Natural Skin Care Products Market Size 2025-2029

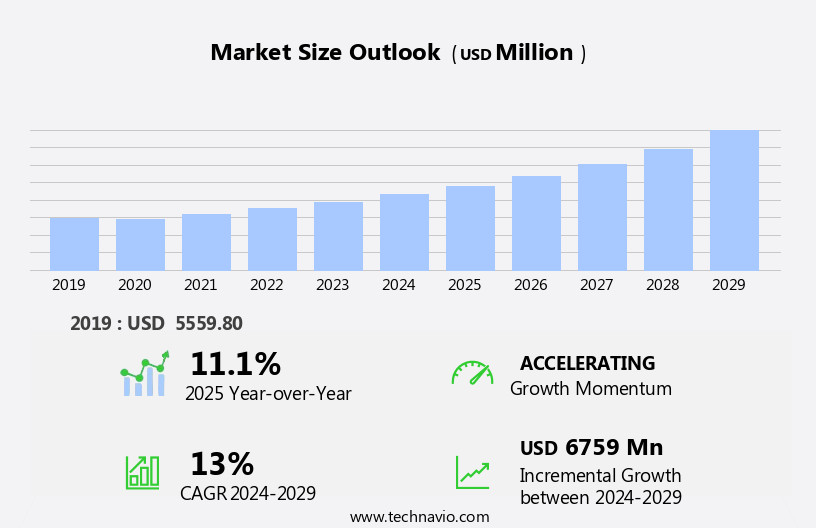

The natural skin care products market size is forecast to increase by USD 6.76 billion, at a CAGR of 13% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing prominence of social media influencers and the growing adoption of organic skincare products. The influence of social media on consumer behavior is undeniable, with influencers promoting natural and organic skincare products to their vast followings. This trend is particularly prevalent among the younger demographic, who are more conscious about what they put on their skin and are willing to pay a premium for natural and organic options. However, the market faces challenges as well. The availability of counterfeit skincare products is a major obstacle, as these products often contain harmful chemicals and can lead to adverse health effects.

- Consumers are increasingly demanding transparency and authenticity from brands, making it essential for companies to ensure the authenticity of their products and build trust with their customer base. Additionally, the increasing competition in the market requires companies to differentiate themselves through innovative product offerings and effective marketing strategies. To capitalize on market opportunities and navigate challenges effectively, companies must stay abreast of consumer trends and prioritize transparency, authenticity, and innovation in their offerings.

What will be the Size of the Natural Skin Care Products Market during the forecast period?

- The market continues to evolve, driven by consumer demand for transparency and authenticity. Specialty stores and online retailers showcase a wide range of offerings, from green beauty lines to natural remedies, catering to diverse skin health concerns and types. Product certifications, such as organic and fair trade, play a crucial role in consumer trust and decision-making. Influencer marketing and content marketing strategies dominate the digital landscape, with essential oils and skin brightening solutions gaining popularity. Customer reviews and sun protection are essential factors in the skincare routine, driving innovation and product development. Natural extracts, including those from the skin microbiome, are at the forefront of formulation development.

- Supply chain management and ethical sourcing are essential components of the industry, ensuring the highest quality and sustainability. Holistic approaches to skin care extend beyond face care to include hair care, body care, and personalized skincare solutions. The market's ongoing dynamism is further reflected in the emergence of subscription boxes, acne treatment innovations, and clinical trials. Brand storytelling, sustainable packaging, and quality control are key differentiators, as consumers increasingly seek products that align with their values and lifestyles. The market's continuous unfolding is shaped by the interplay of these various trends and factors, with ongoing product innovation and supply chain adaptations shaping the future landscape.

How is this Natural Skin Care Products Industry segmented?

