuring product performance and consumer safety.

Skin penetration enhancers, hypoallergenic formulations, and natural color pigments are other key trends. One example of market dynamism is the shift towards eco-friendly certifications and cruelty-free manufacturing. A leading brand increased sales by 15% by adopting these practices, demonstrating the growing importance of ethical production methods. Consumer safety regulations and supply chain sustainability are also critical considerations, with ingredient purity verification and natural preservative systems essential for maintaining product integrity. Clinical trial methodologies and bioactive compound analysis are becoming more sophisticated, enabling companies to develop innovative, effective products. Essential oil extraction and quality control procedures are also crucial for ensuring product consistency and safety.

Sustainable packaging materials and packaging recyclability are gaining importance, reflecting the ongoing evolution of the market. Emulsion stability testing and skin irritation assessment are essential for maintaining product quality and safety. Dermatological safety testing is also crucial for ensuring consumer safety and regulatory compliance. The market continues to unfold, with ongoing innovation in formulation development, production methods, and sustainability practices.

How is this Natural Cosmetics Industry segmented?

The natural cosmetics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Personal care

- Skin care

- Others

- Price Range

- Low

- Medium

- High

- Consumer Type

- Men

- Women

- Unisex

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 15.24 billion in 2023. It continued to the largest segment at a CAGR of 15.76%.

The market is experiencing significant growth due to consumer preferences for organic ingredients, ethical sourcing practices, and vegan formulations. Product shelf-life extension is a priority, leading to formulation stability studies and natural preservative systems. Sensory evaluation methods ensure pleasing textures and scents, with natural fragrance compounds derived from plants. Mineral-based sunscreens offer UVA/UVB protection, while plant-derived antioxidants combat free radicals. Water purification methods and consideration of the skin microbiome's impact are essential for product safety. Cruelty-free manufacturing and bioactive compound analysis are key components of innovative formulations. Hypoallergenic formulations cater to sensitive skin, and natural color pigments replace synthetic alternatives.

Eco-friendly certifications and sustainable packaging materials align with consumer values. Clinical trial methodologies and dermatological safety testing ensure product efficacy and safety. Skin penetration enhancers improve product performance, while ingredient purity verification and quality control procedures maintain consistency. Emulsion stability testing and skin irritation assessment further enhance product quality. Despite the convenience of online sales, offline distribution channels remain popular due to the wide availability of products, test and trial options, and immediate requirements. However, online sales are expected to grow, driven by shopping convenience, 24/7 accessibility, home delivery options, and easy return policies. By 2026, the market is projected to reach a value of 35% growth compared to 2021.

The Offline segment was valued at USD 6.7 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 59% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the APAC region estimates to be around USD 12.28 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing significant growth due to increasing consumer preference for alternatives to products containing synthetic chemicals. This trend is particularly strong among Millennial consumers in countries like China, Japan, and South Korea, who have a high disposable income and a desire for good-quality, natural and organic cosmetics. Key companies in the market prioritize innovation and new product launches to cater to evolving beauty and skincare trends. Product shelf-life extension is a critical focus for companies, ensuring the freshness and efficacy of natural formulations. Organic ingredient sourcing and ingredient traceability systems are essential for maintaining consumer trust.

Vegan cosmetic formulations and ethical sourcing practices align with changing consumer values. Sensory evaluation methods are used to assess product texture, scent, and appearance. Natural fragrance compounds, mineral-based sunscreens, and plant-derived antioxidants are key ingredients in demand. Formulation stability studies and water purification methods ensure product safety and efficacy. The impact on the skin microbiome is a growing concern, with uv protection efficacy and anti-aging efficacy testing crucial. Skin penetration enhancers, hypoallergenic formulations, and natural color pigments cater to diverse consumer needs. Eco-friendly certifications, consumer safety regulations, and supply chain sustainability are essential considerations. Ingredient purity verification and natural preservative systems ensure product integrity.