The natural skin care products industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Facial care

- Body care

- End-user

- Women

- Men

- Formulation

- Creams and lotions

- Oils and serums

- Powders

- Gels

- Sticks

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

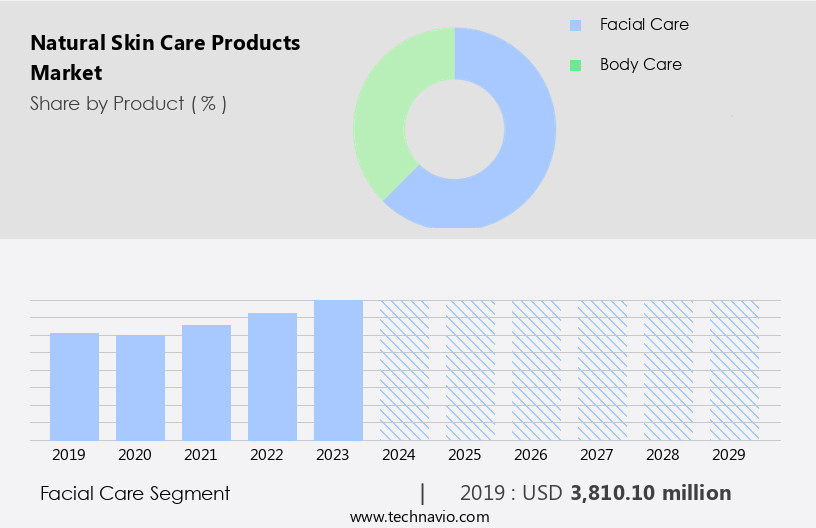

The facial care segment is estimated to witness significant growth during the forecast period.

In the dynamic skincare market, transparency in ingredient sourcing and certification is a priority for consumers. Specialty stores and online retailers cater to this demand, offering a wide range of natural and organic products. Content marketing and influencer collaborations have become effective strategies for brands to tell their story and build trust. Green beauty and natural remedies continue to gain popularity, with skin brightening and sun protection being key concerns. Product innovation, such as formulations with essential oils and natural extracts, addresses these issues while promoting skin health. Social media marketing and digital platforms facilitate customer engagement and reviews. Skincare routines are personalized based on skin type and concerns, with clinical trials and product certifications ensuring efficacy.

Ethical sourcing, fair trade, and sustainable packaging are essential considerations for consumers. Supply chain management and quality control are crucial for maintaining a holistic approach to skincare. Hair care and body care segments also witness growth, with clean beauty and personalized offerings gaining traction. Formulation development focuses on natural ingredients and catering to specific skin types and concerns. Subscription boxes and acne treatment options further expand the market, catering to diverse consumer needs. In the face care segment, sun protection and anti-aging properties remain essential features. Product innovation, such as Lakmé's new suncare range, combines sun protection with skincare benefits, offering a harmonious approach to maintaining healthy, youthful skin.

The skincare market continues to evolve, prioritizing natural ingredients, transparency, and customer satisfaction.

The Facial care segment was valued at USD 3.81 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

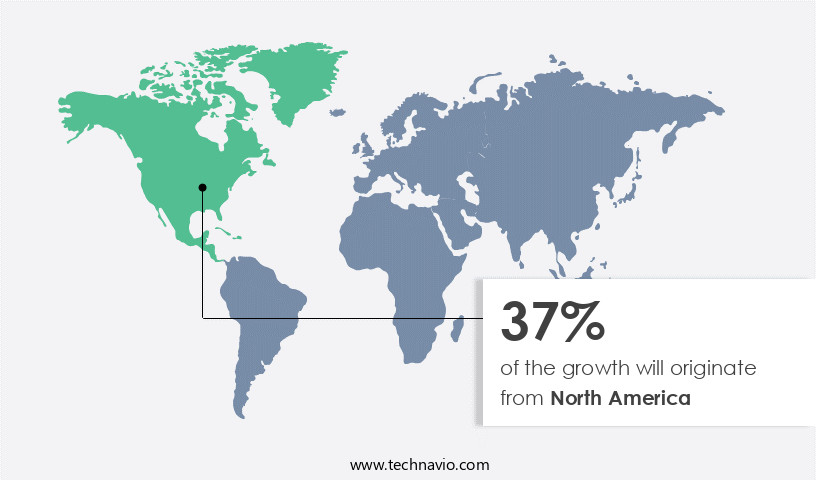

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Natural skincare products have gained significant popularity in North America, driven by consumers' increasing preference for ingredients that are natural and organic. The region's market is characterized by a high level of ingredient transparency, with consumers prioritizing products that align with their values. Specialty stores and online retailers catering to natural skincare have proliferated, making it easier for consumers to access a diverse range of offerings. Content marketing and influencer partnerships have become essential tools for brands to engage with consumers, sharing educational resources and product recommendations. Green beauty and natural remedies continue to be key trends, with skin brightening and sun protection being major concerns.