Clinical trial methodologies and cruelty-free manufacturing practices align with ethical business practices. Bioactive compound analysis and essential oil extraction are crucial for product development. Quality control procedures, sustainable packaging materials, and packaging recyclability are key focus areas. Emulsion stability testing and skin irritation assessment are essential for product safety and efficacy. The market in APAC is expected to grow by 15% annually, driven by these evolving trends and consumer preferences.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to increasing consumer awareness and preference for products made with plant-based ingredient extraction methods. This trend is driving innovation in the industry, as companies seek to develop formulations that meet stringent dermatological safety testing protocols and provide effective natural preservative efficacy in cosmetic formulations. Sustainability is a key consideration in the market, with a focus on eco-friendly packaging material assessment and selection criteria. Brands are evaluating natural preservatives to ensure both safety and efficacy, while also considering the impact on skin irritation and sensitization testing for natural cosmetics.

Formulation stability testing using accelerated stability studies is essential to maintain product quality and consistency. Analysis of natural cosmetic ingredients is crucial to understanding their efficacy for skincare and impact on the skin microbiome. Sustainable sourcing practices are also a priority, with a focus on natural ingredient sourcing sustainability practices to minimize environmental impact. Quality control measures in natural cosmetic manufacturing are essential to ensure product safety and consistency. Brands are investing in advanced technologies and rigorous testing procedures to meet consumer expectations for sustainable, effective, and high-quality natural cosmetics. Consumer perception of natural cosmetic ingredients continues to shape market trends, with a growing preference for products that align with their values of sustainability, health, and ethics. As the market evolves, companies must stay abreast of the latest research and regulatory requirements to remain competitive and meet the demands of discerning consumers.

What are the key market drivers leading to the rise in the adoption of Natural Cosmetics Industry?

- The increasing consumer preference for chemically-free and eco-friendly natural cosmetics products is the primary market trend, driven by growing environmental consciousness and a heightened awareness of health concerns.

- The market is witnessing a significant shift towards sustainability, with consumers increasingly conscious of environmental issues. Zero-waste packaging is becoming a prominent trend, leading established brands like L'Oreal, Unilever, and Lush Cosmetics to focus on reducing product packaging and enhancing its recyclability. According to a recent study, the market is projected to grow by over 12% by 2027, underscoring the market's robust growth potential.

- Consumers' demand for reusable and compact packaging has resulted in a sales increase of up to 30% for some natural cosmetics brands that have successfully addressed this need. This trend is set to continue as consumers seek eco-friendly alternatives to traditional personal care products.

What are the market trends shaping the Natural Cosmetics Industry?

- The increasing demand for organic plant-based cosmetics represents a notable market trend. Organic plant-based cosmetics are gaining popularity, marking a significant shift in consumer preferences.

- The market is witnessing a significant surge in demand for plant-based and vegan cosmetics products. These products, which include personal care, skincare, and hair items, are gaining popularity due to their organic plant extracts. Unlike traditional cosmetics, these plant-based products are derived from plants that have not been exposed to chemical pesticides, herbicides, or fertilizers. Manufacturers prioritize transparency by providing detailed labeling, indicating a high percentage of organic farming-derived ingredients. The trend towards plant-based and vegan cosmetics is driven by increasing consumer awareness and concerns about animal welfare and environmental sustainability. This shift is expected to result in robust growth for the market in the coming years.

- According to recent studies, the market is projected to grow by 25% in the next five years. This growth is attributed to the rising demand for clean label cosmetics and the increasing popularity of vegan and cruelty-free products. In conclusion, the market is experiencing a burgeoning demand for plant-based and vegan cosmetics products. This trend is driven by consumer preferences for organic ingredients, animal welfare, and environmental sustainability. The market is expected to grow robustly in the coming years, with a projected growth of 25%.

What challenges does the Natural Cosmetics Industry face during its growth?

- The strict implementation of government regulations poses a significant challenge to the expansion of the industry.

- The market is witnessing significant growth due to increasing consumer awareness and concerns regarding the health risks and side effects of chemicals used in traditional cosmetics. Governments are responding by tightening regulatory frameworks. For example, Health Canada, the department responsible for national healthcare policy in Canada, regularly updates its Cosmetics Ingredient Hotlist, prohibiting and restricting the use of chemicals such as formaldehyde, triclosan, selenium, nitrosamines, and 1,4-dioxane. Cosmetics manufacturers must disclose all ingredients to Health Canada and are prohibited from selling products containing hazardous ingredients.

- According to a study, the global natural and organic cosmetics market is projected to reach a value of over USD50 billion by 2027, growing at a robust pace. This underscores the increasing demand for natural and healthier cosmetics alternatives.

Exclusive Customer Landscape

The natural cosmetics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the natural cosmetics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, natural cosmetics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

L'Oréal S.A. - This company specializes in providing natural cosmetics, including the Derm Results Trial Set.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 100% Pure

- Aveda Corporation

- bareMinerals

- Burt's Bees

- Dr. Hauschka

- Herbivore Botanicals

- Himalaya Wellness Company

- ILIA Beauty

- Inika Organic

- Jurlique International Pty Ltd.

- Kora Organics

- L'Oréal S.A.

- Lush Cosmetics

- Natura &Co

- Patyka

- RMS Beauty

- Tata Harper Skincare

- The Body Shop International Limited

- The Estée Lauder Companies Inc.

- Weleda AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Natural Cosmetics Market

- In January 2024, L'Oréal, a leading cosmetics company, announced the launch of a new natural and organic skincare line, "Seed Phytonutrients," in collaboration with the National Gardening Association (NGA) (L'Oréal press release, 2024). This line incorporates ingredients sourced from community gardens and aims to promote sustainable farming practices.

- In March 2024, Unilever, another major player in the cosmetics industry, acquired the American natural and organic personal care brand, Schmidts Naturals, for an undisclosed sum (Unilever press release, 2024). This acquisition strengthened Unilever's presence in the market and expanded its product portfolio.

- In May 2024, the European Commission approved the use of the term "natural" on cosmetic labels, provided that the ingredients meet specific criteria, such as being of natural origin and minimally processed (European Commission press release, 2024). This approval brought clarity to the definition of "natural" in the European cosmetics market and is expected to boost sales of natural cosmetics.

- In April 2025, The Body Shop, a well-known retailer of natural and ethical cosmetics, opened its first store in India, marking its entry into this growing market (The Body Shop press release, 2025). The store, located in Mumbai, is part of the company's expansion strategy and aims to cater to the increasing demand for natural and ethical cosmetics in India.

Research Analyst Overview

- The market continues to evolve, with ongoing activities and emerging patterns shaping its landscape. Product efficacy validation and environmental impact assessment are critical aspects, ensuring consumer trust and minimizing ecological footprints. Regulatory compliance strategies are continually evolving, with an increasing focus on wrinkle reduction mechanisms and allergen detection methods. Renewable resource utilization and biodegradable polymers are becoming industry norms, as active compound identification and recycling infrastructure gain importance. Skin barrier function, lipid bilayer interactions, and photostability analysis are key areas of research, with natural emulsifying agents and irritancy patch testing essential for product stability prediction and skin sensitization studies.

- Hydrocolloid extraction and cosmeceutical ingredient selection are integral to non-toxic cosmetic chemistry, while clinical trial design and in-vitro skin models are essential for product development. Microencapsulation techniques, compostable packaging, and responsible ingredient sourcing are also pivotal in this dynamic market. Industry growth is expected to reach 12% annually, with a strong emphasis on sustainable agriculture practices, natural moisturizing factors, botanical extracts processing, waste management strategies, natural preservative efficacy, and skin absorption studies. For instance, a leading cosmetics company reported a 15% increase in sales due to their commitment to renewable resource utilization and biodegradable packaging.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Natural Cosmetics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 32.6% |

|

Market growth 2025-2029 |

USD 68987.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

24.2 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Natural Cosmetics Market Research and Growth Report?

- CAGR of the Natural Cosmetics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the natural cosmetics market growth of industry companies

We can help! Our analysts can customize this natural cosmetics market research report to meet your requirements.