Skincare routines are becoming more personalized, with consumers seeking solutions tailored to their unique skin types and concerns. Product innovation is a significant focus, with brands investing in formulation development and clinical trials to deliver effective, high-quality offerings. Ethical sourcing, fair trade, and sustainable packaging are also essential considerations for many consumers. Organic farming, natural extracts, and essential oils are increasingly used in formulations, reflecting a holistic approach to skincare. Sensitive skin and skin microbiome health are emerging concerns, driving demand for gentle, effective products. Hair care, body care, and personalized skincare solutions are also growing categories, as consumers seek comprehensive self-care offerings.

Subscription boxes and acne treatment are other areas of interest, with brands focusing on ingredient sourcing and product efficacy to meet consumer needs. Supply chain management, quality control, and digital marketing are crucial elements in the natural skincare market, ensuring efficient operations and effective communication with consumers. Brands are also investing in brand storytelling to build trust and loyalty, creating immersive and harmonious experiences for their customers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Natural Skin Care Products Industry?

- The increasing influence of social media personalities significantly drives the market's growth.

- The market is experiencing significant growth due to the increasing consumer preference for holistic approaches to beauty and wellness. This sector places a strong emphasis on product efficacy and quality control, utilizing clean beauty formulations and sourcing ingredients from reputable suppliers. In the realm of body care, there is a growing demand for personalized skincare solutions, as well as effective acne treatments. Subscription boxes have emerged as a popular trend, providing customers with regular deliveries of curated skincare products tailored to their specific needs.

- The formulation development process is meticulously carried out to ensure the highest standard of product quality and safety. Social media platforms and e-commerce channels are essential tools for reaching a broader audience and increasing brand awareness. The immersive and harmonious experience offered by natural skin care products resonates with consumers, making it a thriving industry.

What are the market trends shaping the Natural Skin Care Products Industry?

- The increasing preference for organic skin care products represents a significant market trend. This trend reflects consumers' growing awareness and concern for healthier and more natural personal care options.

- Organic skincare products, characterized by their natural ingredients and transparency, have gained significant traction in the beauty industry. These products, which often include antioxidants, vitamins, and botanical extracts, are highly sought after for their potential long-term benefits on skin health. The increasing popularity of green beauty and natural remedies, driven by consumer awareness and concerns for health and the environment, has propelled the market's growth. Word of mouth and social media influence play a crucial role in driving demand for these products. Specialty stores and online platforms offer a wide range of organic skincare products catering to various skin concerns.

- Consumers are increasingly willing to invest in premium skincare products, recognizing the importance of a consistent skincare routine for optimal skin health. The market's expansion is further fueled by the global trend towards organic and natural living. Overall, the organic skincare market presents a promising opportunity for businesses looking to cater to health-conscious consumers seeking effective and natural face care solutions.

What challenges does the Natural Skin Care Products Industry face during its growth?

- The proliferation of counterfeit skincare products poses a significant challenge to the industry's growth, as consumers are often deceived into purchasing inferior or potentially harmful products, undermining the credibility and trust in the market.

- The natural skincare products market faces a challenge with the proliferation of counterfeit items. These imitations, sold through online retailers, can pose health risks to consumers. The affordability of counterfeits, despite their potential hazards, is a significant draw. This issue negatively impacts market players, affecting their sales and pricing strategies. To mitigate this concern, natural skincare brands can adopt reasonable pricing strategies, reducing profit margins to compete. Product certifications, such as those for natural extracts, essential oils, and sun protection, can help consumers identify authentic products.

- Influencer marketing and customer reviews also serve as valuable resources for consumers in making informed purchasing decisions. Product innovation and supply chain management are essential for brands to maintain a competitive edge. Natural dyes and essential oils are popular trends, enhancing the consumer experience with immersive and harmonious offerings.

Exclusive Customer Landscape

The natural skin care products market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the natural skin care products market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, natural skin care products market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AbbVie Inc. - This company specializes in providing a range of natural skin care solutions, including SkinMedica and Skinvive.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Amway Corp.

- Bare Necessities Zero Waste Solutions Pvt. Ltd.

- Bloomtown Ltd.

- Botanic Beauty LLC

- FOM Cosmetics UK Ltd.

- Honasa Consumer Pvt. Ltd.

- IQVIA Holdings Inc.

- Johnson and Johnson

- LOreal SA

- Natura and Co Holding SA

- The Clorox Co.

- The Estee Lauder Co. Inc.

- The Honest Co. Inc.

- The Procter and Gamble Co.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Natural Skin Care Products Market

- In February 2023, L'Oréal, the world's leading cosmetics company, introduced an innovative range of natural skin care products under its brand, Seed Phytonutrients. This line, which includes cleansers, serums, and moisturizers, is made from plant-based ingredients and aims to reduce the carbon footprint by using 100% renewable energy in its manufacturing process (L'Oréal Press Release, 2023).

- In May 2024, The Body Shop International, a well-known ethical beauty brand, announced a strategic partnership with Natura &Co, the Brazilian cosmetics group. This collaboration aimed to accelerate The Body Shop's growth in key markets, particularly in Latin America, and to strengthen its commitment to ethical sourcing and sustainability (The Body Shop Press Release, 2024).

- In October 2024, Unilever, a leading consumer goods company, completed the acquisition of Paula's Choice, a US-based skincare brand known for its effective, science-backed products. This acquisition expanded Unilever's portfolio in the premium skincare segment and provided Paula's Choice with access to Unilever's global distribution network (Unilever Press Release, 2024).

- In March 2025, the European Commission approved the use of the term "natural" on cosmetic products with a minimum of 95% natural origin ingredients. This policy change, which aligns with the increasing consumer demand for natural and organic products, is expected to boost the growth of the European natural skin care market (European Commission Press Release, 2025).

Research Analyst Overview

The natural skin care market is experiencing significant transformation, driven by consumer demand for transparency, personalization, and sustainability. Ingredient traceability and machine learning are key trends shaping the industry, enabling brands to verify product claims and conduct clinical studies with greater accuracy. Dermatological testing and predictive analytics are also crucial in developing effective, data-driven insights for men's and sensitive skin care. Omnichannel marketing and e-commerce platforms are essential for reaching customers, while customer relationship management and marketing regulations ensure brand loyalty and safety. Digital transformation and artificial intelligence are revolutionizing customer experience, with transparency initiatives and water conservation becoming increasingly important.

Baby skincare and mature skin care cater to specific consumer segments, requiring careful formulation and testing. Sustainability initiatives, such as circular economy, carbon footprint reduction, and ethical manufacturing, are essential for addressing environmental concerns. Social responsibility, biodiversity conservation, and packaging waste reduction are also critical components of a brand's social and ethical stance. Microbiome research and product labeling guidelines are shaping the future of natural skin care, with a focus on preserving the delicate balance of the skin's ecosystem. Brands are embracing regenerative agriculture and adopting sustainable sourcing practices to minimize their environmental impact. By prioritizing these trends and initiatives, natural skin care companies can effectively cater to evolving consumer preferences and expectations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Natural Skin Care Products Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13% |

|

Market growth 2025-2029 |

USD 6759 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.1 |

|

Key countries |

US, China, Canada, UK, Germany, Japan, India, France, The Netherlands, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Natural Skin Care Products Market Research and Growth Report?

- CAGR of the Natural Skin Care Products industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the natural skin care products market growth of industry companies

We can help! Our analysts can customize this natural skin care products market research report to meet your requirements.